Shopee Parent Gives Signal to Enter Insurtech, Reportedly Acquisition of Insurance Company

A range of financial solutions at Sea Group: banking (SeaBank, Bank Mayora), multifinance (ShopeePay Later), and electronic money (ShopeePay)

Sea Group, Shopee's parent, is reported to have acquired general insurance company Asuransi Mega Pratama, according to news in Indonesia Financial Times. If this information is accurate, we can be sure that Sea Group will become a technology giant with the most complete financial solutions in Southeast Asia.

In the range of its financial business portfolio so far, Sea Group has subsidiaries in the field of financing through CS Finance (ShopeePay Later), electronic money through ShopeePay, as well as banking through SeaBank and Bank Mayora. Meanwhile, its competitors Grab and GoTo has yet to reach that level.

Asuransi Mega Pratama itself, was previously part of the Bakrie Group, until finally acquired in 2003 by the transportation and shipping company PT Wahana Mandiri Sentosa Cemerlang. Then at the beginning of the year it was purchased by an entity owned by Andy Indigo, nephew of Martua Sitorus, owner of Wilmar International.

It could be said, the entry into the realm of insurance will provide a new color in the range of product variations in the ecosystem at Sea Group. For example, in a bank it can be mated into a product bancassurance to boost contributions fee-based income.

As for Shopee itself, so far consumers can buy micro insurance for every transaction on Shopee with a simple price and claim process. The company cooperates with insurtech as PasarPolis, Qoala, and other general insurance companies.

As an illustration, the potential for insurance in Indonesia is still very large. Penetration is still stagnant in the range of 3% since the last five years. In a joint interview DailySocial.id, Founder and CEO PasarPolis Cleosent Randing said that there are some basic problems in the insurance industry, such as lackluster innovation, products that are not affordable for the general public, and business processes that are still manual.

Hence, the right approach for players insurtech is building a concept embedded insurance, by linking insurance products as part of a digital lifestyle. It's like service PasarPolis integrated with various digital services through the connection backend. Then mix with insurance companies to present more personalized insurance products.

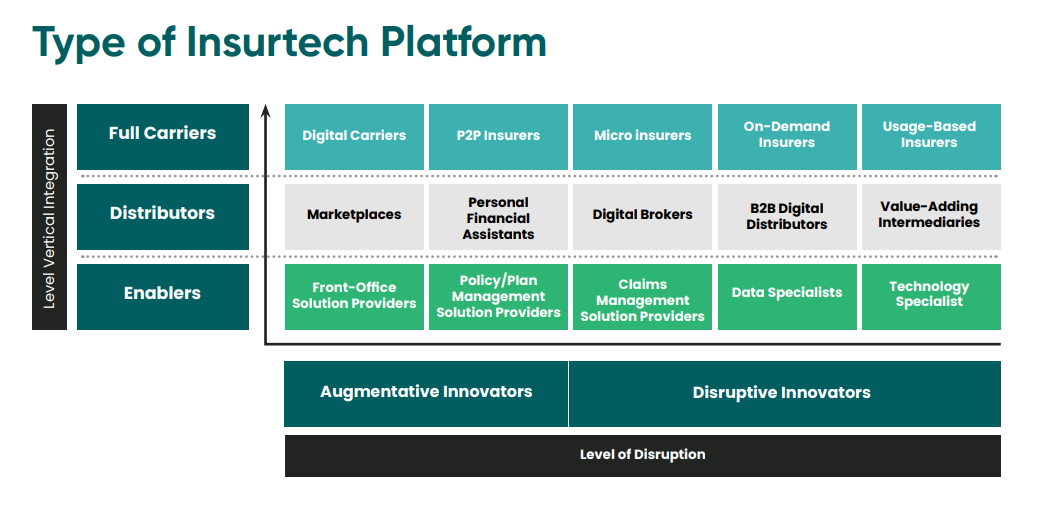

Quoting from the report "Insurtech Ecosystem in Indonesia 2021” released DSInnovate, business insurtech in the world has grown rapidly, offering a variety of specific business models.

More Coverage:

In Indonesia alone, some of the most popular models are marketplaces, digital brokers, digital carriersand micro insurers. Even a startup can accommodate several business models at the same time, such as: PasarPolis in this case as marketplaces, digital brokers, on-demand insurersand digital carriers.

Sign up for our

newsletter