Stock Red Carpet Titles for Startups

IDX has prepared a number of relaxation rules to welcome three unicorns. It is hoped that the Indonesian stock exchange will be more excited

Since the beginning of this year, the discourse on unicorn startup IPOs has been heating up considering that it is "time" for VC investment for early generation startups to enter the stage mature, aka must cash out to be returned to the LPs.

For that reason, the Indonesian Stock Exchange (IDX) openly issues a discourse that the three Indonesian unicorns will vote dual listings. At least Gojek, Tokopedia, and Traveloka have been widely reported willIPO This year. IPO is one way exit for investors, other than mergers, acquisitions, or issuing new shares.

The company's interest to take the floor, regardless of its status as a technology startup or not, is a very strategic decision because it must be committed to complying with the rules of the exchange with good governance.

Until now, technology startups that have taken the floor can still be counted on the fingers. Exchanges racked their brains to make IPOs friendly to disruptive types of companies and chose to focus on pursuing growth over profit. Creating acceleration boards, simplifying regulations, and creating an IDX Incubator program, are some of these efforts.

IDX Incubator first started in Jakarta in 2017, followed by Surabaya and Bandung a year later. It is stated that it currently has 114 fostered startups, 62 startups from Jakarta, 24 startups from Bandung, and 28 startups from Surabaya.

So far, three startups have succeeded in taking the floor. They are PT Yelooo Integra Datanet Tbk (YELO), PT Tourindo Guide Indonesia Tbk (PGJO), and PT Cashlez Worldwide Indonesia Tbk (CASH). Stock exchange officials said that in the first semester there would be two guided startups that would follow.

Separately, DailySocial contact the Head of IDX Incubator Saptono Adi Junarso regarding the evaluation of IDX Incubator so far. He did not provide a specific answer as to what stock exchange learning is like. It was explained that his party continues to learn and improve so that the program implemented is better.

More support is needed from various parties to prepare the company for an IPO. Not only from supporting professional institutions, but also from stakeholder others such as investors, government and communities.

"We always try to collaborate with agencies that can support more startups and small and medium scale companies go public, "He said.

One of the adjustments made by IDX Incubator is changing the curriculum to be more focused on helping companies with small and medium scale assets to list their shares on the IDX. This curriculum is called "Road to IPO" which has been in effect since 2019.

Road to IPO has a contained curriculum training and mentoring. With a differentiator like this, IDX Incubator is claimed to be in a more strategic position in the ecosystem. It also does not overlap with other incubator/accelerator programs.

"For incubation program which emphasizes business development, there are already several players. Well we want to be incubation program "continued preparations for the IPO," said IDX Incubator Operational Manager Aditya Nugraha.

This curriculum adjustment has the impact of tightening the requirements for assisted startups wishing to join. One of them is a startup that is already one step below the IPO process. However, those who join do not have to be technology startups. Conventional SMEs have the same opportunity.

