The Idealism of BTPN Syariah Venture Investing Hypothesis

BTPN Syariah Ventura is looking for startups that focus on working on the economy in second- and third-tier cities; Trading is the first portfolio

BTPN Syariah Ventura participated in coloring the presence corporate venture capital (CVC) in Indonesia in the middle of this year. Of note, so far there have been eight CVCs (Telkom, Telkomsel, Bank Mandiri, BRI, BNI, BCA, OCBC NISP) which are already operating and disbursing funds, except for BNI Venture Capital, which has just announced its presence.

Each CVC has a specific mandate from the parent to support openness to innovations that have the potential to be worked on together in the future. In the corporate context, innovation development cannot be realized immediately, even though anyone can do it.

The same condition is also carried out by BPTN Syariah Ventura. Compared to other banks, even sharia, the main business of Sharia BPTN is productive financing for the pre- / moderately prosperous community with a nominal loan starting from IDR 2 million with a one year tenor. This segment is different from most banks, so there are many conditions that need to be considered when BPTN Syariah performs digitization.

Interestingly, because BTPN Syariah Ventura's parent company is sharia banking, its CVC also aligns itself. DailySocial.id had the opportunity to have a deeper interview with the Main Director of BTPN Syariah Ventura, Ade Fauzan.

Investment hypothesis

With a segmented business realm, the opportunity for BTPN Syariah to enter the digital realm is like a double-edged sword. This is because the digitalization process in rural areas and urban areas is different, including the speed of adoption. The quality of the internet network is one factor. Ade also realized that digitalization was a necessity.

“We looked at how to do digital for the segment market- that's why we call it technology for good. "But we believe we need acceleration through collaboration because nowadays a new term has emerged, namely collaboration, because not all the needs we need have to be built by ourselves," said Ade.

In accordance with the mandate of BTPN Syariah, the investment hypothesis adopted is to look for startups that focus on empowering underprivileged/moderately prosperous communities in second and third tier cities. Of the total six million customers who have been served by BTPN Syariah, they must receive added value from every innovation that occurs, so that their lives will improve.

This principle is the end found from Merchandise. The decision to inject startups social commerce This actually went through stages that didn't last long, in fact it was far from finally being officially established. A little back to early 2020, that's where the partnership between the company and Dagangan began.

At that time, Trade did pilot project to support BTPN Syariah debtors to develop their business through the loans they receive. Merchandise provides a stock of grocery items in the form of economical packages that can be purchased for later resale by partners in their home environment. Because you sell grocery items, the turnover of money is much faster, only around one to two days.

“There is a need for stalls, they need access to goods. Our customers work alone to support their families. Breadhis access to supply, must travel, must close the shop, meaning there is opportunity loss. "Because it's not just goods, there are many startups that provide goods for stalls, but what BTPS is looking for is not much, only merchandise," said Ade.

He continued, Dagangan dedicates itself as a startup that only works on second, third and fourth tier cities, which is in line with BTPN Syariah's strategy. The characteristics of the business model are also interesting because Dagangan accommodates small amounts of shopping, adapting to the shopping habits of the shop owner.

“Small traders buy in small quantities, not bottles sachet. Well, the type of merchandise is like that, at least orderIt doesn't have to be much either. For other players, the minimum must be IDR 1,5 million. If that's how much [minimum spending] our customers can't afford order. "

This partnership continued, until the two companies even achieved API integration, aka they became more serious because they started to "open the kitchen". This agreement was taken long before BTPN Syariah Ventura obtained permission from the regulator.

"In the future, the partnership with Dagangan will continue, there will be collaboration access to market to help expand small businesses to reach a wider range of consumers."

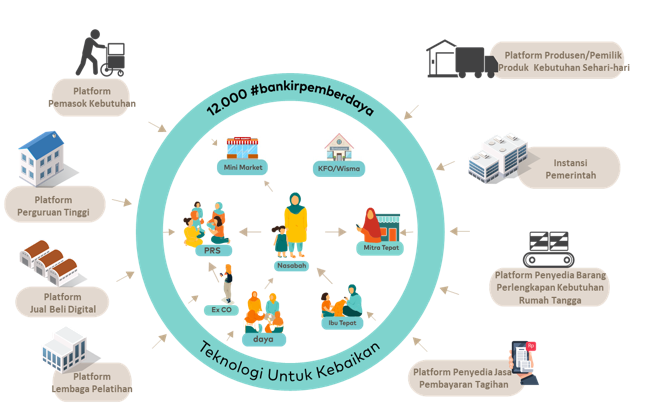

After Dagangan, his party will continue to look for other startups targeting village communities from various verticals. Although not specifically detailed, BTPN Syariah is looking for collaboration opportunities with startups that play in EdTech, digital buying and selling, training, bill payment service provider, household goods provider, producer/owner of daily necessities products.

The above services are directed to help BTPN Syariah consumers, consisting of customers, Mitra Mitra, Daya (CSR program), Mrs. Apa, and others.

Competition with VCs

Another interesting thing that raises the question is why is BTPN Syariah only now entering venture capital, while other corporations have started four to six years ago.

Ade also answered that whether it was late or not to enter venture capital was a matter of priorities. For management, the presence of BTPN Syariah Ventura is at the right moment to accelerate digital in the holding company and create a sharia digital ecosystem.

“The goal is specific because the mandate is very important clear to help the bank [BTPN Syariah]. Because we have built the process of building a sharia digital ecosystem all this time ourselves. Once you reach a point you can leave it, source we are then diverted to building VC. So it's not whether it's late or not, but we did arrange it milestone-his."

He added, the principle that BTPN Syariah Ventura always prioritizes is to always be a strategic investor, right? ordinary investors or investors looking for valuation. For Ade, valuation is one thing, but developing the BTPN Syariah business is the most important thing.

“When startups come to help our customers grow, they help BTPS grow bigger. We have been running this [Islamic banking business] since 2010 so we know what ultra-micro needs, now we just have to choose which one [to invest] first.

More Coverage:

Because it is a strategic investor, it can analyze prospective startups by providing pilot project and access to customers. From there, BTPN Syariah can measure its effectiveness, whether it is worth continuing or not. "When entering the BTPS business, market the startup can becompare, the risk has been measured. "It's different if they have a different business from us, it's difficult to validate, so we go into an area that we understand."

BTPN Syariah Ventura's managed funds are relatively small, only IDR 300 billion (from issued and fully paid-up capital). Ade and the team will invest smartly in quality startups. The investment process will be carried out patiently and not rushed.

As the only sharia CVC, continued Ade, it is a superior value that the company provides to prospective startups. Because, his party has a two-person Sharia Supervisory Board (DPS) which ensures that its operations comply with sharia provisions regulated by DSN MUI, OJK and other relevant regulators.

"So in every capital investment we make, the startup must obtain a sharia compliance opinion from the DPS BTPN Syariah Ventura."

He is also not worried about competing with other VCs. At least, in the BTPN Syariah Ventura business plan, it can fund one startup every year. Unfortunately, Ade didn't mention it ticket sizes which will be given for each investment. It is only stated that it depends on the capital investment made for each business model and startup plan.

“We've been 'dating' Merchandise before they were as famous as they are now. "We will look for other trades that are still small but have potential and we know that this potential can solve problems," concluded Ade.

Sign up for our

newsletter

Premium

Premium