SPAC Too Crowded, MNC Refuses to Bring Vision+ to the NASDAQ Exchange

It is based on two reasons: the large number of SPACs made MLAC's share price drop and the enthusiasm of investors on the IDX for digital companies

Since the second half of 2020, Asia Vision Network (AVN) or known for its application product Vision+ has started considering listing on the US stock exchange through SPAC vehicles. The Malaca Straits Acquisition Company (NASDAQ: MLAC) was then partnered to become a strategic partner. Until the first quarter of this year The plan is still optimistic to be implemented, until they have a target to finalize the deal in the second quarter of 2021.

However, from the latest disclosure submitted by MNC Vision, as the parent of AVN, the company decided not to proceed with the transaction. There are two things to highlight. First, in 2021 there will be many SPAC transactions on the NASDAQ, so that it affects MLAC's valuation below the par value of $10 per share. According to EY data, as of H1 2021 there were 634 successful SPAC transactions, a new record on the local stock exchange.

The second reason given was that MNC saw the enthusiasm of investors in the IDX for companies engaged in the digital field. Although no details are mentioned, we think the success of Bukalapak's IPO in Indonesia is one of the benchmarks used. AVN's main business is the platform video streaming, pay TV operators and services broadband.

Previously, the process of signing the Business Combination Agreement had been carried out as of March 22, 2021 by AVN and MLAC. The company's projected valuation is $573 million or equivalent to IDR 8 trillion --- reflecting an EV/EBITDA ratio of 5,8 times that value. The business combination is also expected to add about $135 million in fresh capital -- if there is no redemption of MLAC's public shareholders.

Value proposition strengthening

According to data compiled by Statista, revenue for business video streaming in Indonesia will reach $237 million in 2021. It is projected to continue to increase to $467 million in 2025 at a CAGR of 18,55%. This increase was supported by an increase in penetration reaching 6,4% this year. The pandemic that limits activities outside the home makes services video streaming be an alternative entertainment.

As a media company, MNC Vision (IDX: IPTV) sees this as a potential to leverage their platform under AVN. Vision+ is here to accommodate content needs on-demand for the audience, including to provide options streaming for TV viewers who need an alternative medium to watch MNC network shows. Local content is certainly a property owned by the company, many IPs have been produced, both in films, soap operas, and other concept videos.

Innovation continues to be intensified, including through strategic partnerships with similar players. Latest, MNC Vision provides investment of $40 million or equivalent to 570 billion Rupiah for application video streaming Migo. The goal is to take advantage of the technology developed by the startup, which allows the audience of the application video streaming to enjoy content online online.

Migo's technology is online to offline (O2O) videos-to-go which allows users to watch movies online offline without buffering. Content distribution is done through Wargo (Warung Migo) or Migo Download Stations (MDS). Users only need to go to the partner grocery shop location to download the content and then enjoy it online offline in the application.

