Insignia Explains New Investment Paradigm for Advanced Stage Startups

Discussion with Founding Managing Partner of Insignia Ventures Partners Yinglan Tan discussing the startup investment climate in Indonesia and Southeast Asia

Ula, a B2B Commerce startup for MSMEs, was founded in 2020 by Alan Wong, Derry Sakti, Riky Tenggara, and Nipun Mehra. In its debut, they raised $10,5 million in seed funding from Sequoia, Lightspeed, and a number of other VCs and individuals. In 6 months, they got 2x the series A funding than before. Then, within 9 months, they secured $87 million in series B funding, including from VC Jeff Bezos. The total equity funds raised reached $140 million.

This story illustrates how easy it is for venture capitalists to pour investment money into a startup. And this didn't just happen to Ula, the outpouring of funding also happened to other startups such as Lummo, BukuWarung, Astro, and others. In a relatively short time, several funding rounds were successfully closed, involving investors from local, regional and global levels. It even gives them status centaur less than 2 years.

Unfortunately, getting large funding does not guarantee that a startup will be successful 'take-off' to the sustainable business stage. Ula and Lummo for example, now they choose closing the business model previously filled in nationwide raising funds and carrying out complete operational restructuring (including disbanding the team). Both Ula and Lummo are filled by ranks founder who is quite experienced in the technology business ecosystem.

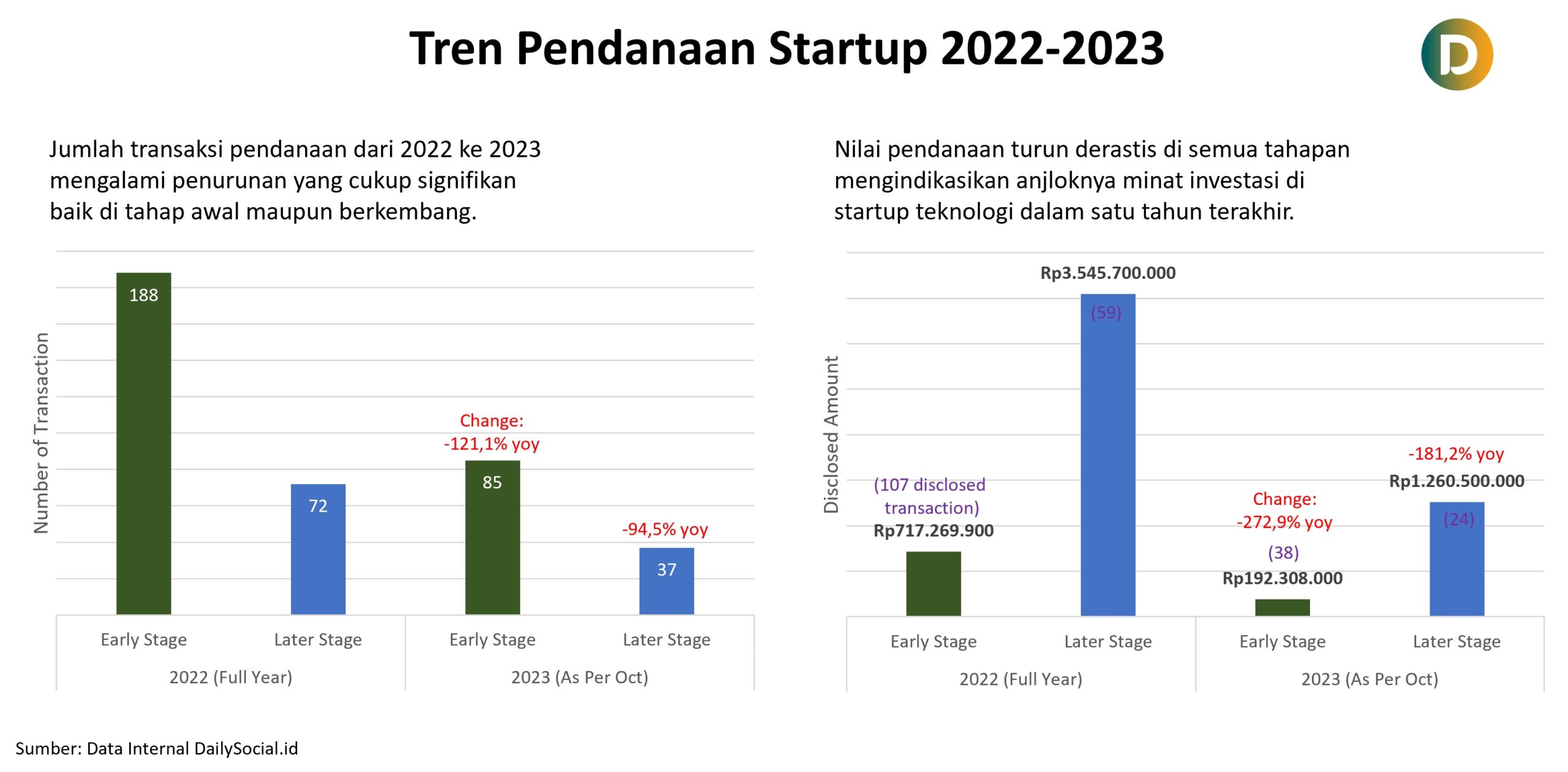

Market correction

Observers say, era 'easy money' in startup investing is over. Investors are again thinking conservatively when putting their money into a startup, emphasizing metrics such as revenue and projected business development --- instead of just chasing user growth. However, it cannot be denied that thanks to smooth investment in the startup ecosystem, dozens have emerged unicorn and dozens centaur which revolutionized various sectors in Indonesia. Direct boost to the digital economy in this region.

