Strategy PasarPolis Placing Insurance as Part of a Digital Lifestyle

Intensify “embedded insurance”-based services, integrated with dozens of large user-based consumer applications

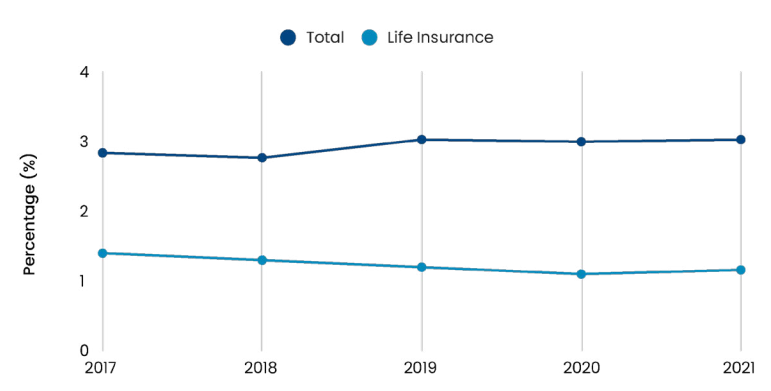

For the past five years, insurance penetration in Indonesia has remained consistent at close to 3%. The metric is calculated based on growth (growth) insurance products or services by GDP. Even then, the existence of life insurance still dominates. Government programs began to "encourage" the public to have BPJS Health services.

From these facts, technology is believed to be able to bridge the existing gap. The presence of insurance products packaged in a digital application is expected to be able to bring services closer to the needs of the community - amid the increasing awareness of insurance, especially during the pandemic.

It is believed Founder & CEO PasarPolis Cleosen Randing.

In a media discussion held at the end of October 2021, Cleo (nickname Cleosent Randing) emphasized the value proposition that her company is trying to raise is an insurance platform that customer-centric not product-centric. They try to provide insurance services right behind the progress of people's lives. Take for example, when someone buys handphone, at the same time they can immediately get protection against damage, thus providing peace of mind. It was done PasarPolis through its partnership with Xiaomi Indonesia.

"PasarPolis want to build next generation insurance company and products; including providing instant claims services [80% completed in 18 seconds]. "The goal is none other than increasing public trust," added Cleo.

Embedded insurance

If we look deeper, according to Cleo, there are several fundamental problems that exist in the insurance industry. For example, innovation is not very fast, products are not affordable for the wider community, and many business processes are still manual. From here, there are many digitalization opportunities that players can take advantage of insurtech.

