Paying Attention to 2023 Fintech Lending Data, Positive Signals of Industry Growth

AFPI said there had been significant improvements in the risk management system, claiming it had successfully overcome previous issues

The latest OJK data, as of October 9 2023, there are 101 companies registered. This number has been relatively stagnant in recent years (the rise and fall has not reached double digits). However, other statistics continue to experience exponential increases.

For example, in terms of total assets, by the end of 2023 the value reached IDR 7.043 billion, up 27,7% compared to 2022. Meanwhile, liabilities were IDR 3.575 billion, up 44,8% and equity IDR 3.468 rose slightly by 13,9%.

Growth space still wide open. Referring to Bank Indonesia data, 97,8 million people or 48% of the total population of Indonesia do not have access to banking services (unbanked). On the other hand, of the more than 60 million MSMEs in Indonesia, only around 27,6% have received credit facilities from formal institutions. There are various factors, ranging from financial education to limited access.

Value propositions matter is in the utilization of technology to break down boundaries that traditional financial institutions are unable to accommodate. For example, to improve risk management para build platforms alternative credit scoring powered by big data – making credit assessment no longer dependent on SLIK which has limitations in assessing community credit unbanked.

In the midst of various achievements, this industry is also facing a number of cases. Starting from the distribution of illegal players to the failure of management of registered players. Maybe readers still remember a case that recently occurred, related complaint Actioncalendar investree who have difficulty withdrawing their funds. Or problems that occurred at Tanifund in managing funds, AdaKami in billing, and iGrow in managing loans.

The case above has become a topic of conversation, because fintech brands is relatively included in the list of players top of mind in society. Preventive and repressive measures are actually included in OJK Regulation no. 10 of 2022 which regulates the criteria and business model mechanisms in Indonesia.

