Studying Cash Flow for Better Business Financial Management

Studying cash flow is something you must do to be able to manage the finances of a business or personal finance.

Running a business is not just about providing stock of raw materials or also thinking about profit targets. You also have to understand to learn cash flow from your business.

The importance of studying cash flow it is the same as maintaining business finances in order to have definite developments in financial terms.

Well, for those of you who just want to run a business, it's very important to learn cash flow from this article. Check out the discussion cash flow and an example that you can use as a reference.

What is that cash flow?

Cash flow is a statement of cash inflows and outflows of a company or individual used to meet needs. Definition cash flow It is also often interpreted by another name, namely cash flow. So, meaning cash flow It is also defined as the outflow and inflow of cash.

Cash flow or cash flow will record income and expenses over a certain period, usually report cash flow made on a monthly basis. Just like his name, cash flow only record income that is cash or paid directly.

Main purpose of the report cash flow is as a form of financial picture and also as a financial projection. With the report cash flow can determine whether these personal or personal finances will generate sufficient cash flow negative or positive.

Component cash flow

To make a report cash flow requires you need details of income and expenses. However, the income and expenses are divided into: three important components. What are the components cash flow?

- Operating activity cash flow

This cash flow comes from business transactions which will be in the form of cash income or can be referred to as the company's net profit. In addition to income, cash from operating activities is also in the form of operating expenses such as sales proceeds, settlement of non-bank accounts payable, salary expenses, rental expenses, electricity and water expenses.

- Investment cash flow

This cash comes from purchases, sales, and investment gains.

- Funding Cash Flow

Funding cash flow comes from the cost of reducing and increasing business capital, such as buying shares, funds from investors, buying dividends, repayment and debt loans at the Bank.

These three components are used to calculate netcash flow and also to analyze cash flow.

Diagram cash flow

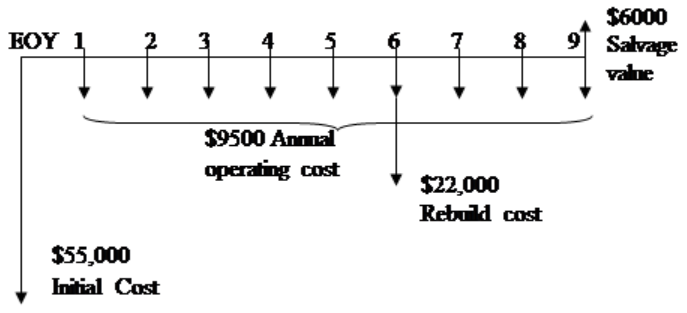

In the report cash flow there is what is called a diagram cash flow, which serves to visualize cash in and cash out during a certain period. According to Oxford University Press diagram cash flow consists of a horizontal line marking a series of period intervals.

Diagram cash flow There are various types including:

- Single cash flow

- Equal (uniform) payment series

- Linear gradient series

- Geometric gradient series

- Irregular payment series

Here's an example of a diagram cash flow:

What is cash flow simple?

As previously mentioned if a report cash flow not only used for the purposes of a business or company. Report cash flow can also be used for personal purposes.

Why is it important to make a report cash flow personal? Because with cash flow, you can manage your finances. Especially if you are already working and earning, of course, you need to make a cash flow report every month to find out your salary flow. So, you can make the right financial projections.

Cash flow personal is also included cash flow simple, because it only records the use of the income you receive and you know best where the money is spent. Even, cash flow templates you can find it on the internet for free.

