Finansialku Relaunch Website, Prioritize Financial Literacy Improvement

The new site is equipped with storytelling content, research articles, and study guides; complement the existence of pre-existing applications

Financial planning startup my finances reintroducing the appearance of the site with additional features that have the main objective of increasing people's financial literacy. As is known, based on the OJK survey, last year's public literacy rate was 40% and the inclusion index was 61,7%.

“Our vision from 2016 has always been to focus on helping Indonesians achieve their financial goals through planning, inclusion and financial literacy. My Finansialku site is part of that vision," said Founder of Finansialku Melvin Mumpuni in a virtual press conference, Thursday (30/9).

In his presentation, there are three new features that are presented on the Finansialku site. First, Web Stories that contain storytelling finance based on a true story with the approval of my Finansialku client before going live. The stories raised in this feature are focused on relevant topics, empathize, and are equipped with solutions.

Next, research-based Financial Planning and Investment Analysis articles. The writing of this article and analysis is written by a competent, experienced, client-oriented, and objective financial planner from Finansialku. This feature can also help investors with the display of JCI data and the latest exchange rates every week.

Finally, the Study Guide or Guide which contains steps for financial planning. This third feature can help readers to plan finances from scratch. A guide on how to increase income and investment is also provided in this feature. "All of these features can be accessed for free by readers," he added.

Complete application presence

In addition to having a website, Finansialku also has a financial planning application that has been launched since 2017. According to Melvin, these two products complement each other's goal of Finansialku which is to improve financial literacy. The site is more directed at the information needed for beginners.

“Meanwhile, in financial planning it is not only literacy that is needed, but practice. The application accommodates these needs because it is equipped with tools complete."

This Finansialku application has premium features that require users to pay a subscription fee of IDR 350 thousand per year or IDR 35 thousand per month. According to Melvin, this fee is charged because it is part of the company's commitment to protecting customer data with international standards.

Currently, Finansialku is certified to ISO 27001: 2013 regarding data security and confidentiality. The company has been registered as a Certified Financial Planner, is also listed as an IKD organizer at the OJK, and is a member of the Indonesian Fintech Association.

The company also has channel other monetization, namely providing consulting services with financial planners. It is claimed the company has served almost thousands of clients, not only from individuals and corporations.

Melvin targets launch this site can boost the rate of site visits between 9-10 million visits in a year. As for the application's users, it is claimed to have reached more than 350 thousand people and is expected to increase to 500 thousand people by the end of this year.

In the near future, the company plans to add financial recording features from various banks to the Finansialku application. "We will release this feature in November 2021," he concluded.

Five players registered in OJK IKD

More Coverage:

Finansialku is one of the five IKD organizers listed at OJK in the cluster financial planneras of June 2021. The other four players are Arkana Finance, Halofina, Fundtastic, PayOk, and Savio. No player has pocketed a licensed status yet.

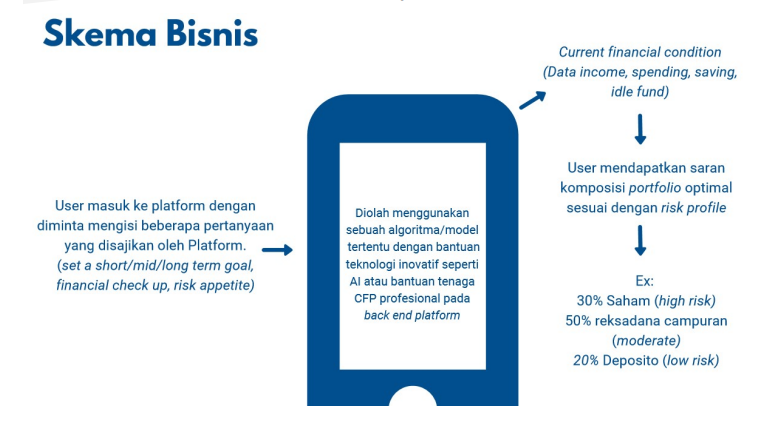

According to OJK's terminology, Financial Planner is a platform that helps individuals in financial planning, providing advise related to the choice of investment products offered by LJK that are registered and/or licensed and supervised by the OJK in accordance with risk profile each individual to achieve a certain goal.

Sign up for our

newsletter