Trends in Indonesian Startup Funding Throughout 2021

Throughout 2021, there were 213 funding rounds with an announced value of over $4,3 billion

In 2021, Indonesia will have 12 unicorn and over 50 centaur.

There are many aspects that can be used as measurement variables to see the maturity of the startup ecosystem in a country. Funding or investment is one of the most important, because in a funding process there are a series of validation stages to assess the quality of the business, market, technology, to founder. The rollover of a funding means that there is a startup that has been successfully validated through the hypotheses owned by the investors.

All year 2021, there were 213 startup funding rounds announced and posted a total value of more than $4,3 billion from the 126 transactions named for the acquisition. This achievement is an increase when compared to 2020, which was 113 transactions with a nominal value of $3,3 billion from 50 transactions whose value was announced.

The following is a review of Indonesian startup funding data collected by the team DailySocial.id.

Advanced stage funding is increasing

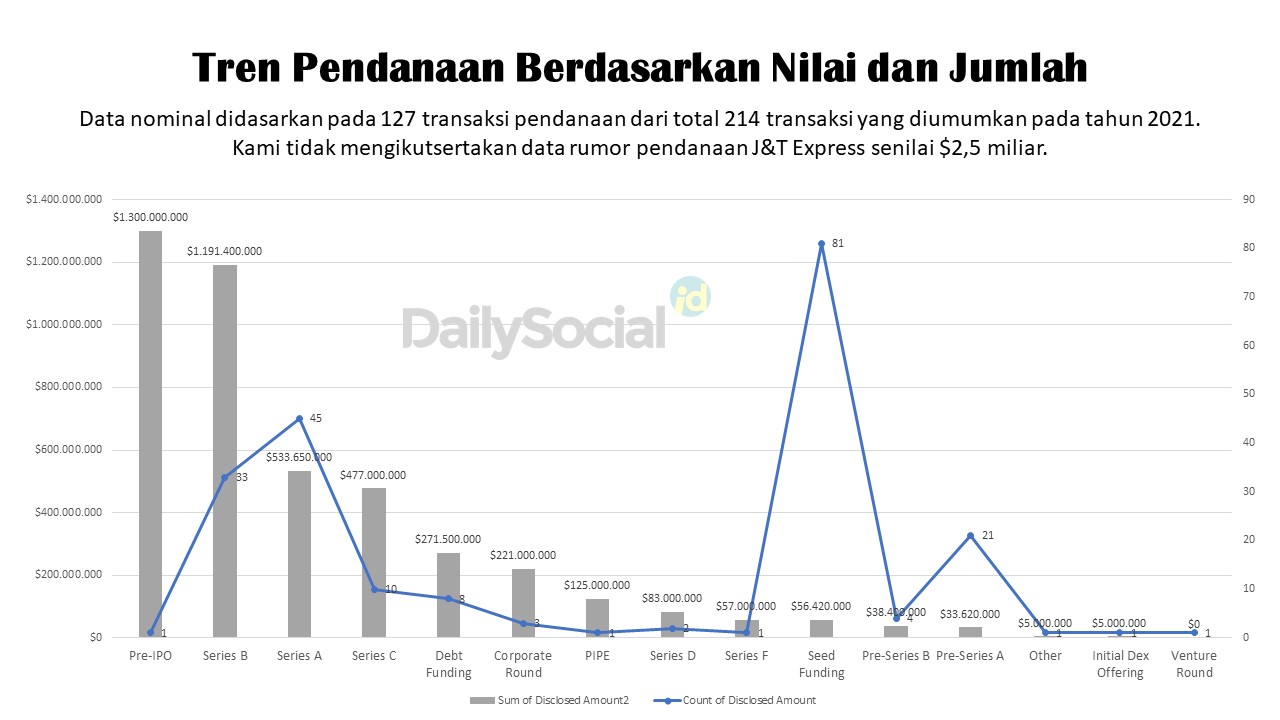

Later stage funding defines rounds that occur after the initial stage. In 2021, there are 45 startups that have recorded series A funding, 33 series B, 10 series C, 2 series D, and 1 series F. Combined, this figure exceeds the initial stage funding which reached 81 transactions.

The high number of initial funding implies that opportunities are still open for the new generation founder to give birth to new innovations to democratize certain aspects of business. While follow-on funding implies a market-validated business model – giving rise to more confidence in investors to put more funds into related startups.

In a number of interviews with venture capitalists in Indonesia, para businesses indeed said that during this pandemic they would provide more portion to provide support to the existing portfolio.

General Partner Alpha JWC Ventures Chandra Tjan, with new managed funds that were successfully obtained in 2021, said that his party was increasing ticket sizes and also give more focus to follow-on funding for startups that have become its portfolio.