Fintech Lending Statistics 2023

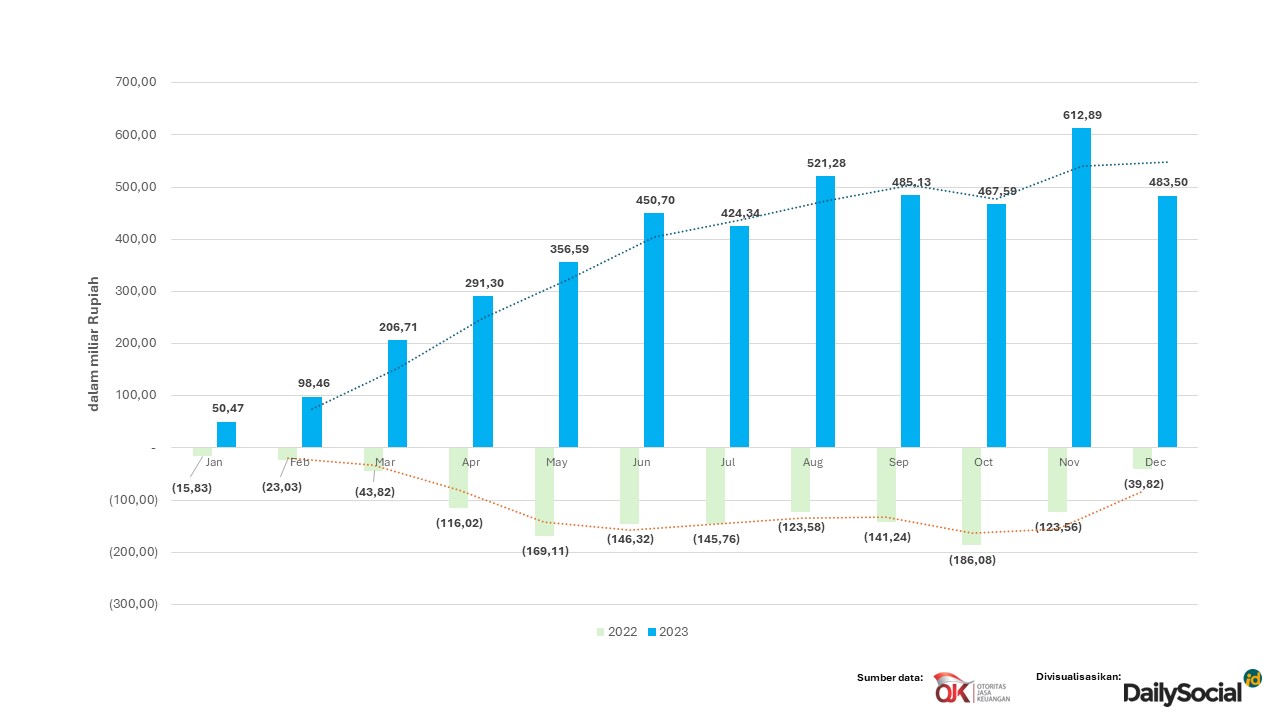

Towards Positive Cash Flow

Starting in 2023, this industry will cumulatively begin to record positive cash flow. Of course, this sets a good precedent, after previously for a full year the accumulated cash flow always showed negative numbers. This profitability achievement is also in the right situation - as is known, investors are currently starting to think conservatively about making profit achievement the main measure when investing in a digital business.

Looking at the achievement graph, the profit recorded in 2023 will grow quite exponentially. In response to this, AFPI Chairman Entjik S. Djafar in his interview with DailySocial.id said, throughout 2023, one of the important improvements in the industry will be improving the risk management system (including credit scoring). This has direct implications for loan quality – significantly minimizing the rate of default.

“In 2022 we know that there are some weaknesses for credit scoring. Then in 2023 it won't be a problem. Now there is a lot of ecosystem support (for mobile devices to report the, data etc.) that helps support this industry so that it continues to mature, carefuland comply. However, we are continuously evaluating credit risk – we innovate how to mitigate it and minimize credit risk," he said.

