The Indonesian Electric Vehicle Market is Estimated to Reach More Than IDR 300 Trillion

Penetration of electric motorbikes in Indonesia is only 0,2% of the total distribution of two-wheeled vehicles, Vietnam has reached 9,7% and China 19,7%.

AC Ventures and the Electric Mobility Ecosystem Association (AEML) have just released a report titled "Indonesia's Electric Vehicle Outlook: Supercharging Tomorrow's Mobility" which reviews various key topics related to electric vehicles, ranging from industry players, infrastructure, local production, supply chains, to policies and regulations.

This report highlights the potential for electric vehicles in Indonesia with a projected value of $20 billion or more than Rp300 trillion in total supported by a number of key factors, including increasing consumer demand, government policies, and new technological developments that drive performance and reduce overall costs.

As of 2020, the use of electric vehicles in Indonesia has only reached 26.000 two-wheeled units and 7.600 four-wheeled units. This usage is primarily driven from B2B partnerships and direct purchases. In percentage terms, currently electric motorbikes are recorded as contributing only 0,2% of the total motorcycle market in Indonesia. This percentage could increase to 10% in the next five years if public and private stakeholders work together to promote local electric vehicles.

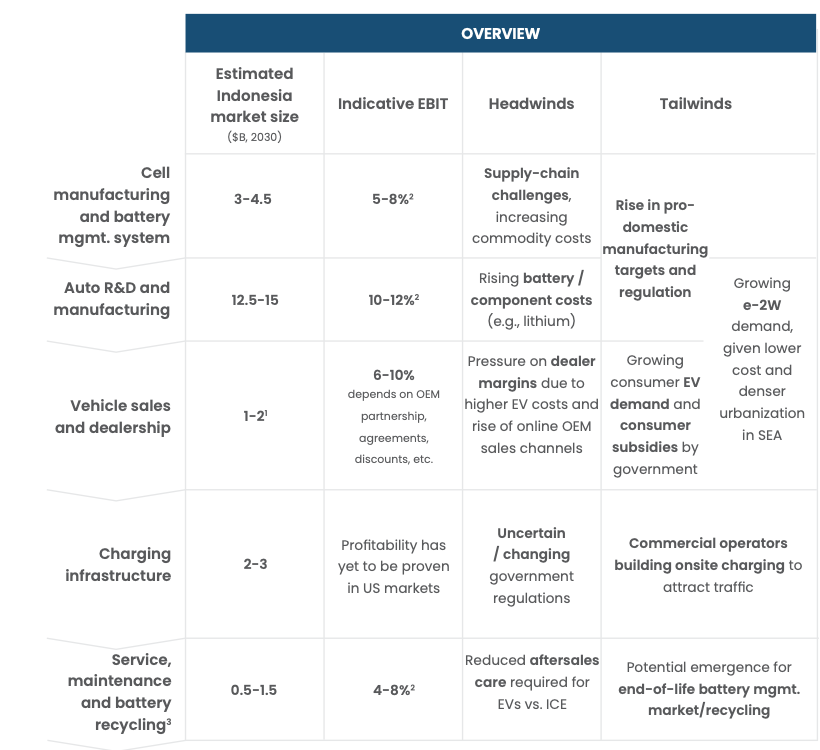

Support ecosystem, eg cell manufacturing and battery management system estimated to pocket a market value of $ 3 billion-$ 4,5 billion by 2030. Meanwhile, auto R&D and manufacturing projected to cross $12,5 billion-$15 billion. Even so, a number of challenges surround the development of electric vehicles in the country, starting from the high production costs of vehicles and battery components to the supply chain.

Stakeholders in the country have issued a number of policies on the demand, supply and infrastructure sides to provide subsidized financing/incentives to manufacturers, infrastructure developers and users.

In comparison, the penetration of two-wheeled electric vehicles in Vietnam has reached 9,7% in 2021. This does not include the use of electric bicycles. China and European countries recorded greater penetration, 15% and 16,1%, respectively, for four-wheeled electric vehicles in 2021. Meanwhile, China dominates the use of two-wheeled electric vehicles with 19,7%.

Local challenges, sentiments and ecosystems

The Ministry of Industry (Kemenperin) is targeting as many as 1,76 million battery-based electric motorized vehicles (KBLBB) and 400 thousand units for four-wheeled vehicles to be paved in 2025. In its realization, the government has been hampered by a number of challenges due to limited ecosystems to support production, infrastructure, and the supply chain. locally.

One of them is a network of charging stations (charging station) and battery exchange (BSS) in electric vehicles. As of 2022, there are only 439 high-powered general charging station which are located in 328 location points and 961 BSS in Indonesia.