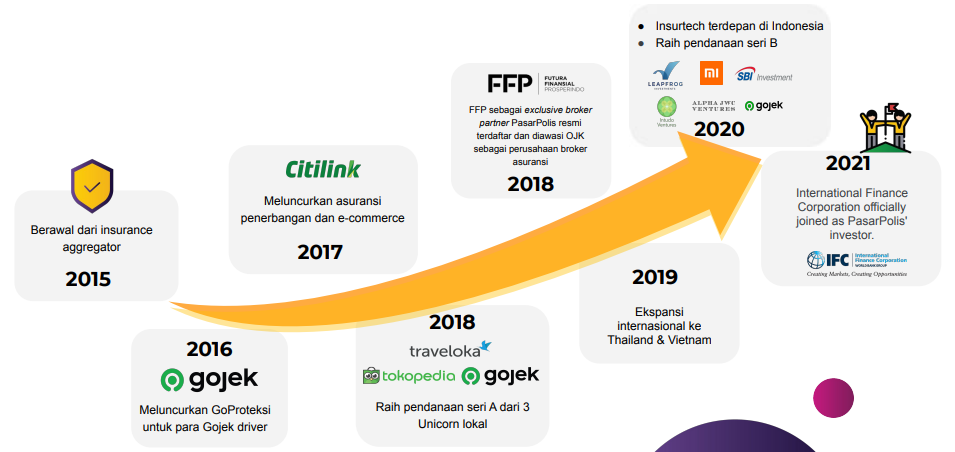

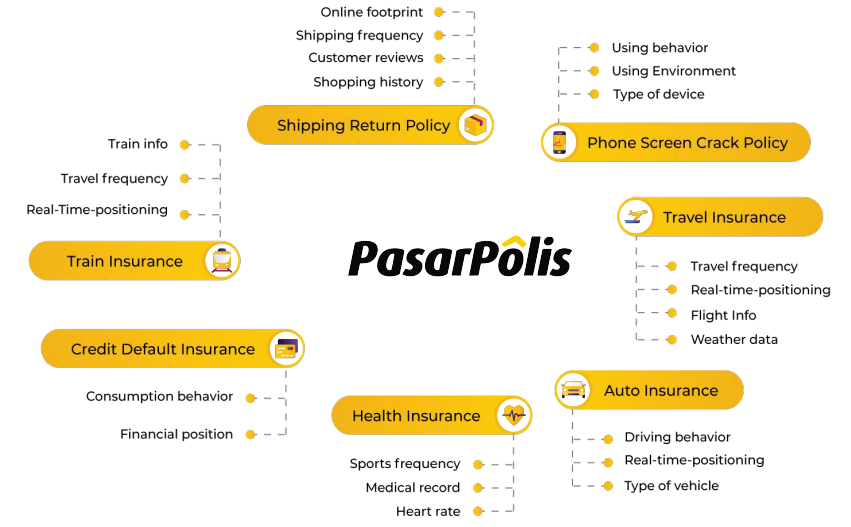

Under these conditions, this approach is being tried PasarPolis is to build first "digital engagement". They are trying to link insurance as part of the digital lifestyle of Indonesian people, especially since the pandemic has also encouraged digitalization on all fronts. From there, the strategy is to provide services "embedded insurance".

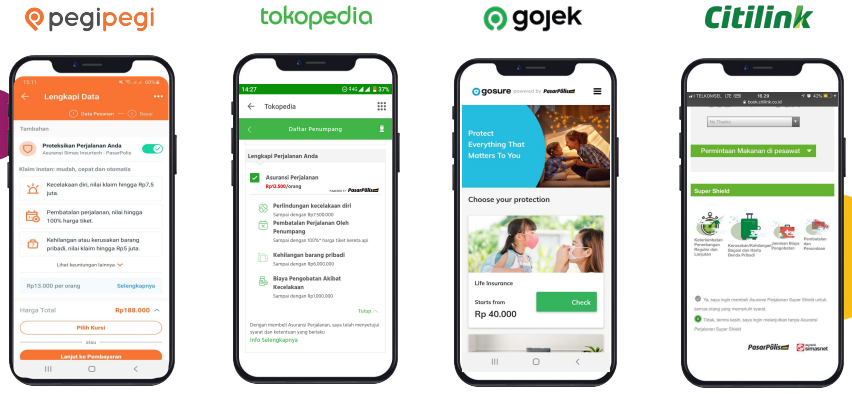

Simply put, service PasarPolis can be integrated with various digital services via connection in backend. Currently they have partnered with more than 30+ app ecosystems, incl Gojek, Traveloka, Bukalapak, Shopee, Citilink, Telkom, Home Credit, and others. This is also what they do in regional markets -- currently PasarPolis starting to reach the Thai and Vietnamese markets, soon launching in Malaysia and the Philippines.

With each partner, PasarPolis also offers unique services. For example, together with Tokopedia they provide Goods Damage Protection and Cracked Screen Protection services. Together Gojek, they present a new feature called GoSure to provide microinsurance products for the user ecosystem within it. Meanwhile, together with DANA, they also present a feature called DANA Siaga, in the form of an insurance product standalone provided by PasarPolis.

This product differentiation can be rolled out now PasarPolis does have a fairly extensive ecosystem of microinsurance products. Currently there are around 170+ types of insurance products and 30+ insurance company partners. With this business model, PasarPolis is also currently registered as an “Insurance Hub” platform with the Financial Services Authority – previously it was also registered as a digital broker service.

"We present embedded insurance, so that insurance products are embedded in daily digital journey/lifestyle. Like when people buy goods at marketplace, insurance feels like air [something that accompanies, in this case for the protection of goods]. So the goal is to bring insurance into people's lives, not people who come looking for insurance. This partnership is the best strategy to access customers," explained Cleo.

Cleo also emphasized that some partnerships are very strategic in nature - this is known Gojek, Tokopedia, and Traveloka are early stage investors PasarPolis; Xiaomi is also an investor PasarPolis. Meanwhile, together with several other parties, he said "more losely".

Start building a partnership business

With the business approach taken, throughout 2020 and 2021, PasarPolis has issued around 600 million policies. Meanwhile, the total accumulation of users who have been successfully accommodated has reached more than 21 million -- including from the partnership ecosystem owned. Meanwhile, for the Gross Written Premium itself, Cleo was reluctant to mention nominal details, only that it had grown 4-5x year-on-year.

At the end of 2020, PasarPolis also launched agency application"PasarPolis Partner". Since launching, they currently have around 15 thousand+ active partners who help the company to educate the market. PasarPolis Partners are not insurance agents because they have a different mechanism, they only provide insurance product references to consumers. The insurance products sold are relatively simple with low premiums. Partners who join must go through a training process to ensure this does not happen misselling.

According to data from the Indonesian Life Insurance Association (AAJI), the agency model is indeed one of the most effective after bancassurance. Premium income from agency channels was recorded at IDR 30,44 trillion during semester I/2021. Even though this achievement decreased by 4,9 percent compared to the same period last year, the portion was quite large.