This continued funding also succeeded in bringing dozens of startups into the fold centaur. Call them Flip, Shipper, GudangAda, Lemonilo, and ALAMI. Even through the series B funding round, Ajaib managed to establish itself in status unicorn; then Xendit and Kopi Kenangan were finished unicorn after closing their series C.

Most popular business sectors

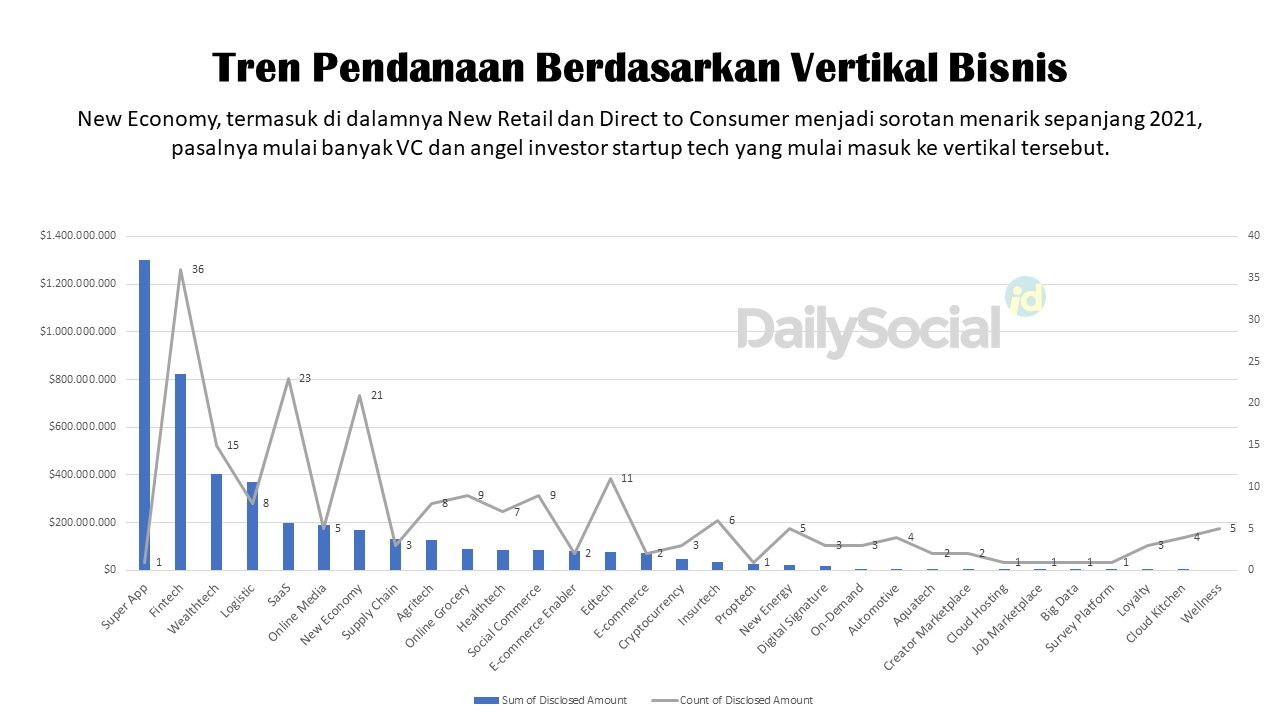

Despite fintech still gets the largest amount in terms of the number of funding transactions - as well as nominal funding - but there is starting to be a divergence. SaaS (23), New Economy (21), and Wealthtech (15) succeeded in attracting investors' attention.

SaaS is considered to still have great potential amidst the growth of MSME businesses in Indonesia. Various solutions were developed to simplify their business processes, starting from recording services, operational governance, human resource management, and others.

Meanwhile, the New Economy was successfully lifted by the existence of owners brand who are starting to transition their strategy towards digital – such as fashion brands that focus on models direct to consumers for product distribution. It is believed that this way will give value more on the business being run, due to the intervention of technology and comprehensive data obtained from the transaction process. This strategy also allows brand developers to focus more on product innovation – because their sales channels generally utilize services online existing ones like online marketplace.

Wealthtech even already has unicorn with magical brilliant incisions. They are in the midst of the growth momentum of retail investors. According to IDX data, as of October 2021 the number of capital market investors reached 6,7 million SID, growing 7,5x since 2016.