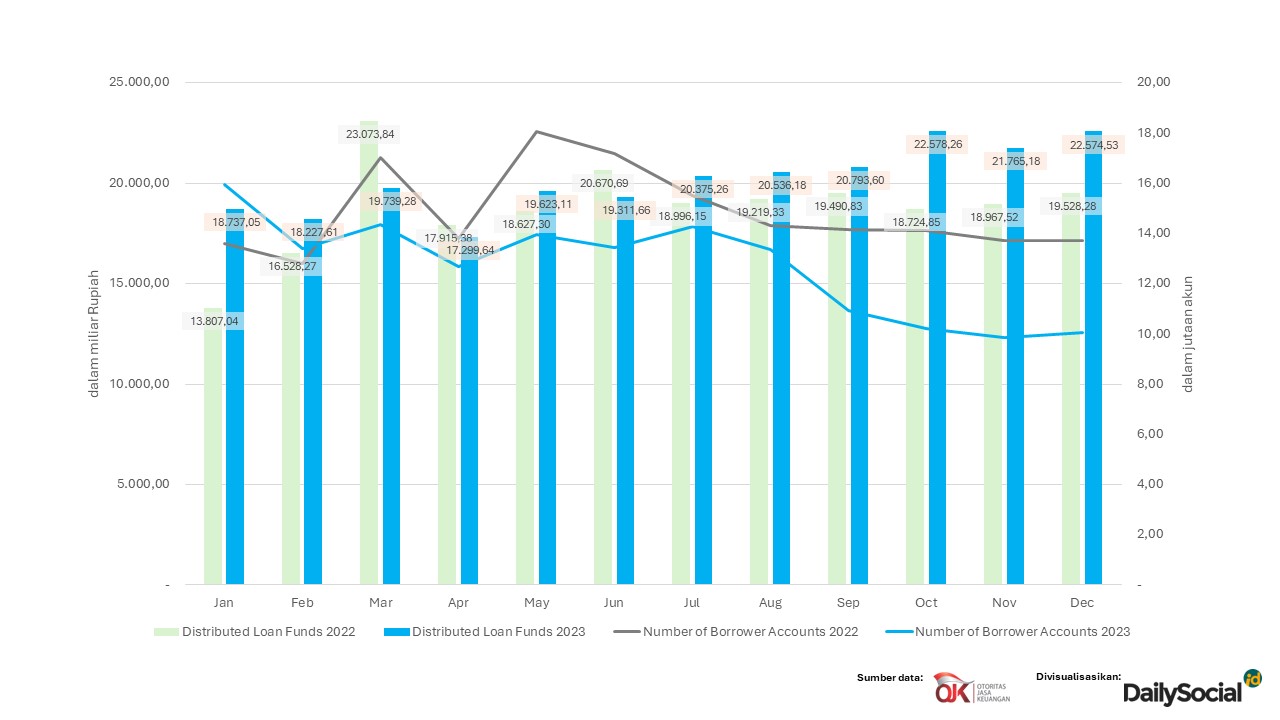

Slight Decline in Loan Distribution

Compared with 2022, the distribution of funds to borrowers in 2023 fell very slightly by 0,14%. Meanwhile for the number of borrower accounts (borrowers) monthly actually consistently decreases from month to month compared to the same annual period. According to AFPI, a stronger risk management system has a direct impact on reducing the number of borrowers. The system has succeeded in minimizing potential borrowers who have the potential to default.

"To be honest, in 2021 and 2022 there were several failed payment syndicates that were discovered. These syndicates tried to break into this industry with stolen ID cards, manipulating selfies during verification, and applying for loans without making any repayments. Now the verification system has become more sophisticated "We apply AI to prevent image manipulation, and can even read whether it is a real face or a robot. In 2023, it will be further refined, so that more potential borrowers will be eliminated," said Entjik.

