Two Years of Focusing on "Cash Loan", Lightweight P2P Lending Ready to Expand Productive Loans

Has served more than 200 thousand borrowers and disbursed a total loan of more than IDR 10 billion since its establishment in 2019

Startups p2p loans Lightweight immediately fulfills the requirements from OJK to participate in productive loans in his business portfolio. For approximately two years of existence, they were known as fintech which provides fast loan funds (cash loans).

To DailySocial.id, CEO & President Director Light Yudhono Rawis explained that the loan product will target the MSME segment as its borrowers. Its nature is like KTA, a loan product at a bank because it does not require collateral as a requirement. "We hope that the launch of the LightweightKTA product can help MSME players from various sectors to develop their current business," he said.

OJK itself encourages the industry to enlarge the portion of distribution to the productive sector rather than consumptive and multipurpose. In the revised regulation of POJK Number 77 of 2016 which is currently being discussed, the authorities want the portion to reach 60% of the total distribution.

Companies are encouraged to disburse loans to productive sectors at least 40% in stages over three years. That is, a minimum of 15% in the first year, and 30% in the second year. Under current regulations, new companies are required to disburse loans to the productive sector at least 20% of their total business.

According to Yudhono, in distributing loans to borrowers, the use of funds is quite varied. Some use it for additional costs to start a business, home renovation costs, or costs for emergency needs. Thus, the company's initiative by launching products for the productive sector has a spirit that is in line with what is pushed by the regulator.

Since operating in 2019, the company, part of the Ping An Group, has served more than 200 thousand borrowers and disbursed a total loan of more than IDR 10 billion. The company provides a loan ceiling of up to IDR 20 million with a choice of 3 to 1 year terms and interest starting from 0,05% per day.

As for lenders, so far it is still closed to institutional lenders only. Yudhono did not mention any lenders who had joined. However, the company opens up possibilities for individual lenders in the future.

As of August 2, 2021, the company has officially obtained a permit from the OJK.

Take advantage of OneConnect technology for e-KYC

Yudhono explained that the use of the latest technology is actually a must for companies fintech. Not only does it help companies to be more careful in disbursing loans, it also improves the user experience because the application process does not take a long time.

Therefore, the company announced its cooperation with another sister company of Ping An Group, namely OneConnect Indonesia. In this collaboration, Lightweight utilizes OneConnect technology for automation and simplification of processes within the Lightweight application, starting from the initial process, setting up loan applications, billing payments, risk assessments, and final reports.

OneConnect is the provider of AI technology in Lightweight apps to run the process e-KYC, including verification of prospective borrowers, authentication of customer ID cards remotely, automatically collecting electronic application files, and biometric facial scanners for remote verification of customer identity. "With the application of this technology, we can provide a good and fast customer experience for prospective borrowers."

Initially, verification of loan applications required 8.000 working hours, now it is faster. More than 100 thousand submissions have successfully scanned their ID cards and completed the loan process via Lightweight. The electronic application process also reduces the possibility of errors, minimizes identity fraud, and increases work productivity.

The company also prioritizes a prudent process in the credit analysis process, through a combination of analysis carried out by the system, including the use of AI, and the company's credit analyst staff. “We are also connected with credit bureaus to find out the character of potential borrowers. Our percentage of bad loans in July 2021 is 0,06%.”

In Indonesia, OneConnect is also working with Sinarmas to build a retail loan system. Beyond that, OneConnect's business portfolio is quite dispersed. Among them are Bank RHB Malaysia, UBX Philippines, SB Finance Philippines, National Development Bank Sri Lanka, and a commercial bank in Vietnam.

The portion of the productive sector is still minimal

More Coverage:

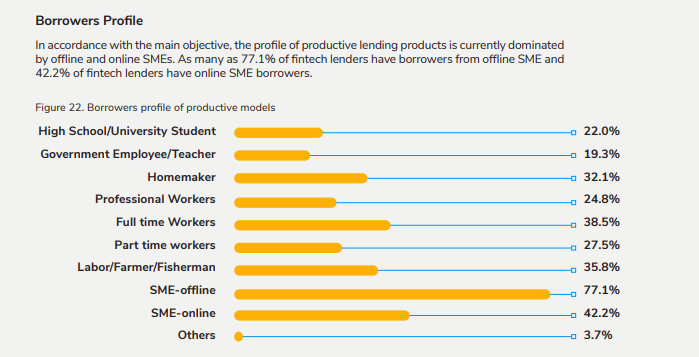

Menurut report DSResearch and AFPI Last year, 36,1 million borrowers in the productive sector borrowed Rp. 2,5 million to Rp. 25 million. Only 17,6% of them borrowed more than Rp500 million. This sector still needs to be further boosted by regulators, especially during this pandemic, many MSMEs need to be hit and must survive.

Sign up for our

newsletter