Ribbit Capital is Expected to Help Bank Jago Expand the Service Ecosystem

Ribbit's share ownership does not reach 5%; in Indonesia they also invest in Magic

Earlier this week (04/10), Bank Jago officially announced the entry of Ribbit Capital into the ranks of its investors. Although the details regarding the nominal funding provided have not been stated, in a disclosure on the IDX, it was stated that Ribbit Capital's ownership of Bank Jago does not exceed 5%.

The company's representative said that Ribbit's entry was considered strategic because previously they were known as venture capitalists who oversee the application. fintech excel in the global arena. Services such as Robinhood, Revolut, Affirm, Nubank, Coinbase, and Credit Karma are included in the portfolio.

Ribbit is also a shareholder in the startup Magic investment app developer -- recently they managed to reach the status "unicorn" through new funding, which was also followed by Ribbit Capital.

Validating future prospects

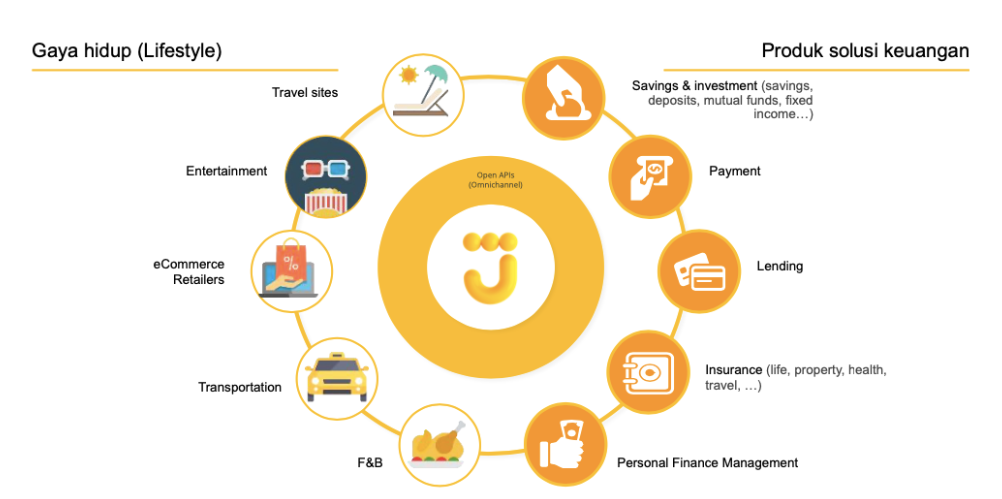

digital bank mushrooming presence in the midst of a rapidly accelerating financial technology ecosystem. This forces every service provider to present a plus in their application. Bank Jago himself said that the formation of an ecosystem is one of its main strategies. In the last 12 months for example, they have intensively partnered with several platforms and wealth management. Lastly, they integrate the service into Gojek and the Seed application.

| Application | Google Play Ranking (Finance) | Downloads | Rating |

| neobank | 1 | 10 million+ | 3,8 |

| Seabank | 19 | 100 thousand+ | 3,8 |

| Jago | 21 | 1 million+ | 3,8 |

| New Livin' | 28 | 100 thousand+ | 3,9 |

| blu | 43 | 100 thousand+ | 4,0 |

| Jenius | 54 | 5 million+ | 4,0 |

| TMRW | 80 | 500 thousand+ | 4,0 |

| LINEBank | 81 | 500 thousand+ | 3,9 |

(ranking is based on data as of October 8, 2021, at 16.00 WIB)

According to the President Director of Bank Jago Kharim Siregar, Ribbit's presence in the ranks of strategic investors shows two things. First, validation regarding the prospects for digital banks in Indonesia, especially for the future of Bank Jago products. Second, their interest in participating in increasing financial inclusion in this country.

"This is a form of investor appreciation for Bank Jago's business model as a digital bank that serves mass market, embedded in the ecosystem and using the latest technology. We feel we are on the right track to take Bank Jago to a higher level," he said.

Looking at the prospects for integration with portfolios, the situation is quite the opposite. In segment wealthtech, Bank Jago is currently working with Seeds – Ajaib's direct competitor. While other shareholders, namely Gojek, through its venture unit as well invest in Pluang.

However, in general the Ribbit experience accompanies a wide range of applications fintech world's top leaders are expected to provide support to achieve a broad financial services ecosystem.

Keep improving integration

Kharim too say, the focus of the company this year is to develop strategic partnerships to expand the scope of the service ecosystem. use case In the future, Bank Jago users are expected to be able to use various types of financial services without having to switch applications. In selecting strategic partners, shared vision and passion be the first thing seen.

More Coverage:

Going forward, Bank Jago will continue to improve application capabilities with various services that focus on lifestyle and financial management.

Sign up for our

newsletter