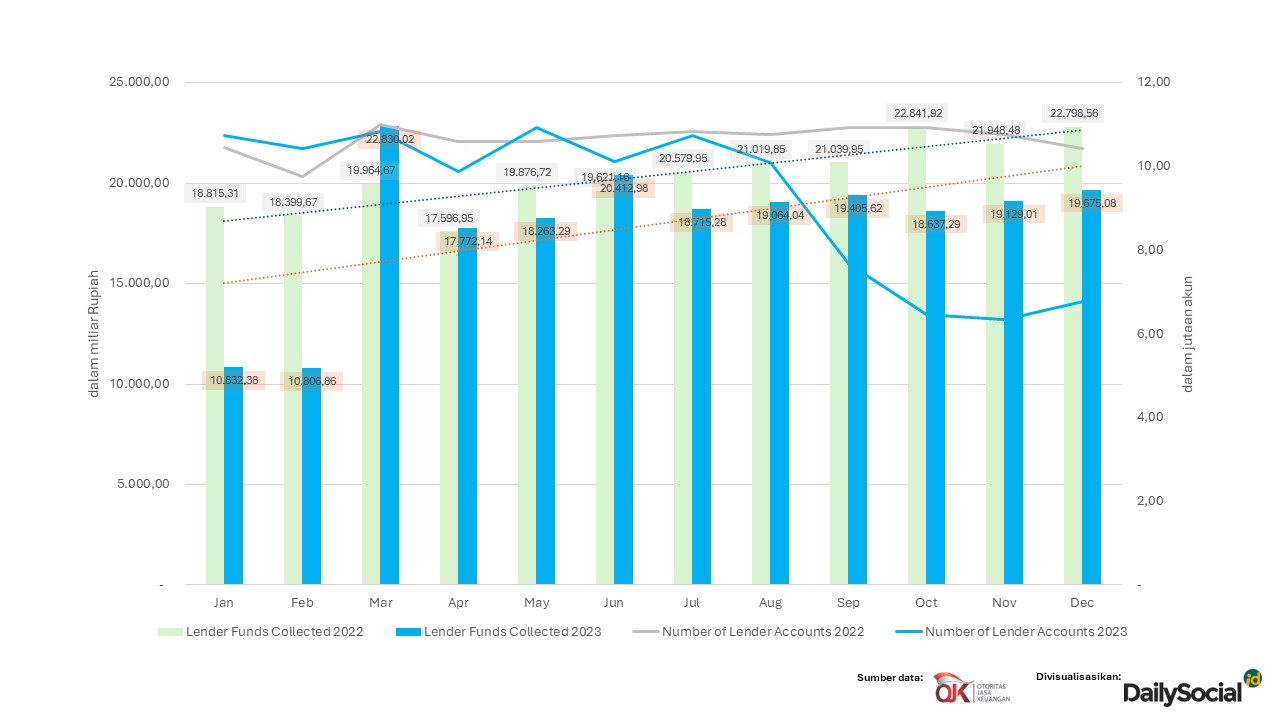

Interest in P2P Lending Lenders Declines

With schema peer-to-peer, service also accommodates the community to participate in providing funds. Throughout 2023, there is a downward trend both in terms of the total amount of Rupiah and the number of accounts Actioncalendar registered. The peak of the decline was quite obvious when entering the fourth quarter.

If we look at industry news records, last year there were indeed a number of industry dynamics that dragged down a number of people top of mindbrand, especially those who also provide features Actioncalendar. Some cases make Actioncalendar difficulty in accessing funds, one of the cases as mentioned above is related to the Investree incident.

Although he did not want to provide specific comments on a case by case basis, Entjik said that a number of cases involved locally due to the company's lack of strictness in implementing standardized SOPs and regulatory rules.

"Never deviate from the POJK. Never deviate from what is regulated by law. That's all. So as long as we follow it, we will definitely be safe. Because of legal issues fraud or others, 1000% definitely deviate from existing POJK or SOP. That's what I always say," he stressed.

Further examples are given regarding cases Actioncalendar which demands, if industry players do what is stipulated in the regulations, ideally this issue will not occur.

“For example at the time Actioncalendar register, we must explain in detail these credit risks. So don't let it happen Actioncalendar think this is an investment. Or it's like placement deposits where you will definitely get your money back. Well, this is something you might need to educate yourself about Actioncalendar so that you understand from the start," said Entjik.