This limitation is due to the high investment cost of building infrastructure for charging/exchanging electric vehicle batteries. Another challenge is that electric vehicles are not cheap, while options are financing not many electric vehicles. In addition, the limited specifications also cannot meet the needs of motorists.

In addition, interest in electric vehicles is also considered not high. Based on a survey related to sentiment or public perception of electric vehicles, as many as 95% and 84% of respondents respectively had a positive impression on this aspect. fuel efficiency and low maintenance costs. However, the biggest negative impressions were made on aspects of the electric vehicle model (84%), battery charging infrastructure (81%), and the size of the electric vehicle (79%).

"A lot of people are interested Switch to electric vehicles because they feel they are spending too much on fuel. However, for us, it's not just a matter of saving costs, but how to develop products that have the same performance and reliability as the vehicles they already have. That's why, we design products from our experience that are tailored to Indonesian users. We are developing R&D capabilities with our team," Maka Motors Founder and CEO Raditya Wibowo said during a panel session for this report, Monday (3/7).

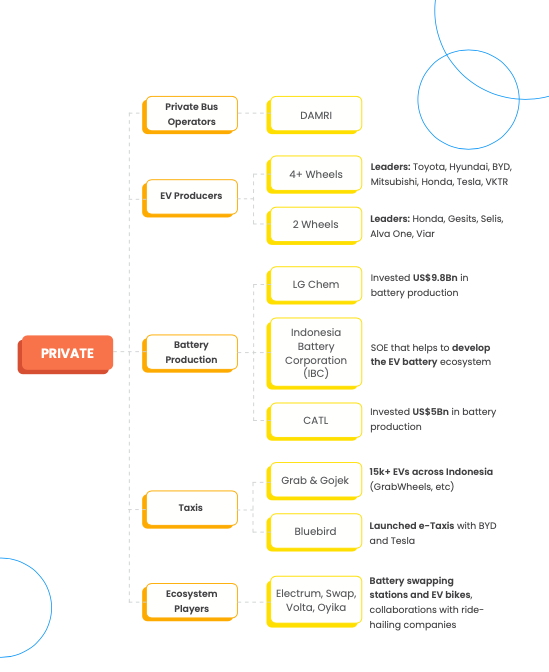

Furthermore, this report highlights government and private sector initiatives in supporting the domestic electric vehicle ecosystem. government established holding Indonesia Battery Corporation (IBC) to develop the electric vehicle battery industry from upstream to downstream.

In the private sector, electric vehicle battery manufacturing giant Contemporary Amperex Technology Co Ltd (CATL) from China plans to invest $5,6 billion to develop raw materials for electric vehicle batteries in Indonesia.

From a usage standpoint, big tech companies, like Grab and Gojek, take part by introducing the use of electric vehicles through services ride hailing and logistics as entry point they. Grab Indonesia operates a fleet of 14.000 electric motorbikes, while Lazada Logistics uses electric vehicles produced by PT Smoot Motor Indonesia for logistics purposes.

More Coverage:

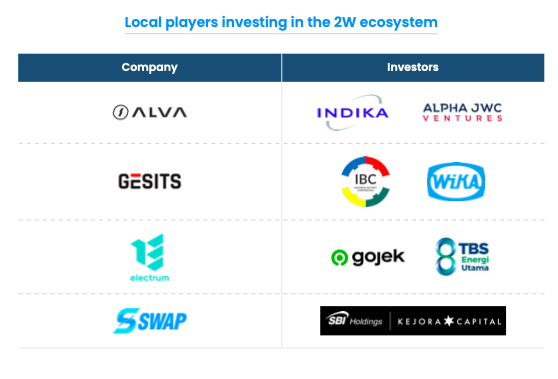

Based on the data we have collected, the domestic electric vehicle ecosystem is currently filled with various startups for electric motorbike manufacturers and battery developers involving a number of stakeholders. Some of them are Alva One, Charged Indonesia, ION Mobility, to Energy Swaps.

Corporations and venture capitalists are also getting involved by setting up joint ventures (j/JV) to work on electric vehicles, of which there are Electrum (GoTo and PT TBS Energi Utama Tbk) and Ilectra Motor Group (PT Indika Energy Tbk, Alpha JWC Ventures, and Horizons Ventures.

Meanwhile, a subsidiary of BUMN, PertaminaNRE participated in disbursing managed funds of IDR 7,7 trillion last year. The managed fund, called the Energy Fund, is set up to invest in innovation in the energy sector.

Sign up for our

newsletter