Bank Jago Officially Becomes a Payment Option in Gojek

Bank Jago customers who often make payments at Gojek can do the debit process directly from the special "pocket" that is connected

Aiming to expedite customer integration, Bank Jaji formalized a strategic partnership with Gojek, one of shareholders company. At this stage, customers can use Jago's pocket as a source of funds to pay for various services in the application. To enjoy this integration, consumers can update the application Gojek each.

Briefly in the release it is stated how this integration works, namely for Bank Jago customers who often make payments for daily needs, ranging from transportation facilities to purchasing food at Gojek, will be able to do the debit process directly. Customers can separate these funds into a special bag that is connected to the application Gojek.

"So, apart from not wasting time and money on top up balance, customers can also check the transaction history in the special bag in detail and in detail. Over time, this new experience has made customers more disciplined and more precise in their monthly spending,” said Director of Compliance and Corporate Secretary of Bank Jago Tjit Siat Fun.

Nila Marita as Chief Corporate Affairs Gojek explained, the initial stage of integration with the Jago application further complements the non-cash payment options available in the application Gojek. "This partnership will continue to present various innovations and conveniences in digital financial services going forward, one of which is opening a Jago bank account which can be done directly from the application. Gojek,” said Nila.

Previously, Bank Jago also started working with marketplace Mutual Fund Seed. There are several advantages that users can enjoy through this collaboration. First, users can open a Jago account in the Bibit application. Then, can also set it as recurring transactions for automatic mutual fund transactions.

Bank Jago in the early stages

PT Bank Jago Tbk (IDX: ARTO) officially launched the Jago banking application in early April 2021. Three months after launching to date, the Jago application has recorded a 4.0 rating with total downloads approaching 1 million times.

To DailySocial Dalam exclusive interviewBank Jago President Director Kharim Indra Gupta Siregar said that although he did not disclose statistics, he claimed to have received healthy traction and feedback from the launch of the Jago application. Some of the positive responses highlighted by Bank Jago users are the speed of the process on account opening and presence of the Pocket feature.

“Even our [debit] cards can be connected to any Pocket at any time the user wants. For me, it's very cool because users can know the exact use of their money, such as cash withdrawals or shopping online. We put a lot of effort into design and architecture so that you can produce response time which is very good. We are continuously upgrading the technology as we speak, said Kharim.

From a number of plans throughout 2021, Bank Jago quite a lot highlights the realization of synergies with Gojek. The big picture, Bank Jago ecosystem and Gojek targets can be connected to each other. For the initial stage, both of them will first enter through the account opening service.

Lots of digital banks

Lately, digital banking applications continue to emerge. Besides Jago, there are several other services that can be used, including blu, LINEBank, Jenius, Neo+, SeaBank, and TMRW ID. Some have strong affiliations with digital platforms with massive users, such as SeaBank with Shopee or Neo+ with Akulaku.

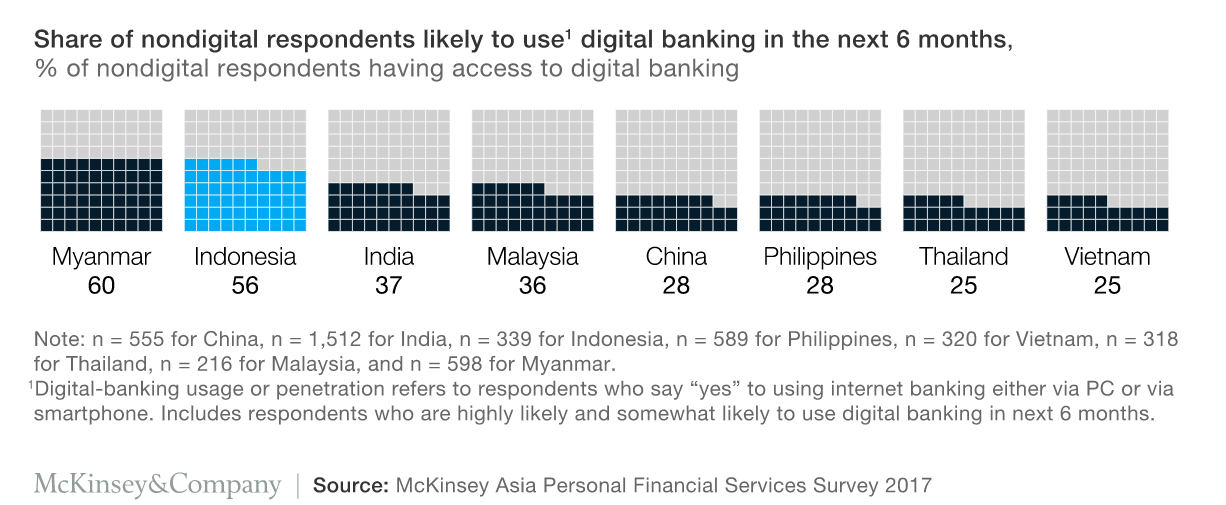

The level of penetration is still new, these applications are also still in the development stage awareness among the people. However, long before digital banking services emerged in Indonesia, McKinsey had conducted a survey about Indonesian people using digital banking services. From a survey conducted, 55% of non-digital customers said they are interested or will use digital banking applications in the future.

Integration with consumer applications also has great potential to increase adoption rates. Of course the next question, whether to replace the role e-wallet like Gopay? Of course, it will take much longer to see the market's response to this. However, there are several variables that can be taken into consideration.

More Coverage:

First, bank accounts are more flexible -- including in relation to the limit of money that can be accommodated. Temporary e-wallet regulation has limitations. Article 45 of the Bank Indonesia Regulation concerning Electronic Money states that the maximum monthly transaction value limit is 20 million Rupiah. Meanwhile, the maximum amount of money that can be saved is 10 million Rupiah for applications that have been registered with BI, and 2 million Rupiah that has not been registered.

Second, the digital bank service process is very easy. Allows users to have a bank account and access various services in it (including investments) from home. The registration process up to KYC is done virtually.

And third, the features that were created began to prioritize the personalization of user needs. In almost all initial registration processes, prospective customers will be asked about the purpose of opening an account, whether to save, invest or something else. In the next phase, various features will be adjusted according to these preferences in the hope of meeting user needs appropriately.

Sign up for our

newsletter