B2B2C Strategy Becomes a Bios Digiasia Approach to Compete in the Fintech Industry

GTV Digiasia breaks over $40 million in 2020 to over $120 million in Q2021 XNUMX

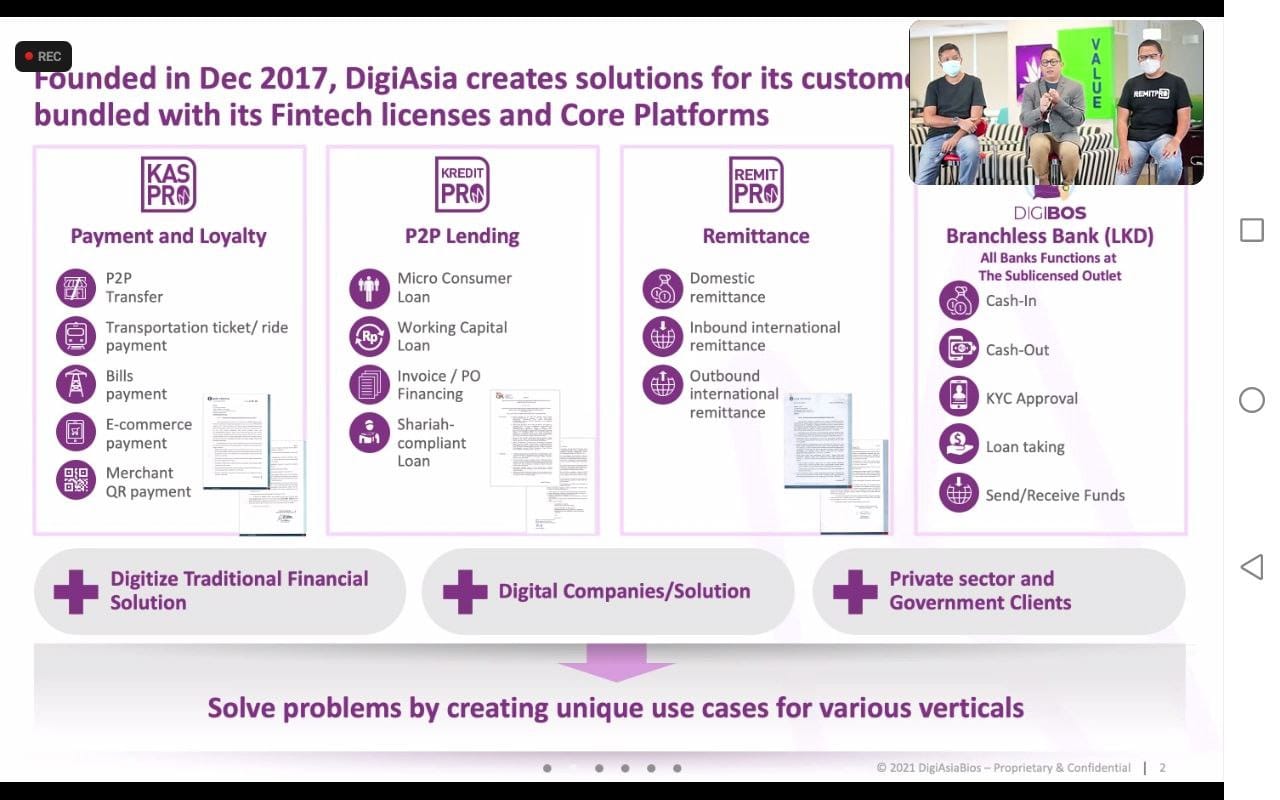

Digiasia Bios is a group of companies fintech which has four licenses to serve opportunities in Indonesia, namely digital money (KasPro), p2p loans (KreditPro), remittances (RemitPro), and digital financial services (Digibos). The company was founded in December 2017 by former Indosat Ooredoo officials, namely Alexander Rusli and Prashant Gokarn.

This broad business scope makes Digiasia free to carry out various initiatives in order to deepen financial inclusion. According to reports e-Conomy SEA 2019 there are still many Indonesians who have not been touched by financial services, as many as 92 million people enter the population unbanked and 47 million inhabitants underbanked.

However, not much information is routinely provided by the company regarding its achievements and what its position is in the industry. To answer that, DailySocial.id trying to dig further through interviews with management. Digiasia CEO Hermansjah Haryono explained that the four lines operated by Digiasia represent fintech solutions needed by the industry.

"Digiasia is the only one one stop solution for all kinds challenges related to financial topics. We are the only one businesses which can provide complete solutions ranging from digital payment systems, through KasPro licenses, fast funding solutions through the KreditPro platform, and finally various domestic and international transfer features through the RemitRro license and platform," said Hermasjah.

The company does not target directly to individuals, but B2B2C. It is not explained behind the change in strategy. In fact, since the presence of Digibios, for example when PayPro came into existence, the company has played directly at targeting individual consumers with various features that are presented with ecosystem support partners.

