"Same Day Delivery" Trend Predicted to Increase, Competition in Logistics Services is Getting Tighter

Food delivery is one of the drivers of "same day delivery"

The growth of the logistics market in Indonesia is predicted to improve in 2021. This prediction has taken into account the factors of Indonesia's current situation with the implementation of social restriction policies in a number of regions.

Chairman of the Indonesian Logistics Association (ALI) Zaldy Ilham Masita revealed a number of predictions and logistics trends that will occur in Indonesia this year. First, he observed that logistics service actors have begun to adapt during the pandemic. This can be seen from the emergence of new services and collaborations between startups and large logistics companies, especially to accommodate the needs of instant courier services (on-demand).

"In the fourth quarter of 2020, logistics have started to increase because spending society has started. In the first quarter of 2021, it is a bit worrying because there is a re-imposition of social restrictions. However, we are optimistic because for the last six months, [logisticians] have been trained to adapt. We predict that the peak of logistics [increase] will occur in the third and fourth quarters of 2021 in line with more and more people being vaccinated," he said when contacted. DailySocial.

Based on reports Ken Research, Indonesia's logistics market is estimated to reach a value of $200,3 billion with a CAGR of 7,9% in 2024. This value includes the business of freight forwarding, freight forwarding, warehouse, express and parcel (CEP), up to cold chain logistics.

Secondly,, he estimates that the increase in logistics business this year will be largely driven by services same-day delivery. With the current situation, he estimated This trend can spur logistics industry players to evaluate the duration of delivery times same-day delivery existing ones have met customer expectations and are business competitive.

Zaldy, who is also the President Director of Paxel, even admitted that he would consider these findings. Moreover, Paxel, which is a technology-based logistics delivery service platform startup, initially started the service same-day delivery with a delivery duration of up to 10 hours.

Services | Ja(bo)detabek rates | Duration |

| GoSend | IDR 2.815/km (0-6km), IDR 18.000 (6-15km), IDR 1.200/km (>15km) | Max 4 hours from after pickup barang |

| Grab Express | Starting from IDR 15.000 (0-5km) | Max 6 hours (motorcycle) starting after pickup barang |

| paxel | Flat up to 5kg Rp. 8.000 (in city), Rp. 15.000 (outside city) | 6-8 hours (in city), 10-12 hours (outside the city) |

| MrSpeedy | IDR 8.000 for the first 4km | Max 90 minutes |

Source: official site Gojek, Grab, Paxel, MrSpeedy / Reprocessed by DailySocial

"Now, same-day delivery in the city only 2 hours. Over the last few years, customer expectations have risen significantly. [Paxel] is even evaluating again is same delivery 8-10 hours long can still compete. Moreover, there are more extreme ones with lower costs. It means the industry needs greater innovation," he explained.

Train same-day delivery driven by food delivery

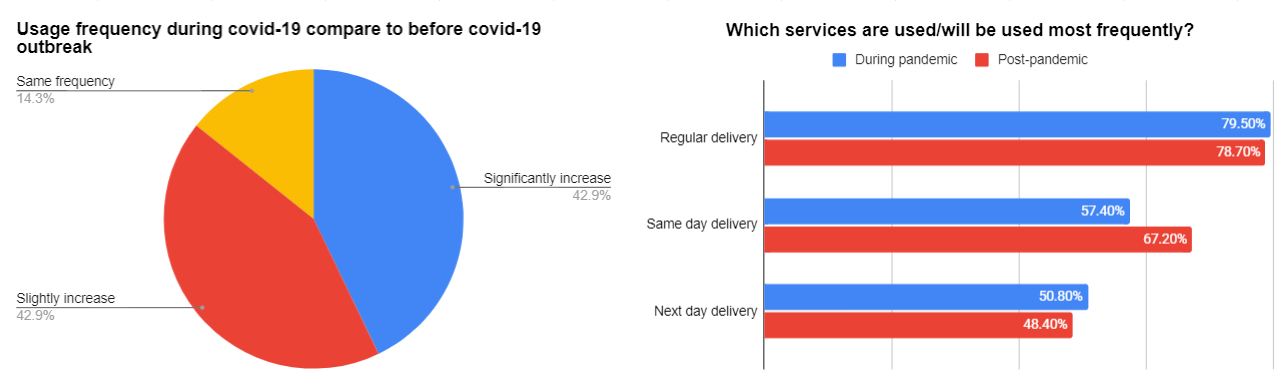

If referring to the report The 2nd Series Industry Roundtable: Logistics Industry Perspective which was released by MarkPlus Inc in October 2020, the frequency of courier services increased rapidly during the pandemic. This increase was triggered by a number of key factors, including online shopping activities, prices, and delivery times.

In addition, service same-day delivery Usage is expected to increase more rapidly post-pandemic (67,2%) compared to regular delivery services (78,7%) although the portion is still larger. This research was attended by 122 respondents from the Jabodetabek area (59,8%) and non-Jabodetabek (40,2%).

