Welcome to Digital Bank

Digital banks in Indonesia are still under conventional banking, the legal umbrella also has not accommodated the opening of virtual banks

Banking, the oldest financial industry in the world, is now required to transform towards digital, both in services to consumers and in its operations. While on the external side they are also required to cooperate with startups fintech so as not to be further eroded by technological trends.

Many admit that utilizing digital technology can provide efficiency, because it does not only rely on the quantity of physical and non-physical assets. That's why most of the solutions offered are disruptive, disrupting old habits.

Banks cannot forever rely on cooperation with third parties so that business is not eroded. They are required to be more efficient by fully adopting digital, finally a newer banking model has emerged, known as a digital bank (or virtual bank).

According to IBM, digital banks are different from other forms of digital banking because they are only online, they do not have branch offices in a country. Consumer expectations from this are savings in bank facilities and staff which ultimately translates into higher interest rates on savings and lower interest rates on loans.

The difference they feel most is the emotional connection when visiting a branch office to interact, rent a safe, ask a banker for advice or so on.

Digital banks in Indonesia: Still waiting for a legal umbrella

Indonesia does not yet have a legal umbrella regarding digital banks. The discourse of creation already exists, but a formal framework unfortunately does not yet exist. Currently, digital banks that operate are still under the banner of conventional banks, namely BTPN Jenius (2016) and DBS Digibank (2017).

The umbrella regarding new digital banks is accommodated by POJK Number 12 of 2018. It is explained that the definition of digital banking services is services developed by optimizing the use of customer data in order to serve customers more quickly, easily and according to their needs; and can be carried out completely independently by the customer, taking into account security aspects.

OJK also stated that this provision can only be made by banks that are at least in the commercial bank category of business group (BUKU) II or have core capital ownership of between IDR 1 trillion to IDR 5 trillion. Regulations regarding virtual banks or banks without a physical presence have not been accommodated in the POJK.

This limitation means that the regulator wants to ensure that all fundamentals carried out are within the guidelines of banking regulations. Entering BUKU II has an impact on the scope of the bank's business activities, the most influential being that they can start payment system activities and e-banking without having to be limited if it is still in BOOK I.

In terms of the services offered, neither Jenius nor Digibank really target this group unbanked. The distribution map is strategic, not immediately mass, but slowly entering big cities. For example, Jenius as of the end of 2019, opened booths in Malang, Medan, Makassar, Palembang, Yogyakarta, Bali, and of course Jakarta in pilot project-New.

However, this is no longer an issue because opening an account at Jenius is facilitated with a KYC video call service, so you can become a customer without having to come to the booth. Quite an innovative feature, but it can't stop there.

There must be an impact on customers unkanked. The story is different from current conditions, startup expansion or payment which seems to be faster in attracting its target customers because there is a "business cake" that has not been touched by banks.

Even though there is no legal umbrella yet, armed with the regulations that have been issued, the digital bank map is now starting to get busy. This is marked by the entry of conglomerates, big-name investors and startups who have been busy acquiring small banks since last year.

Salim Group has annexed Bank Ina Perdana, Jerry Ng (senior banker) and Patrick Walujo (Northstar Group) to Bank Artos, BCA to Bank Royal and Rabobank (to be merged into one of BCA's subsidiaries), Akulaku to Bank Yudha Bhakti.

All the actions above have not shown their fangs, except Akulaku and Yudha Bhakti Bank. But the preparations are already starting to take hold. BCA, for example, has targeted Bank Royal to start pilot project in the second half of this year and is ready to increase capital of up to IDR 3 trillion so that its movements are more agile.

Meanwhile, Bank Artos has been occupied by former BTPN people, effective as of 15 November 2019. They are Jerry Ng (Main Commissioner), Anika Faisal (Board of Commissioners), Kharim Indra Gupta Siregar (Main Director), Arief Harris Tandjung (Deputy Director Main) and Peterjan van Nieuwenhuizen (Director). This succession indicates that there is great hope to repeat Jenius' success under the same leadership.

The close relationship between Patrick Walujo and Gojek It is widely rumored that Bank Artos will become GoBank (owned bank Gojek). He emphasized that the rumors were not true. According to his confession, in a panel discussion forum, there was indeed a discussion regarding the use of the ecosystem Gojek and utilizing the Bank Artos team with experience in banking.

However, in the end it was decided that the concept of Bank Artos was not exclusively a bank Gojek. Although, banking will specifically be directed at becoming a digital bank. "Because we see that there is a need that cannot be met by the market, namely from the digital banking side," said Patrick when speaking at a conference at the end of January 2020.

Before investing in Bank Artos, Patrick had experience investing in BTPN in 2008, through TPG Nusantara, a joint venture with Trans Pacific Group. He bought 71% of BTPN shares for $195 million (around Rp. 1,8 trillion at that time). The shares were released in stages until 2015, the nominal value obtained was IDR 5,3 trillion by releasing 17,5% of the shares.

