Karim Siregar: Follow the Bank Jago Road, While Building Engineering Talent

Again for an exclusive chat with Karim Siregar, this time in his position as CEO/Chairman of DKatalis

"DKatalis has an important role because we focus on building financial technology that serves banking and can be integrated into the partner ecosystem," Karim Siregar

Maybe not many people know, DKatalis is the technology company behind the existence of the Jago application. With its position as a strategic partner, DKatalis plays a crucial element in the digital bank owned by Jerry Ng.

In conversation DailySocial.id two years ago with Karim Siregar who at that time served as President Director of Bank Jago, he referred to Bank Jago as tech-based bank—prioritizes digital experiences and leverages APIs to connect with its partner ecosystem.

However, since May 2023, Karim Siregar has moved to DKatalis. He was asked to lead Bank Jago's next mission to the expansion stage. How DKatalis efforts to build engineering talent in the financial sector?

DKatalyst at a glance

“The initial idea of Bank Jago was a bank for digital financial services that could be connected to the ecosystem. Banks are technology-based and embedded in the ecosystem. "At that time, the bank already existed (Bank Artos), but the technology didn't yet," said Karim in his latest interview with DailySocial.id.

According to him, the technology in Indonesia's digital ecosystem at that time was much more advanced than the technology in the banking sector. This is because the development of the digital ecosystem has started earlier than banks which tend to focus more on investing in technology internally, for example risk management.

As a result, there are no technology companies that are considered capable of realizing Bank Jago's vision as a tech-based banks. DKatalis was founded as Bank Jago's technological right hand, playing a role in building its entire technological infrastructure so that it can serve user segments and ecosystem partners.

“Building a bank is not easy, we have to understand the industry because it is very complex and regulated. Banks cannot just create technology, implement it and run it. There is compliance, risk, all regulatory requirements banking is not easy,” he added.

Please note, Bank Jago does not have direct ownership in DKatalis. The status of both is strategic partners under different entities.

Supporting the expansion of Bank Jago

Touching on its development kitchen, Karim revealed that there were three core things that DKatalis built, namely product design, engineering, and data. DKatalis technology is specifically designed to serve the financial sector. There are currently four partners, two of which are Bank Jago and Amaan.

As the main partner, said Karim, DKatalis must be technologically ready to support Bank Jago's further development. During his time leading Bank Jago for the last three years, he saw the company grow and no longer be in the ""building".

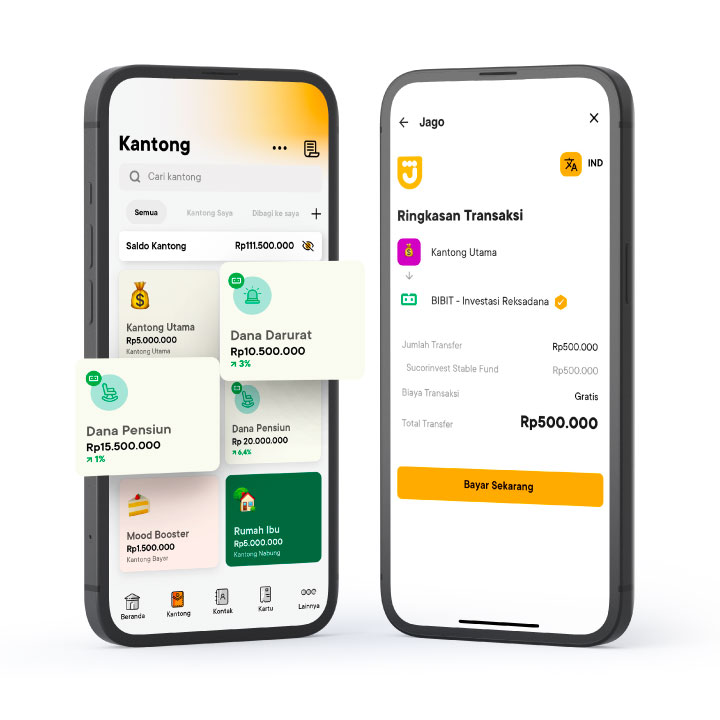

As of the third quarter of 2023, Bank Jago is recorded as having 9 million customers (including 7,4 million Jago application users) and making a net profit of IDR 50 billion. The number of Jago ecosystem partners grows to 38; three of them are main ecosystem partners, namely GoTo, Bibit, and Amaan.

“Bank Jago is focusing on building business and partnerships with various ecosystems. Therefore, we have to be ready, from phase to stage building ke expanding, because our partners are increasing. Jago's position has shifted, so the Jago application is Bank Jago. Everything Jago builds, will be in it. The application is the bank. "Everything [will] be there," he said.

Kantong/Pocket is one of the main products of the Jago application built by DKatalis—which is already integrated with Gojek and Seeds. DKatalis will enter new products that are in line with Jago's next plans, namely digital lending.

“Regarding the issue of bad credit, we understand risk management system that's very crucial. We and Jago ensure that we have a very strong system, well maintained. Each partner (channeling) You're good at it risk assessment itself, but when transferred to Jago (as Actioncalendar), this will be reviewed again with the DKatalis system," he said.

In addition, new payment technology standards are also being awaited by the company. Previously, the new government had equalized payment standards QR (QRIS) and API-based (SNAP), his party is currently looking at the potential for NFC development in Indonesia.

“I see this payment standard will become more and more. Will it lead to open banking? We'll see. Jago is currently collaborating with many partners. If there is a standard open banking, this will be an easy unlock for us to implement.”

Get up engineering talent

DKatalis also highlighted the importance of building talent to accommodate technological development trends in the financial sector. One of the outputs that DKatalis has fully developed is People Experience (PX), an HR platform which claims to have been designed by professionals with accumulated 80 years of experience.

More Coverage:

"This platform was developed to accommodate the development of organizations that can no longer rely on conventional culture. "Many organizations say work agile, but the process implementation does not agile. I mean there's a huge difference. They don't do like this [DCatalyst].”

Karim said that this platform can accommodate the needs of young talents who can no longer adapt to conventional innovation practices. According to him, in both Jago and DKatalis, everything was developed from scratch. The division hierarchy is also divided into teams, squads, and even the smallest groups.

“For example, development digital lending actually it's much harder because of the process bankingit's very specific. If transactions were easier. We are not asking about the obstacles first, but describing the ideal journey-what's it like? Then, we did refinement. Oh, it turns out there are problems from banks or technology, for example. Only then did we identify the parts of the system that had to be developed. The team just has to decide for themselves which part they want to work on. So, they fully collaborate among themselves to make it all.”

Currently, the DKatalis team is spread across Indonesia, Singapore and India to easily absorb the adoption of new financial technology from outside.

Sign up for our

newsletter

Premium

Premium