GajiGesa Offer Access Instant Salary Disbursement Via WhatsApp

GajiGesa has partnered with more than 300 companies and helped around 750 thousand employees

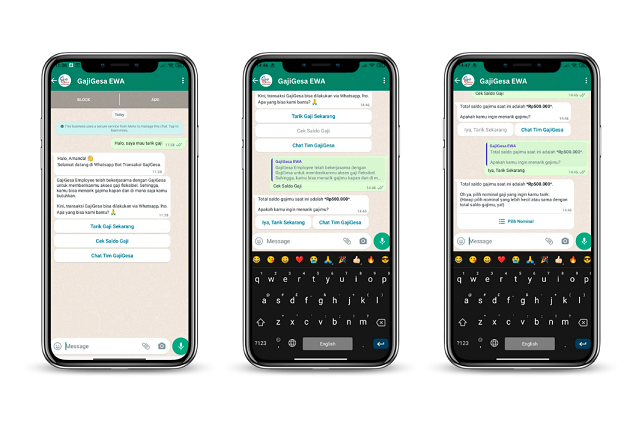

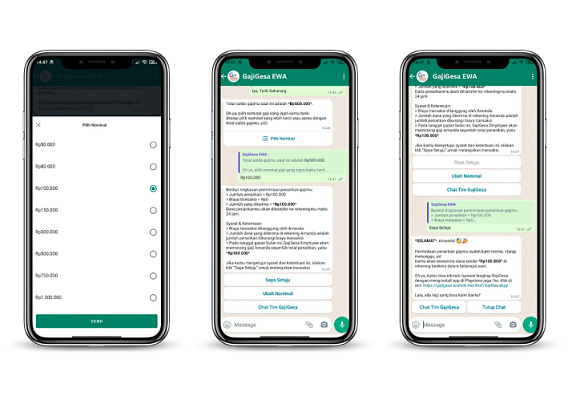

Early salary access provider platform or earned wage access (EWA), GajiGesa, launched its latest innovation that allows employees to access their income directly real time, and withdraw some of their wages via WhatsApp. This innovation is claimed to be the first, even though EWA-based solutions are currently being developed by many startups in Indonesia and the world.

Platform GajiGesa itself allows partner companies to manage employee data and cash flow effectively and easily, both for financial benefits, health, and holistic education to employees. Employees can also withdraw their earned salaries on demand and faster than the traditional pay cycle at the end of the month.

For users who have limited access or understanding of technology, the WhatsApp feature can make access easier by simply sending a message to Facebook GajiGesa using a number that has been successfully registered. After the process, users will receive easy-to-do instructions and can make transactions immediately.

Co-Founder GajiGesa Martyna Malinowska revealed the fact that more than 70% of the adult population in Southeast Asia live with limited access to finance. Indonesia, with a population of 270 million, accounts for at least 6% of the world's unbanked population.

For decades, this market is said to have been affected by low levels of financial literacy, the absence of a formal credit bureau resulting in poor or even non-existent credit data. This does not include significant infrastructure constraints.

"We are excited to spearhead efforts to ensure innovative financial services powered by technology have the potential to accelerate financial inclusion on an unprecedented scale. WhatsApp's penetration in markets like Indonesia will help GajiGesa making this EWA system more affordable for millions of people across Southeast Asia," he added.

Since its establishment in mid 2020, solutions GajiGesa It has become an invaluable empowerment tool for employers and their employees in various sectors including manufacturing, plantations, manufacturing, retail, restaurants, hospitals and technology companies. To date, the company has partnered with more than 300 companies and has assisted around 750 thousand employees.

Platform salary-on-demand in Indonesia

Solutions that are oriented towards improving the financial well-being of employees are increasingly emerging in the realm of the company fintech. Globally, many startups, banking service providers and payment gateway who took the initiative to provide solutions to the significant financial stress during the pandemic.

PwC's report entitled "Employee Financial Wellness" in 2022 stated that among employees who claimed to have financial stress that felt a significant negative impact on productivity, around 67% struggled to meet their household expenses on time each month, 71% had personal debt, and 64% used a credit card to pay their bills. pay for necessities they cannot afford.

More Coverage:

These figures show that the ongoing pandemic situation has had a negative impact on the economic conditions of low- and middle-income workers, so many companies need solutions to help ease the financial stress of many of their workers.

In Indonesia itself, there are already several companies that offer similar services, such as: wagely, my salary, Kini, and GetPaid, whose ambition is to improve employee finances with early access to paychecks. The presence of such services is expected to reduce the public's dependence on consumer loans which are considered detrimental because of the high interest rates.

In addition, several companies fintech also started to expand their services into the realm of salary-on-demand, including KoinGaji from KoinWorks, Halogaji from Halofina, as well as SaaS service developer for Mekari's business through products Mekari Flex. In the end, all of these services have the same goal which is to give workers the flexibility to access their paychecks early.

Sign up for our

newsletter