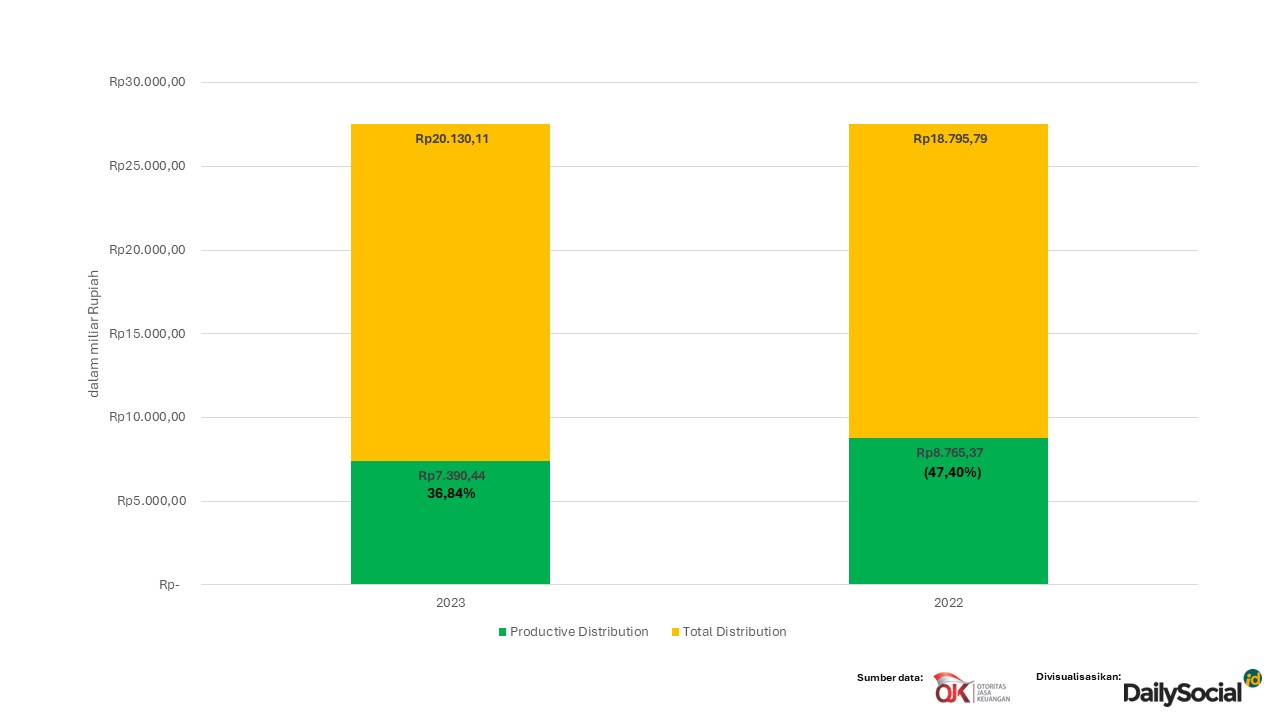

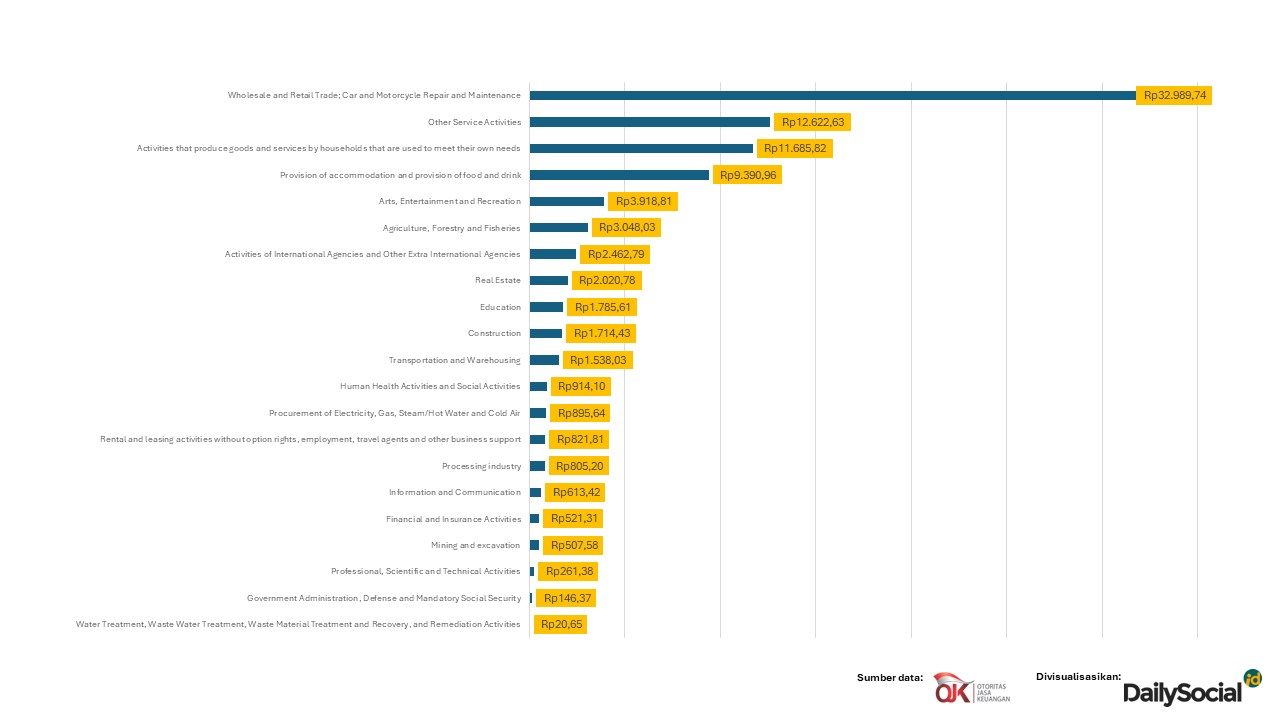

Distribution in the Productive Sector is Still Minimal

According to data from the Ministry of Cooperatives and SMEs, as of December 2023, the MSME credit ratio was still at 19,36%. This is still far from the government's target of at least 30%. Furthermore, according to Bank Indonesia, 46,21% of MSME credit was distributed to the micro segment, 31,26% to the small segment, and 22,53% to the medium segment. Actually It is hoped that it can fill this gap, assisting institutions such as banks in helping MSMEs overcome capital issues.

In fact, the distribution of loans to the productive sector is still small. In 2023 the figure will only be 36,84% of total credit disbursed to MSMEs – this achievement is a slight decrease from the previous year.

In more detail, the inflammation sector dominates the gains. A number of startups Indeed, it specializes in providing supply chain financing to meet retail needs, especially in the FMCG segment. The large market value, supported by fast transaction turnover, makes this area currently considered prospective.

One of the players in the FMCG financing sector is CloudCash through AwanTempo stall stock financing services and wholesale Supplier Financing financing. Through technological innovation embodied in an integrated ERP, AwanTunai has created a system that allows MSMEs and FMCG suppliers to gain smoother financial access. The ERP platform is also an important data source to help companies carry out more comprehensive risk analysis.

By focusing on playing in this area, AwanTunai has achieved positive EBITDA and is targeting positive profit (after tax) by the end of 2024.

