How DigiAsia Bios Takes Advantage of Embedded Finance for Inclusive Finance

Plans to issue debit cards with Bank Index and Mastercard

Indonesia has a population unbanked and underbanked the highest (81%) in Southeast Asia, according to the e-Conomy 2022 report compiled by Google with Temasek, and Bain & Co.. This condition places this country as the first highest in ASEAN, which is then followed by the Philippines (75%) and Vietnam ( 54%).

When translated, this figure shows that it is still difficult for the Indonesian people to gain access to finance. That's why the current homework for all industry players is to increase financial literacy and inclusion. In the context of fintech, solutions embedded finance could be one way to inclusive financial access, as is currently being done by DigiAsia Bios (Digiasia).

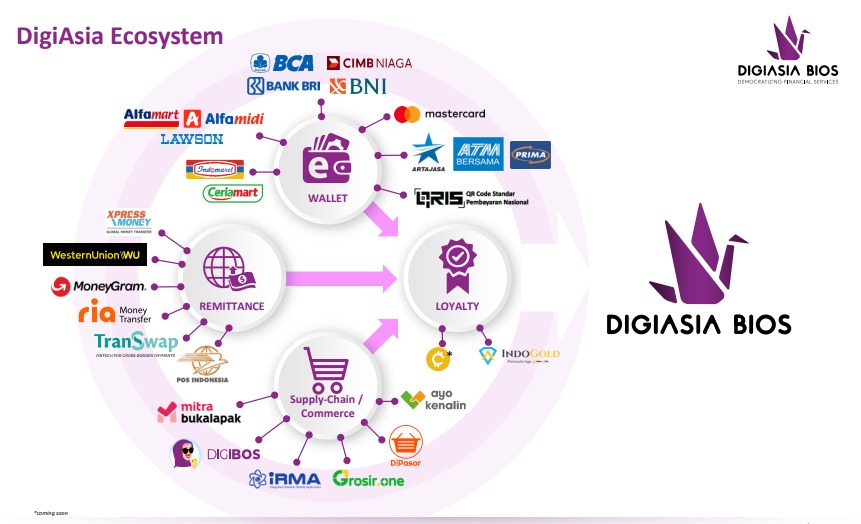

This fintech group of companies has four licensed financial products, namely electronic money (KasPro), p2p lending (KreditPro), remittances (RemitPro), and digital financial services (Digibos). All of these services are provided to meet business needs, aka B2B, so it is only natural that the brands above are not familiar to B2C consumers.

"We are not for B2C, rather enablers for B2B [with four licenses]. Meanwhile, we are serving enterprises that already have an audience but need financial products to serve their consumers," said DigiAsia Bios Chief of Digital Ecosystem Integration Joseph Lumban Gaol when met. DailySocial.id.

Menurutnya, potensi korporat yang membutuhkan solusi keuangan jauh lebih besar dan tak kalah pentingnya dalam rangka meningkatkan keuangan yang inklusif. Hanya saja bagi korporat tersebut untuk memiliki solusi keuangan, uang elektronik misalnya, harus mengajukan lisensi ke Bank Indonesia dan memenuhi berbagai persyaratan. Tak hanya makan waktu, tapi juga investasi yang dikeluarkan tak kalah besar.

Seluruh solusi ini sudah berbasis API, dapat dihubungkan dengan sistem API di enterprise sesuai dengan kebutuhan masing-masing. Perusahaan lebih suka menyebut solusinya tersebut sebagai EFaaS (embedded-finance-as-a-service), sebenarnya tidak berbeda dengan istilah embedded finance yang lebih familiar di industri fintech.

Diklaim perusahaan telah bermitra dengan 97 korporasi besar lintas industri sejak beroperasi di 2017. Mereka datang dari jasa keuangan, teknologi, ritel, telekomunikasi, transportasi, dan F&B.

Dicontohkan, salah satu pengguna KasPro, yakni PT KAI membutuhkan kehadiran solusi dompet digital di aplikasi KAI Access. Memanfaatkan lisensi yang dimiliki KasPro, kini hadir KAIPay sebagai alternatif pembayaran untuk pemesanan tiket, pesanan makanan di kereta api, dan jasa lainnya di aplikasi KAI Access.

Contoh lainnya, Kredivo yang membutuhkan kemudahan transfer dana ke rekening debitur untuk setiap pengajuan pinjaman yang telah disetujui perusahaan. "Jadi solusi yang dibutuhkan para enterprise this tailored untuk mengatasi masalah masing-masing. Karena Indonesia itu banyak yang unbanked, jadi masalahnya sangat beragam," tambahnya.

