Digital Banks Are Still Just “Nice to Have”

DailySocial editors tried 9 digital bank applications in Indonesia and explored their features

My name is Randi (29). I am currently working as a private employee and living in one city tier-3 in Central Java – work full time remote. Although in a small district, access to public facilities such as banks and modern retail is quite easy. At home, the three of me live with my wife [housewife] and a toddler. Using the Socio-Economic Status (SES) category commonly used in the survey, the alphabet that reflects my current condition is “A” at the middle class level.

If you look at the financial records application that I manage with my wife, our average monthly expenses are in the range of IDR 4 million to IDR 6 million [an increase of about 40% after having children]. Some routine expenses that have been budgeted for are bill payments, daily necessities, children's needs, health including child immunization, and entertainment. Beyond that, of course, there are some sudden or urgent needs that are almost issued every month with an indeterminate amount.

In managing financial flows, we have several bank accounts for specific purposes. Gem Bank for payroll salary from the office, Bank Mandiri is used as savings, and Bank BRI is used to pay various routine bills. The selection of these banks also had a fundamental reason. The first, of course the obligations of the office; even though the nearest Permata Bank branch is in the next town which is about 45 minutes away by car. The Mandiri account used for savings is actually a former account payroll wife when she used to work.

Meanwhile, I chose the BRI Bank account because the nearest branch office is opposite my house, complete with an ATM machine. So it's quite easy if you have to take cash. That's important, because it's here to really be cashless society still very difficult. I remember very well, a few weeks ago the Batagor carpenter near my house put up a LinkAja sticker; but when I asked and intended to pay non-cash, the trader refused. Even when shopping at a department store in the city, the EDC machine sometimes couldn't be used, making me have to first withdraw cash at the nearest ATM.

Apart from banks, I also use several services e-money. Currently, the balances that always top up are OVO, LinkAja and ShopeePay. Mostly used for transactions in E-commerce and apps ride hailing. I use a premium financial recording application on my cellphone.

Get acquainted with digital banking

This year the news about digital bank quite loud to the ear. Even though I know that in previous years services such as Jenius or Digibank could already be used, I wasn't tempted to try them at that time, even though they were offered several times directly by salesmen at airports and shopping centers.

In the last few months, I have been interested in exploring the digital banking applications that continue to emerge.

For me, the definition of a digital bank is quite simple. Completely digital and no hassle with branch office matters, especially in terms of opening an account and the administrative processes that follow.

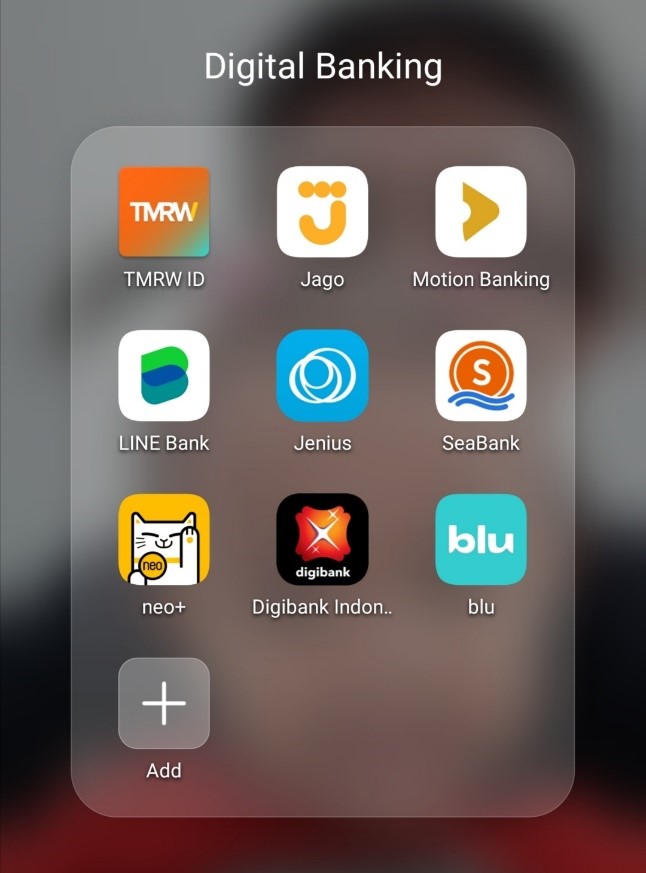

In the last three months, I have installed and tried at least 9 digital banking applications on my cellphone, starting from TMRW ID, Jago, Motion Banking, LINE Bank, Jenius, SeaBank, neo+, Digibank, and blu.

Apart from Digibank and neo+, the registration process was carried out easily. In fact, I have gotten debit cards for all five banks, apart from blu and SeaBank which do not offer physical card facilities.

For Digibank, the verification process should be able to be done via the biometric service on the cellphone, but either my device doesn't support it or other factors require me to carry out manual verification via an agent. The closest is in Yogyakarta, in a shopping center or branch office there - apart from having to travel 1,5 hours, I didn't because it was still PPKM.

For neo+, the queue is still long. When I registered on June 16 2021, I got number 83.971. After a few weeks, I got a call from the bank to make an appointment to verify via telephone the next day. Unfortunately, when the call came, I was in the bathroom. And had to wait for a new queue again - until now I haven't received another call for verification.

Experience trying digital banking

The registration process for all applications is relatively the same. Starting from filling in personal data on the form provided, taking a selfie with identification, and uploading other supporting documents [NPWP]. Next, the verification process is carried out video call via the application. At some banks, users have to wait in quite long queues to carry out verification. In fact, from my experience, there have been people who had to repeat it 2-3 times with different agents, because from their side the KTP was not visible during the verification process.

