Thrasio Collapses, Resilience of Local E-commerce Roll-up Startups Questioned

Analysis of local e-commerce roll-up players on Thrasio failure and their strategies for building sustainable businesses

Service developer e-commerce roll-up or brand aggregators Thrasio has recently become a hot topic of conversation among startup activists. The company has raised $3,4 billion funding of the 18 investors are reportedly restructuring -- in fact WSJ reporting, said they were preparing to declare bankruptcy.

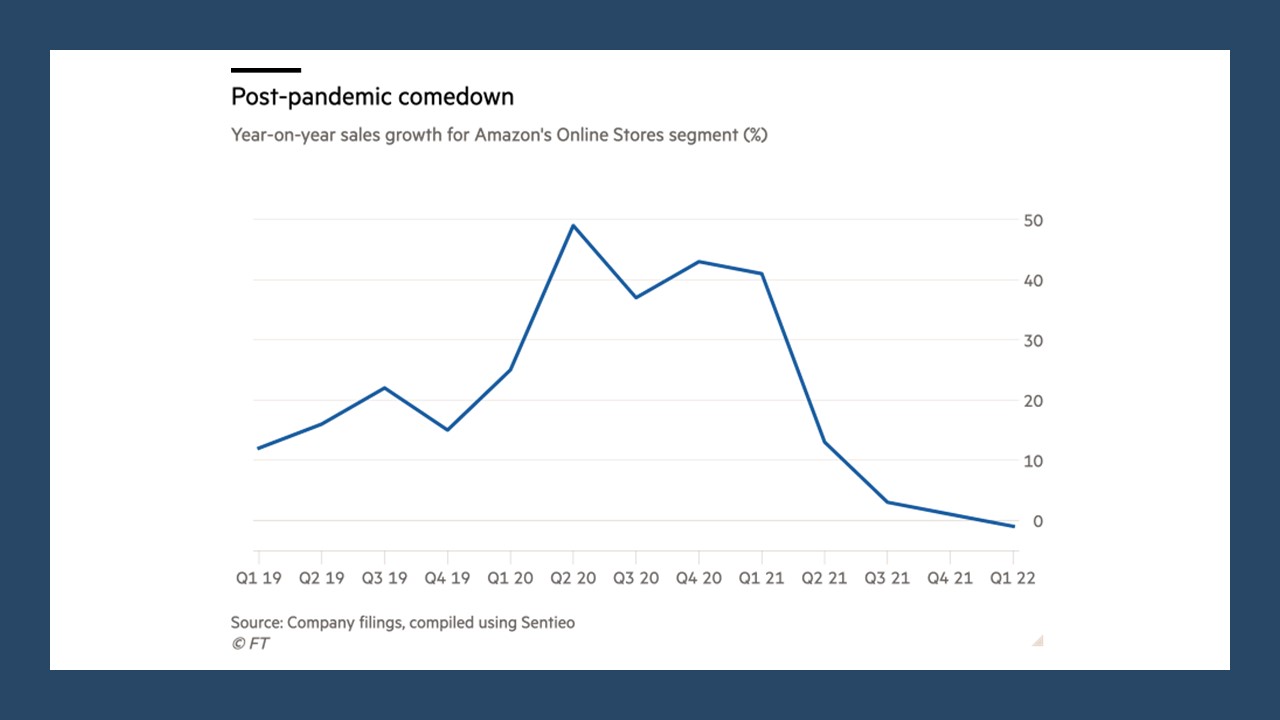

The main issue is due to internal financial problems caused by the rapid decline in sales post-pandemic.

Execute the business model Roll-up since 2018, Thrasio has been working on acquisitions brand from third-party businesses that are on average successful selling on Amazon. Currently there are about 150 brand which has been acquired and accelerated by the Thrasio team. With its latest funding bringing the company to a valuation of over $5 billion, they are looking to multiply that revenue 10x.

However, bad luck struck this startup founded by Joshua Silberstein and Carlos Cashman. After the crisis caused by Covid-19, there was a decline in purchases online on Amazon platforms. On the other hand, there is a trend of changing consumer patterns which has previously increased spending online, then return to mode offline like before the pandemic.

Thrasio also managed to improve business efficiency, last year 20% of the workforce was laid off.

Actually, this is not the first failure story of the platform e-commerce roll-up. Previously Benitago Group, another Amazon aggregator, filed for bankruptcy two years after raising $325 million in funding. This condition also influences the investment climate in this sector up to 88% in 2022.

