ACV and Bain: In 2023 Initial Funding Volume Will Still Be Good, Advanced Stages Will Experience a Decline

VC is optimistic about a number of key sectors, such as electric vehicles, agriculture and digitalization of MSMEs

Indonesia's Venture Capital (VC) funding climate has experienced ups and downs in recent years due to global macroeconomic uncertainty. In the report "Indonesia Venture Capital Report 2023" by AC Ventures and Bain & Company, this uncertainty is triggered by investor caution.

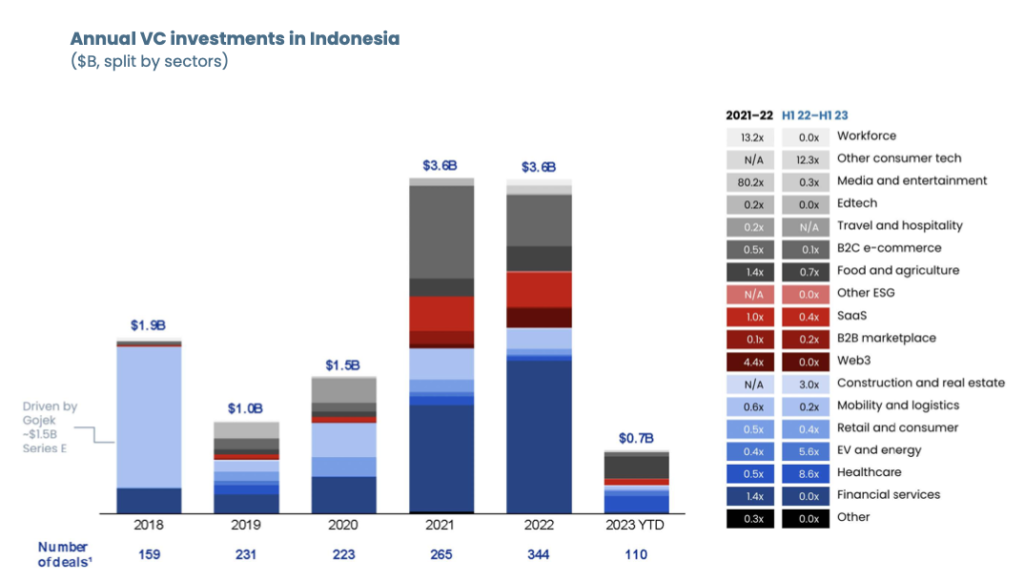

This situation resulted in a decrease in the number of investment deals in the second half of 2022 from 344 to 110 deals in the first half of 2023. Meanwhile, total VC funding was recorded as growing flat (YoY) of $3,6 billion in 2023. When compared, global investment trends (including the US, China and India) actually fell by 20%-40%.

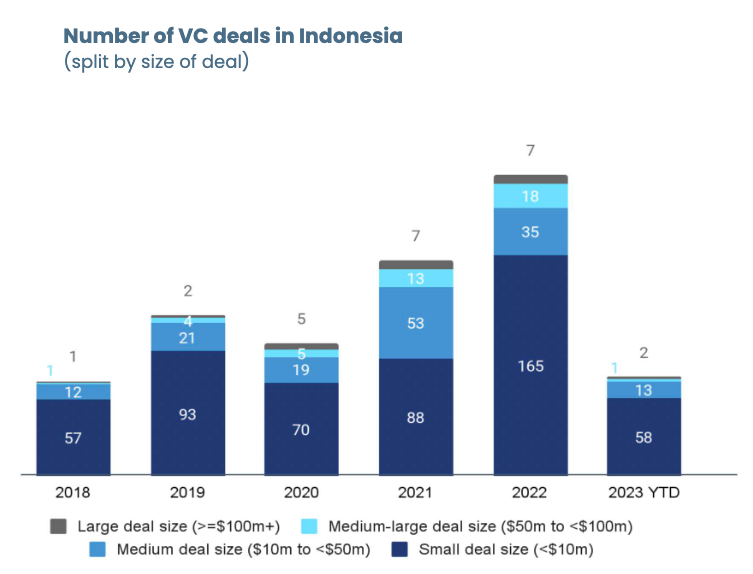

On investing with ticket sizes above $50 million, volumes decline in the second half of 2022 to 2023 (year-to-date), 72% of its funding rounds were actually closed in the first half of 2022 to avoid a macroeconomic situation that could impact capital deployment.

