Mandiri Group Whitepaper: IPO Regulatory Developments in Indonesia, Adoption from the United States Exchange

With increasingly friendly regulations, ready to accommodate more technology companies on the IDX

The United States stock market is home to many global technology companies because it is regulatory-friendly and investor penetration is so mature. However, there is not always a beautiful story there. There are many lessons that can be learned and become learning material for regulators in Indonesia.

Success Bukalapak IPO last August, proved that regulators in Indonesia are ready to accept technology companies, as well as absorb the funds targeted by Bukalapak. Apart from Bukalapak, there are many technology companies that have stated their plans to immediately take the floor on the stock exchange.

To make it easier to understand the latest paradigm regarding IPO regulation both in Indonesia and in the global market. Mandiri Group composes whitepaper entitled, "The Billion Dollar Moment: A Paradigm Shift for Indonesian IPOs". The study is the result of a collaboration between the Mandiri Group, namely Mandiri Capital Indonesia, Mandiri Sekuritas, and the Mandiri Institute.

In general, the study describes a macro view of the fundraising strategy of technology companies in Southeast Asia, the IPO process for technology startups, and a comparison of IPO policies at home and abroad. Some of the conclusions of this study are that the rate of IPO volume of technology companies on the IDX is expected to continue to soar in the future.

Then, Bukalapak's success has proven to regulators and stakeholders that the IPO of a developing technology company will provide great benefits for the economy and welfare of the Indonesian people.

“With the record-breaking market debut of one of the tech unicorns, policymakers continue to actively transform the IDX into a more startup-friendly exit environment,” the study reads.

In the whitepaper presented, there are at least 14 technology companies that do IPO on the IDX throughout 2002-2021. Since 2002-2016, only three companies have IPOs, namely PT Limas Indonesia Makmur (2002), Multipolar (2013), Anabatic (2015). Then it increased to 11 issuers during 2017-2021.

Based on the business classification, they are divided into five groups, namely e-commerce, fintech, SME solutions, IT & Data Securityand digital trade marketing. At that time, PT Limas Indonesia Makmur had an IPO with a market capitalization of IDR 242 billion. Meanwhile, PT Bukalapak.com conducted an IPO with a market capitalization of IDR 87 trillion.

In regional markets, the trend of fundraising through mergers and acquisitions is predicted to reach $75 billion this year, after more than a decade of stagnant numbers at around $20 billion annually. This year alone, there have been at least three mergers and acquisitions between technology companies with a total transaction value of more than $245 million. The action was carried out by Carsome (acquisition of iCar Asia), Mekari (acquisition of Qontak), and Warung Pintar (acquisition of Bizzy).

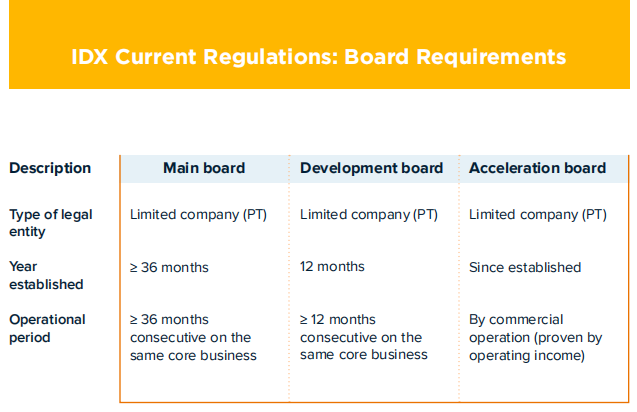

IDX and OJK are also more adaptive in doing a lot of relaxation to welcome more technology companies to take the floor on local exchanges. The relaxation is to standardize the method of calculating the stock index based on the number of outstanding public shares free float using the JCI as the main reference index.

They also make adjustments to the index selection criteria that allow issuers to be considered for immediate entry (fast entry) into the LQ45, IDX30, IDX80, JII, JII70, IDX BUMN20 and IDX-MES BUMN 17 constituents.

Learn from IPOs in the West

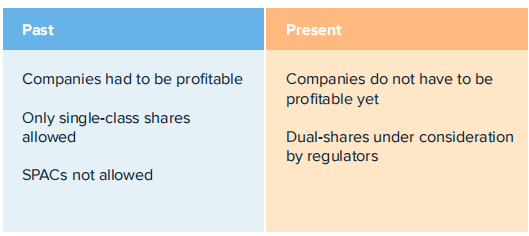

It must be admitted, the IDX and OJK's steps to support the passion of local technology companies to take the floor on the local exchange deserves thumbs up. One of the requests of local founders is the possibility of enactment of the rules dual class stock (DSC). Which, this rule just launched OJK after waiting.

This practice is needed by technology companies for four reasons. First, it provides peace of mind for founders who want to access the public capital market for funding but don't want to give up control of their business; allows owners of fast-growing companies to access the public equity market without giving up total voting control.

Then, management can focus on long-term wealth acquisition instead of being distracted by short-term performance goals; provide security in the event of a potential takeover or strategic threat, especially in an era of increasing shareholder activity; and investors may be less concerned about the potential downsides of a dual class structure when evaluating the benefits of investing in a company headed by a well-known executive or founder.

“From 2017 to 2019, nearly 30% of IPOs offered dual class shares. This type of structure is especially popular with technology companies whose founders want to retain voting rights and control over the company.”

It's not just about DCS, SPAC or anything else, it should be noted that not all IPO debuts of technology companies in Western countries went smoothly in the early stages. This indicates healthy investor skepticism. Even if a company has a healthy balance sheet and continues to be in the top position, it doesn't necessarily mean that an IPO will perform well in the near future.

Again, this is a healthy one as it shows that selling the company to public investors is becoming more challenging and valuation volumes are far from dot-com-mania levels. Take the example of Airbnb's stock price, when the IPO was priced at $68 per share, now breaking through to the $170 mark.

Then, SEA is an interesting case because since its IPO in October 2017, its shares have been priced at $15 per share, but the movement was not dramatic until finally in mid-October 2020 it exploded. As of the third quarter of 2021, SEA's share price rose 25 times from the IPO price to more than $360 per share.

“This is just one example showing that technology investment is a long game. Even if the stock price drops shortly after the IPO, the long-term growth and profit potential often feels worth it.”

Sign up for our

newsletter