Largest funding of the year

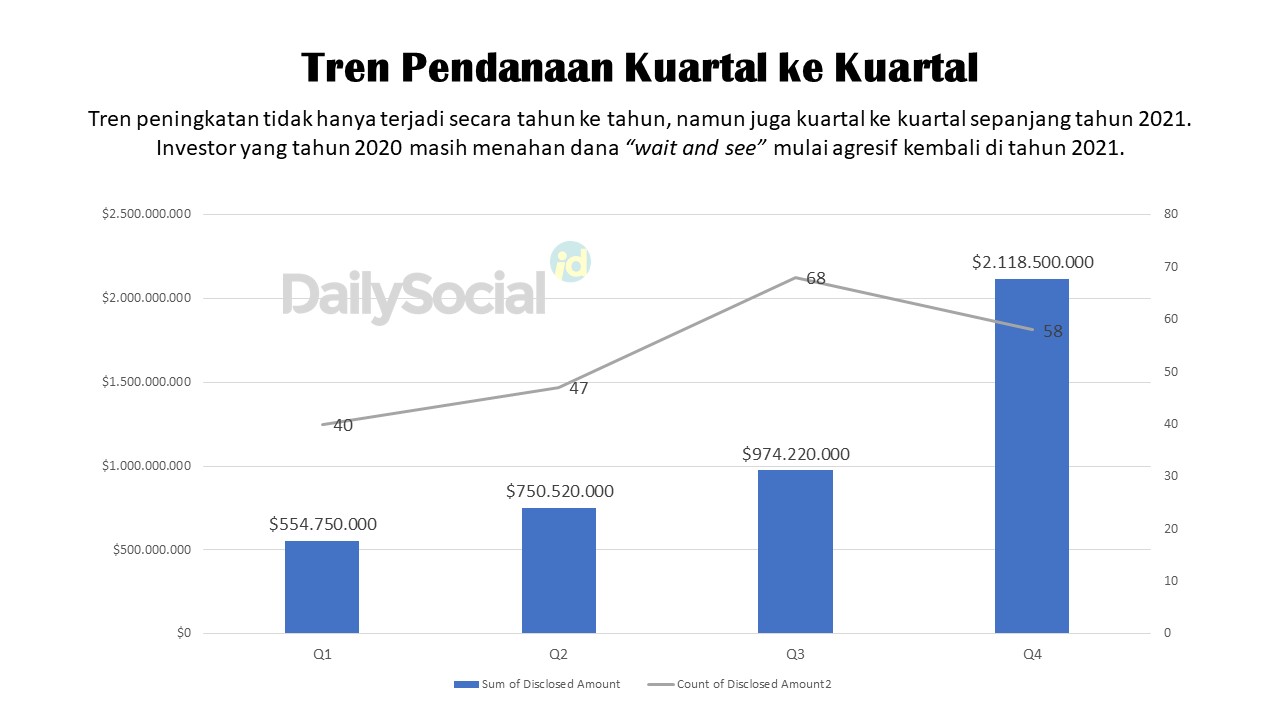

Not only is it a year-on-year trend, throughout 2021 the nominal funding recorded by the Indonesian startup ecosystem also increased from quarter to quarter. This indicates that investors are opening themselves up to channeling their managed funds again, after previously having a lot “wait and see” seeing the conditions that are not yet conducive due to Covid-19.

There were 22 funding transactions worth equal to or greater than $50 million. While dozens of others got 8 figures of dollars in funding. On the nominal side, GoTo, SiCepat, Ajaib, Xendit, etc Halodoc saw the highest gain in its follow-up funding round. The investment obtained by GoTo and Kredivo related to its plans to take the floor on the stock exchange.

If you read Startup Report In previous years, large nominal funding (tens of millions of dollars) always came in the startup's follow-on round unicorn. However, the current trend is that quite a few short-lived startups are getting fantastic support from investors.

More Coverage:

There are several influencing factors. First, generation founder new ones born from the ecosystem. Not infrequently we come across new startups founded by ex-employee unicorn or ex-employee in venture capital. These are people who have studied how digital businesses maneuver. His experience in growing previous companies has made investors add more value to the innovation he is trying to promote.

Second, the digital market tends to be more educated. If half a decade ago, digital platform developers still faced challenges in conducting basic market education, the situation is different from today. Effort to carry out socialization can feel easier, making the process scale-up or growth be shorter. Large capital support is needed to ensure related startups gain this growth momentum.

Angel Investors continue to move aggressively

Of the total existing transactions, there are at least 341 institutions involved in funding Indonesian startups, both from venture capital, CVC, and corporations. What's interesting is that there is engagement angel investors in 51 funding transactions.

As for the ranks of investors who are most active in funding [in terms of transaction quantity], the composition is still not much different from previous years. These investors mostly play at all stages of funding, from seed up to you growth stages. MDI Ventures, for example, also operates Arise Fund with Finch Capital to help early stage startups operating in real sectors, such as agriculture and livestock.

Sign up for our

newsletter

Premium

Premium