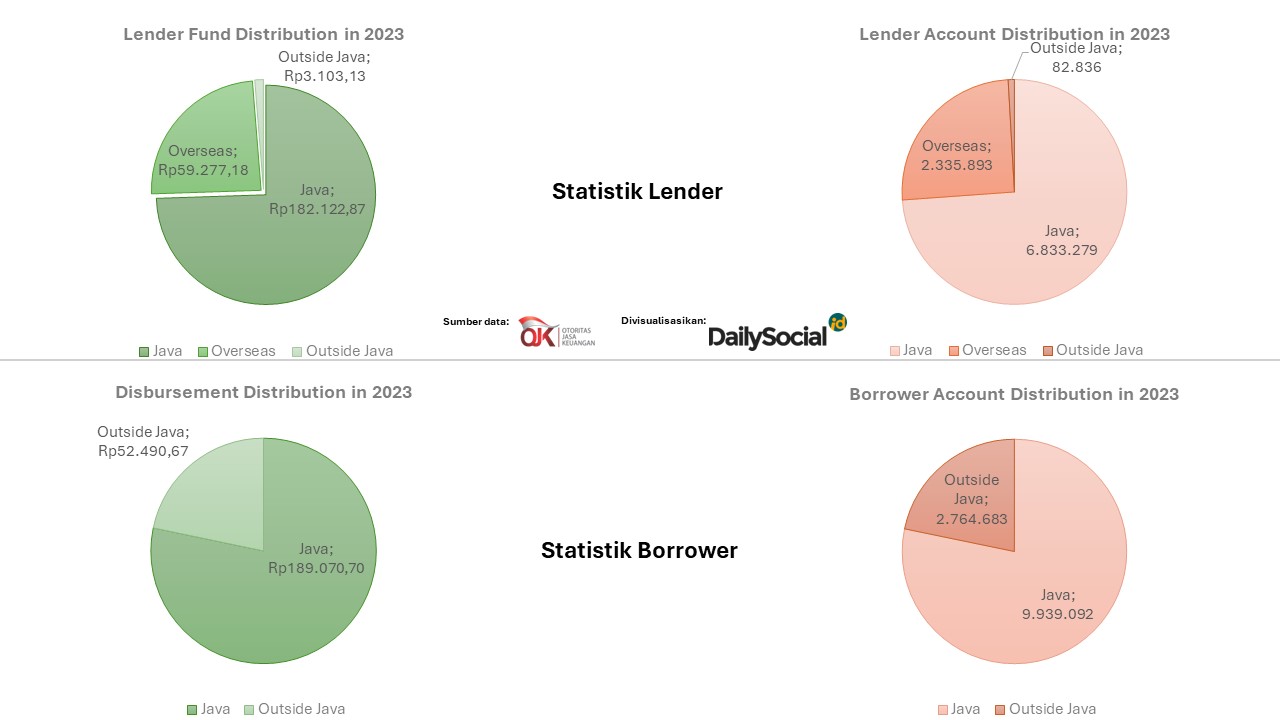

Still Focused on the Java Area

Another interesting statistic regarding distribution borrowers and Actioncalendar which until 2023 will still focus heavily on the Java area. Responding to this, AFPI said that actually there was a desire from the people To expand outside Java, I still have a number of limitations, one of which is infrastructure. Apart from that, there are user education challenges that still need to be pursued, because the level of literacy is considered to be still not the same as that in general between Java and outside Java.

"Why are there so many in Java? Indeed, most of the population is in Java (and Bali). So we still have more than 80% concentration in Java. Well, even that 80% hasn't touched everything. There are still many areas in Java that have not been touched [...] ] In fintech It consists of three clusters: Cash Loan, Productive, and Sharia. "Well, many productive friends are also financing in Sumatra and in Sulawesi and even in Papua," said Entjik.

He continued, "An ecosystem for risk control in Java is more accurate [at the moment], so we prefer Java first. I mean person by person, borrowers for borrowers This is still easy for us to detect, yes, easier for us to analyze compared to those outside Java. But in the future we will definitely expand outwards."

Loan Quality

More Coverage:

One of the industrial quality assessments based on the level of Non-Performing Loans (NPL), aka non-performing loans. Formally, OJK measures this through a number of measurement variables. The following are the measurement results in 2023:

| 2023 | 2022 | |

| TKB90 | 97,05% | 97,38% |

| TWP90 | 2,95% | 2,62% |

| TKB0* | 85,30% | - |

| TKB30* | 89,43% | - |

| TKB60* | 91,95% | - |

*DailySocial.id carried out measurements by taking the average value of 12 cash loan players registered with the OJK chosen randomly

As is known, TKB90 is the percentage of loans that are paid within 90 days after maturity. A high value indicates good payment performance. Meanwhile TWP90 is the percentage of loans that fail to pay more than 90 days. A low value indicates low credit risk.

With an average TKB90 of 97%, the industry In general, I still get good scores. Likewise, the TWP90 achievement which is still at 2,95% implies that the risk level is still relatively maintained.

However, we are trying to explore the achievements of other variables which are currently also being measured , especially for companies that play in cashloan. Using sampling from 12 players cashloan licensed by the OJK, we found that the percentages achieved by TKB0, TKB30 and TKB60 were still below benchmarking 97% for TKB90.

“From 2022 to 2023 it looks even better. I also see NPL dropping slightly, even stable. Credit too, although it is not as intense as in 2020 and 2021 growth- but there is still growth. And indeed in 2023, most industrial companies in fintech peer-to-peer lending "This focuses more on consolidation, so many strategies are more conservative," explained Entjik.

Industry Overview

Overall, the industry Indonesia shows positive growth based on the data presented. However, to ensure its continuity and stability, efforts need to be made to reduce business dynamics that have the potential to harm players fintech by complying more with regulations and strengthening supervision. AFPI can play an important role in promoting regulatory discipline among its members.

Apart from that, there is an emphasis on NPLs, especially in the context of loans with short tenors such as cashloan, needs to be the main focus. Efforts to tighten the assessment process for potential debtors and improve user education could be key strategies in reducing NPL levels and ensuring sustainable growth for the industry in the future.

For more data on industry statistics in Indonesia, download the following report: Indonesia's Fintech Lending Report.

Sign up for our

newsletter

Premium

Premium