Marking a New Era, MNC Group's OTT Business Will Immediately "Go Public" on the United States Exchange Through SPAC

Vision+ has officially signed a merger agreement with Malacca Straits Acquisition Company

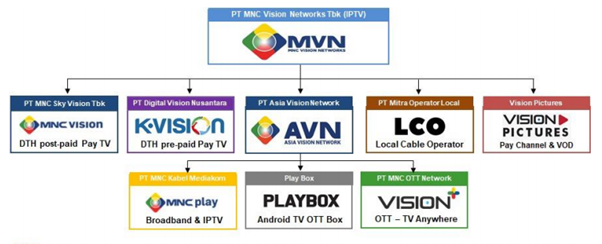

MNC Vision Networks, (IDX: IPTV) through its subsidiary Asia Vision Network (AVN) otherwise known as its application product Vision+, announced that it has officially signed a merger agreement with Malacca Straits Acquisition Company (NASDAQ: MLAC), a SPAC (Special Purpose Acquisition Company).

This rumor has been circulating since February 2021. Through response letter published through IDX, IPTV confirmed the plan. It's just that the process filling has not been carried out, so we cannot provide further information to the authorities.

Based on the latest information disseminated to the media, the merger process is targeted to be completed by the end of Q2 2021. The signing of the Business Combination Agreement has been carried out as of March 22, 2021 by both parties. The company's projected valuation is $573 million or equivalent to IDR 8 trillion --- reflecting an EV/EBITDA ratio of 5,8 times that value. The business combination is also expected to add about $135 million in fresh capital -- if there is no redemption of MLAC's public shareholders.

Apart from operating OTT (over the top) via app video streaming, AVN also oversees MNC Play as a pay TV and service operator broadband.

This merger will mark the first agreement between an Indonesian technology startup and a SPAC to list on the United States stock exchange. Previously amount startup unicorn It has been widely rumored to be taking similar steps, but so far there has been no confirmation of its realization.

Overview of market competition

Based on data collected in Statista Digital Market Outlook 2020, revenue service video-on-demand (VOD) in Indonesia is predicted to reach $411 million or the equivalent of 5,9 trillion Rupiah in 2021 with user penetration reaching 16,5% on average revenue per user (ARPU) $9.02. The sub-segments that contribute the greatest value are video streaming (SVoD), at around $237 billion.

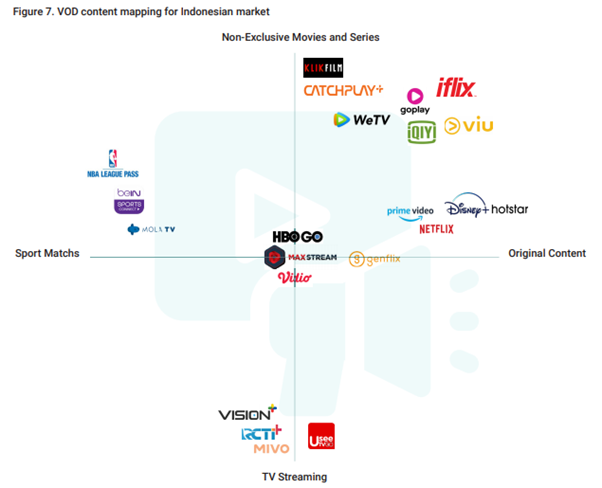

Vision+ is part of this ecosystem, competing fiercely with other players. From the mapping of SVOD players summarized in Startup Report 2020, currently there are at least 21 service variants with various content specializations. Judging from local service usage statistics, the Vidio, RCTI+ and Maxstream applications still lead the top three most widely used.

Being strong on broadcast TV (both free and pay) hasn't stopped Vision+ from improving value proposition-his. Because of this, they also started releasing a lot of original series of films, and several other exclusive shows. Currently, the application has been downloaded by more than 5 million users on Google Play with a rating of 4.4/5.0.

Meanwhile, if you compare it with global players, there are several tough competitors who are currently continuing to increase their penetration in Indonesia. From Tencent, they have two ammunition, namely WeTV and iflix, with diversified Chinese-produced original series content. Then there is Netflix as global SVOD market leader, as well as Disney+ Hotstar which debuted in 2020 with its unique content.