Enthusiasm is still minimal

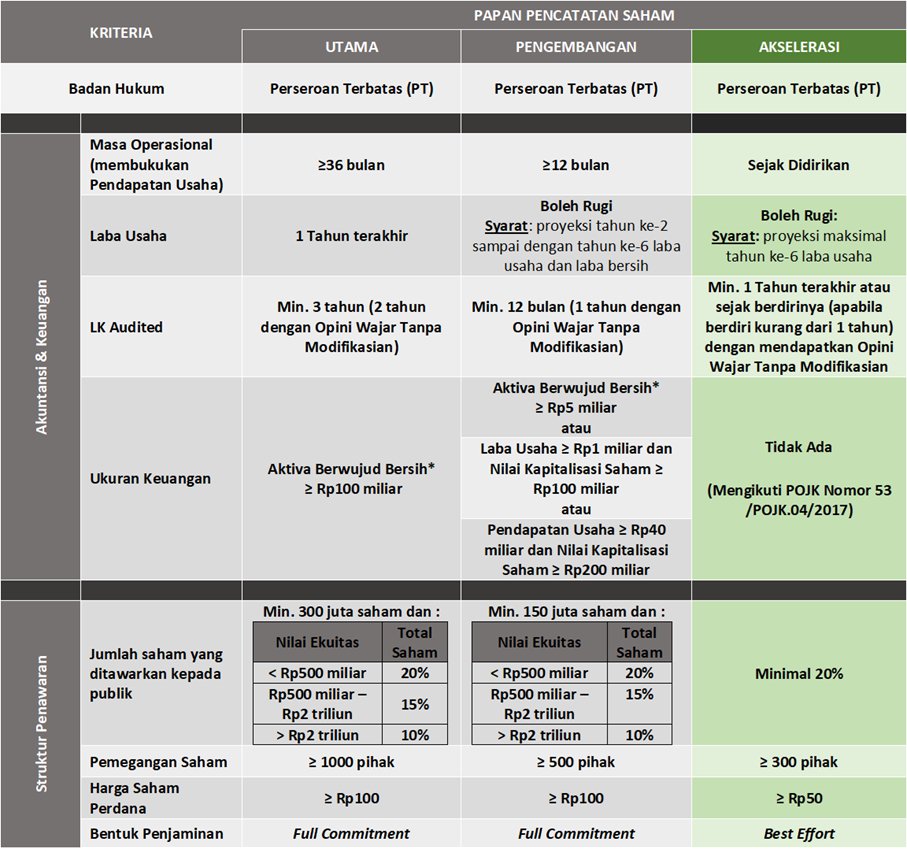

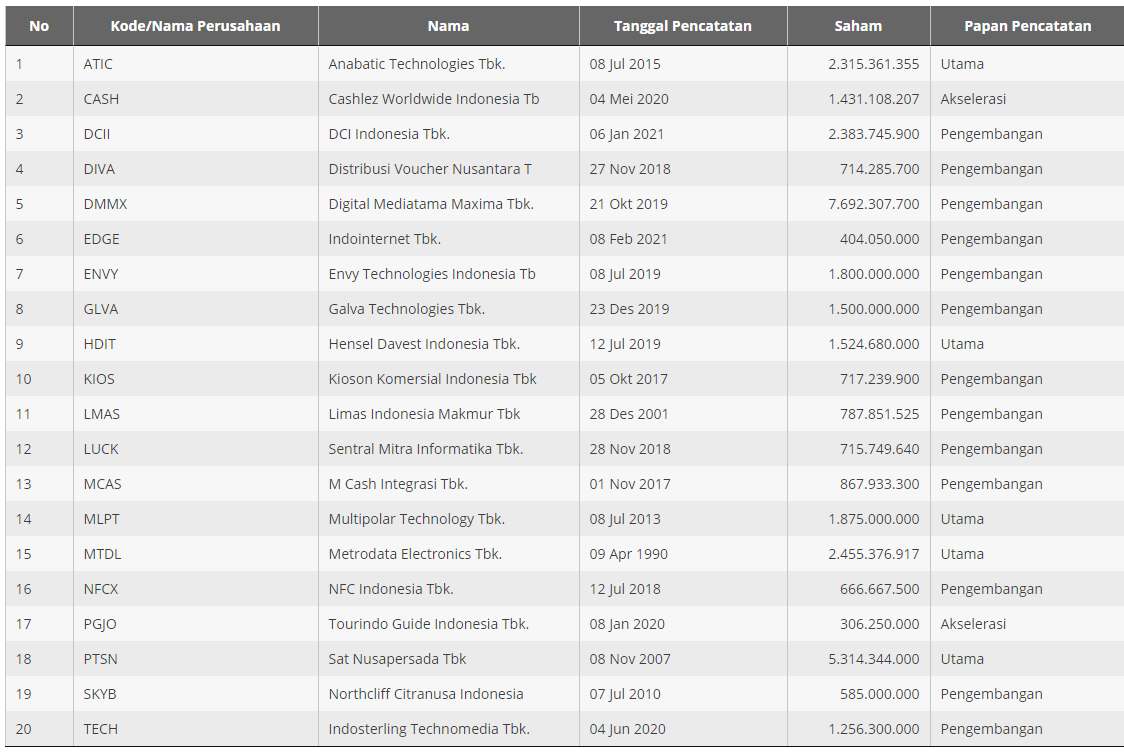

Apart from the three IDX Incubator graduates who successfully took the floor, citing the IDX page, there are 20 technology companies that have IPO'd. If you look at the board used, there are five companies listed on the acceleration board. Two of them are Cashlez and Pigijo. Other technology companies listed the majority on the development board, then the main board. The acceleration board itself BEI has inaugurated it since 2019, contained in Regulation Number IV.

