Indonesian Startup Funding in 2023 Experiences a Declining Trend, Returning to Pre-Pandemic Levels

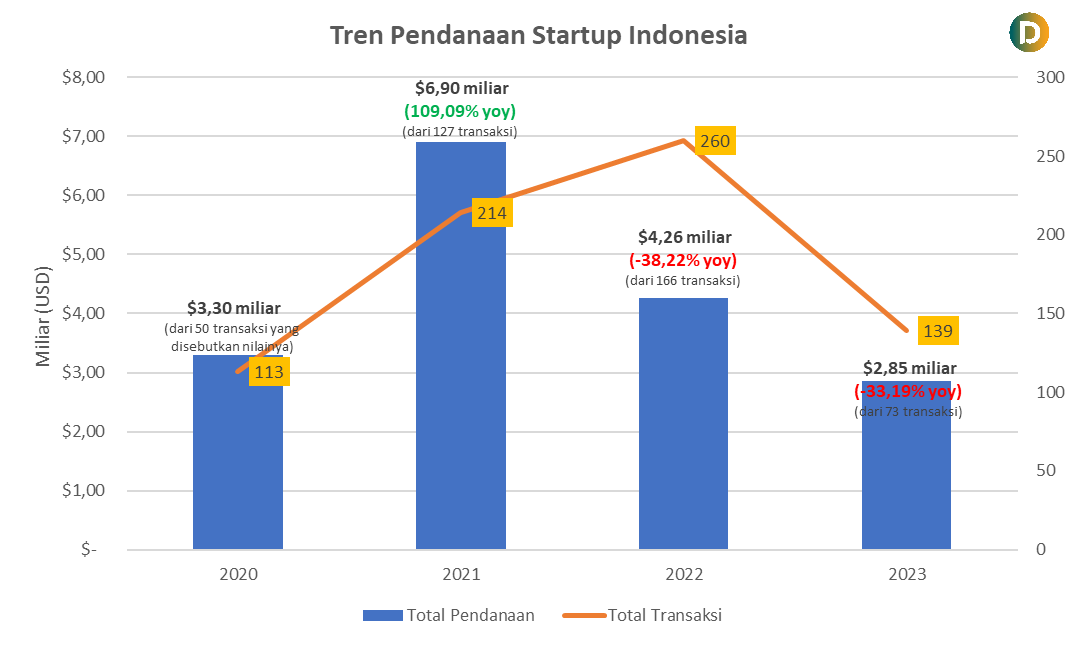

Total funding in 2023 will decrease to -33,19% yoy; total transactions also decreased from 260 investments in 2022 to 139 in 2023

In 2023, Indonesian startup funding will decline again. This trend has occurred in the last two years post-pandemic -- after previously in 2021 there was a significant increase (it could even be said to be one of the best years in terms of investment gains).

Sourced from official announcements and input regulatory data, DailySocial.id noted that in 2023 Indonesian startups will record total funding of $2,85 billion (from 73 transactions that stated the value). The total investment transactions that were successfully recorded were 139x.

This gain shows pgrowth decline year-over-year (yoy) -33,19% compared to the 2022 period. This is also the second post-pandemic decline. It should be noted that since 2015, Indonesian startup funding has always shown growth, even during the initial period of the pandemic.

When talking with stakeholder, this decline was allegedly caused by a number of things. One of them is due to market adjustments to global economic dynamics, which has a direct impact on decreasing investor interest in the sector high-risk as venture capital.

"Tech-winter This was mainly due to the increase in Central Bank interest rates which made government bonds more attractive to invest in compared to venture capital. By implication, a smaller supply of capital results in lower levels of investment. "Another domino effect of rising interest rates is lower valuations, because most startup investors use the DCF (Discounted Cash Flow) model to value the business, in the DCF model if interest rates rise, the valuation goes down," explained Head of Investment MDI Ventures Gani Putra. Lie in an interview.

On the other hand, startups are starting to think about strategies to reach profitability faster. In the middle of the process fundraising increasingly difficult, fuel is optimized to open business growth opportunities. Some include starting to seek consolidation, operational efficiency and innovation to maintain runway his business.

