Fabelio Governance Issues and the Complexity of the Furniture Business Chain

Employees, vendors, and consumers are calling for demands to Fabelio through the media regarding salaries, payments, and product delivery

Fabelio (PT Tiga Elora Nusantara) is a startup in the field of marketplace furniture which has been established since 2015. Apart from selling various furniture, they also provide interior design services. It is claimed that all products sold are the work of Indonesian craftsmen. Previously they became one of the leading startups, because of a bright business and should have a valuation above $100 million.

But recently, Fabelio is being widely discussed through social media and the press due to issues affecting their employees, vendors and consumers.

EM, a customer, complained that orders made in May 2021 did not arrive. Previously, Fabelio had promised that the goods would be delivered in July 2021, then for some reason it was postponed to August 2021 until it was finally cancelled.

When they want to claim a refund, EM is asked to wait 30 to 45 working days with an estimate that it will be disbursed in September 2021. Unfortunately, until 1 week ago, EM had not received the refund. He has also submitted complaints via email, WhatsApp messages and social media.

EM is one of dozens—maybe even hundreds—of consumers who have complained about this. This can be seen from the comments on Fabelio social media and petitions created and addressed to Fabelio management.

Vendors also have payment problems. Many of them admitted that they had not received transfers from products that were successfully sold through the Fabelio platform. As complained by SD as one of the vendors supplying goods at Fabelio, it has been more than 1 year since they have received payment for the goods/services provided. Even CA, which is also one of the vendors, said that Fabelio had outstanding payments of up to hundreds of millions of Rupiah.

Employees also complained to Fabelio management because the company delayed salary payments. One of them is conveyed via petition at Change.org. Since September 2021, Fabelio has not paid salaries to its employees. Some of the company's obligations, such as payment of holiday allowances and BPJS Employment, are also problematic - they have not been paid off.

From the comments submitted, salary arrears are quite evenly distributed across all staff levels. Source TFR said, there are employees whose salaries have been delayed since the end of 2020, there are also those starting in early 2021, August 2021, or October 2021. In some cases, companies divide salary payments into 50%, some only receive 75%, 80%, or 85%.

CEO Fabelio: Pursue funding to cover debt

To a number of media, one of them coil, Co-founder & CEO Fabelio Marshall Tegar Utoyo said that currently The company is indeed experiencing financial difficulties. This is due to businesses being negatively impacted by Covid-19. He even said that management had not received remuneration since 18 months ago.