Social restrictions due to the pandemic have also brought in many new users, as an alternative entertainment while at home. One of them was validated by a McKinsey survey from March to April 2020, as many as 45% of respondents admitted to spending more money on entertainment at home and this had an impact on the growth of video content consumption by 53% from before.

According to data from Media Partners Asia, as of the beginning of this year, Disney+ Hotstar already had 2,5 million subscribers in Indonesia, Viu had 1,5 million subscribers, and Vidio had 1,1 million subscribers (premium). While Netflix has 800 thousand. Disney+ Hotstar aggressively provides free premium access packages, in-bundling with internet packages from Telkomsel (its launch partner in Indonesia). According to MNC information, Vision+ currently has 5,6 million subscribers, and 1,6 million of them are paying subscribers.

MNC Group's business DNA as a media corporation is certainly a plus if it hopes that Vision+ can become a market leader in Indonesia. At least they have proven it through television broadcast channels by controlling 48% market share national. However, SVOD subscribers (in the context of premium users) and television viewers may have different demographics and characteristics, so this must be further validated.

Fixed broadband and cable TV

Related fixed-broadband or home internet network, according to the data collected Techinasia As of June 2020, there are at least 11 players currently providing their services, including MNC Play. Most cable TV services are also offered in conjunction with the internet package provided.

| Fixed Broadband | Entertainment Services | Speed Offer | Basic Subscription Fee | Scope |

| MNCPlay | Cable TV, VOD | 10Mbps to 70Mbps | IDR 290 thousand to IDR 1 million | Jakarta, Bandung, Semarang, Surabaya, Medan, Malang |

| Indosat Ooredoo GIG | Cable TV, VOD | 20Mbps to 100Mbps | IDR 280 thousand to IDR 1 million | DKI Jakarta, West Java, Central Java, East Java, DI Yogyakarta, Banten |

| Biznet Networks | Cable TV, VOD | 75Mbps to 150Mbps | IDR 325 thousand to IDR 725 thousand | Java, Batam, and Bali Islands |

| FirstMedia | Cable TV, VOD | 15Mbps to 300Mbps | IDR 361 thousand to IDR 3,1 million | Greater Jakarta, Bandung, Cirebon, Purwakarta, Semarang, Solo, Surabaya, Kediri, Malang, Gresik, Sidoarjo, Surabaya, Bali, Medan, Batam |

| CBN Fiber | Cable TV, VOD | 30Mbps to 200Mbps | IDR 299 thousand to IDR 1,3 million | Greater Jakarta, Bandung, Cirebon, Denpasar, Medan, Palembang, Surabaya, Jember Kediri, Madiun, Malang, Sidoarjo, Semarang |

| Indihome | Cable TV, VOD | 10Mbps to 50Mbps | IDR 169 thousand to IDR 625 thousand | Sumatra, Java, Bali, Nusa Tenggara, Kalimantan, Sulawesi, Maluku, Papua |

| Groovy | Cable TV | 10Mbps to 80Mbps | IDR 269 thousand to IDR 568 thousand | Greater Jakarta, Bandung |

| myRepublic | Cable TV, VOD | 30Mbps to 300Mbps | IDR 329 thousand to IDR 1,2 million | Greater Jakarta, Bandung, Malang, Medan, Palembang, Semarang, Surabaya |

| Oxygen. ID | Cable TV, VOD | 25Mbps to 100Mbps | IDR 273 thousand to IDR 493 thousand | Greater Jakarta, Bandung, Pekalongan |

| XL Home | Cable TV, VOD | 100Mbps to 1Gbps | IDR 349 thousand to IDR 999 thousand | Greater Jakarta, Bandung, Banjar Baru, Banjarmasin, Bekasi, Balikpapan, Bantul, Denpasar, Makassar, Sleman |

| transvision | Cable TV, VOD | 30Mbps to 1Gbps | IDR 269 thousand up to - | Greater Jakarta |

