Antler Injects IDR 19 Billion Investment into 10 Indonesian Startups

These startups include Alter, Bootloader, Club Kyta, Hazana, Kamoo, Katalis, Loop, Plans, Sqouts, and startups with "stealth" status.

Early stage VC and startupbuilders Antler injected an initial investment of $1,25 million (around Rp. 19,5 billion) for ten startups in Indonesia. They include Alter, Club Kyta, Hazana, Kamoo, Katalis, Loop, Plans, Safelog.AI, Sqouts, and startups with the status "stealth".

In the official statement, the investment value includes an investment round from the total allocation in Indonesia of $5 million to be disbursed to 40 startups. This additional funding shows Antler's commitment to strengthening its portfolio in Indonesia and supporting its customers founder with potential business ideas, as well as diverse backgrounds and experiences.

Antler is present in Indonesia in 2021, and currently has 33 portfolios (not including the additional 10 startups) according to data on its official website. In total, Antler has invested in more than 900 startups from various sectors. The target is that Antler wants to support as many as 6.000 startups by 2030.

"To face the challenging market dynamics in 2024, we see this as an opportunity for talented founders and to create a positive business impact in Indonesia," said Antler Indonesia Partner Agung Bezharie Hadinegoro.

Agung continued, Antler's position as an investor and provider of in-depth programs, not only offers opportunities to prospective founders, but is also present in their intensive journey, honing their vision and carefully testing their business concept before launching a startup.

A glance at some of his portfolio; (1) Alter is a social networking and collaboration platform for users gamer, (2) Plans is a platform for fertility and family planning services, and (3) Sqouts is a conversational AI-based talent recruiting platform.

Investors are in vogue 'wait and see'

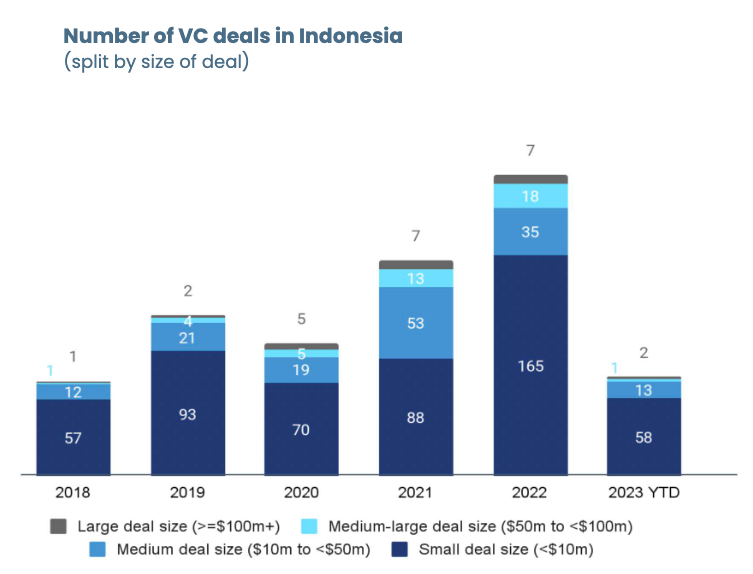

Based on the latest report AC Ventures and Bain & Company, the VC investment trend in Indonesia shows stagnant growth (YoY) with total funding of $3,6 billion in 2023. According to reports, this stagnation was triggered by investor caution amid global macroeconomic uncertainty.

However, this report reveals that initial funding with an investment range of less than $10 million still shows healthy growth, and dominates the total funding agreements that occur throughout 2023.

More Coverage:

Meanwhile, the trend of slowing investment is expected to continue until 2024, mainly driven by the General Election factor. Investors are predicted to choose to be more careful before making investment decisions.

Sign up for our

newsletter