One Year of Operation, Segari Gets Series A Funding of 227,6 Billion Rupiah Led by Go-Ventures

A number of investors were involved, including SIG, Alfamart, Gunung Sewu Group, Intrinity Capital, and venture capitalists in the previous stage.

After 12 months of operation, startup online groceries Segari announced the acquisition of further funding in a series A round. The value reached $16 million or equivalent to 227,6 billion Rupiah. The investment was led by Go-Ventures with the participation of SIG, Alfamart, Gunung Sewu Group, and Intrinity Capital.

Investors in the previous stage participating, including Beenext, AC Ventures, and Saison Capital. In total, from the sources of information we have, Segari has recorded an investment of around $18 million.

The company will use the fresh funds to strengthen infrastructure, ensuring a more efficient process from farmers to consumers. In addition, they also plan to strengthen and add teams in various fields, including operations, technology, and marketing.

Through the solutions offered, Segari is committed to simplifying complex distribution chains by leveraging technology and empowering communities as partners in more efficient sales and distribution.

"The agricultural distribution chain is one of the most complex problems in Indonesia. There are still many layers from farmers to agricultural products to consumers," said Segari Co-Founder & CEO Yosua Setiawan.

He continued, "We hope to have a positive impact where consumers can receive quality food ingredients faster and at a lower cost. On the farmer's side, we also help them to receive a fair price for the products they sell."

Through the application or website, users can order fruit, vegetable, meat and other staple food products. In just 15 hours, fresh food products will reach consumers from farmers. Most of the product sources are sourced directly from partner farmers in Java and Sumatra.

With a decentralized approach to warehouses and a network of sales partners, Segari claims to be able to provide faster delivery times, better product quality, and lower costs that customers can enjoy.

Agro startups at Go-Ventures

Segari is the 16th portfolio for Go-Ventures. Previously, venture capitalists owned Gojek it has also invested in several startups with similar business models, including eFishery (Fresh), FoodMarketHub, and KitaBeli.

Through the GoMart feature, Gojek it's average trying to strengthen the line online groceries. Their capabilities provide order systems, payment infrastructure, and delivery services. As for the product, so far Gojek partnered with several companies and startups, including Alfamart and Sayurbox. Segari's entry clearly has the potential for integration into GoMart.

Then regarding his investment in Segari, Go-Ventures Partner Aditya Kamath said, "The pandemic has become a catalyst for the growth of the online market (e-grocery) in Indonesia. More and more consumers are turning to online purchases, especially shopping for their daily needs. last year, Joshua, Farand Anugerah (COO) and Farandy Ramadhana (CTO) have shown outstanding execution, Segari is growing very fast and still maintaining the best economic unit in the sector."

Online grocery in Indonesia

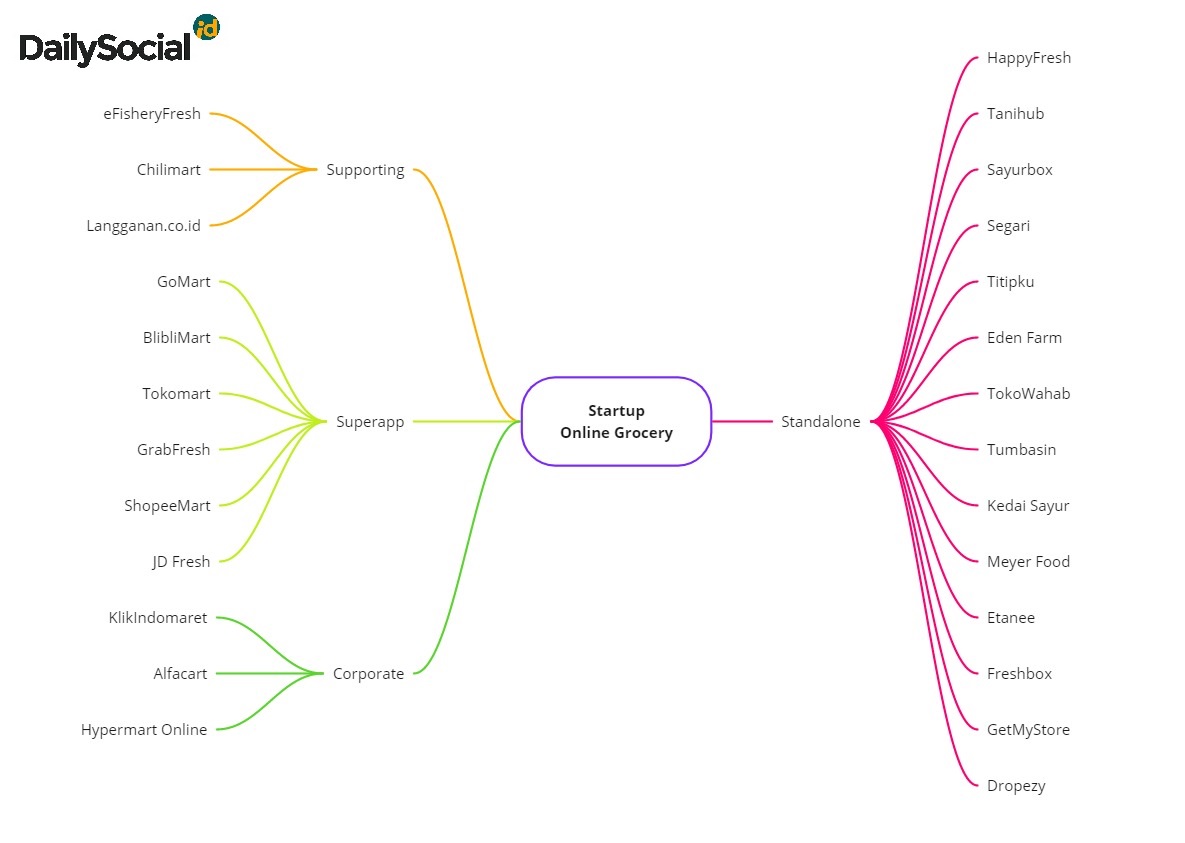

Social restrictions caused by the pandemic have become a separate momentum for players online groceries in Indonesia. In addition to the new players who keep arriving, the old players and super app also strengthen its reach in the market.

More Coverage:

According to IGD Asia Pacific analysis, as of 2019 market size Grocery total has reached $140,2 billion. Projected to grow to $169,4 billion by 2020 at a CAGR of 5,2% in two years -- turning the country into a market Grocery 13rd largest in the world. Online grocery itself is judged to have an ever-increasing portion here. No doubt, there are now dozens of digital players who are trying their luck to acquire the market.

However, what digital platforms do is still at a very early stage. Regarding the coverage itself, almost all services are still focused on tier-1 cities. The biggest players like HappyFresh still cover the Greater Jakarta area, Surabaya, and several other big cities. Meanwhile, newcomers such as Segari still serve limited areas in Jadetabek.

Sign up for our

newsletter