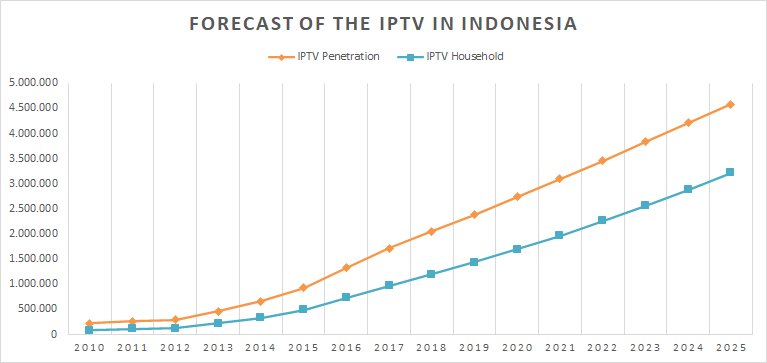

Sourced from Key Market Indicators Statista, the following statistical data shows the estimated number of households and penetration of subscription internet TV (IPTV) use in Indonesia until 2025. The iptv concept uses the internet as a service transmission.

The urgency to have a home internet service can be the main driver for increasing penetration of this service – especially since the pandemic has really driven internet consumption among Indonesian people, both to support needs. work from home (WFH), learning/school from home (LFH), or for entertainment.

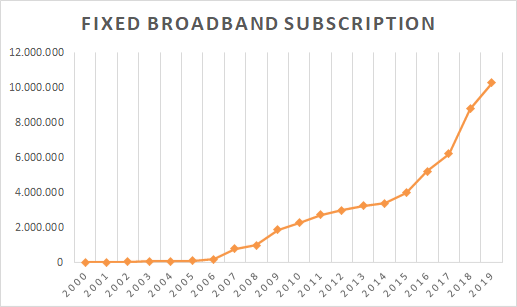

Meanwhile, according to data from the International Telecommunication Union, home internet service customers (fixed broadband) in Indonesia until 2019 it has exceeded 10 million. If you link to the service provider distribution table above, there are still many areas that have not been accommodated by this service. This means that this number still has the potential to grow along with increased adoption and expansion from the business providers themselves.

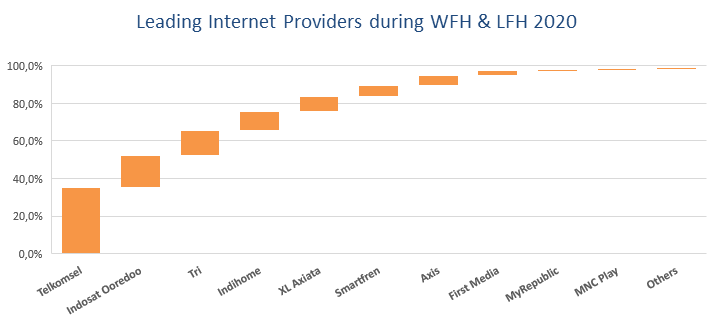

From the results of a survey conducted by Nusaresearch for the April 2020 period involving 2.792 respondents, several service providers revealed broadband (includes mobile devices and fixed) in Indonesia. With coverage that is still quite limited, MNC Play still occupies the top 10 position and is 1 of 4 services fixed the most widely used. From the releases distributed, MNC Play currently has around 300 thousand subscribers.

More Coverage:

Strengthening business lines

In its disclosure, it was also stated that AVN is currently completing the acquisition of 100% of K-Vision's shares. The transaction is targeted to be completed by the end of this month. K-Vision itself is a cable TV service provider company which is based in the same company. It is hoped that post-acquisition we can add content choices to the SVOD Vision+ service, including popular broadcasts from RCTI, GTV, MNCTV, iNews, and 13 other local channels. Currently K-Vision has around 6 million customers.

In terms of business structure, AVN will oversee three company units, including Playbox as the developer of OTT BOX Android for pay television broadcasting.

Outside of the media business group, MNC also continues to strengthen its digital ecosystem. Some time ago we had the opportunity interviewed MNC Kapital Director Jessica Tanoesoedibjo, in his presentation, the company is currently strengthening penetration of the SPIN payment application, including by integrating it into various other business lines, including Vision+, MNC Play, and others.

Sign up for our

newsletter

Premium

Premium