RedDoorz Group Aims for Profitability in 2024

Has achieved positive cash flow in Q4 2023; will maintain that trend with lower opex

Lodging network provider budget online RedDoorz is aiming for full profitability in 2024 after realizing it positive cash flow (as a group) in the final quarter of 2023. Despite the uncertain market situation, RedDoorz recorded revenue growth of 30% in 2023 and maintained its growth momentum in the range of 30%-50% this year.

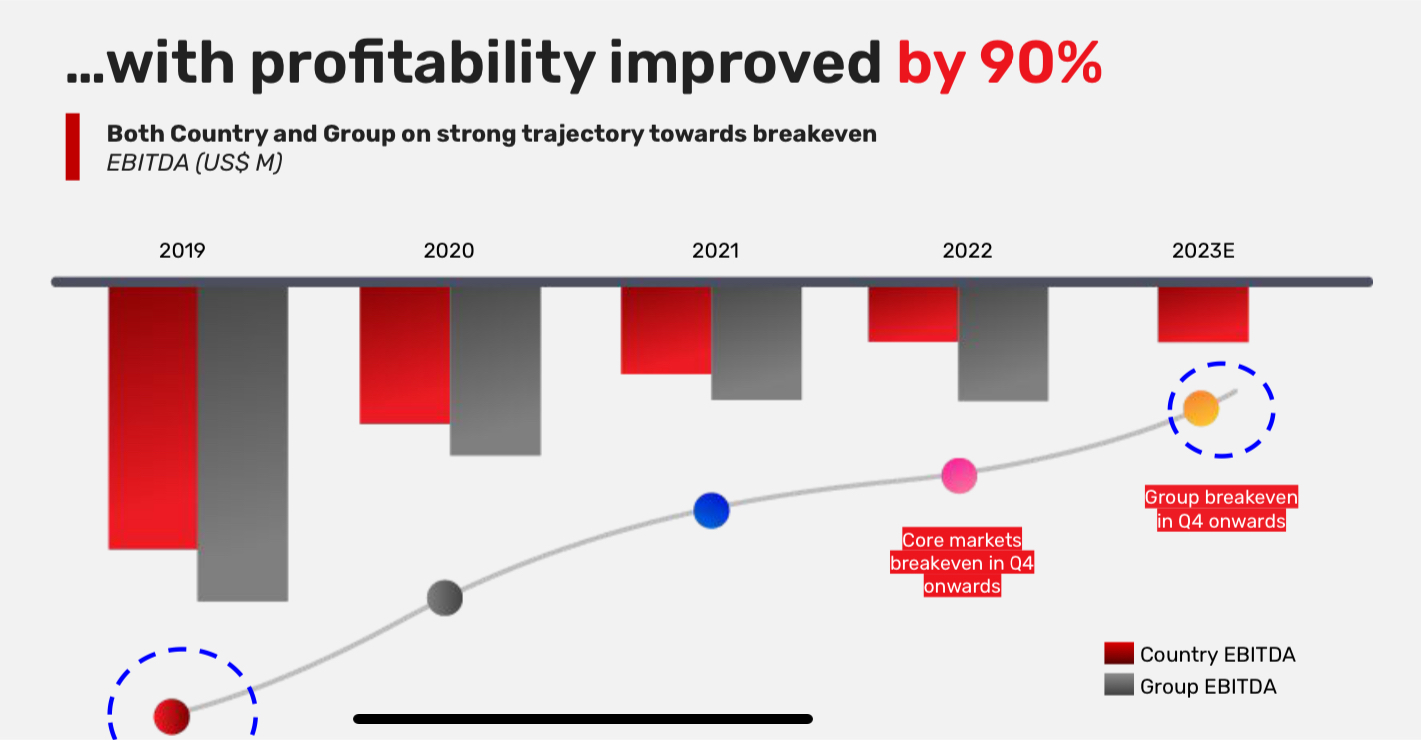

As can be seen in the following data, RedDoorz reports that it has reached break even (breakeven) in the last quarter of 2023. From 2019 to Q4 2023, the RedDoorz Group said it had reduced cash burn every year so that the company could achieve positive cash flow in the last two quarters of 2023.

In fact, in the fourth quarter, the order rate (booking rate) was said to be much better than expected. Better post-pandemic recovery throughout 2023 will contribute to achieving this positive cash flow.

President Director of RedDoorz Indonesia, Mohit Gandas, said that this achievement was realized thanks to the automation strategy carried out throughout the year. As a result, RedDoorz starts 2024 with operational costs (Opex) which is much lower than in 2023.

From 2022 to 2023, RedDoorz strives to encourage cost efficiency through automation in its operational activities, so that this makes the company much more efficient than in 2021.

"We are focusing more on larger and quality properties so that each property unit now generates greater [income]. We want to replicate this [strategy] in 2024. So, if we want to maintain 30% growth with the current income realization with Opex similar in 2023, we are likely to be more profitable,Mohit explained to DailySocial.id.

Another factor, RedDoorz is focusing on a multibrand strategy, of which there are currently 8 brand properties held include RedDoorz, SANS Hotel, Koolkost, RedPartner, Sunerra, Urbanview, Red Living, and The Lavana. RedDoorz has now partnered with 285 hotels in the premium segment.

Meanwhile, Mohit said the level of accommodation capacity he manages in Jakarta reaches 60% -70%. Meanwhile, the average combined accommodation capacity of all brands reaches 45%. RedDoorz is still the main product that contributes greatly to group revenue.

70% of the total users were recorded as ordering directly via the RedDoorz application, 70% were recorded as repeat users, and 50% of them were users with an order rate of more than 4x.

"Post-pandemic, folks traveler now relying more on quality accommodation. "Properties that are better quality and better appraised tend to be more booked now," he added.

More Coverage:

This year, RedDoorz plans to aggressively expand its property network and digitization in Indonesia with a potential total available market (TAM) in Southeast Asia of more than 400 thousand properties.

His party will increase technological support so that partners' operations are more efficient, including utilizing pricing engine technology-based to maximize their income. This was because previously many property owners still used a manual system for recording bookings. In fact, if they have systems, they are not connected to each other.

Related IPO plan in 2027 or raising new funds this year, Mohit was reluctant to comment further. The IPO plan was first revealed by RedDoorz Founder and CEO Amit Saberwal last year.

Sign up for our

newsletter