After the pandemic, the hypothesis regarding the technology sector which will accelerate rapidly is accepted by various parties. Investors are rushing into new technology startups that are considered to be able to democratize certain business segments (for example, at that time what was quite popular was the digitalization of MSMEs). The fast flow of early stage funding means that many new startups have fantastic valuations --- the average early stage funding is already worth millions of dollars.

On the other hand, this has an impact on its formation gap in advanced funding rounds. In the early stages, startups already get fantastic valuations – multiple valuation values post-money higher than the previous average. Even though this condition is prone to being affected by shocks when turbulence occurs in the economic system.

It's true, in 2022 global economic conditions will experience a number of pressures. The increase in interest rates makes fund owners start to reconsider investing in startups - with a much higher level of risk, for example, compared to bank deposits. With the dominance of LPs in venture capitalists who come from global investors, the impact of the decline in the investment climate is being felt in Southeast Asia, especially in Indonesia.

However, with many early stage startups having received funding several years ago, further funding support is urgently needed. With the previous paradigm, startups tried to prioritize growth, with the hope that when the user base has been formed we can start monetization at a later stage. This makes runway their business is limited and quite dependent on the next round of funding.

A number of VCs argue that a market correction (or so-called tech winter) This It will still be felt until the end of 2023 this.

Starting a new paradigm

We met with Yinglan Tan, Founding Managing Partner of Insignia Ventures Partners, which has invested in startups in Indonesia and Southeast Asia multi stage. He believes that in current market conditions, VCs expect more mature financial management and business governance for startups after completing their early-stage (post-series A) round. And this must be reflected in audited financial statements with positive unit economics, sound cash flow management, and several other business validations.

“The cost vs. return ratio for startups has increased especially for late-stage investments, as they scale up cost of money and price adjustments in the landscape exit post-pandemic. This encourages VCs to be more thorough in avoiding losses, or broadening their exposure to considered companies undervalued. "There is also a strategy to move to seed rounds, although this may impact the speed of disbursement of large funds," Tan said.

Some things seem to have changed recently, durability of cash for example. Previously one round of funding could secure runway startups 12-18 months before closing the next round, but this is difficult for many startups to do now. On the other hand, the fundraising process is also more difficult, analysts at VC need more time to carry out a strict assessment of the startup's performance.

Tan said that this situation could be anticipated founder by applying a number of scenario options, including:

| Scenario | Explanation |

| Move Aggressively | Focus on expansion and growth. If the startup already has enough cash, at least it does runway three years or have reached the point of profitability. This is a condition that all startups need to strive for. |

| Putting the Brakes on Spending | Startups can focus on making expenses more efficient to increase runway, including redirecting the business towards profitability. A number of founder also trying bridge round when making these adjustments to ensure the next rotation is smoother. |

| Do Down-round | If the two scenarios above do not meet, the startup can raise down-round at the expense of a reduced valuation value. You can also consider other instruments such as venture debt, financing, and others. |

| Selling a Business | If all the steps above are still difficult to carry out, then handing over ownership of the startup to another party to get an injection of funds could be an option. This is done so that products/services can continue to be developed. |

"The founders who were successful in the last five years were able to raise $10 million with a PowerPoint presentation and subsidized growth. They won't be the founders who will be successful in the next five years because the environment has completely changed," Tan said.

Insignia Ventures Partner has invested in a number of local startups. Here's the list:

- Initial stage: ATTN, Asani, Assemblr, Bakool, Credibook, Elevarm, Fishlog, Lifepal, Nimbly, Pahamify, Sayurbox, Tentang Anak, Verihub

- Advanced stage: Ajaib, AwanTunai, Fazz, Flip, GoTo, Pinhome, Shipper, Super, Travelio

Impact on adjustments

Widespread news layoffs, business closure, pivot, the acquisitions that have been presented explicitly in recent times prove that these 4 scenarios are possible and are indeed relevant options for the founder.

More Coverage:

Sound cash flow management practices are critical to a company's continued growth in today's marketplace. This involves accurate measurement systems, a strong financial foundation, careful management of employee growth, planned marketing spending, as well as consideration of funding alternatives such as accounts payable.

Founder must understand business risks and consider various funding options before diving into the funding market. These practices are not only related to finance, but also many aspects of company development, confirming that integrating the above practices into the company's operational principles is crucial for better cash flow management.

Tan also commented on considering exit via IPO for advanced stage startups. He said, "While we believe that the public markets are the best buyers for our portfolio startups, this is not the end but a fundamental transition for each company. It is important not only that companies go public, but also that they are able to leverage the public markets effectively for sustainable growth. "Many factors need to come together for a company, from the nature of the stock exchange to the story the company is bringing to market and the preparations they have put in place leading up to the IPO."

This comment is based on the public's unfavorable stigma towards technology companies that have already gone public.

"More than simply ushering a company into the public markets at a certain point in time, what is more important to us is supporting companies in strengthening their fundamentals if they decide to begin the process go public," concluded Tan.

Sign up for our

newsletter

Premium

Premium