Bibit Announces IDR 418 Billion Funding Led by Sequoia Capital India

East Ventures, EV Growth, and 500 Startups took part in this round

Mutual fund app online Bibit announces further funding of $30 million or the equivalent of more than 418 billion Rupiah led by Redwood Capital India. East Ventures, EV Growth, and 500 Startups participated in this round.

In his official statement, the fresh funds will be used to develop services to encourage more novice investors in Indonesia to invest.

The President Director of Bibit, Sigit Kouwagam, explained that the number of Bibit users increased dramatically to more than one million new investors over the past year. "This is due to the increased awareness and education given to novice investors to save regularly every month consistently and the importance of having good personal financial management principles," he said, Tuesday (5/1).

Based on IDX and KSEI data, the number of retail investors in Indonesia grew 56% YOY last year. This increase was contributed by millennials with a 92% growth in new investors, from the age group of 21-40 years. Despite a significant increase, Indonesian people's participation in the capital market is still less than 2% at present.

“We believe that all people deserve a better future. Helping to increase financial inclusion and encouraging investment habits the right way is one way to make that happen. We are very proud to have the support of Sequoia Capital India to pursue this mission.”

On the same occasion, Sequioa Capital India VP Rohit Agarwal also said, “Globally we see consumers starting to shift their savings from low-yielding products, such as gold and property, to higher-yielding financial products. In Indonesia, we see Bibit as a trusted investment platform that can help millions of Indonesians invest optimally.”

Co-Founder and Managing Partner of East Ventures Willson Cuaca added, “Stockbit and Bibit are showing very high growth in the retail investor segment where transaction value growth will increase more than 10 times in 2020. We believe this funding will drive Stockbit's growth and strengthen their position as a leading investment platform.”

For information, Stockbit released Seeds in January 2019, via acquisition of majority stake in Bibit with an unspecified value. Stockbit itself was originally started as an investment community platform to exchange ideas and stock news online real-time.

As part of the Stockbit Group, Seeds become channel company to reach novice investors with easy investment. Seeds utilize Robo Advisor technology which adapts the product according to the user's risk profile and investment objectives. It is claimed that 90% of Bibit users come from millennials.

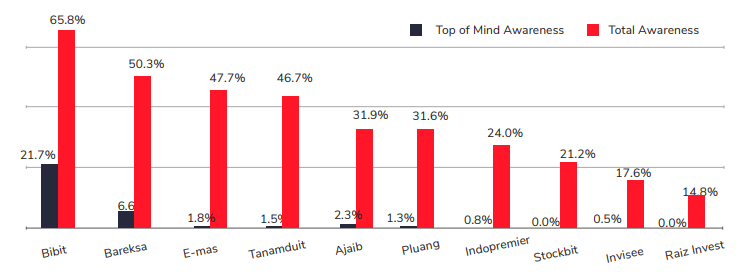

According to the survey results summarized in the 2020 Fintech Report, there are currently several investment applications targeting consumers. Seeds themselves become an investment application that gets a total awareness highest of the survey respondents.

More Coverage:

On the other hand, for mutual funds, Bibit is currently competing with other players such as Bareksa, Ajaib, and Bukalapak, which is currently being setting up a subsidiary specializing in investment products.

Sign up for our

newsletter