Funding trends 2023

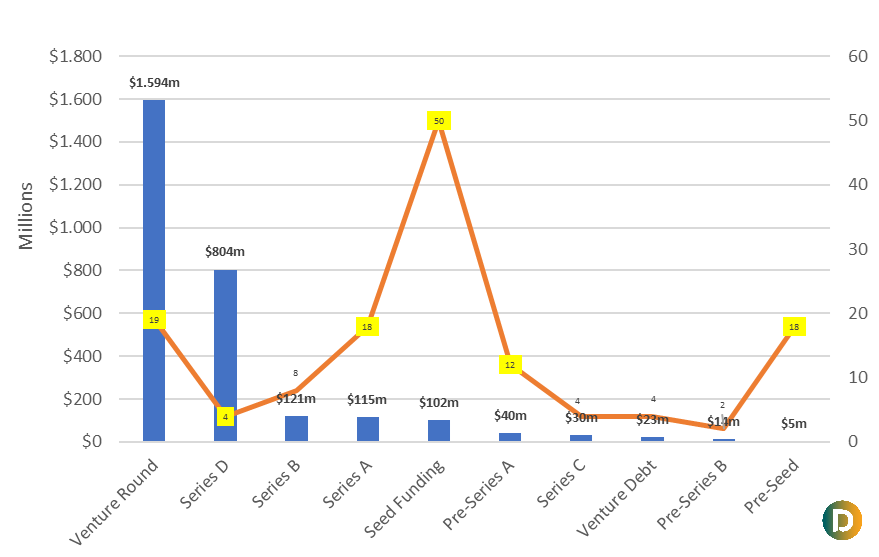

From funding data throughout 2023, a number of interesting facts were also discovered. Initial stage funding (seed funding) still has the highest share in terms of number of transactions. However, the amount of further funding (series A or above) also appears to be quite small.

The high number of initial funding rounds indicates that investor confidence is still maintained for generations founder Furthermore, the new innovations that are born. Meanwhile, further funding also shows the investor's commitment follow-on funding to support previously owned startup portfolios.

A number of investors have indeed revealed that in the situation tech-winter they choose to do “fashion portfolio”. Instead of exploring new investor opportunities, they choose to focus on helping founder in its portfolio accelerates business.

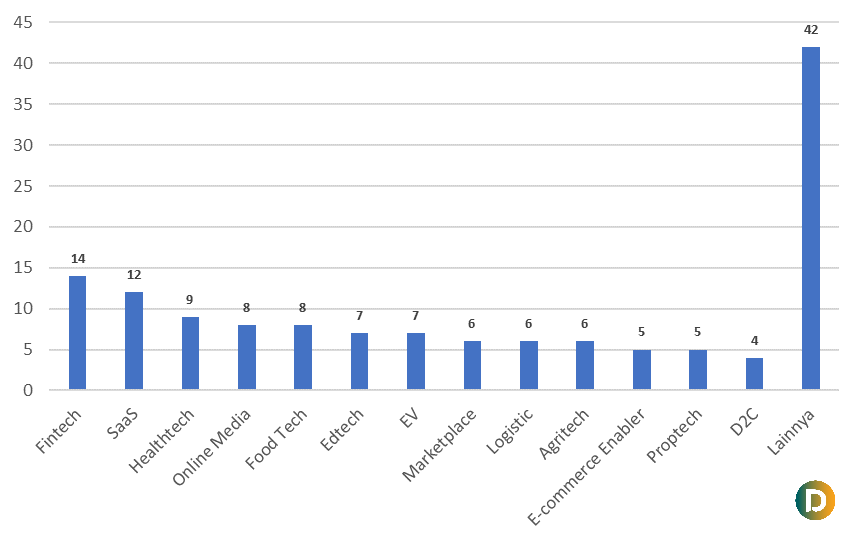

Then if we look at it from the industry vertical, fintech still dominates the most investment gains. This trend has continued since the last five years. Followed by the SaaS sector and healthtech. However, various industry verticals are also gaining investor attention (in the graph below, the 'other' category consists of 24 different business sectors).

From the existing funding, 10 rounds with the largest value were obtained. Tokopedia got investment from parent TikTok towards the end of 2023, as an effort by the company to combine business strengths and restore TikTok Shop operations in Indonesia.

