The Opportunity to Add Crypto Asset Instruments to Diversify Your Investment Portfolio

Taking Zipmex as a strategic partner

At the end of the year, Pluang has released a new investment product on its platform. This time it was the turn of crypto assets to be traded, starting with Bitcoin and Ethereum as the digital currencies with the largest capitalization values today. The company cooperates zipmex as partners in transaction processing.

There are two reasons why Pluang chose Zipmex to integrate into its platform. First, because it has been registered with BAPPEBTI as a crypto exchanger. Second, Zipmex uses BitGo as a custodian, equipped with protection (insurance) issued by Lloyd.

Pluang's Co-Founder Claudia Kolonas said, "For Pluang, the purpose of launching this product is to open wider access for the Indonesian people to world financial products." He also said that one of the things that Pluang prioritizes is making the transaction/investment process more practical.

"Sale crypto in the Pluang application can also be done directly real-time. Pluang users can buy, sell and store crypto-token in the application comfortably, because it is covered by insurance. Currently, deposits and withdrawals can only be made in Rupiah, but we will consider the features crypto withdrawal later on," explained Claudia

Previously Pluang was known as a gold investment platform. Then last September 2020, they released the instrument S&P 500 futures investment, enabling Indonesians to invest through publicly listed companies in the United States.

Crypto assets are not popular investment instruments

The decision to include crypto assets in its investment product line tends to be "bold" in the midst of public interest that is not too big to invest in digital currencies. One of them was validated by the research we did with Populix last July 2020. From a survey of 209 respondents using digital investment services, mutual funds (67%), gold (62,7%), and stocks (44,5%) were the most chosen instruments.

Research conducted by Pluang itself involving a larger number of respondents, namely 5500 people, found almost similar results. Gold (32%), stocks (15%), and mutual funds (16%) are the most popular. Meanwhile, very few respondents choose crypto assets for their investments.

Related to this, Claudia said that the main goal is asset diversification. “Having an investment allocation in Bitcoin or other cryptocurrencies can provide broad diversification to traditional portfolios, which are usually stocks or bonds,” he said.

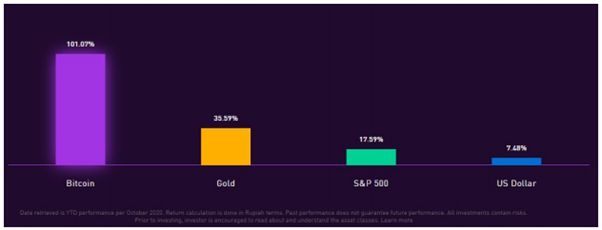

From research conducted by Pluang, it is found that Bitcoin is the asset that has the highest yield in the past year -- compared to gold, the S&P 500, and the US dollar. The data obtained is the performance from the beginning of the year to October 2020. The yield calculation is calculated in rupiah currency conversion.

Crypto assets such as Bitcoin have a fairly high market volatility, ups and downs based on people's trust in the digital currency. If you look at the trend of recent times, the price even dropped to $3000.

On that basis, Claudia also suggested that crypto asset products are suitable for long-term investments. "We do not recommend purchasing Pluang cryptocurrency if there is an urgent need for funds in the short term. So in addition to having a moderate to high risk profile, this product is also recommended for investors who already have investment experience," he explained.

Header image: Depositphotos.com

Sign up for our

newsletter