Conceptually embedded finance, apa yang ditawarkan DigiAsia serupa dengan pemain seperti AyoConnect, Brick, dan Brankas. Namun Joe, panggilan akrab dari Joseph, menuturkan keunggulan dari DigiAsia adalah keempat lisensi yang sudah dikantonginya tersebut.

Walau demikian, pihaknya mengaku tetap menjalin kemitraan dengan pemain sejenis apabila ada teknologi yang dirasa lebih unggul daripada yang dimiliki perusahaan. Menurutnya, di era sekarang kolaborasi lebih baik daripada memonopoli pasar, apalagi pasar Indonesia dinilai too specialized (sangat terspesialisasi).

Turut hadir dalam kesempatan tersebut Chief of Exchange and Gaming DigiAsia Bios Jimmy Tjandra. Ia menambahkan, Stripe adalah tolak ukur terbaik sebagai penyedia solusi embedded finance dalam skala global. Perusahaan banyak memperhatikan geliat perusahaan tersebut dan inovasi-inovasi yang dihadirkan.

Hanya saja, karena pasar Indonesia terlalu terspesialisasi, solusi yang begitu canggih dari perusahaan skala global seringkali tidak tepat sasaran. Alhasil tetap dibutuhkan lokalisasi agar diterima masyarakat. "Karena Indonesia itu populasi unbanked-nya masih tinggi, sehingga solusi yang terlalu canggih itu seringkali belum tentu tepat," ujarnya.

Technology development

Chief of Technology & Operations Officer DigiAsia Bios Hardi Tanuwijaya menambahkan, dari berbagai contoh kasus lintas industri yang sudah ditangani perusahaan, terkumpullah API-API yang dapat langsung di-plug-and-play sesuai kebutuhan yang dicari. Semuanya tersimpan di dalam komputasi awan yang membuat semua prosesnya efisien, hemat, dan cepat.

Proses kerja tim teknologi di DigiAsia menggunakan microservices architecture. This is framework yang dipakai sebagai model dalam pembuatan aplikasi komputasi awan yang modern. Di dalam microservices, setiap aplikasi dibangun sebagai sekumpulan services dan setiap layanan berjalanan dalam prosesnya sendiri.

Masing-masing dari aplikasi tersebut saling berkomunikasi melalui API. Alhasil, setiap ada perubahan pada program yang dilakukan oleh developer, tidak akan mengganggu keseluruhan aplikasi. "Dengan microservices architecture kita jadi lebih fleksibel, semua berjalan secara modular menggabungkan empat lisensi yang kita punya tanpa terganggu jika kita bangun program baru di dalam cloud."

Dampak dari pola kerja demikian membuat struktur karyawan di DigiAsia terbilang ramping, dengan total karyawan sekitar 100 orang dan mayoritas terdiri dari tim teknologi.

Kemudian dari sisi korporasi yang ingin "menjahitkan" API dari DigiAsia ke API internal juga lebih ramah. Tapi itu tergantung kesiapan teknologi masing-masing. Hardi memperkirakan, apabila perusahaan sudah matang dengan teknologi mereka, biasanya proses penjaitan API hanya memakan waktu tiga minggu. Akan tetapi, apabila perusahaan tersebut masih memiliki banyak aspirasi pembangunan teknologi, maksimal proses penjaitannya kurang dari tiga bulan.

"Karena sudah banyak use case sejak 2017 dan sudah API-based, makanya proses penjaitan API dapat berjalan lebih cepat."

Business plan

Dalam rangka melanjutkan visi ingin meningkatkan keuangan yang inklusif di Indonesia, perusahaan segera meluncurkan solusi baru berbentuk marketplace berbasis Open API untuk menyasar berbagai skala bisnis mulai dari UKM hingga enterprise.

Joe menjelaskan, solusi tersebut diperuntukkan buat para developer yang membutuhkan solusi keuangan sesuai yang dicari, berdasarkan API-API dengan berbagai use case yang sudah tersedia di platform tersebut. Kemudian, mereka dapat langsung menjaitnya dan mencoba apakah berjalan sukses atau tidak di platform masing-masing.

"Rencananya produk ini akan hadir bulan Juni, platform-nya kami buka khusus untuk para engineer yang ada di seluruh Indonesia. Dengan demikian, keuangan digital semakin inklusif karena masuk ke berbagai aspek hidup masyarakat karena masih banyak industri yang membutuhkan solusi keuangan yang tidak mungkin bila kita sendiri yang terjun langsung ke sana."