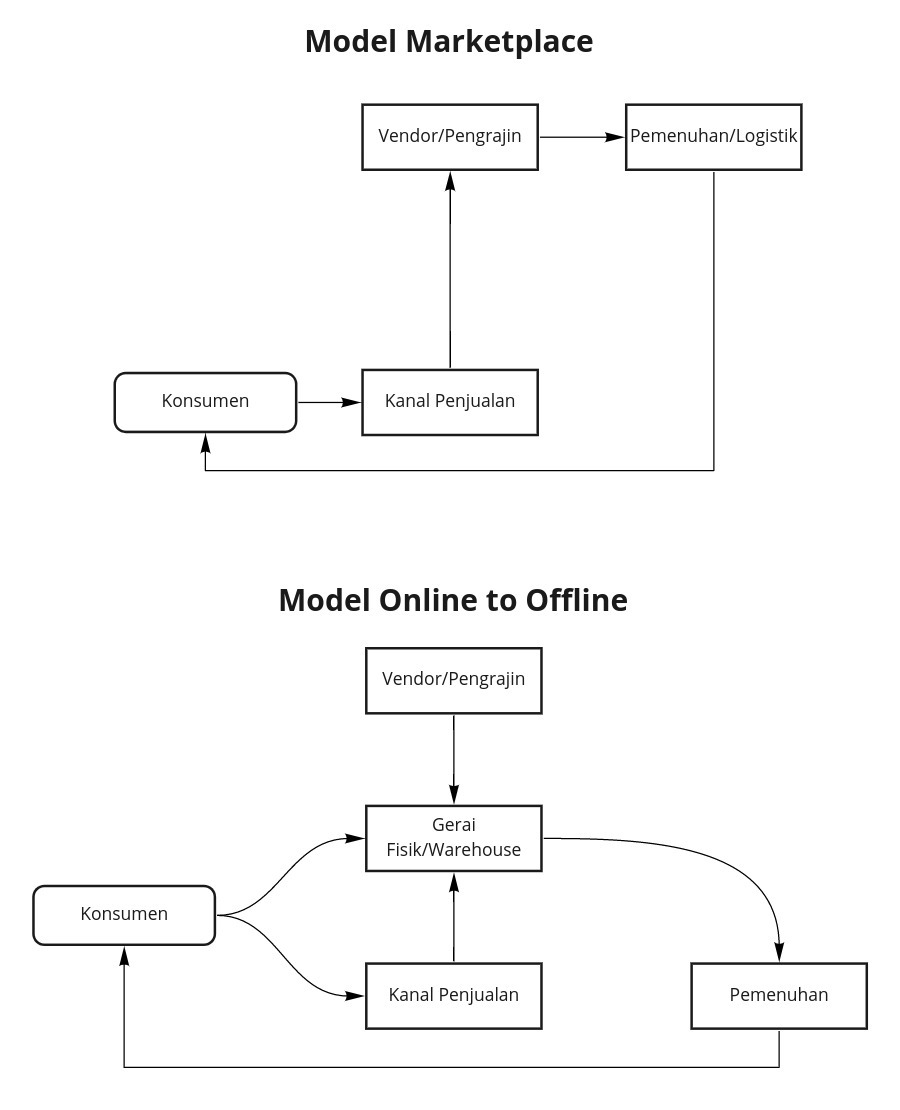

This issue has been surfacing since early 2020, precisely when Covid-19 became a serious problem in Indonesia. The company could not rely on sales, because they experienced a drastic decline. As is known, their business model is online-to-offline, the operational system combines online channels with physical outlets which are currently spread across 9 locations around Jabodetabek, Bandung and Surabaya -- also warehouse to serve their delivery coverage in Banten, Yogyakarta, Jakarta, West Java, East Java and Central Java.

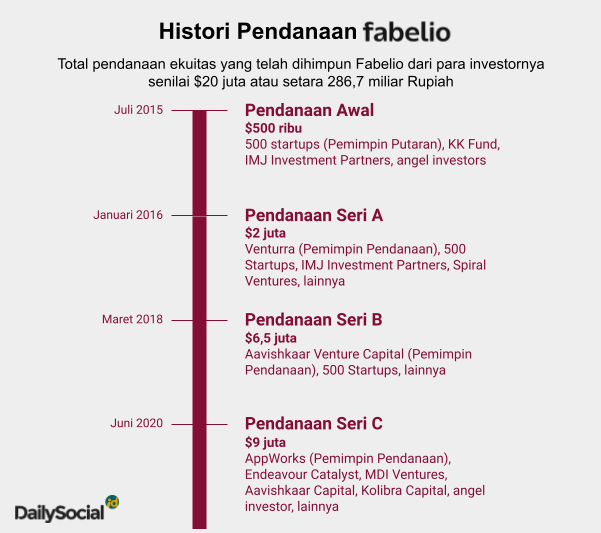

During 2020, Fabelio was also deep survival mode, relying on investment funds obtained in $9 million Series C round or the equivalent of 127 billion Rupiah.

In his statement, Marshall said that the company immediately paid off its obligations, both to employees, vendors and customers. They will rely on investment funds in the next round which is targeted to be completed in the next few weeks. Question fundraising This D Series has been presented by Marshall since June 2021.

Apart from Marshall, the company's Co-Founders are Christian Sutardi, Krishnan Menon, and Srinivas Sista. Now only Marshall and Christian are still active in Fabelio. Krishnan is now focused on developing BukuKas and Tokko – SaaS services to help MSMEs in Indonesia. Meanwhile, Srinivas focuses on his career with companies abroad.

The complexity of the furniture business

In order to understand the business flow of furniture products and interior design services, we interviewed one of the industry players in this field. According to him, revenue The potential yield from each furniture product is actually quite high, it can reach 45%. However for winning the market requires strong volume and scalability.

Despite the potential for large profits and market share, new players such as Fabelio have to compete with businesses legacy which already has many branches in Indonesia. The existence of this branch is important, because furniture products require special handling in terms of fulfillment and delivery to consumers.

The source we interviewed said that the Kawan Lama Group is currently one of the most significant players in this industry with two well-known brands: ACE Hardware and Informa. Based on openness on the IDX, ACE Hardware currently has 215 outlets in various cities in Indonesia. In the first half of 2021, they have recorded sales of up to 3,3 trillion Rupiah.

To produce large volumes of products and sales, of course players in the furniture sector need to have large capital. This is about how they ensure complete stock of goods supply which is good from the product developer/vendor side.