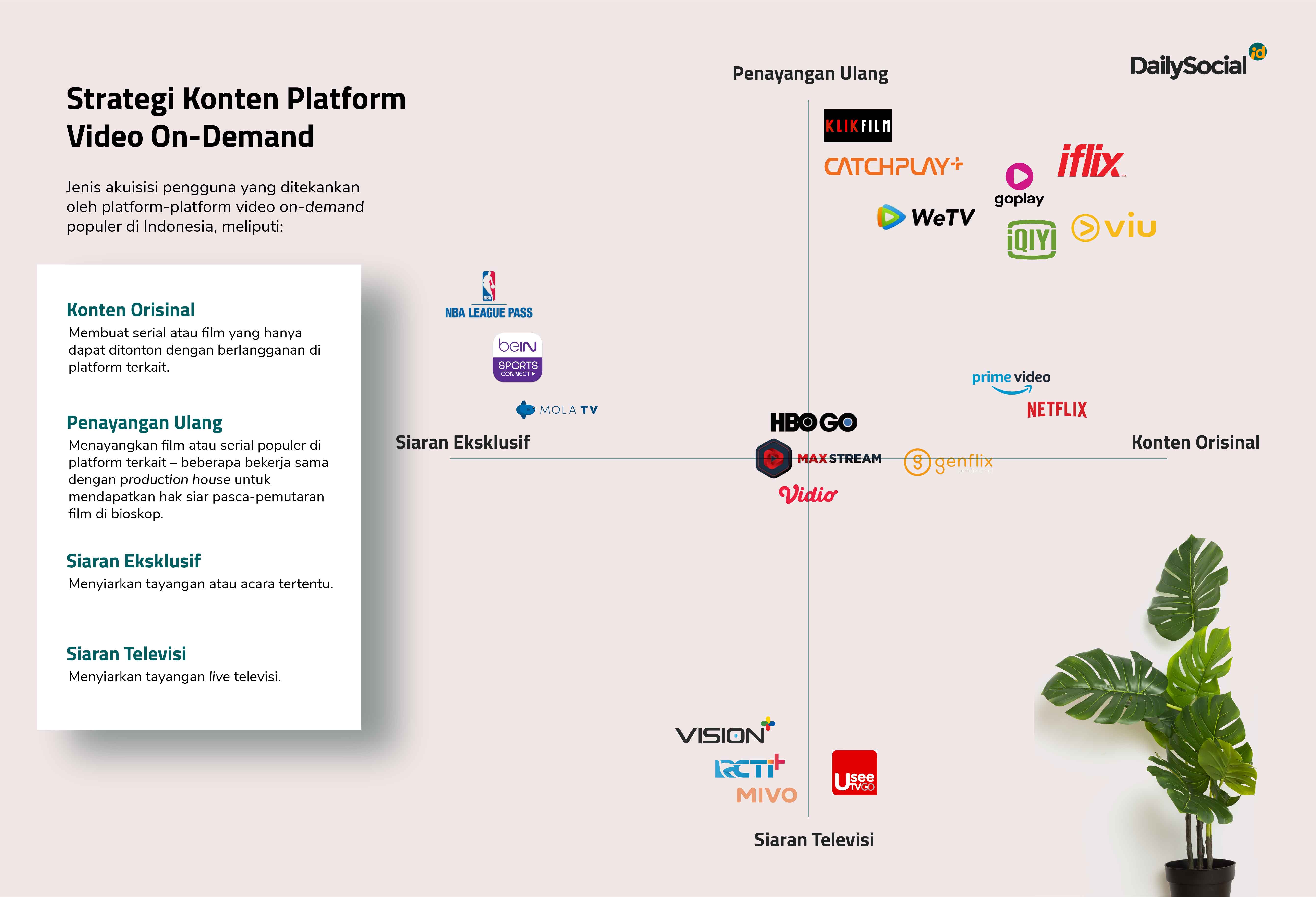

Service competition map video streaming in Indonesia itself is quite tight, enlivened by local and foreign players.

Other SPAC potentially delayed

Not only AVN, several other local digital companies are reportedly considering SPAC as a pathway to enter the stock exchange. The names that are widely discussed include Tiket.com, Traveloka, GoTo, to the newest one Kredivo -- even the latter has officially announced the corporate action.

Kredivo akan merger with VPC Impact Acquisition Holdings II (NASDAQ: VPCB) which is an affiliate of Victory Park Capital (VPC), a global investment firm that has several times provided credit facilities for Kredivo. With this merge, FinAccel (parent Kredivo) will have a pro-forma equity valuation of around $2,5 billion, assuming no redemption.

More Coverage:

Previously there was news unicorn Traveloka will make an agreement with Bridgetown Holdings Ltd. for SPAC. However, recently, information emerged that Traveloka's board of directors decided not to proceed with this step. The reason is more or less the same as MNC, because the enthusiasm of SPAC has diminished with the high frequency in the market. The company is likely to explore the traditional IPO process, remaining on US exchanges, according to sources Bloomberg.

another company, Grab has also officially announced plans go public on the United States stock exchange using SPAC with blank check companies (blank check company) Altimeter Growth Corp (NASDQ:AGC). Grab targeting a valuation of $ 39,6 billion (around Rp. 580 trillion) and obtaining fresh funds of $ 500 million from $ AGC and through PIPE (Private Investment in Public Equity) worth $ 4 billion. $750 million of which is the Altimeter commitment.

Initially, the agreement will be finalized in mid-2021. But in the latest news, Grab postponed the merger on the grounds that there was a request for a financial audit from the local stock exchange authority. It is likely that this plan will be pushed back until the end of 2021.

Sign up for our

newsletter