BEI Development Director Hasan Fawzi explained that although the companies on the acceleration board can still be counted on the fingers of one hand, this does not mean that they are not in line with the targets targeted by BEI. In fact, he views that the IDX remains the same careful in carrying out his duties. Not just any company can pass the selection.

"We really looked at the condition of the company and what it was like concern them about what future growth prospects are like. There is mini exposure for us to look at from the company management and prospectus side business planwhether it's confirmed or not," he explained.

IDX tends to be stricter in assessing companies that want to enter this board because there is a responsibility to protect investors. IDX creates different monitoring parameters because it has its own board. On the one hand, investors are expected to really understand all the risks of buying shares there, apart from seeing the business potential on offer.

"We have required stock exchange members to submit a disclaimer for each share on the acceleration board, interfaceThe prices will be different specifically for transactions here. This has been done by all exchange members.”

Hasan said that currently the stock exchange is positioning itself as an inclusive place by offering alternative funding sources through IPOs. "It's possible that because it's still small [the scale of the business] it's still difficult to get funding sources from conventional [financial institutions]."

According to economist and researcher Indef Nailul Huda, the stock exchange still needs a long time to grow enthusiasm for startups to take the floor. Basically, IDX Incubator is only a means. Whether an IPO is successful or not depends on the company's own capabilities.

"Current existing equity crowdfunding as an alternative to IPO other than on the IDX. This is more possible because at BEI the process is very complicated complicated and must submit standardized financial reports. "It's tough for those who may not have qualified financial staff."

Another thing that might be burdensome for startups is maintaining share prices. There are many stories of technology companies in the United States whose share prices deteriorated after the IPO. On average, they do not have a strong path to ensure how the company can profit in the future.

“[Because] what is being pursued is only valuation. Calculated from GMV and range size subscriber. The business model cannot yet explain future profits."

Nailul also believes that the concept of share prices does not always reflect company performance.

"The share price is high but the company's fundamentals are bad, there will definitely be a lot of play and irrational buyers, usually only for a short time. But if the company's performance and fundamentals are good, share prices will tend to increase. One interesting example [that does not reflect company performance] is Gamestop.”

If these three unicorns successfully enter the stock exchange, Nailul believes that other startups will not necessarily be immediately encouraged to follow the same strategy. They will definitely monitor the results listing. If the stock price is okay at the start, it means they are just looking how at the beginning. After that, I don't care about stock prices.

“Of course it will be a benchmark for other technology companies not to listing Formerly. But if the results are good it will definitely become a benchmark for other companies too listing. "

Separately, in a media meeting held by East Ventures (19/2), Co-Founder & Managing Partner of East Ventures Willson Cuaca views that all startups must eventually be listed on the stock exchange, but not all startups can do that because each is at a different stage. What's more, IPO is only a part of cycle from a company.

For startups, the advantage of being listed is having additional liquidity and having excellent compliance because they have to comply with stock exchange rules. Meanwhile, for investors, becoming a public company is proof of validation of the valuation that has been measured before investing in the startup, whether it is correct or not.

"In my opinion, which startup should it be? listing? All startups must listing because there is validation of valuation, liquidity, and compliance improved. But can all startups do it? listing? You can't, because getting to that point takes time. "If the initial startup is busy going there, it won't be able to make products," said Willson.

Another serious preparation

The stock exchange is getting serious about encouraging unicorns to enter the capital market by making a number of adjustments. Their presence is considered to encourage enthusiasm for other startups listing.

Hasan explained that they had met intensively with the people stakeholder unicorn to discuss anything that is a problem. First request is the desire to enter the main board because it provides more added value for its investors, rather than development or acceleration boards.

This makes sense considering that the valuation of each company is worthy of being on par with large capitalized public companies in Indonesia.

