Potential 92 Million Customers Who Want to Be Captured Through the Partnership Program

Shopee Partners are the latest program launched to present the O2O business model

Platform marketplace Shopee finally joins in enlivening the business model online-to-offline (O2O) in Indonesia by releasing Shopee Partners. A similar program had previously been run by two of its competitors, through Mitra Bukalapak and Mitra Tokopedia. The advantage, Shopee already has a platform digital wallet-itself, ShopeePay.

In terms of features, all three have almost the same scope. The application was developed to invite micro business owners –with shop as a target mainly—selling various digital products such as PPOB vouchers and making E-commerce associated as a channel for merchandise suppliers.

Digital payment service (digital wallets) which was well received by users also spurred the penetration of the partnership program. Because it allows every transaction – for example the purchase of PLN tokens – to be carried out more quickly, thus providing a fairly good experience for business customers of its partners.

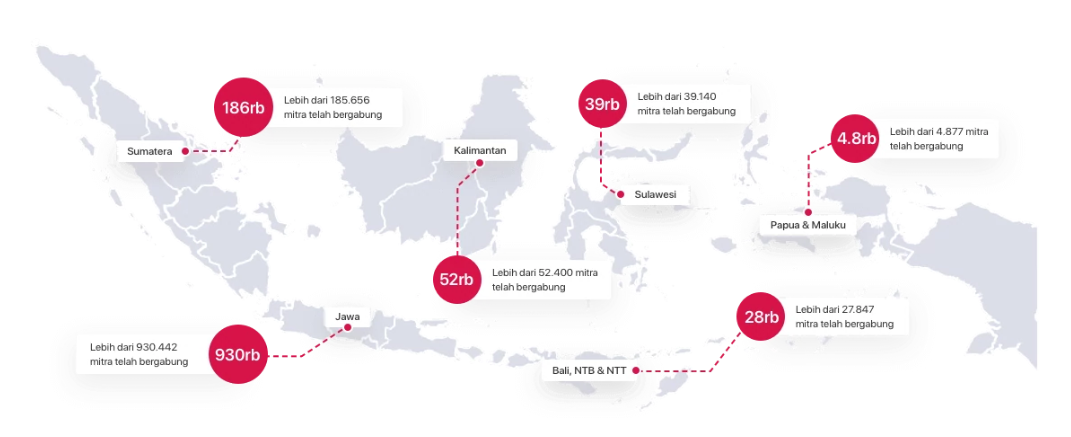

Glide the most between platforms marketplace On the other hand, Bukalapak claims to have around 1 million partners spread across Indonesia, up to tier-3 areas. Meanwhile, according to Tokopedia's AVP of New Retail Adi Putra, closing the year 2019 the Tokopedia Partner program has been followed by around 400 thousand micro-entrepreneurs. There is no data yet for Shopee's initiatives because they are still relatively new.

What to look for in a partnership program?

Based on the results of research entitled The Future of Southeast Asia's Digital Financial Services by Google, Temasek and Bain & Company, at least 92 million adults in Indonesia have not been touched by financial or banking services (unbankable). This number is certainly very large, greater than the total population of other countries in Southeast Asia except the Philippines.

circle unbankable Most of these people are assumed to be people who have never accessed online buying and selling platforms, because basically, users must at least have a bank account to be able to transact there. The purpose of the partnership program is to distribute sales agents offline scattered in various regions to act as intermediaries, providing convenience to unbankable for easy access to products E-commerce.

Another scenario, the agent is used as a distribution point for the delivery of goods. Some areas, especially in remote areas, are difficult to reach by logistics services. Various payment services enable micro businesses managed by agents to offer more complete product variants at relatively cheaper kulak prices.

So there are three things that businesses actually get E-commerce of this program. First, helping product distribution by reaching the population unbankable. Second, help expand product marketing or brand by presenting local representation. And thirdly, opening up opportunities for a more effective distribution chain.

Scramble the market with other digital businesses?

Obviously 92 million is not a small number, in fact it is a very large market potential considering that this number comes from among the productive age. Unfortunately the opportunity was not only competed by three unicornE-commerce Of course, there are many other digital businesses who are now serious about working on O2O in Indonesia.

Payfazz currently has 450 thousand agents. This financial application makes it easy for SME owners to offer various financial products, including for PPOB, bill payments, fund transfers, cash withdrawals, to credit payments. The contribution of PPOB alone every month almost touches Rp. 1 trillion. According to Co-Founder & CEO Hendra Kwik, PPOB is a service that contributes greatly, almost touching the transaction value of IDR 1 trillion every month.

Apart from that it still exists GrabKios by Kudo, Netzme, Paytren and many other platforms outside the ecosystem E-commerce which offers a similar concept. Not to mention now the app digital wallets popular with consumers, it has also provided complete payment features – although some are integrated with E-commerce, such as Dana on Bukalapak and Ovo on Tokopedia.

Competition for agents has also begun to be felt, with a digital business competition strategy that often exists: price wars. So, who is strong he will win?

More Coverage:

With the development of technology and the expansion of connectivity, it can be said that the success of O2O is very dependent on the experience of the consumers being sold. Inconvenience, delays or technical issues may cause a decrease in interest in related services amid strong competition between platforms.

The concept of O2O is actually broader than just a partnership. Brand many of the world's products are also adapting this approach. Despite the fact that according to statistics, 91% brand failed bringing digital experiences to their retail stores.

From the case studies of the success of the retailer like Amazon or Alibaba in applying O2O, there are several points that be the key to business. First, make sure the O2O initiative makes activation easy online happen naturally offline. Second, prioritize customer experience personalization. And third, always take advantage of technological developments. Some brands are now using AR/VR to help improve product visualization.

Sign up for our

newsletter