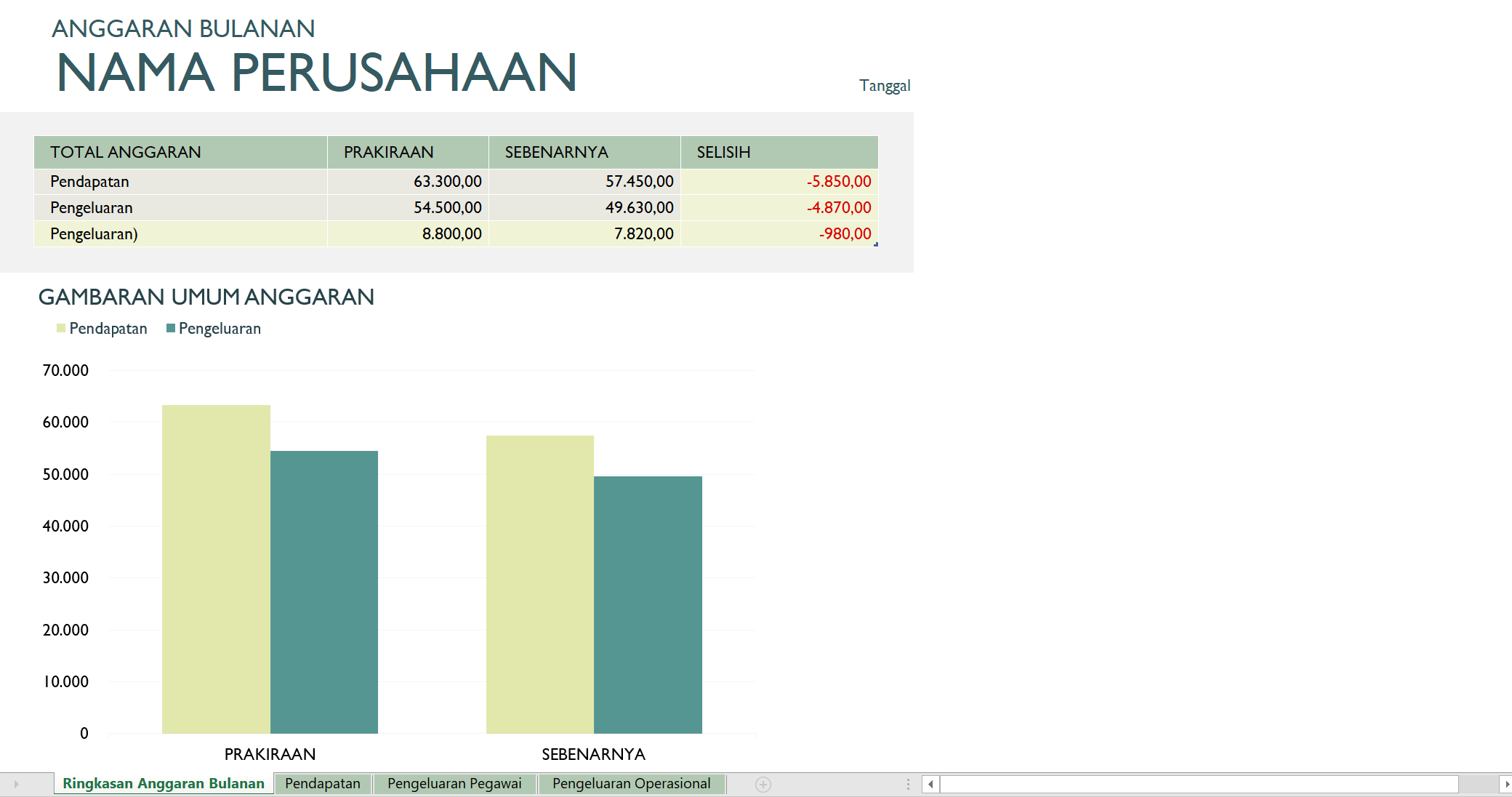

One of which is for mobile devices to report the Microsoft Excel which already provides various templatecash flow ready to use like personal cash flow. Like the example below.

Download link: cash flow templates personal

Download link: cash flow templates personal

Quadrant cash flow

Make a report cash flow actually easy and difficult, especially for those of you who have never learned about accounting, you will definitely be confused with accounting languages, one of which is about accounting. cash flow quadrants. Though this term is very important for those of you who are opening a business.

What is that cash flow quadrants? Quadrant cash flowis a term pioneered by Robert T. Kiyosaki who is also an investor from the United States. Maybe for those of you who are interested in the business world, you are familiar with the book with the title written by Robert, namely Cashflow Quadrant.

Apart from being used as a book title, cash flow quadrants is a diagram that discusses how each individual earns income or income. Robert shared cash flow quadrants into four types, all of which have different ways of managing finances such as managing personal assets and debt.

Four types cash flow it is S(Self-Employee), E (Employee), I (Investor), B (Business).

To understand the four kinds quadrant You can listen to the explanation of each point below:

1. Self-Employee Quadrant

This S quadrant contains those who have their own business. So that the business he has is also done independently. In his book, Robert mentions that those who fall into the S quadrant are restaurant owners, doctors, designers, or architects.