For this reason, IDX is finalizing changes to regulation number IA, later this regulation will accommodate various characteristics of issuers, including technology companies for IPO. "We hell "I really want [the regulations to be implemented] immediately, but now we are in the discussion process to get approval from the OJK."

According to the current stock exchange rules, there is an obligation for companies intending to enter the main board to have tangible assets (net tangible assets). Meanwhile, the characteristic of a startup is ownership intangible assets which is greater than tangible assets. Therefore, the stock exchange will provide other measurement aspects, such as income and market utilization.

"We cannot deny the fact that in the past this has not been accommodated for companies like them whose strategy development is different from companies in general."

Second thing What is of concern and has been prepared by the stock exchange is the classification of sub-sectors that suit the businesses of unicorns. The stock exchange launched the IDX Industrial Classification (IDX-IC) on January 25. This classification changes the stock exchange classification previously used since 1996, namely the Jakarta Stock Industrial Classification (JASICA). The transition process was carried out over three months.

IDX-IC uses a grouping method based on market exposure for final goods or services used by listed companies, aiming to provide guidance for users regarding groups of companies with similar market exposure.

The division is more detailed into four levels, namely sector, subsector, industry and subindustry. Meanwhile, JASICA has so far grouped issuers per sector based on the principle of economic activity, so that the division is only at two levels, namely sector and subsector.

Hasan explained, IDX-IC uses benchmarking used by global exchanges, including similar to indices published by private parties such as Bloomberg.

Global investors will be happier if the shares they invest in companies can be compared with similar industrial groups in other countries. When compared based on sector, it becomes more apple-to-apple to see the growth or performance of peer-New.

“So now it's even more comparable. Companies that have listed can also benefit because previously it was in the general category, some were included in services or trading, now there are subsectors sports to entertainment who is more suited to his field.”

The last request regarding the potential application of several rules, such as special rights for founders to exercise dual class sharing by giving voting weights (vote) which differs between founding shareholders and public shareholders. Then apply the scheme multiple voting shares or one share owned by the founder has greater rights than ordinary shares in terms of decision making.

Saptono added, in completing all this homework, BEI did not only focus on improving the side supply, but also from demand investment from para sophisticated investors for technology companies, such as venture capital, private equity, as well as other investors by doing engagement and invite them to enter the Indonesian capital market.

Dual listings

Dual listings This is nothing new in the world of global stock exchanges, but in Indonesia this strategy is rarely chosen by most companies. Global technology companies, such as Alibaba and Sea Group, choose the United States stock exchange because it is the largest stock market in the world. NYSE (New York Stock Exchange) is the largest, followed by NASDAQ, which is composed of technology companies.

On the NYSE, for example, millions of shares can change hands between buyers and sellers per second. Due to the high exchange volume, the transaction process is relatively easy. In other words the US stock market is very liquid with low transaction costs.

So far, local companies listed on global stock exchanges can still be counted on the fingers of one hand. Quoting from Bisnis.com, a number of state-owned companies are doing it dual listings there are Indosat, Telkom Indonesia, Aneka Tambang, and Timah. Only Telkom and Antam are still implementing this strategy until now.

Telkom has been listed on the NYSE for 25 years. The journey is not always smooth. They were threatened delisted because they were unable to meet the deadline for submitting the audit of the 2002 financial statements.

Head of Research Samuel Sekuritas Indonesia (SSI) Suria Dharma believes dual listings has a positive impact on companies in general because they can have access to greater funding sources. However, there is a price to be paid, namely that regulations and reporting are often stricter than at home.

Meanwhile for unicorns, because they are predicted to have large market capitalization, scheme dual listings This is estimated to make the potential spread to potential investors also much greater. As a result, the fresh funds that can be obtained are greater.

He describes stock price movements for companies that dual listings they adapt to each other. “In the past, we often followed prices abroad, but now, on the contrary, we often follow prices in Indonesia. Maybe because there is more information that investors in Indonesia know first."

Willson added, dual listings what local unicorns will do can combine the best of two things, entering the US and local exchanges. "This is related to nationalism. If possible dual, of course the local market will be more enthusiastic. Had to go to the US because it's there the capital market sector, equity side and debt side, in all the preparatory and executive phases for the issue and placement of financial instruments;it's huge, so it combines the best of both."

- Header image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium