Expansion to Indonesia, Fairbanc Offers “PayLater” Special for Micro Merchants

The concept of "closed loop financing"; has served 1000 stalls

The Indonesian economy is mostly supported by SMEs. In 2014, SMEs accounted for 58,92% of GDP. There were 57,9 million SMEs in that year, the number jumped to 62,9 million in three years. The most important key in growing this sector is to combine digital technology and the right access to capital.

Startups fintechFairbanc take this opportunity for business owners, especially rural micro-business owners who do not have bank accounts or have difficulty obtaining loans from conventional financial institutions.

From its headquarters in San Francisco, Fairbanc spread its wings to Indonesia after receiving funding with an undisclosed amount from 500 Startups and Indonesian billionaire Michael Sampoerna earlier this year.

The concept offered is different from startups fintech most. To DailySocial, CEO of Fairbanc Indonesia Iman Pribadi explained, the platform offers the concept closed loop financing, namely the financing system carried out in supply chain leaders. In it there is no change in the process for borrowers and is also facilitated by distributors/principals who have been providing goods to borrowers.

This means that there is no loan in the form of money, only additional facilities from the distributor in the form of an additional payment period to buy more goods from the distributor/principal.

“We offer micro traders in the form of revolving fund financing (revolving credit line) which can be used every week to buy merchandise from our selected distributors which can result in increased sales for distributors,” he explained.

Fairbanc business model

Merchants who receive this facility do not receive cash, but can purchase merchandise in interest-free installments. Cash is given to distributors and merchants pay interest-free installments to Fairbanc after selling merchandise.

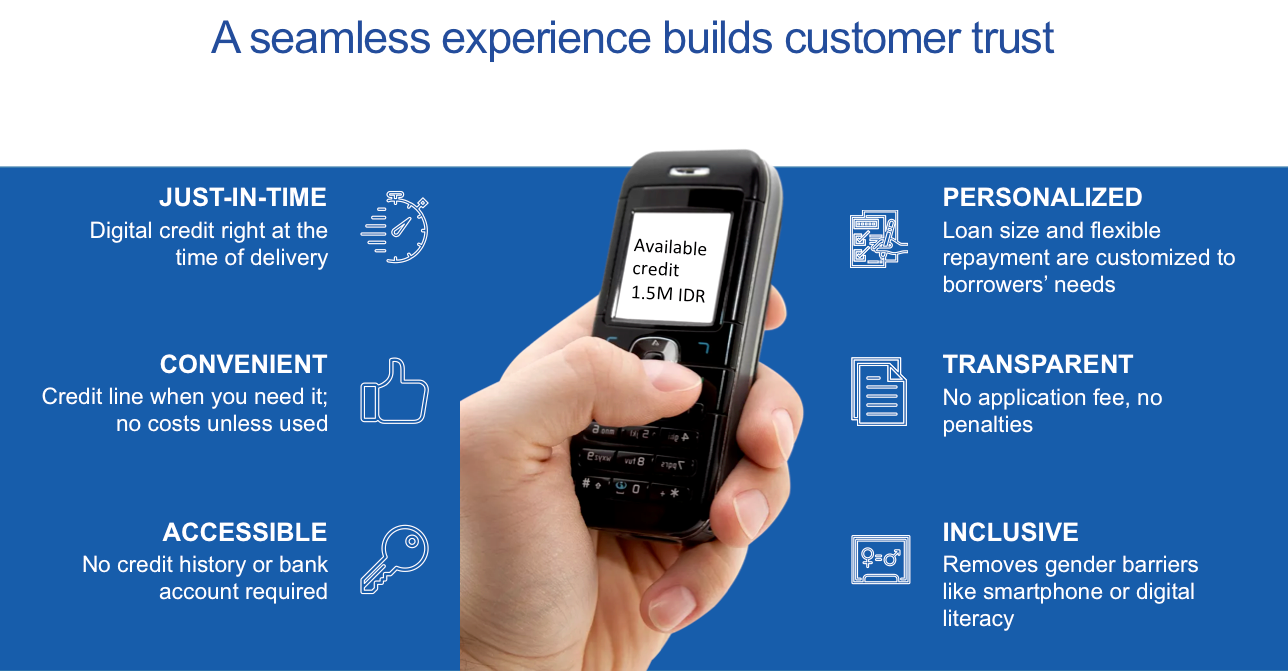

Fairbanc only sends a verification code via SMS to the merchant's cellphone when making a transaction. This solution is considered accurate to serve people who do not have a bank account.

Every trader, he continued, has a limit on the amount of financing that has been automated with data science. The credit limit will increase when they buy more merchandise from the company's selected distributors.

Iman explained, the company operates as a technology platform for the banking and financial services industry in Indonesia that offers financing using technology and financial services data science from Fairbanc.

This technology is used to automate credit scoring and monitor risk. The startup is also developing AI-powered product recognition capabilities to offer insight competitive for FMCG partners.

"We are not an institution" p2p fintech and does not provide loans so there is no restructuring process. We are a technology platform or machine learning which helps increase the income of the shop owners. Only one loan tools which Fairbanc can facilitate with financial institutions.”

Furthermore, Fairbanc's monetization concept is slightly different. Because there is no interest charged to micro merchants and no additional costs for the principal FMCG company and its distributors, Fairbanc makes money by optimizing cash payments directly to distributors and using discounts on sales volume.

By partnering with FMCG companies and offering productive loans to purchase high-margin daily necessities such as Unilever, Fairbanc hopes to significantly reduce the risk of loan defaults while scaling fast by leveraging a network of consumer brand wholesalers.

Iman gave an example, with Unilever, the company can increase sales of Unilever micro merchants by up to 35% using data science. A total of 100% of its sales outlets increased between 11% to 250%.

Not only Unilever, now Fairbanc has collaborated with Sinar Mas to expand its business in Indonesia. The company has also tied up with the largest Islamic organization, the Nahdlatul Ulama Executive Board (PBNU) for sharia-based SME capital.

“Our target is to serve 15000 stalls/shops this year. Currently on the way for 1000 stalls or shops with one of the largest FMCG in Indonesia.”

Fairbanc Indonesia Team

More Coverage:

Iman himself before joining Fairbanc, he had careers at the Revolving Fund Management Agency (LPDB) of the Ministry of Cooperatives and SMEs, Reliance Capital, CIMB Niaga Auto Finance, and Astra Financial Service.

In addition to Iman, the Fairbanc Indonesia team is led by experienced experts in finance, technology, and FMCG experts. The names include Siswanto as FMCG Specialist. He has five years of experience at Unilever and 20 years in the FMCG industry. In addition, there is Ivan Manarung as a Business Intelligent Specialist. He has also worked at Unilever.

In his home country, Fairbanc was started by Mir Haque, Kevin O'Brien, Sayeem Ahmed, and Thomas Schumacher. In the past two years, the company did pilot project in Bangladesh before officially collaborating with Unilever Indonesia, through the Unilever Foundry Program.

It is claimed, the program has succeeded in connecting 80% of unbanked micro merchants and 70% of them are women. They managed to increase their sales 35% through this initiative.

Sign up for our

newsletter