M&A of Local Startups by Foreigners Could Be an Ideal Option, But You Need to Be Careful

Observers and venture capitalists have spoken out about the trend of acquiring local startups by foreign companies in recent years

For more than a decade, Indonesia's digital economic sector has developed dynamically, in recent years showing the maturity of its industry. Ending 2023, this sector will be characterized by major consolidation actions between E-commerce from China and Indonesia, TikTok Shop and Tokopedia.

Consolidation through a merger and acquisition (M&A) strategy is a common step, taken by many companies to gain access to capital, technology synergy, or business expansion.

Interestingly, it seems that this M&A trend is starting to be adopted by many foreign companies to expand their market to Indonesia. For domestic startups, this option becomes possible amidst the difficulty in finding funding.

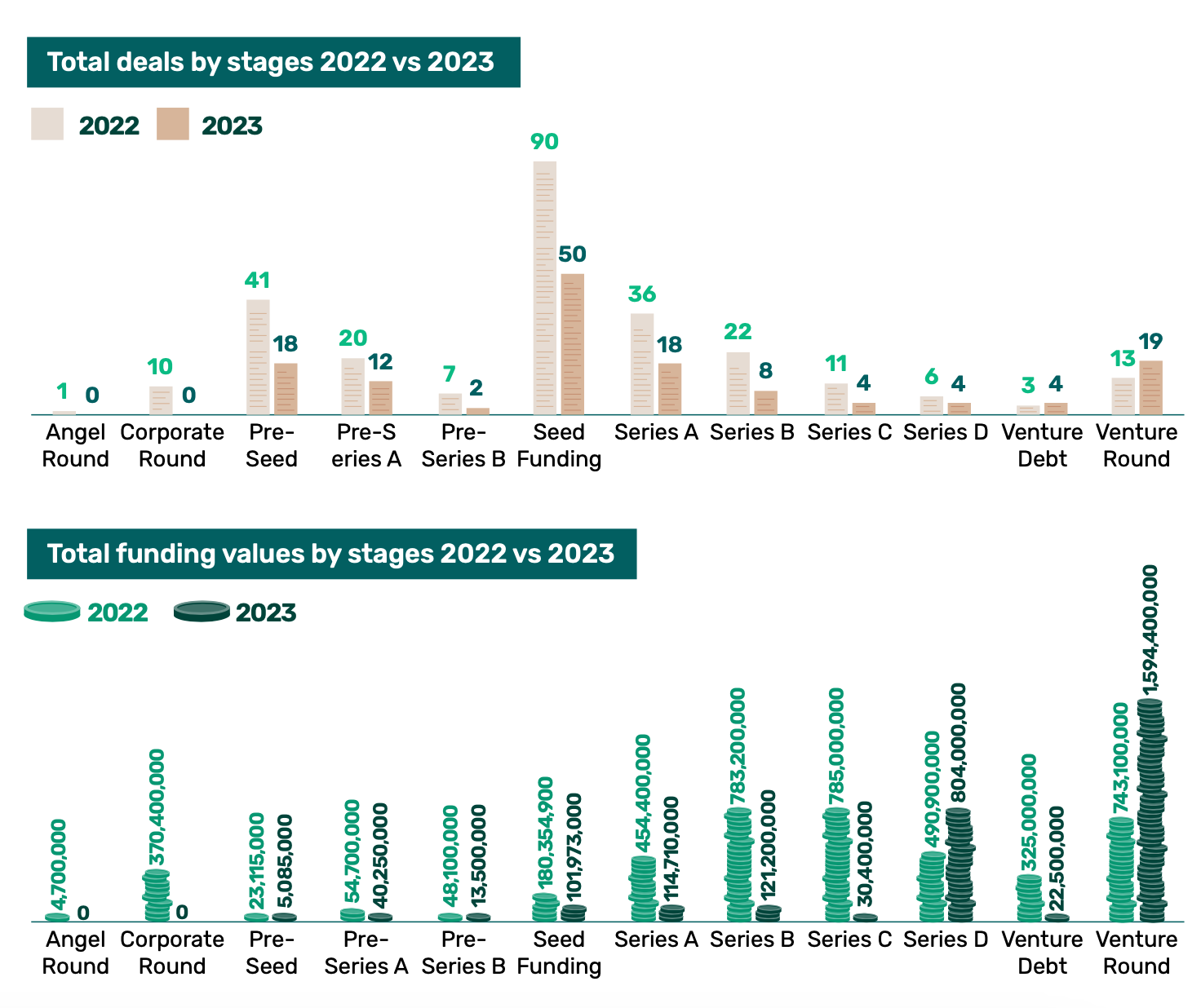

"Funding in the digital economy sector will be slower in 2022-2023 compared to 2023. In 2021, funding for the digital economy in Indonesia will reach IDR 140 trillion. In 2022 it will fall by 50%. In 2023 it will decrease by half compared to [achievement] in 2022. Acquisition is an option rational in the midst of decreasing funding and tight competition," said Director of Digital Economy at the Center of Economic and Law Studies (CELIOS) Nailul Huda when contacted DailySocial.id.

As another illustration, the 2023 Startup Report published by DSInnovate noted that there were 25 M&A in the digital ecosystem announced throughout 2023. This number is down slightly from 32 M&A in the previous year.

When viewed from the aspect of business competition, Huda said that the trend of acquiring local startups by foreign companies could trigger a negative impact on the industry. One of them is the lack of players in one sector.

"Of course, the reduction in players in one industry results in reduced opportunities for consumers to get services/products at cheaper prices. Therefore, it is important for the Business Competition Supervisory Commission (KPPU) to monitor business competition, especially in analyzing the impact of mergers on industry," he added. Huda.

M&A could be an option exit The ideal

According to Managing Director at Northstar Group Carlson Lau, M&A interest does not only occur in foreign companies who want to expand here, but also vice versa. The decline in investment interest in funding startups, especially for early stage startups, has triggered M&A.

"Local strategic companies are also actively seeking opportunities to acquire smaller technology companies, including some within the Northstar Venture portfolio," Carlson said in a statement to DailySocial.id.

Carlson declined to comment further on potential M&A that may/is occurring within its portfolio.

Nevertheless, the increasing M&A trend in Indonesia's digital ecosystem shows that this sector is increasingly moving dynamically, and indicates increased competition and innovation. Acquisitions, said Carlson, often result in synergies of technology, talent and resources. so that it can encourage both companies to develop innovation and achieve better efficiency.

"Before, there were a lot founder choose IPO as exit strategy is ideal, but mergers and acquisitions may also be another option. Founder should not be fixated on unrealistic idealism. "Instead, when the right M&A opportunity is presented, they should focus on making the right decisions to drive the company forward and grow," he added.

More Coverage:

He believes that local startups should be enthusiastic about this trend and anticipate a positive impact on the ecosystem. The reason is that M&A actions are said to facilitate access to new markets and customer bases. This allows companies to diversify their offerings and expand their reach.

As an additional illustration, the great synergy between TikTok and Tokopedia merges their businesses into their ninja way to increase the scale of growth e-commerce. Tokopedia, which is more associated with the planned purchase segment (Tokopedia), can synergize with the impulse purchase segment on TikTok Shop.

In previous news, this synergy has been calculated and is projected to be able to raise Tokopedia's GMV and Monthly Transacting User (MTU) which had declined. As of 2023, Tokopedia has 18 million Monthly Active Users (MAU), while TikTok Shop has 125 million MAU with MTU growing by three digits.

Sign up for our

newsletter

Premium

Premium