Latest Super App: Still Problem Gojek vs Grab

The company's profitability strategy may be realized through food delivery services and digital wallets

great app now a terminology that is more familiar to hear. Two celebrities, Gojek and Grab, continue to campaign to be the most super application. Both of them are competing hard (directly) in almost all fronts. Not only in Indonesia, but also in regional coverage. With the same valuation status "decacorn“No doubt the targeted market share is quite ambitious.

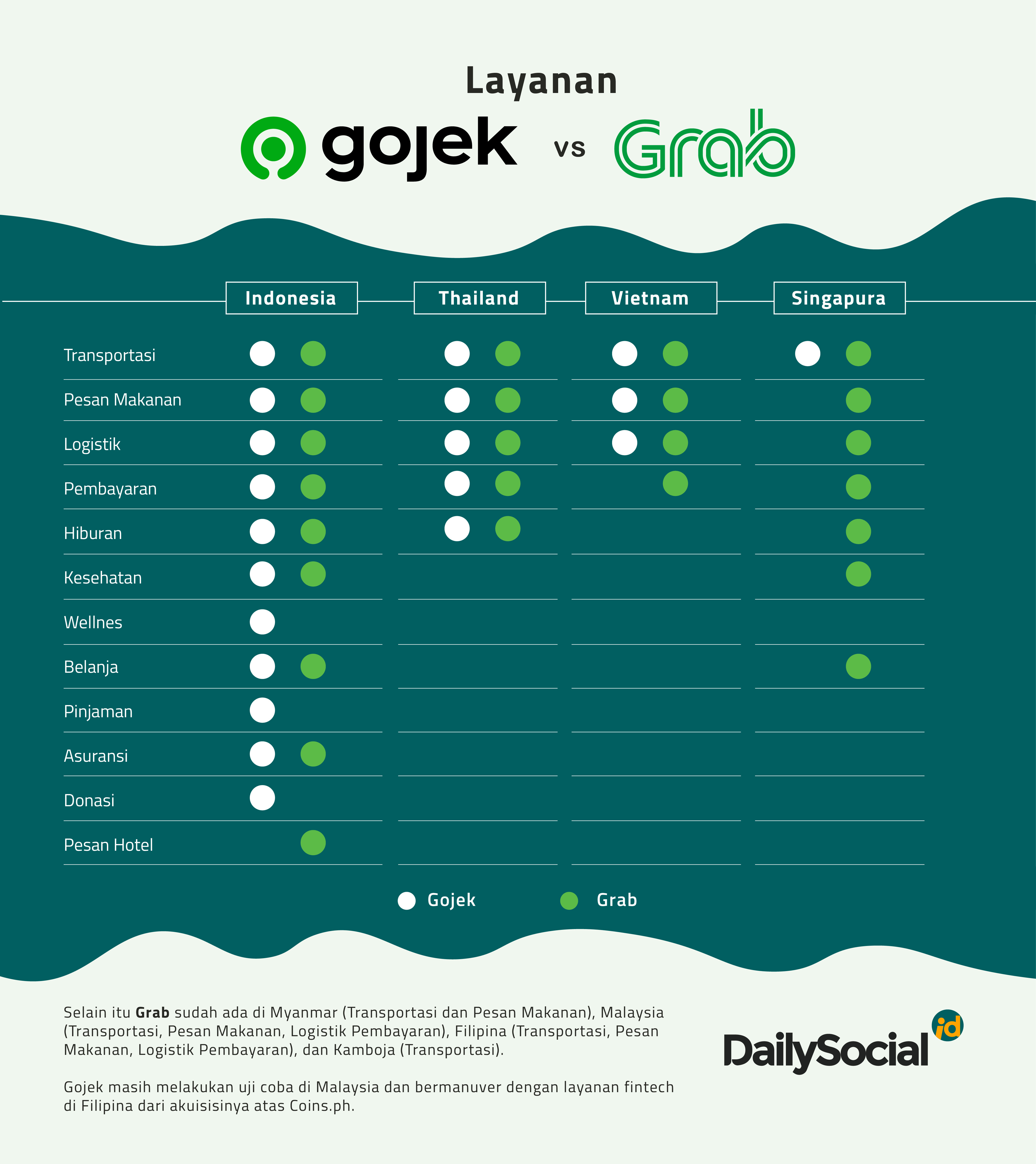

The following is the current business coverage of both services:

Grab it tends to be superior regarding the area of coverage. They started expanding in 2014 – including to Indonesia. Temporary Gojek themselves only started their regional expansion in mid-2018. Judging from the type of service, it is the most complete in the Indonesian market. The completeness of the service is what prompted the nickname great app was added earlier.