Technology development

Early this year PasarPolis received $5 million in funding from International Finance Corporation (IFC), a financial institution under the auspices of the World Bank that focuses on accelerating financial inclusion and literacy in various developing countries. This funding was raised four months after announcing a Series B of $54 million. One of the focuses is to develop integrated technology to digitize the insurance business as a whole.

"For us, technological development cannot beoutsourced. "Technology is an important foundation for business," said Cleo.

Currently, there are four important technological aspects being developed and made into propositions by PasarPolis, includes:

- Smart Instant Claim; utilize technology machine learning and image processing to automate the claims and payment process to consumers. Also ensure that the claims system is proactive in providing notifications to customers.

- API Connection; presenting API standardization to make it easier for digital platforms to provide insurance services. PasarPolis presents an SDK with guaranteed 1 day ease in adding products to the system.

- Green & Red Channel Tech; customer risk analysis assessment system with integrated database for processes underwriting better.

- Automated Risk Assessment; AI-based services to reduce manual assessment and claims processes.

The AI system that has been developed is currently capable of effectively verifying identity, predicting behavior, image recognition, and providing customer service. In addition, together with its partners, PasarPolis also develop "join data lake" to increase data and capabilities underwriting.

For technology development, apart from the team in Indonesia, Cleo also said they have a development center based in India. Confidence founder to democratize the insurance business with technology, making digital products a separate [and important] focus in the company.

business model insurtech

More Coverage:

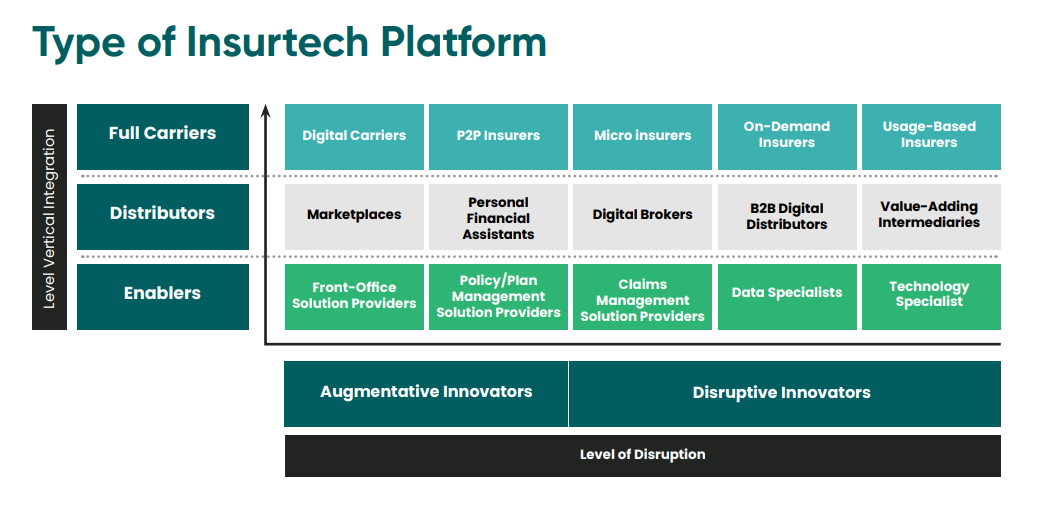

Based on the report entitled “Insurtech Ecosystem in Indonesia 2021” released DSInnovate, business insurtech in the world has developed rapidly, offering a variety of specific business models. In Indonesia itself, some of the most popular models are marketplaces, digital brokers, digital carriersand micro insurers. Even a startup can accommodate several business models at the same time, such as: PasarPolis in this case as marketplaces, digital brokers, on-demand insurers, and digital carriers.

Another player, Fuse, is taking the approach of digitizing the agency concept that has so far been popular in the insurance industry. One reason is that this process will take relatively less time in relation to market education. It is claimed that the Gross Written Premium that Fuse managed to record will reach $50 million (more than IDR 700 billion) in 2020. This value is targeted this year to reach the range of $100-120 million (around IDR 1,4-1,7 trillion).

There are other approaches taken by local startups, for example Lifepal which focuses on helping potential customers compare, buy and use insurance products. They present an application marketplace Integrated insurance, connecting dozens of insurance products and presenting them to end consumers. This year it's Lifepal announced series A funding worth $9 million. Combined with previous gains, the total investment funds the company has raised reaches $12 million.

Increasingly mature business models, increasing investor confidence, and increasing insurance penetration provide opportunities for startups insurtech. That's what Cleo and the team believe PasarPolis.

"Since 5 years ago, consumer lifestyles have moved to digital, but at that time insurance was not able to accommodate [that lifestyle]. Now everything is digital, so are insurance services [...] In the end, digital insurance "It's not just an insurance company that has an application, but it must be able to put people's lives before insurance, to produce a life free from worry," said Cleo.

Sign up for our

newsletter

Premium

Premium