“I invited Jerry Ng to join and improve BTPN's business. The bank goes into mass market "namely small traders in traditional markets whose markets are large and well developed, to the point where state-owned banks have joined in," continued Patrick.

When Bank Royal Bank Artos and Bank Yudha Bhakti start operating, it is hoped that there will be product offerings that are more varied and easy to use by the public. unbanked.

According to the latest e-Conomy SEA 2019 report compiled by Google, Temasek and Bain & Company, 51% of Indonesia's population falls into the category unbanked; underbanked 26%; and banked 23%.

"There are many business actors who need funding, but have difficulty borrowing funds from banks, including because they don't have collateral to use as collateral. "This need could be a potential service for digital banks," continued Patrick.

Hong Kong could be the best example, because in this country there have been eight digital banks operating since the license was granted in 2019. ZA Bank offers a maximum deposit interest of 6,8% for three months for deposits of up to 100 thousand Hong Kong dollars (equivalent to IDR 176 million).

Compared to offers from conventional banks such as HSBC and Standard Chartered, the deposit interest offered is between 2%-3% for high nominal deposits.

This initial strategy, according to the Managing Director of VC Asset Management Louis Tse Ming-Kwong, is an attempt by new players to improve brand awareness, while gaining a consumer base.

“The rate war may not just be limited to virtual banks, but encourage conventional banks to respond to defend their market share,” he said.

Different countries, different developments

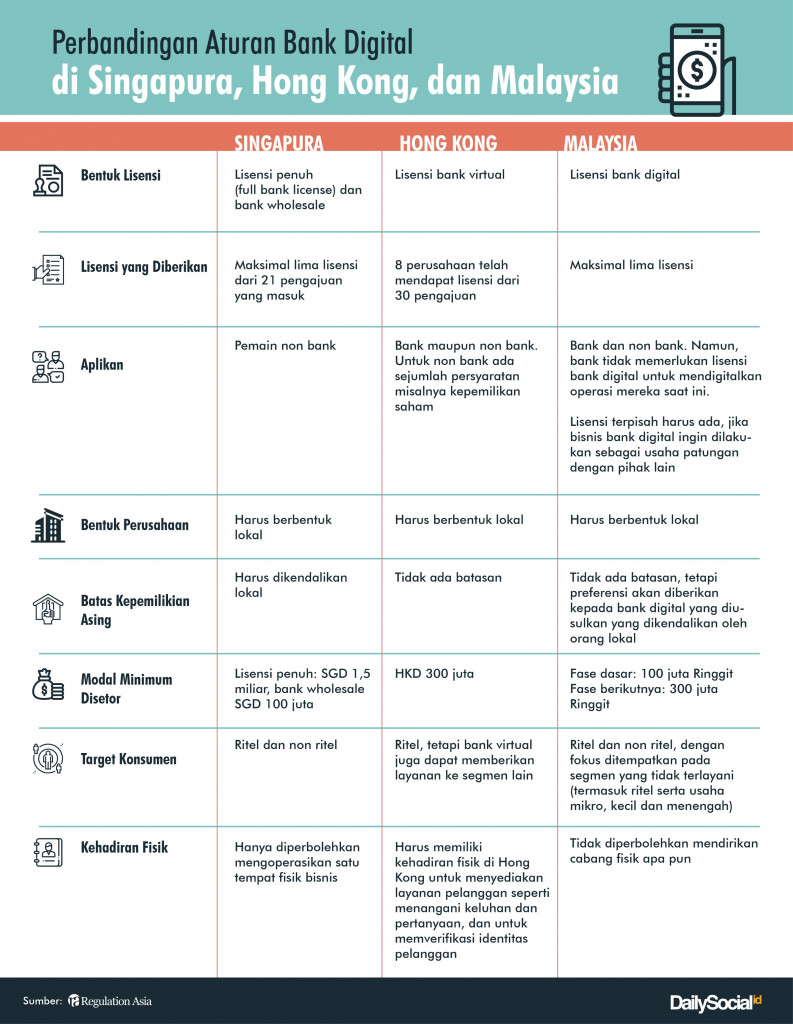

Talking about virtual banks, Indonesia does not yet have a legal umbrella. The requirements for creating a digital bank can only be carried out if the basic license is banking. This is different from its two neighboring countries, namely Singapore and Malaysia.

