Tips for Fundraising Today from the Eyes of a Startup Executive

Three startup executives and founders share their experiences regarding fundraising

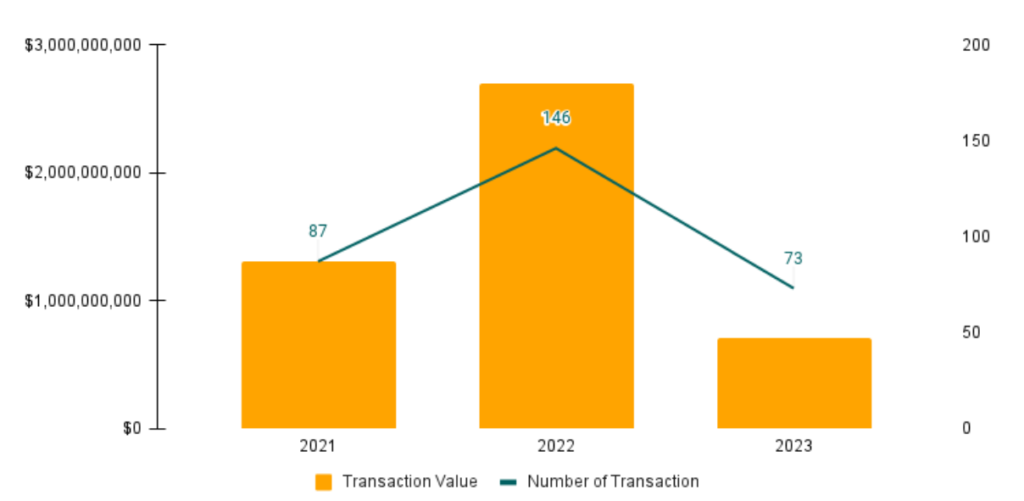

Fundraising or fundraising is an important part of the journey founder. However, this activity can be a complex challenge, and is often overwhelming founder itself. Moreover, fundraising is no longer as easy as before.

Call it a process pitching or negotiating terms, which demands tenacity and a strategic mindset from the participants founder. From this experience, founder gain valuable lessons that can be utilized in making future business decisions.

DailySocial.id talks with three startup executives who are pursuing and already achieving profitability about the ins and outs of fundraising, and offers valuable tips that can help aspiring founder next navigate the startup industry.

Funding allocation strategy

The P2P Lending sector has been under the spotlight of the public and regulators for several years. Bad credit, deteriorating performance, and old issues such as illegal borrowing, have become an alarm for P2P players to strengthen their business fundamentals.

Modalku Country Head Arthur Adisusanto said that the potential for lending is still very large. Since 2021, he noted that Modalku Group's loan distribution, to Indonesia, Singapore, Malaysia, Thailand and Vietnam, has been quite stable with an average growth of almost 30% every year.

However, in this uncertain macroeconomic situation, the company claims to be focused on pursuing profitability to show positive growth. He also carefully manages expenses to maintain the company's financial health.

"We are seeing an increase dry powder which many VC funds are holding back as market valuations tighten. "Apart from that, in the midst of the current challenging global economic situation, investors' expectations have also changed, with many investors now focusing more on profitability," said Arthur.

This step is also reflected in the Modalku Group's strategy to seek funding. The company raises funding from a number of VCs for product development and business outreach. Temporary, debt funding The money he obtained recently was used to increase loan facilities for MSMEs in Southeast Asia. Especially MSMEs which are still underserved or underbanked.

To ensure loans can be received by the right MSMEs, Modalku applies principles responsible lending to conduct an assessment of fund recipients and their financial ability to repay the funding,

Achievement, not narrative

It is common knowledge that it is easy to get investment from VCs. Not a few startups can easily convince investors just armed with an idea. At least that's what the Co-Founder said Eden Farm David Setyadi Gunawan when talking about the situation fundraising startup a decade ago.

This also cannot be separated from the fact that VC at that time was eyeing investment in high growth company, using familiar metrics, such as revenue or GMV. However, since the last few years, there have been changes mindset where VCs target startups that have a clear direction for profitability.

"In the past, [startups] only used narrative, whereas now there has to be one clear and proven way, whatever has been achieved. "We always use data metrics from what we have done and achieved - and the results have been proven," said David.

Even then, he said, it took eight months to close the funding deal. This is different from the years before the pandemic where startups could raise millions of US dollars in funding and get it in 1-2 months.

"Previously, VC competition was tight, anyone could easily get capital. Now VC is starting to decrease, and investors are starting to observe before investing, especially after the Fed raised interest rates to 5%."

Importance due diligence

Doing fundraising while going solo founder not easy for me Ryan Gondokusumo. He met with 80 VCs before securing funding from Asteria Corporation in 2014. He admitted that at that time there were not many options from local VCs, most of them came from abroad.

Additionally, the average VC he met was less than interested due diligence which is a complex and long process. Investors don't even understand the domestic market because they never go to the field. In fact, he said, this process is actually very important.

Even though it took a lot of time, he admitted that this experience helped him avoid 'mine' steps that were risky for his business.

"Once I decided on profitability, what's more, [Sribu's] market share wasn't as big consumer, that's where VCs aren't as interested. This explains why our investors are corporates because they demand profits.”

Regarding business development, Ryan advised that founder dig more information on the market, identify what they need. This is to avoid expensive costs incurred for product development without knowing the market. "Try to test the market as quickly and cheaply as possible. For example, Sribu Recruitment doesn't have a product yet, but we have the talent. Start with servicing, we are not trying to sell, but want to know appetite from market."

bottom line, Make sure where the business is going, especially if you have to burn money. The reason is, fundraising will never end. Focus on strengthening good business fundamentals, then investors will come themselves.

Sign up for our

newsletter