This change in strategy could be a sign that the company is unable to compete with GoPay, OVO, ShopeePay, DANA, and LinkAja in acquiring new users quickly. These five players are supported by large capital and qualified investors to carry out a money-burning strategy.

KasPro positions itself as an integrated payment solution for various partners in order to serve their respective users. The partners who have worked together come from the F&B retail industry, public transportation, P2P lending and finance, to the MSME ecosystem that prioritizes convenience, acceleration, security, and financial inclusion.

Separately, in a press conference some time ago, Hermansjah explained one example use case KasPro is a partnership with a global F&B company for closed-loop ecosystem. KasPro provides services wallet consumer, switching banks, and card management.

From there, partners gain experience, including their customers being able to top up their balances wallet in-store or transferring from any local bank, customers who have a unique physical card can be linked to the app for use in the store. Wallet This consumer (app/card) can only be used in the store.

Next for example use case others in KreditPro, the service provided is an application wallet consumer and merchant network QRIS. The experience that partners get is that when consumers borrow through the partner application, the balance will be injected into the wallet quickly from the partner's deposit funds. The balance can be used by consumers at all outlets totaling more than 10 million QRIS merchants throughout Indonesia.

“We are in bond non disclosure agreement, then cannot mention brand partner. From our experience, many have been helped by our solutions, both from the F&B vertical, the financing ecosystem, and others. And we can say that all have phases for the next development because digital transformation has no limits at this time,” said Hermansjah.

Further explained, KreditPro together with other Digiasia services work together with various productive ecosystems such as networks supply chain leaders FMCG, digital goods distribution, and others, to provide appropriate solutions at various levels. "Until now, KreditPro has disbursed a significant amount and revolving every cycle-with a well-maintained portfolio performance,” added KasPro CMO Rully Hariwinata.

Through this B2B2C strategy, the company is able to increase the gross transaction value or gross transaction value (GTV) reached more than $40 million in 2020 to more than $120 million in the third quarter of 2021. Hermansjah targets this year's company's GTV to grow three times before the end of this year.

He also declined to specify which line of business made the biggest business contribution. He claims all businesses contribute equally.

RemitPro Business

CEO RemitPro Arman Bhariadi explained, starting this year the company began working on the B2B segment, especially MSMEs for domestic and overseas fund transfer services. This segment is considered to have great potential, considering that it is still very fragmented and controlled by banks.

Previously, from the very beginning, RemitPro focused on the individual segment specifically targeting the families of Indonesian migrant workers who wanted to take remittances at the TPT (Cash Cash) physical location network. This location has spread in Answer, Madura, Bali, and Lombok.

In further detail, RemitPro is claimed to always grow far more than industry growth according to Bank Indonesia data. Even during the pandemic, the remittance industry from abroad to Indonesia has decreased for the second year in a row, RemitPro can still grow double digits. "Growth outbound international even in percentage reach triple digits, said Arman.

Regionally, remittances from the Middle East still dominate the growth contribution. Specifically, Saudi Arabia is the country with the largest contribution to shipments to Indonesia facilitated by RemitPro.

This business growth is also supported by the various partnerships that RemitPro has successfully carried out. They are WesternUnion, MoneyGram, Transfast, which are the top 10 global remittance companies by transaction volume. Then, Merchantrade, BNI, BRI, BSI, Xfers, Instamoney, Digital Solusi Pramata, and Ebays.

More Coverage:

According to Arman, together with Merchantrade, which is one of the largest remittance players in Malaysia, they are developing innovations to pamper users. Among other things, providing BPJS Employment payments for TKI. Malaysia will be pilot project, then connected to other countries, such as Hong Kong, Taiwan, and Saudi Arabia.

Next, presenting the concept send now pay later. Later, through the Merchantrade application, users can apply for early salary disbursement, then send it to their family in Indonesia. Next, when payday arrives, the balance will be automatically deducted by the system and paid directly to RemitPro. "It's an interconnected ecosystem."

In the next year, the company has prepared a plan for the next cooperation to boost the business. These companies are Ria Money Transfer, Terrapay, EMQ, BRDGX, Paygo, and Lifepay.

To accommodate the transfer inbound and outbound, RemitPro has collaborated with 147 banks with a maximum transfer balance of IDR 50 million and seven e-wallets. A total of 30 countries have now connected with RemitPro for outbound transfers, while for B2B only 11 countries are available. These countries are China, Hong Kong, UK, US, Taiwan, Japan, and a number of countries in Southeast Asia.

Arman said that his party is preparing a new feature that allows users abroad to pay their family bills in Indonesia through the RemitPro application and website. “We see there is a high bill payment need among RemitPro users. This feature is planned to be available in the first quarter of 2022," concluded Arman.

Sign up for our

newsletter