Local players' views

Business e-commerce roll-up also developed in Indonesia. There are currently a number of players in this vertical, two of which are Hypefast and Tjufoo. Both have grown quite rapidly in the last two years and have received equity funding support from investors.

To explore the views of industry players regarding the phenomenon that occurred with Thrasio, DailySocial.id had the opportunity to discuss with the Founder and CEO of the two startups, namely Achmad Alkatiri (Mad) and TJ Tham.

Mad argues, various platforms e-commerce roll-up have their own strategies. However, if you look at what happened to Thrasio, there are several things that can be used as lessons.

First, acquisition brand done too much and too fast. According to Mad, this resulted in the process from brand This is not very optimal, because quite often quite challenging challenges arise in portfolio management, considering each of them brand sometimes it needs special treatment. Ultimately this has a direct impact on growth which is not good---because there is no synergy and cost optimization.

The second factor, Thrasio is assessed more inclined to acquire "hero product", No "hero brand". This makes the challenge even more difficult when other players emerge offering the same product variants and priced cheaper, such as Amazon Basics. There is no loyalty there, because there is no process."brandbuilding".

The next factor is related to decision founder accumulating too much debt. Mad said, "Too much debt was raised when the capital was cheap, and with that, paid too high multiples on brand acquisition because of asset competition on acquisition."

For example, as of 2021, Thrasio has raised funding debt worth $650 million. The reason is that with these debt funds, founder believes Thrasio will have additional flexibility and liquidity as it targets acquiring more brands across borders. In fact, interest rates continue to rise without an increase in sales, making it difficult for companies to make payments debt which is owned.

The last factor, Thrasio is too focused on selling on Amazon---sales contribution there can be up to 95%. By placing revenue especially in one basket, is considered to have the potential for strong turbulence when platform owners release new policies (for example related to algorithms or products) that have a direct impact on brand related.

In addition to the points Mad expressed above, TJ also added "Brand aggregators or any D2C can not only sustain but also thrive if there is a focus on sustainable profitability, distribution omnichannel, and the development of long-term brand equity, rather than simply chasing revenue."

What makes e-commerce roll-up different locales

Local players such as Tjufoo and Hypefast have a different approach to Thrasio. And according to TJ, the market also has different characteristics. In Indonesia and Southeast Asia, ecosystems E-commerce fragmented that forces each brand to diversify sales channels. Not to mention that if we talk about Indonesia, retail is still dominated by more than 90% offline.

"This is where Tjufoo has had a distribution approach since its inception omnichannel, 70% of sales are generated online offline," said TJ.

Recently, Dapur Coklat, one of Tjufoo's portfolios, announced its opening o new. Founded in 2001, Dapur Cokelat now has 32 outlets and 56 delivery points in a number of big cities in Indonesia.

To design a sustainable business, a number of strategies are also being intensified by local players. TJ summarizes the strategy into three main points. First, focus on building a brand and selling products. Second, partner with the founders brand and improve their skills.

And third, supplying quality talent in various operational lines to encourage deeper penetration of their business.

Tjufoo himself claims he has profitable since the beginning of 2023 this is with 5 brands with a combined experience of over 46 years. To further accelerate its business, the company is also finalizing its next funding round -- it is said that the closing of this funding will not be long.

Integrated management

More Coverage:

Meanwhile, according to Mad's statement, Hypefast generated net revenue of $43 million in 2022, nearly 2x their revenue in 2021 ($22 million), with no new brand acquisitions and purely organic growth of existing brands. Hypefast is also in a profitable condition.

In a previous interview, Mad said that even though Hypefast operates by acquiring brands, the company still maintains brand founders in the management ranks to maintain strong relevance in the local market.

From the start, Hypefast was designed as a startup whose expenditure always paid attention to business scalability and profitability. The operational process is centralized with warehouse, procurement, cross border facility, to marketing, and got Hypefast's dedicated team to ensure the business can run more efficiently.

"Cross border facility we prepare for brand so they can be used together. We are one because all operations are carried out together. Warehouse they will be moved to Hypefast to be more efficient because our capacity is greater. We do all this because when investing in brand, we are upgrading their business fundamentals.”

According to Mad, the presence of facilities cross border this makes the shopping experience online remains localized for consumers in each brand remains the same. Delivery can be done quickly, without having to wait for it to be sent from the brand's country of origin.

In-depth cooperation with e-trade local also sharpened. Hypefast recently signed a collaboration Joint Business Plan (JBP) with Lazada Indonesia. This collaboration will help its brand portfolio through various collaborative activities such as exclusive launch products, joint events, marketing barter, training and development, to other innovations.

Sign up for our

newsletter

Premium

Premium