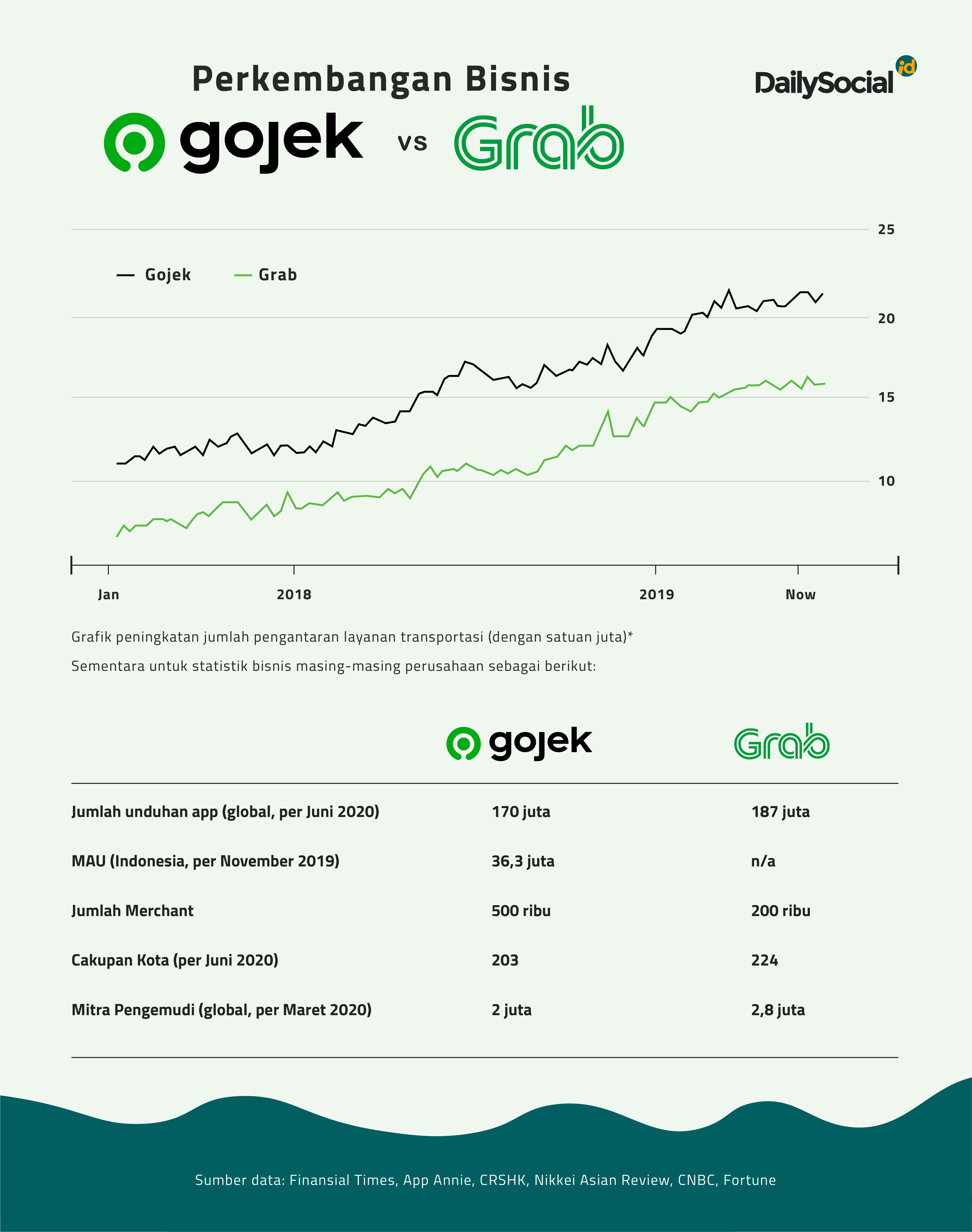

According to App Annie data, as of June 2020 the app Grab 187 million users have downloaded it, meanwhile Gojek 170 million users. The largest user base is still in Indonesia. For Grab in the range of 66%, while Gojek 90%.

Previous Gojek also launched a separate application for its expansion outside Indonesia. Starting this month they started unifies applications and brand menjadi Gojek – has started for service in Vietnam by changing Go-Viet to Gojek. GET in Thailand will also follow in the near future.

Latest report released investment bank China Renaissance summarizes a number of achievements and business strategies Gojek and Grab. One of them is related to data monthly active users. MAU data Gojek Currently, it has reached 36 million users in four countries, meanwhile Grab did not reveal the data. The research also calculates total addressable market for service ride hailing this year it will reach $25 billion.

Strategy towards profitability

The Covid-19 pandemic has clearly had a significant impact on business rid hailing. In a exclusive interview with DailySocial, their international team confirmed this. Likewise for Grab. For business operational efficiency, both companies had time to do it layoffs last June. Grab laid off 5% of its employees, equivalent to 360 people. Temporary Gojek laid off 9% of its total employees, equivalent to 430 people.

However, this super app platform is still surviving, because other business areas tend to have the potential to continue to increase, including during the pandemic. Referring to existing business data, China Renaissance optimistically said that service food delivery and e-wallet likely to underpin sustainability strategies great app. Large amounts of monetization are very possible with these two features.

