MDI Ventures and Several Investors Provide Funding of 1,79 Trillion Rupiah to Kredivo Via PIPE

Also announced three new Board of Commissioners, namely Arsjad Rasjid, Darmin Nasution, and Karen Brooks

FinAccel as the parent company Kredivo another $125 million or 1,79 trillion Rupiah investment from MDI Ventures, Cathay Innovation, and Endeavor Catalyst through Private Investment in Public Equity (PIPE). This additional investment will strengthen its position ahead of the IPO preparation through the SPAC scheme.

In his official statement, MDI Ventures CEO Donald Wihardja said he was impressed with the company's vision to build an AI-based digital consumer credit platform through the use of alternative data after its first post-funding round for the series B round. Kredivo also supported by ongoing partnerships with eight platforms E-commerce leading in Indonesia.

On the same occasion, FinAccel also announced three new ranks who will fill the position of the Board of Commissioners Kredivo Indonesia, namely Arsjad Rasjid, Darmin Nasution, and Karen Brooks. All three are still waiting for approval from the regulator. Meanwhile, the new Board of Commissioners will play a role in helping to design strategic growth and market expansion Kredivo.

The brief profiles of the three consist of Arsjad Rasjid currently serving as CEO of PT Indika Energy Tbk and General Chair of the Indonesian Chamber of Commerce and Industry (KADIN Indonesia); Darmin Nasution is a leading economist in Indonesia who is also the former Coordinating Minister for Economic Affairs (2015-2019), and former Governor of Bank Indonesia (2010-2013); and Karen Brooks, who served on the National Security Council Staff at the White House, has more than a decade of experience in private equity and global investment management.

In a joint statement, the three said that Indonesia is still one of the markets unbanked largest in the world despite the recent increase in financial inclusion. "We are committed to helping Kredivo to impact tens of millions of customers over the next few years as we are optimistic about their innovative credit scoring system."

As known, FinAccel announced its move to become a public company on the NASDAQ through the SPAC scheme. To streamline this plan, Kredivo will merge with shell company VPC Impact Acquisition Holdings II (NASDAQ: VPCB) which is an affiliate of Victory Park Capital (VPC). From the merger of the two, FinAccel will pocket a pro-forma equity valuation of $2,5 billion, assuming no redemption.

Digital loan market

According to the quoted data DSInnovate in the report"Indonesia Paylater Ecosystem Report 2021", paylater services will grow 76,7% compared to the previous year, posting a GMV of $1,5 billion in 2021. It is projected to continue to increase to reach $8,5 billion by 2028. This is also supported by an understanding of the business model paylater increasingly familiar in society.

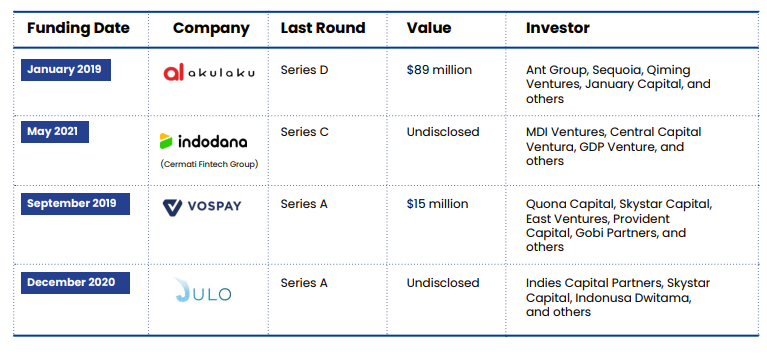

apart Kredivo, in Indonesia there are several other players like Akulaku, Atome, Indodana, Julo, Vospay, Creditmu, and Home Credit. Apart from that, super apps are also developing similar services, such as Gopaylater, Traveloka Paylater, and SPayLater from Shopee.

More Coverage:

Regarding funding, several startups have also received support from investors. From the data we collect, Akulaku become one of the players with the biggest valuation after Kredivo, its value is close to $1 billion.

Sign up for our

newsletter