On the other hand, funding with ticket sizes less than $10 million (early stage) shows healthy growth since 2021, showing the resilience of early stage startups. As seen, transaction amounts of less than $10 million dominate funding in 2023 (year-to-date)--although it has dropped drastically from 165 in 2022.

Series B funding was recorded to have decreased, both in the number of transactions and ticket size. Then, series C and D+ funding shows an upward trend in the number of transactions and value. A number of notable funding with significant value in 2022 flowing into the sector fintech, namely Xendit ($300 million) and DANA ($250 million).

Despite these dynamics, Indonesia is said to remain a key target for VC. A number of early generation startups that have developed significantly are proof of investors' commitment and optimism to date.

"Our research with AC Ventures highlights the optimism and attractiveness of Indonesia as a long-term investment destination. Macro challenges and difficult funding situations will create a more solid and durable ecosystem. Future growth can be realized through opportunities in emerging new sectors, as well "supported by investors who are increasingly mature and ready with their capital," said Bain & Company Partner Tom Kidd.

Three phases of VC development

In its findings, the report reveals the landscape VC investment in Indonesia has developed deeply three phases. First, phase before 2020, investors inject a lot of funding into businesses that have network effects, aka the phenomenon of a service becoming useful when many people use it. Key sectors of this business include e-commerce, fintech, to logistics.

Second phase (2020-2022) marked by a trend of shifting investment priorities as a result of the Covid-19 pandemic. In this period, investors are targeting sectors that can have a positive impact from mobility restrictions. A number of sectors are popularly used during the pandemic, for example E-commerce and fintech (esp paylater, loans, and investments), as well as web technology3.

Meanwhile, the next phase (2023-onward) shifted back to the ESG sector and technology related to the environment/climate. For example, electric vehicles (EV) and batteries. Other sectors, such as healthtech continues to have a strong position amidst a difficult investment climate. Likewise, the D2C sector is utilizing social media and ecommerce to maximize its business.

Here are highlights of some key sectors:

- Total funding to consumertech sinking to $81 million in the first half of 2023, compared to funding in the first half of 2022 of $580 million. However, investor sentiment remains positive in line with the increasing middle class segment and working population in Indonesia.

- Total funding to financial services plummeted from $1 billion in the first half of 2022 to $25 million in the first half of 2023. Meanwhile, funding to this sector mostly flows to insurtech, banking for rural areas, and mortgages.

- Instead, funding to electric vehicle and energy increased significantly from $3 million in the first half of 2022 to $18 million in the first half of 2023. This increase was partly driven by government policy support regarding subsidies for retail customers and more affordable financing options.

- Agritech also received significant funding in 2023, which was also driven by eFishery's investment of $200 million. Meanwhile, the aquaculture sector will experience 1,2-fold growth from 2022 to the first half of 2023.

More Coverage:

In the report, Northstar Group Managing Director Carlson Lau explained that the sector consumer in Indonesia is ready to face the next phase of significant growth. This growth potential is also driven by rising incomes and consumer interest in trying out new products. The increasingly mature logistics infrastructure and online payment systems have become catalysts for the emergence of new domestic brands.

He also highlights how eFishery success story can be proof of how the use of technology into traditional work models can help businesses develop significantly. The success of eFishery can be a guide for similar startups in Indonesia.

"Finally, the MSME sector is still very broad and has not been widely penetrated. Para founder is building innovative solutions to help MSMEs achieve operational efficiency. We saw an opportunity supply chain digitization, leveraging AI-based agents into internal and external workflows, as well as AI to facilitate better decision making and business planning."

Sign up for our

newsletter