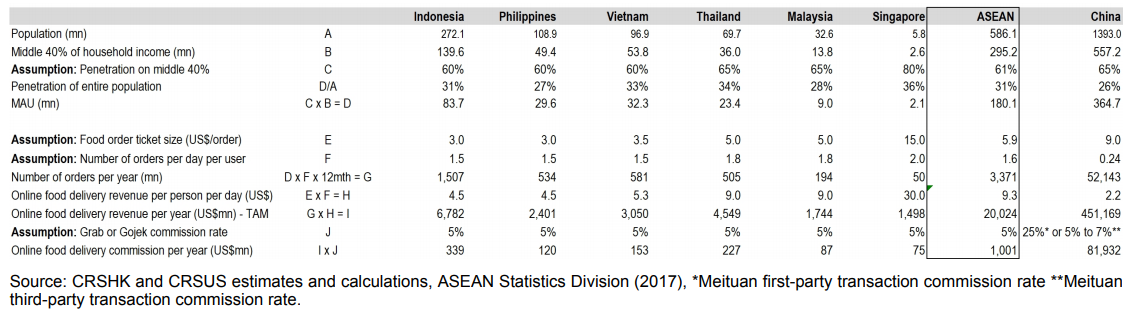

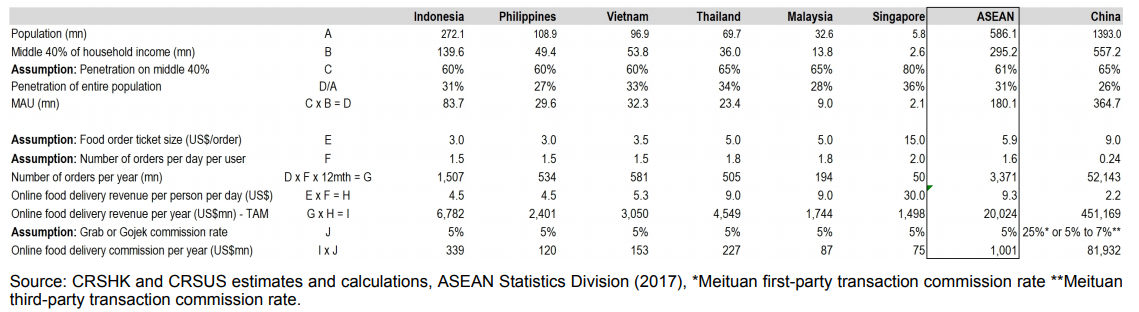

First question food delivery. According to market measurements, this business has the potential to bring in up to $20 billion annually. With each assumption great app able to control 5% of the market, at least they can record revenues of $1 billion annually from this business. Grab never revealed revenue for food delivery lines. In 2017 they recorded $2 billion and grew to $5 billion in 2019.

At the start of this year, Gojek He has also bragged about the strategy to bring GoFood to profit. Chief Food Officer Gojek Catherine Hindra Sutjahyo Group disclose, all the encouragement of investors led to GoFood in a business model that is in line with the direction of profitability. From time to time benchmarking GoFood's achievements are growing, from the initial number of transactions to gross transaction value, and now revenue.

See a food business that has the potential to earn a lot how, various initiatives were intensified. One of them is with development cloud kitchen to help partners efficiently produce and serve products. Good Grab and Gojek continue to expand cloud kitchen as a “shared kitchen” that can be accessed by SME food seller partners. Inside there are shops that only serve purchases via ordering at GrabFood or GoFood.

Digital wallets are the next source of profit

Travel great app goes through several phases: user acquisition, partner acquisition, and product expansion. The first phase has been completed successfully. Millions of driver partners spread across various cities provide capital to convince users regarding the reliability and availability of services. The second phase recorded the same achievements. The pandemic has also significantly driven the adoption of food delivery services and Grocery.

Then the third phase is being maximized by each player. In Indonesia, GoPay is a payment platform most widely used by the community, competing fiercely with Ovo which is currently being applied Grab (also Tokopedia and several other services). It is clear that its existence has a big impact on each company's business. The payment system becomes a link between actors in the application ecosystem: consumers, driver partners, and merchant.

This condition also opens up opportunities for partners and merchant to gain more appropriate financial access. Platforms fintech such as digital wallets are believed to be able to bridge existing gaps, including connecting them with various financial products (transfers, loans, investments).

Several indications point in that direction, including seriousness Grab through the unit GrabFinancial. GoPay itself has been mentioned achieve valuation unicorn.

Next phase: integration

Principle great app such as “must be the most complete” makes Gojek and Grab competing to provide various relevant services. Adding services doesn't mean having to develop everything yourself. For service Telemedicine, Gojek holding hands Halodoc, temporary Grab with Ping An Good Doctor. Even for other services, such as insurtech, lending, to OTA integrated with third party platforms.

Business units are needed that enable the company to connect with related players. The strategies are also similar, starting from developing venture units, acceleration programs, to acquisitions.

This kind of intense competition has so far been considered good for market formation and often benefits consumers. It's been reported that both super apps this will carry out a merger, but it still seems to be a topic of discussion.

Sign up for our

newsletter

Premium

Premium