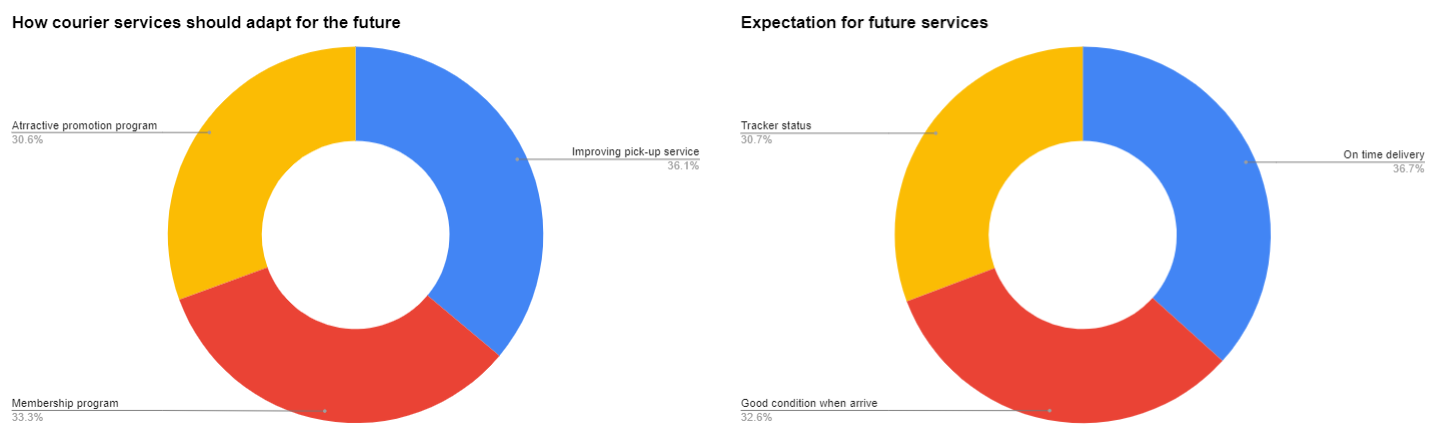

Then, respondents also have main expectations regarding timely service delivery (36,7%) and logistics service providers are deemed to need to improve services pickup in the future.

Third, According to Zaldy's observations, the share of the B2B logistics market has begun to decrease due to this shifting shopping behavior from offline to online. The push is getting stronger during the pandemic and increasing customer expectations which are considered to be increasingly extreme. He estimates that the share of the logistics business in the B2C segment will increase from 10% to 25% this year.

"Fourth, this year is also a proving ground to see which logistics business models are successful and which are not. More new business models will probably emerge because many new markets are not yet open, for example food delivery services," explained Zaldy.

Some giant startups, such as Gojek (GoFood), Bukalapak (BukaFood), and Shopee (ShopeeFood) have started preparing to strengthen their position in this market segment. The large logistics company SiCepat even acquired a 51% stake in the food delivery platform DigiResto in order to encourage revenue contribution from the food delivery market in Indonesia.

Quoting Momentum Works research results, GMV of food delivery services (food delivery) experienced accelerated growth during the pandemic. This report notes that the GMV of food delivery services in six countries in Southeast Asia reached $11,9 billion in 2020.

For the Indonesian market alone, the figure reached $3,7 billion or the equivalent of IDR 52 trillion, which was dominated by two large players, namely Grab and Gojek with respective portions of 53% and 47% of the total market share.

Challenges for logistics companies legacy

Fifth, continued Zaldy, he estimates that conventional logistics companies that have been operating for a long time will find it difficult to catch up with future trends. This is because it is not easy for companies to carry out transformation or build infrastructure in a short time. The key is collaboration.

At least, throughout 2020 there were many collaborations taking place between startups and corporations. For example, Ninja Xpress partners with Grab and Gojek partnered with Paxel. The partnership between the two was carried out to strengthen inter-city goods delivery services (intercity).

According to Zaldy, the pandemic has been an eye opener for conventional logistics companies to want to collaborate. "Many companies legacy Conventional businesses find it difficult to pursue because now customer expectations are much higher. We look at several conventional companies, their services may be threatened because they already exist same-day delivery," said Zaldy.

Even He also sees a new trend that will emerge as a result of the pandemic, namely non-logistics companies entering the logistics sector. Blue Bird is one that has done it.

The company has maneuvered logistics since the second quarter of 2020, which has been strengthened by the support of its fleet assets. Blue Bird is also starting to expand the scope of its logistics services by collaborating with Paxel to deliver large packages with services same-day delivery.

“We use the fleet Existing so cost [efficient]. "In essence, we want to contribute to logistics services during the pandemic, especially regarding hygiene which we apply according to our standards," he said Blue Bird Chief Strategy Officer Paul Soegianto to DailySocial.

Zaldy also gave an example of how this challenge will be faced by PT Pos Indonesia. He believes that the existing infrastructure makes it impossible to catch up with logistics service providers, SiCepat for example.

"However, [models like] PT Pos Indonesia can utilize infrastructure from other platforms, such as Anteraja. It means, first mile and middle mile can collaborate with each other, while there is competition last mile," he added.

Impact of merger Gojek and Tokopedia towards the logistics industry

Sixth, he predicted merger plans Gojek and Tokopedia can have a big impact on the Indonesian logistics industry. And, according to him, those who will be significantly impacted are conventional logistics companies.

"The merger of the two will create a company legacy 'sweating'. Why? It's hard to start a company legacy to change the business model of a business, especially one that already has thousands of courier fleets and hub. Unless they have a good IT system or technology, this will be difficult. Blue Bird is an example of a company legacy whose system is ready. The question is, have they done their homework?" said Zaldy.

In a separate article, Founder and CEO of DailySocial Rama Mamuaya believes that a merger of the two could have a big impact on consumers and the industry. Rama said that cross-breeding products that complement each other would be fantastic for consumers. Moreover, both of them have e-commerce, transportation and financial infrastructure integrated in one application.

"Currently, we already enjoy a delivery system on the same day. Integration between Gojek and Tokopedia can create something more uploading, for example Amazon Prime-style instant delivery in a matter of hours, helping to encourage e-commerce transactions, and increasing driver utilization so that it is more economical as a business," he explained.

Sign up for our

newsletter

Premium

Premium