Those who fall into this quadrant will work extra and even have to change their time to work harder to manage their own business in order to get the appropriate income.

In contrast to ordinary employees who work according to job desk he had and came home on time. The S quadrant must think about all strategies every day to be able to maintain its business

2. Quadrant Employee

As the name implies, this quadrant contains people who are employees to work. Usually people who fall into the E quadrant category have a fixed monthly income or salary from a company owned by someone else.

Whatever the position, as long as he works in a company that is not his own, that person will still enter the E quadrant.

People who are in the E quadrant are also usually willing to trade their time for work in order to earn an income. They don't even dare to take big risks that can destroy their careers.

Employees also usually have a sense of security in themselves, the meaning of security here is that it is safe to get a predetermined income every month.

3. Quadrants Investor

The investor quadrant is the highest type of quadrant in cash flow quadrants, because as we know if the life of an investor has a pretty good life, namely in financial freedom and also time freedom.

The members of the investor quadrant usually get income from the profits from an investment they make. Not just one investment, investors usually invest in various businesses.

With a higher level, of course, this quadrant is the dream quadrant because it has financial freedom and the income from investment is also quite large. However, you need to know that to reach the investor quadrant there is effort and time that must be pursued beforehand, until you can feel the point where there is no need to spend a lot of time doing a job.

4. Quadrant Business

From the S quadrant or Self-Employee quadrant, then the quadrant above it is the business quadrant. If the S quadrant is workers who have their own business, where the business group also belongs to the small-medium class. In contrast to quadrant B, which is the owner of a company with hundreds of employees.

Those who fall into the category business quadrant must be able to develop its business by having skilled human resources, so that the company's raw materials or staples are of the best quality.

To achieve it all, quadrant B will work hard by starting its business from 0 though. Before he could reach this point. However, it is undeniable that many businesses fail in less than ten years. So, maintaining and managing a business is not an easy thing.

In addition to explaining the difference in quadrants in cash flow. Robert Kiyosaki also mentioned that business quadrant and quadrant investors are two types of quadrants that can achieve financial freedom.

Cash flow statements

Cash flow statements or cash flow statement is something that must be prepared for those of you who have a business. This cash flow statement will later record cash in and cash out of a business that you are running. So, you can see how cash transactions are going.

Generally reports cash flow or cash flow is made in monthly periods, the point is to facilitate reporting and business financial projections in the next period.

Financial projections or financial planning can be done by finding new investments, cutting expenses, or increasing sales production in a business. It is necessary to increase income.

To make cashflow statements ada 5 stages what you have to follow are:

- Determine the beginning balance

- Calculating cash flow from operating cash activities

- Calculate cash flow from investing cash activities

- Calculate cash flows from financing cash activities

- Determine the ending balance

net cash flow

After making a cash flow statement, the next step is to calculate the report cash flow to be able to find net cash flow or netcash flow.

To calculate net cash flow, use the following formula:

Net Cash flow = Operating Cash Flow + Investment Cash Flow + Funding Cash Flow

The formula is the formula for calculating netcash flow by adding three components cash flow. Meanwhile, the three components must also perform calculations first by adding up all income and subtracting it from expenses.

Example cash flow

Make cash flow can be done more easily using template cash flow provided by Microsoft Excel. However, you can also make reports cash flow Manually. Here's an example cash flow restaurant business that you can use as a reference.

Restaurant and Drink Business

Cash flow

December 2021 Periode

Cash Flows Earned by Operating Cash Activities

Cash from customer IDR 14.000.000

Payment on cash expense Rp4.000.000

Net cash obtained from operating cash activities Rp10.000

Cash Flows Earned Investing Cash Activities

Sale/purchase of fixed assets Rp2.000.000

Cash Flows Earned Cash Funding Activities

Cash as investment IDR 20.000.000

Withdrawals are made by the owner IDR 5.000.000

Cash flow net cash financing activities Rp15.000

Net increase/decrease in cash Rp5.000.000

CASH AT THE BEGINNING OF THE PERIOD 0

CASH AT THE END OF THE PERIOD IDR 5.000.000

Well, that was the related explanation cash flow what you need to know. You can already make a cash report flow start now with template already available in Excel. You can also read articles cash flow others on DailySocial.

Sign up for our

newsletter