Evermos Reportedly Receives Series B Funding, Followed by Telkom Group's Venture Unit

The total investment value is $23,9 million or 343,2 billion Rupiah; this round also involved UOB Venture and several investors from the previous stage

Platform social commerce for halal products Evermos reportedly booked a series B funding round with a total value of $23,9 million or 343,2 billion Rupiah. Based on our data, this new funding was led by UOB Venture through the Asia Impact Investment Fund II.

In addition to several previous investors such as Jungle Ventures, this round was also followed venture arm owned by the Telkom Group, namely MDI Ventures through the KB Centauri Master Fund and Telkomsel Innovation Partners through TMI Master Fund I.

Previous, co-founder of Evermos already confirmed about this fundraiser some time ago. Evermos secured $8,25 million in series A funding at the end of 2019 from Jungle Ventures, Shunwei Capital and Alpha JWC Ventures.

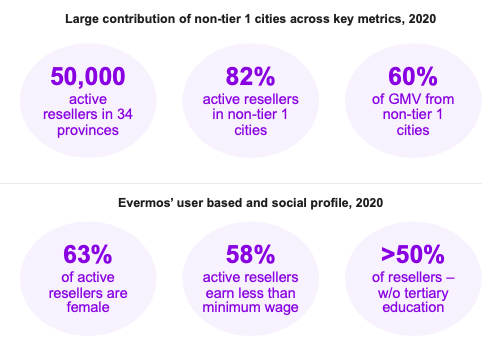

From a previous interview, Evermos Co-founder Ghufron Mustaqim said that his business had achieved monthly growth of 20% in 2020. Evermos is currently used by 500 owners brand, of which 90% are MSMEs, have 50.000-75.000 reseller active, reaching 504 cities/regencies in Indonesia, and serving 200-400 thousand consumers.

Efforts to reach the city tier 2 and 3

Based on the report entitled "Unlocking The Next Wave of Digital Growth" which was released by Alpha JWC Ventures and Kearney Research last April, currently Evermos can be said to be a platform social commerce largest in Indonesia. Evermos' efforts to encourage an inclusive economy can be seen from its strategy of adopting a sales-based model resellers.

According to this report, Evermos was able to gain business growth thanks to its go-to strategy market in town tier 2 and 3 where is adoption E-commerce not yet high and people are not used to shopping online. Nevertheless, adopt E-commerce also began to increase, triggering demand for specialized e-commerce.

From these trends, several sub-sectors E-commerce It is estimated that it will experience large growth, among other things social commerce, B2B, and specific commerce (marketplace car etc.). In fact, this report predicts that in the next five years Indonesia will have unicorn more from social commerce.

More Coverage:

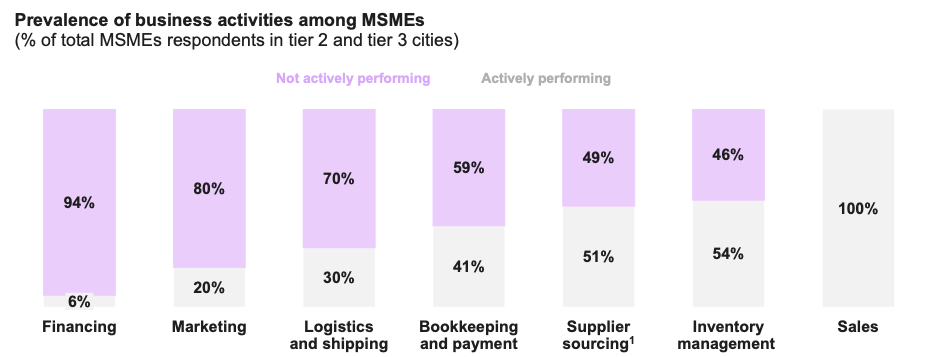

Apart from that, this report states that actually Indonesian MSMEs have not yet realized the potential they have because they are still not actively using their abilities in business. From the chart above, it can be seen that finance, marketing and logistics are some of the business activities that have not been fully deployed.

Therefore, social commerce is considered to be one of the right approaches to encourage the competitiveness of MSMEs which have been the biggest foundation of the Indonesian economy.

Sign up for our

newsletter

Premium

Premium