Apart from that, during the registration process, users will be presented with options for planning how to use the account: for savings, investment, credit, or others. In this experiment, I selected the investment option in all apps.

When you have obtained a bank account, some banks also provide the option to print debit cards. For the Jenius service, I have to top up a minimum balance of IDR 500 thousand first to be able to print a VISA Debit - although after completing the request, the money can be used or spent (it doesn't have to settle). Meanwhile, others do not require topping up their balance first.

Regarding card variants, for Jago bank, LINEBank, and Jenius I got a debit card labeled VISA, while at TMRW and Motion Bank I got a debit card with the GPN logo. Calculated from the moment after it has been successfully verified, the process of sending the debit card home is relatively fast - at most it takes LINE Bank due to the busy queue for card printing.

| Application | Registration Process | Verification Process | Card Delivery |

| Blue | Easy | Relatively Fast | Does not provide cards |

| Jago | Easy | Relatively Fast | 1-2 weeks |

| Jenius | Easy | Medium Queue (requires scheduling) | 1-2 weeks (after topping up) |

| LINEBank | Easy | Medium Queue | More than 4 weeks |

| Motion Banking | Easy | Relatively Fast | 1-2 weeks |

| TMRW ID | Easy | Relatively Fast | 1-2 weeks |

| SeaBank | Easy | Relatively Fast | Does not provide cards |

| Digibank | Easy | Long Queues (requires scheduling or manual verification) | Registration was unsuccessful |

| Neo+ | Easy | Long Queues (requires scheduling) | Registration was unsuccessful |

From this I conclude, digital banking really provides a new experience for having a bank account--compared to the process I previously went through when creating an account at a conventional bank.

Associated with user internace and user experience that is offered, for me it is very easy. Typical of today's applications. I tend to be able to immediately adapt to existing features without having to fumble or find out separately through a search engine. However, regarding performance, some applications still need to be improved. I have experienced this several times forced close and it's hard to get into the dashboard. For example, what happened with Bank Jago this morning (30/9).

Interesting feature, but not yet urgent

In general, each application has basic services such as savings, top-up features to e-money, and transfers. From experiments using each application, I found interesting features, as follows:

| Application | Interesting Features |

| Blu (version 1.8.0) |

|

| Jago (version 5.7.0) |

|

| Genius (version 3.1.0) |

|

| LINE Bank (version 1.1.5) |

|

| Motion Banking (version 2.1.3) |

|

| TMRW IDE (version 4.1) |

|

| SeaBank (version 2.7.0) |

|

By selecting the “investment” preference when registering, some services offer a deposit feature. Personally, I am not interested in using this instrument for investing - either for the short or long term. My current financial condition forces me to be more conservative in investing. However, suggestions from colleagues to try stock instruments and mutual funds are also starting to be considered as options.

This feature has actually started to exist in Jago Bank through its integration with Bibit and will soon be in Jenius. But it feels less comprehensive compared to opening a direct investment application. So for this need, I am still comfortable with separate applications.

For features such as bluGether, Jago pocket, or Save it in Jenius, it is actually interesting for me who manages finances together with my partner. However, so far one account with shared access is still sufficient, instead of having to register new accounts one by one. Efforts to transfer balances to existing digital bank services are also still considered "too many Yago's defensive effort" compared benefits what you got, so don't do it for now.

When discussing migration with his wife, he also gave consideration to sticking with the application he is currently using. There are two reasons, his only source of income is from me and he is reluctant to create a new bank account – even though it is completely digital and will later get access to jointly managed savings.

The unique feature that is quite evocative is the City of TMRW. We are encouraged to save regularly every day, starting from a nominal value of IDR 20 thousand. Every time we increase our balance, the virtual city level displayed will get better. The animation of the gamification provided is also very interesting. I thought, in the future something like this would be fun to use for my children, while teaching them about saving regularly.

More Coverage:

After exploring and trying several of these features, I concluded that currently the urgency is still at the level “nice to have” course, not yet urgent and encouraged to replace previous services. Moreover, applications mobile banking which I currently use every day is also continuing to be developed and makes it very easy. For example, through the PermataMobileX application, I can withdraw cash via the nearest Indomaret - so it's quite helpful in the absence of bank branches in my district.

What is expected from a financial service

The financial management that my small family and I use still requires several applications: mobile banking, financial recording, e-money, and investment. So the process is still separate.

Pain points What is found is that sometimes the nominal value in the note is not the same as that in other applications; and have to do top-up separately when you want to use it e-money for example for shopping. Every month I also have to make separate transfers to the account used for saving and transactions.

Living conditions in the city tier-3 also still forces me to still have a debit card for cash withdrawals which can be used at various EDC machines and ATM Bersama. The blu feature might be interesting because you can withdraw cash via the application, unfortunately the distribution of BCA ATMs around me is still very limited -- the closest one has to travel 12 km.

Actually, if you look at the vision of existing digital banking services, they are trying to accommodate pain points What I feel is that it adapts to the lifestyle of today's young people, for example the pocket feature to separate budgets or integration into consumer services so that you don't need it anymore. top-up ke e-money. Maybe because it is still in the early stages, the user experience presented is still not enough to force me to change direction, moving from conventional banks.

However, it does not rule out the possibility, when the integration becomes wider and the performance becomes more reliable, the level “nice to have” was going to change to "mandatory".

I imagine, for my younger siblings who are still in college and starting to work (first jobber), this digital banking option can be attractive – especially if they haven't had a personal account before. If configured for financial management from the start, these banks offer interesting capabilities with a contemporary design, so I don't hesitate to recommend one of the applications I have tried to colleagues in the future.

Sign up for our

newsletter

Premium

Premium