BCA Digital Collaborates with Blibli as Exclusive Partner of "blu" Application

In the early stages, it allows Blibli users to open blu accounts, e-commerce payments, to transact via in-app payments

After the application launched at the end of last June, PT Bank Digital BCA (BCA Digital) has now officially announced Blibli as the first exclusive "blu" partner to strengthen its digital ecosystem. Through this collaboration, Blibli is claimed to be a platform E-commerce the first in Indonesia to be integrated with a digital banking application.

In a press conference that was held virtual, CEO of Digital Bank Lanny Budiati said, digital banking innovation continues to grow and is no longer limited to financial services. Getting here, the use of digital banking is getting closer in everyday life, such as transaction payments E-commerce, investment, and financial management.

"The exclusive partnership between BCA Digital and Blibli is carried out to expand the scale of a sustainable digital ecosystem. Both also share a common mission, namely prioritizing customer satisfaction and serving the customer segment. digital savvy" said Lanny.

Meanwhile, Blibli's Co-founder and CEO Kusumo Martanto believes that the development of a digital ecosystem in Indonesia can reach its optimal potential through collaboration. "Therefore, we continue to be committed to innovating and adapting strategies to a changing market by responding to the challenges and experiences of this decade," he added.

In the early stages, the integration of the two platforms allows Blibli users to open blu accounts directly, make payments E-commerce, to transact via in-app payment feature or the QRIS feature.

Meanwhile, blu collaborated with PT Dwi Cermati Indonesia (Cermati) as an integrator partner to synergize the blu platform with Blibli. Cermati will also have an important role in the development of blue products in the future.

Currently, blu has three excellent features that can give you the freedom to manage your finances, namely bluSaving, bluDeposit, and bluGether. Based on company data, as many as 26,2% of users allocate budget on bluSaving for shopping. Then, followed by 20,9% allocation of savings for vacations, 18,5% for pension funds, 17,2% for buying a house, and 17% for gifts. This year, BCA Digital is targeting hundreds of thousands of blu users.

To date, E-commerce is still the biggest driving force for the digital economy in Indonesia. Based on the e-Conomy SEA report from Google, Temasek, and Bain & Company in 2020, E-commerce donate highest growth of 54% or to $32 billion from the previous $21 billion in 2019.

Synergy of digital bank and E-commerce

This collaboration is actually not surprising considering that the parent company blu (BCA Group) and Blibli are subsidiaries of the conglomerate company Djarum Group. With this exclusive partnership, BCA Digital and Blibli can explore further synergy models to be developed together.

BCA Digital parent has a user base, ATM network, and network merchant the strong one. Meanwhile, Blibli is currently playing in the B2C, B2B, and B2B2C segments. The platform, which was founded in 2010, also operates Blibli Express Service (BES), which has collaborated with 27 logistics partners, 20 warehouses, and 32 hubs in major cities in Indonesia.

Since the last few years, banks have begun to take advantage of digital platforms, be it e-commerce, ride-hailing, or fintech sebagai front-end channels to acquire new customers. However, to optimize collaboration and synergy, a number of digital platforms began to enter as shareholders in digital banks.

Some of them are Gojek to Jago Bank, Akulaku to Bank Neo Commerce, and Sea Group (parent Shopee) to the Economic Welfare Bank (BKE). In the case of Bank Jago, the synergy with Gojek will be even wider considering that this platform has officially merged with Tokopedia to become GoTo. Tokopedia is one of the largest e-commerce platforms in Indonesia.

A paradigm shift

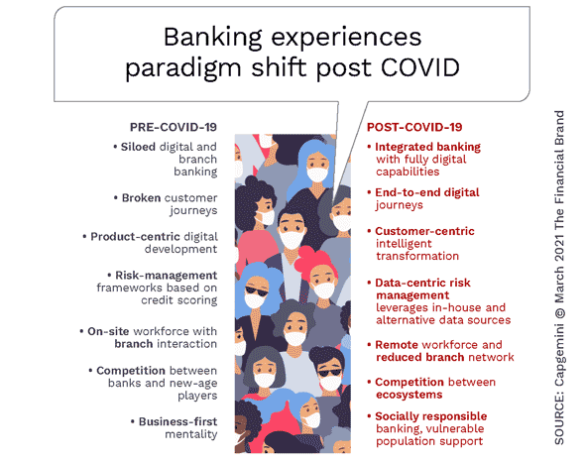

Supported by large capital flows, the trend of digital companies entering the banking ecosystem continues to grow -- both globally and nationally. So the thing that deserves attention is how "digital engagement" is embedded into the DNA of banking services themselves.

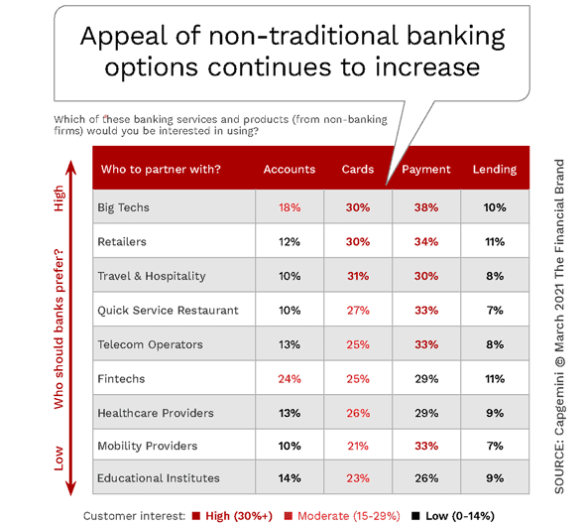

In a survey found the fact that there is a tendency for consumers to expand the use of the banking system in a wider variety of services.

More Coverage:

In Indonesia, this trend is starting to be interpreted well by each, both in terms of banking [which was previously traditional] and digital platforms. For example, in the realization of the collaboration to launch a special Traveloka credit card for Bank Mandiri and BRI customers. Service-based model Banking as a Service will have an important role in the integration process.

The scenario will certainly be more intensive when banks [especially digital] have a special relationship with certain digital platforms.

On the other hand, the pandemic has changed a lot about the experience expected of banking customers. In addition to asking service providers to consider full digitization, respondents expected a more personalized and holistic experience.

Sign up for our

newsletter