Focus on Reaching Profit and Sustainable Business, GoPay Begins to Reduce "Burn Money" Activities

Reducing the promotion period; claim the number of "retention" increases every month

Consistent with the main goal of achieving profit and sustainable business, GoPay is slowly starting to reduce costs "burn money" activities with the number of promos getting smaller. In fact, according to GoPay Managing Director Budi Gandasoebrata, the strategy of burning money is relatively common for digital wallet platforms today.

In general, giving promos is very effective for acquiring new users, but if you continue to do so, you can becoming a problem which will affect the company's business. It is undeniable that promo activities are difficult to stop immediately, but in the right way supported by relevant products, at least it can help this activity to be smaller in volume.

"If we look at today, for example, out of all the existing digital wallet platforms, the one with the smallest promo is GoPay. But our users actually month to month the number continues to rise, this is a validation of the strategy we apply that promos can't be abandoned, but in the end it's the product that decides," said Budi.

Mentioned whether this activity affects the number of loyal users and the retention, according to Budi so far not too influential. As long as these activities are carried out, there are still many users who then reuse all the features in the ecosystem Gojek, although the promos are starting to decrease in number.

"The key is innovation and also the programs we carry out, namely promos that are more efficient and targeted. Because if we look at the banking industry for example, such as credit cards, they also still provide promos, but more targeted nature," said Budi.

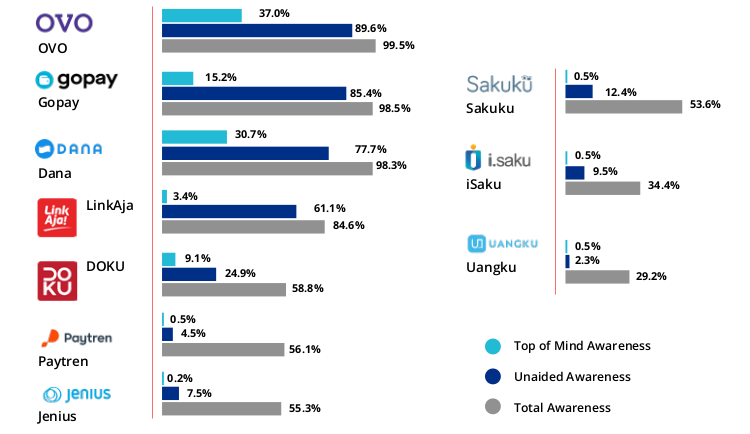

Positive competition of digital wallet platforms

One of the reasons why money-burning activities are becoming more and more common is the competition and the increasing choice of similar players to reach more users. According to Budi, competition is actually welcomed. Thus, each platform competes to provide products that can be even better.

Di Gojek The main focus itself is how existing features can continue to help all users take advantage of GoPay for transactions within the ecosystem and outside the ecosystem.

Although currently GoPay is still widely used for transactions with small nominal and mostly micro nature, this does not mean that this platform does not have the opportunity to earn additional income. Leveraging collaboration with banks, merchant and leading ecosystem in Gojek namely GoFood, GoPay claims to be able to get more stable additional income.

Many QR Codes have been implemented and launched QRIS from Bank Indonesia also seen by GoPay as an increasingly profitable opportunity for the company, thus an opportunity to establish partnerships with enterprise the greater the opportunity which will have a better impact on business income.

More Coverage:

GoFood and GoPay are now known as two main businesses Gojek the fastest growing compared to other services. Last year, it was mentioned that GoFood printed revenue $2 billion, 50 million transactions per month, and 2,5 times growth. While GoPay contributed $6,3 billion, although the growth was not mentioned.

"We are also grateful to have many investors from among us blue chip company which from the beginning pushed us to focus on profit. What we have done so far has been appreciated by them, because from the beginning our focus has never changed, namely profit and profit sustainability, said Budi.

Sign up for our

newsletter