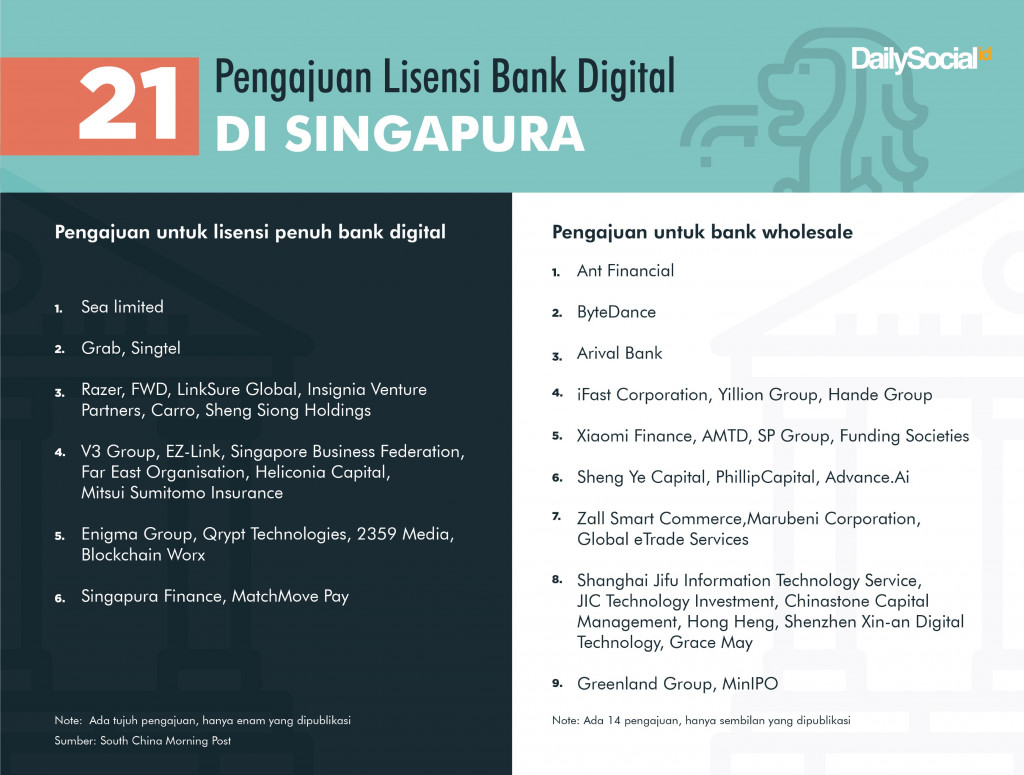

Singapore opened five licenses as digital banks for non-banking, with details of two full licenses and three wholesale bank licenses. The announcement will be made in June 2020 and the five selected companies are expected to start business in mid-2021.

Requirements given Central Bank of Singapore It's also different for each license. For a full license, capital must be 1,5 billion Singapore dollars and must be controlled by local people. They are permitted to provide a variety of financial services as well as hold retail customers' savings.

Meanwhile, banks Wholesale enabling those who want to serve SMEs and other non-retail segments. Minimum capital 100 million Singapore dollars. Submissions are open to local and foreign companies.

There are 21 potential candidates competing to get the permit, both in the form of consortia and individuals. Interestingly, most of the applications came from technology companies from China because the Central Bank of Singapore opened this opportunity for non-banking.

The entry of new players in Lion Country does not focus on "new kids", but rather on what kind of services they will offer. According to Professor of Information Systems at Nanyang Business School Boh Wai Fong, new players are expected to serve low-income people or new companies that cannot meet traditional bank credit requirements.

There are 38% of adults in Singapore who fall into the category underbanked, even though the country has entered the mature stage of its financial industry, according to the 2019 e-Conomy report compiled by Google, Temasek and Bain & Company.

By helicopterview, the high interest of foreign technology players in Singapore indicates that this is the gateway to further entry into the Southeast Asian market. Even though this license will only be valid in Singapore, the business model is considered very feasible to be replicated regionally.

It should be noted, Singapore does not have a digital bank at all. So far, the country has been dominated by large banks such as DBS, UOB and OCBC. All three, according to Boh, have “too good for too long” and monopolize the market.

Malaysia also held the same contest as Singapore, opening five digital bank licenses. Submissions are open to non-banks, banks themselves if they want to separate their digital bank by forming a joint venture.

This neighboring country issued an exposure draft on the Licensing Framework for Digital Banks as a way to promote the development of digital banks in line with the directions taken by Singapore and Hong Kong regulators. Both have published similar occupational licensing frameworks in the last two years.

The Central Bank of Malaysia said it would finalize the draft in the first half of this year. At the same time, applications for new licenses can be made for interested candidates.

Meanwhile, Filipina has awarded four digital bank licenses to CIMB Bank and ING Bank, Tonik and Rizal Commercial Banking Corporation (RCBC). Except for RCBC, digital banks are run by regional banks. Thailand also has a digital bank called Timo which was released in 2016.

Sign up for our

newsletter

Premium

Premium