For this reason, players in this industrial landscape really need large equity capital support from investors, one of which is to strengthen the volume side.

Unfortunately, it doesn't stop there, business scalability is also needed to reach the ideal point in fulfilling products to consumers. From existing practices, furniture sellers online cannot rely on the logistics services that many people currently rely on E-commerce with other consumer products such as clothing, gadgets or food – in terms of shape, furniture is large and heavy, some are even prone to damage if the packaging and delivery process does not meet standards.

If it is forced [to ask the vendor to make the delivery], usually the consumer will be sacrificed by delays or defective goods. Meanwhile, when a company chooses to use a more adequate delivery mode [by providing incentives to vendors/consumers], then the bet is on a smaller margin percentage. Sstrategy online to offline intensified by the owners marketplace, Fabelio is no exception.

When we get into the O2O strategy, it turns out that the problem doesn't stop here. The company must have a place to place the extensive stock of goods it usually requires warehouse with a large size – again this will have a large impact on operational costs in the company. Nevertheless, existence warehouse this is crucial to support the system supply chain leaders product.

When it's operational warehouse Companies also have to carry out extra supervision over their management systems - one of the most crucial is product quality control. Without this control, there will be many potential losses for the company, including in terms of fulfillment, updating product stock, and even financial matters to vendors.

More Coverage:

Di marketplace like Fabelio, people can also order the services of an interior designer. There are even several packages all-in-one, from planning to implementation. The project management system in the company will be tested for its resilience. Because in a project, many parties are involved, starting from designers, contractors, vendors, as well as consumers. What's more, there are usually sub-sections that make the process longer - for example when the contractor has sub-contractors handling certain sections.

This project management system is a tool used to ensure project realization is in accordance with planning. This includes modules to control product quality, service activities, and various changes that may occur. Some similar [digital] companies invest heavily in creating this software – even having dedicated R&D teams.

Possible mismanagement of Fabelio

If it is concluded that there are several problems that many people complain about, namely fulfillment of goods, late payments, and projects that do not meet expectations. So, it is true that the issue of complexity discussed above is true. It does require large capital and the right strategy to launch this business. And management discipline towards proper business process governance is also an important key to this survive and growth.

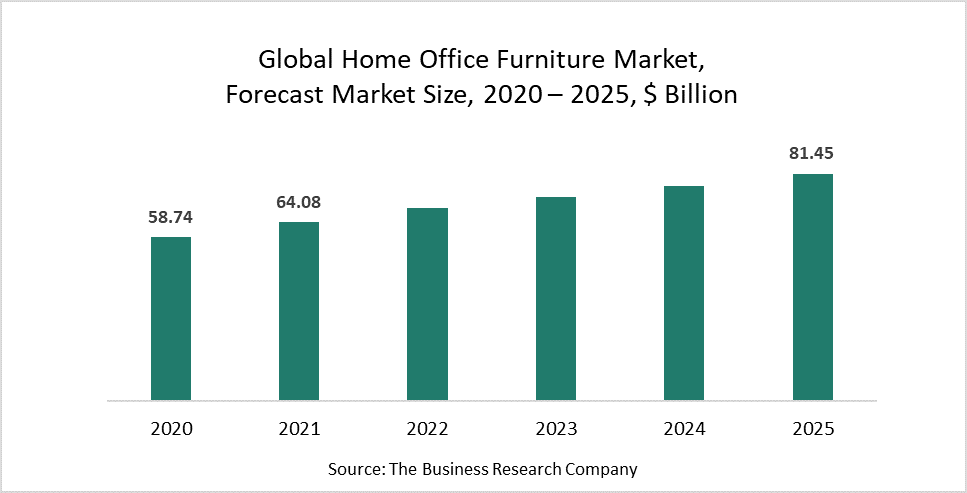

Menurut report, the global furniture product market size has reached $64,08 billion in 2021 and is projected to grow to 81,45 billion in 2025 with a CAGR of 9.09%. Studies in the United States, 40% of growth has been contributed from the segment online. The potential is certainly wide open for all countries, including Indonesia.

This growth was also experienced by several business players in Indonesia. Apart from players legacy which was mentioned at the beginning, Dekoruma [one of the industrial players in Indonesia] when making the announcement series C1 funding a few months ago also claimed that over the last 18 months revenue had increased 3x. The pandemic is a blessing in itself, because more and more consumers need furniture products to support their WFH needs.

Sign up for our

newsletter

Premium

Premium