More Coverage:

Another sector that occupies many of the top 10 is electric vehicles --- they are local startups engaged in manufacturing electric vehicles and their supporting infrastructure. It is known that a large investment is required to start this business.

| Startups | Industry | Round | Funding Value |

| Tokopedia | Marketplace | Venture Rounds | $ 1.500.000.000,00 |

| Kredivo Holdings | Fintech | Series EASY | $ 270.000.000,00 |

| investree | Fintech | Series EASY | $ 234.000.000,00 |

| eFisheries | Aquatech | Series EASY | $ 200.000.000,00 |

| Halodoc | Healthtech | Series EASY | $ 100.000.000,00 |

| ALVA | electric-vehicle | Series B | $50.000.000,00 |

| Charged Asia | electric-vehicle | Venture Rounds | $40.000.000,00 |

| THEN Motors | electric-vehicle | Seed Funding | $37.600.000,00 |

| Evermos | Social Trade | Series B | $30.000.000,00 |

| Swap Energy | electric-vehicle | Series A | $22.000.000,00 |

Funds managed by venture capitalists

Even though there will be a slowdown in investment in 2023, this does not mean that the Indonesian startup ecosystem is on the verge of being pessimistic. Because throughout last year, dozens of venture capitalists made announcements new managed fund who are ready to invest in Indonesian startups this year. This managed fund has a fairly diverse focus, targeting various stages of startups.

| Managed funds | VC | Management Value | Investment Focus | Sector Focus |

| NSV I | Northstar Group | $140.000.000,00 | early-stage | Consumer, Fintech, Enterprise Solutions |

| BTN Fund | State Savings Bank, Mandiri Capital Indonesia | $25.000.000,00 | Multi Stage | Proptech, Mortgage Tech, Fintech, Embedded Finance, Construction Tech, Open Finance, SaaS |

| Telkomsel Ventures 2 | Telkomsel | Undisclosed | Multi Stage | Internet Solution, AI, SME, E-Commerce, Digital Content |

| Fund 1 | Capital Ventures | $12.000.000,00 | early-stage | Sector Agnostic |

| Healthcare Fund | East Ventures | $30.000.000,00 | early-stage | Healthtech |

| East Ventures South Korea Fund in Partnership with SV Investment | East Ventures, SV Investment | $100.000.000,00 | Multi Stage | Biotech, Healthtech, EV, Celantech, Online Media |

| Ascent Fund 3 | Ascent Venture Group | $200.000.000,00 | Multi Stage | Sector Agnostic |

| Fund V | Vertex Ventures SEA and India (VVSEAI) | $541.000.000,00 | Multi Stage | Sector Agnostic |

| 500 SEA III | 500 Overall | $143.000.000,00 | early-stage | Sector Agnostic |

| Red and White Fund | CVC BUMN | $300.000.000,00 | growth stage | Sector Agnostic |

| Energy Fund | Pertamina | Undisclosed | Multi Stage | Energy |

| Argor Fund | Argor | $240.000.000,00 | Multi Stage | Sector Agnostic |

| Peak XV Fund | Sequoia Capital | $2.000.000.000,00 | Multi Stage | Sector Agnostic |

| Growth Plus | East Ventures | $250.000.000,00 | growth stage | Sector Agnostic |

| Growth Fund III | B Capital | $2.100.000.000,00 | growth stage | Sector Agnostic |

| Fund 1 | Creative Gorilla Capital | $19.200.000,00 | early-stage | D2C |

| NSV I | Northstar Group | $90.000.000,00 | early-stage | Consumer, Fintech, Enterprise Solutions |

"In short, we see that in 2023 it will still slow down, in 2024 there will be a gradual recovery. Therefore, our advice is that startups must be able to survive (have runway) until 2025 [...] East Ventures never stops investing. We don't care if it's sunny or rainy today, we will still invest in founder good ones and stop investing if there are no more founder a good one to invest in. We have seen an increase in the quality of para founder from time to time," said the Co-Founder and Managing Partner of East Ventures Willson Cuaca.

Sign up for our

newsletter

Premium

Premium