Rencana lainnya, seiring mengikuti perkembangan teknologi adalah mulai mempelajari penerapan teknologi blockchain. Di Indonesia, teknologi ini masih dalam tahap adaptasi dan belum banyak contoh kasus yang bisa dikatakan sukses.

Namun secara tren global, teknologi blockchain telah menunjukkan nilai lebihnya dalam berbagai kasus penggunaan perusahaan, seperti pelacakan sumber, logistik, dan pembayaran lintas batas. Solusi blockchain lebih efisien dan hemat biaya, sekaligus menghemat waktu dan tenaga bagi perusahaan.

"Walaupun begitu, kami terus mengamati tren karena kami tetap ingin menyeimbangkan antara bisnis dan perkembangan teknologi blockchain apabila diterapkan di Indonesia."

Mengenai rencana perusahaan bersama Mastercard dan Bank Index, Joe menuturkan bahwa saat ini sedang mengajukan izin dari Bank Indonesia untuk menerbitkan kartu debit fisik yang ditenagai Mastercard dan Bank Index sebagai bank penerbit kartu. DigiAsia nantinya sebagai penyedia fitur-fitur yang memberikan nilai tambah bagi pengguna.

Apabila tidak ada aral lintang, kartu debit tersebut nantinya akan dihadirkan untuk masyarakat unbanked namun sudah memanfaatkan berbagai platform digital yang mereka pakai sehari-hari. Ambil contoh, Maxim, yang juga sudah bermitra dengan DigiAsia, dapat membuka kesempatan bagi para pengemudinya -dengan memanfaatkan account linkage- untuk memiliki kartu debit dengan berbagai kemudahan, seperti account management dan transaksi luar negeri.

More Coverage:

Sebagai catatan, DigiAsia kini menjadi salah satu pemegang saham (sebesar 3,67%) di Bank Index sejak awal tahun ini. Adapun, startup fintech lainnya Modalku sudah resmi masuk ke bank tersebut sejak April 2022 dengan mencaplok 10% saham. Sementara, Mastercard adalah salah satu pemegang saham di DigiAsia sejak putaran Seri B yang berlangsung pada Maret 2020.

Sebelumnya, Mastercard dan DigiAsia sudah berkolaborasi dengan Bank Rakyat Indonesia untuk menerbitkan kartu kredit virtual dan fisik Merchant on Record (MOR). Kegunaannya untuk memudahkan pengusaha distributor untuk melakukan pembayaran kepada prinsipal dengan cepat tanpa mendisrupsi model bisnis yang telah berjalan. Salah satu pengguna kartu tersebut adalah startup GrosirOne.

"Rencananya kartu debit fisik bersama Bank Index ini akan segera hadir dalam tahun ini, sekarang sedang dalam tahap compliance di Bank Indonesia."

IPO plan

About perkembangan IPO via SPAC di bursa saham Amerika Serikat, diterangkan lebih jauh bahwa sejauh ini masih sesuai dengan rencana perusahaan. Bila proses lancar, diperkirakan akan resmi melantai sekitar kuartal III/IV tahun ini. "Sekarang prosesnya masih berjalan sesuai pipeline, namun saat ini belum ada sesuatu yang pasti sehingga apapun bisa terjadi," kata Joe.

Sebelumnya, perusahaan merger dengan perusahaan cangkang StoneBridge Acquisition Corporation (StoneBridge). Transaksi tersebut membawa valuasi pra-IPO (pre-money equity) DigiAsia sebesar $500 juta. Sebelum menandatangani perjanjian merger, DigiAsia menutup investasi $14,5 juta dengan valuasi post-money sebesar $450 juta yang dipimpin Reliance Capital Management (RCM).

Bicara mengenai perkembangan bisnis DigiAsia, disebutkan gross merchandise value (GMV) tahunan yang diproses mencapai $3 juta pada tahun lalu, dengan pertumbuhan CAGR lebih dari 200% secara year-on-year. Adapun berdasarkan gross transaction value (GTV) kontributornya terbesar datang dari solusi BaaS (48%), kemudan B2B2M (46%), dan sisanya dari bisnis lainnya.

Joe menuturkan, tahun ini perusahaan menargetkan dapat cetak laba agar dapat tumbuh berkelanjutan ke depannya. "Struktur bisnis kami sudah efisien dan biaya nurse di B2B ini lebih murah dari B2C, makanya kami yakin tahun ini bisa sudah bisa profit," tutupnya.

Sign up for our

newsletter