Example of Personal Cash Flow Format and Tips for Setting It Up

Here's an example of a personal cash flow that you can use to manage your salary

Being a worker and getting a salary is an achievement, but have you ever experienced an incident where you just got paid?, suddenly not a week the money has run out. Well, if ever means something is wrong with the record cash flow your personal or it could be you not have a report cash flow.

What is that cash flow? Cash flow is the cash flow that regulates the entry and exit of money for every need, and cash flow This is very important not only in a company. But in personal matters you also need to have a financial report, the use of a report cash flow Personal is to know the flow of your money in and out.

Through this article you can find out how to set up cash flow personally and any examples cash flow personal.

What is that Cash flow Personal?

By making a report cash flow regularly is very useful for managing your monthly finances. So you can monitor it too. Notes cash flow you can also make it anywhere freely by writing it manually or digitally. However, making digital financial records will be easier and also flexible.

However, to make a cash flow statement manually, you must set the format by distinguishing between: cash flow come in and cash flow go out.

Cash flow entry or income must be divided into some income such as active income, namely income or income received regularly such as salaries, bonuses, honorariums, business profits, and THR (Tunjangan Hari Raya).

In addition to regular income, there is what is known as investment income, namely income obtained from side income such as shares, deposits, property sales, and mutual funds. Then, the latter is referred to as passive income, which is in the form of royalties from the work you make or house rental profits.

Whereas for cash flow out or expenses, you can record expenses that must be paid such as taxes, debts, home ownership loans (KPR), education costs, and insurance.

Furthermore, what is no less mandatory are expenses that cannot be avoided or can be called daily expenses such as money for food, electricity bills, water, internet, transportation, or credit.

Well, sometimes we also spend money for something that is not too emergency or as a self rewards which is called additional expense. Additional expenses can be in the form of entertainment or other consumptive activities such as vacations, shopping at the mall, or just having a snack at a cafe.

In addition to income and expenses, you are also required to record savings, both investments, deposits, or regular savings at the bank.

Example Cash flow Personal

Make a report cash flow also very easy, you can use financial applications or also use template which has existed.

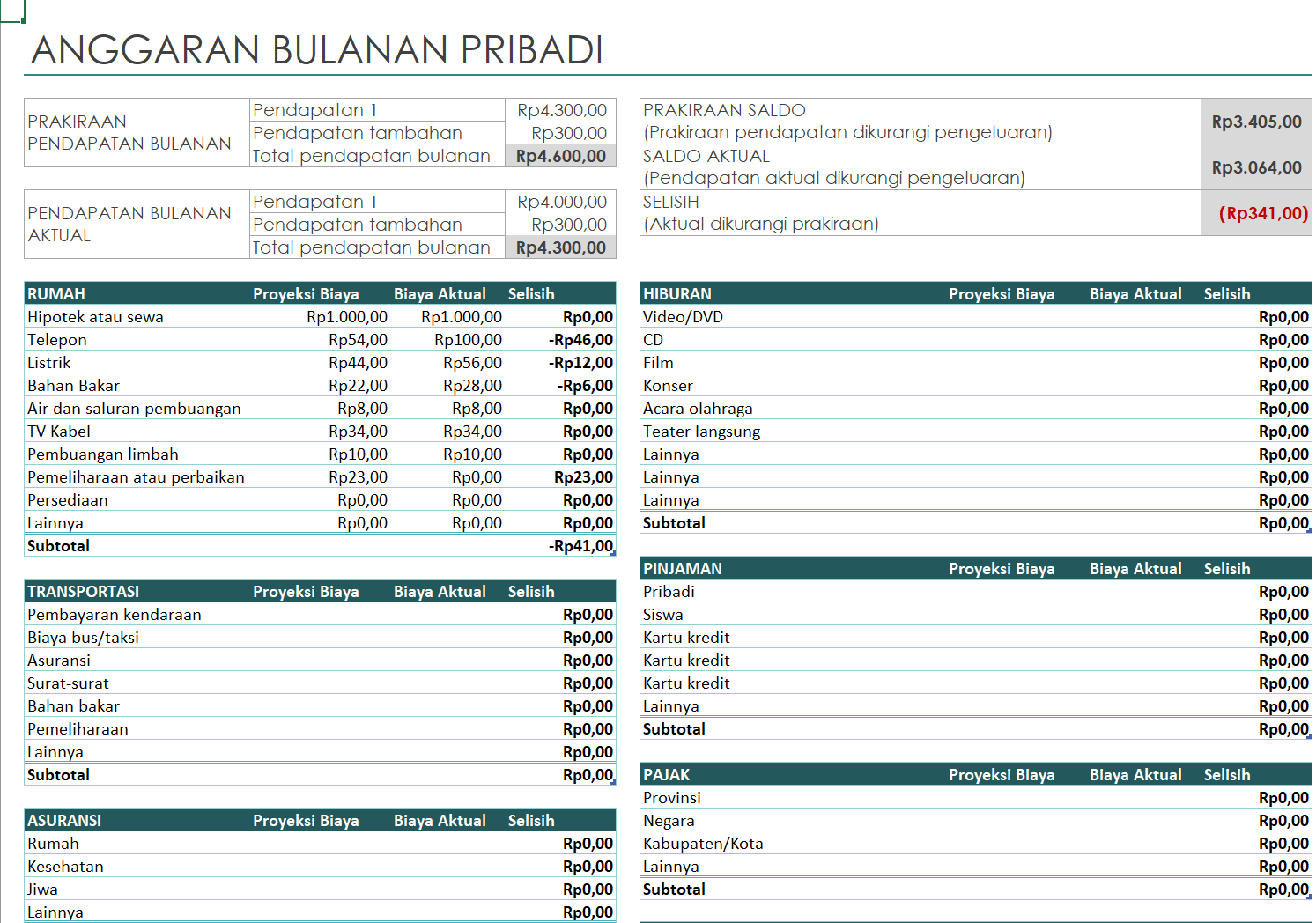

There are many examples of formats cash flow you can get it on the internet, even Microsoft Office has provided template or format cash flow which you can directly use in Excel, the image above is a form cash flow simple personality. You can download the format HERE.

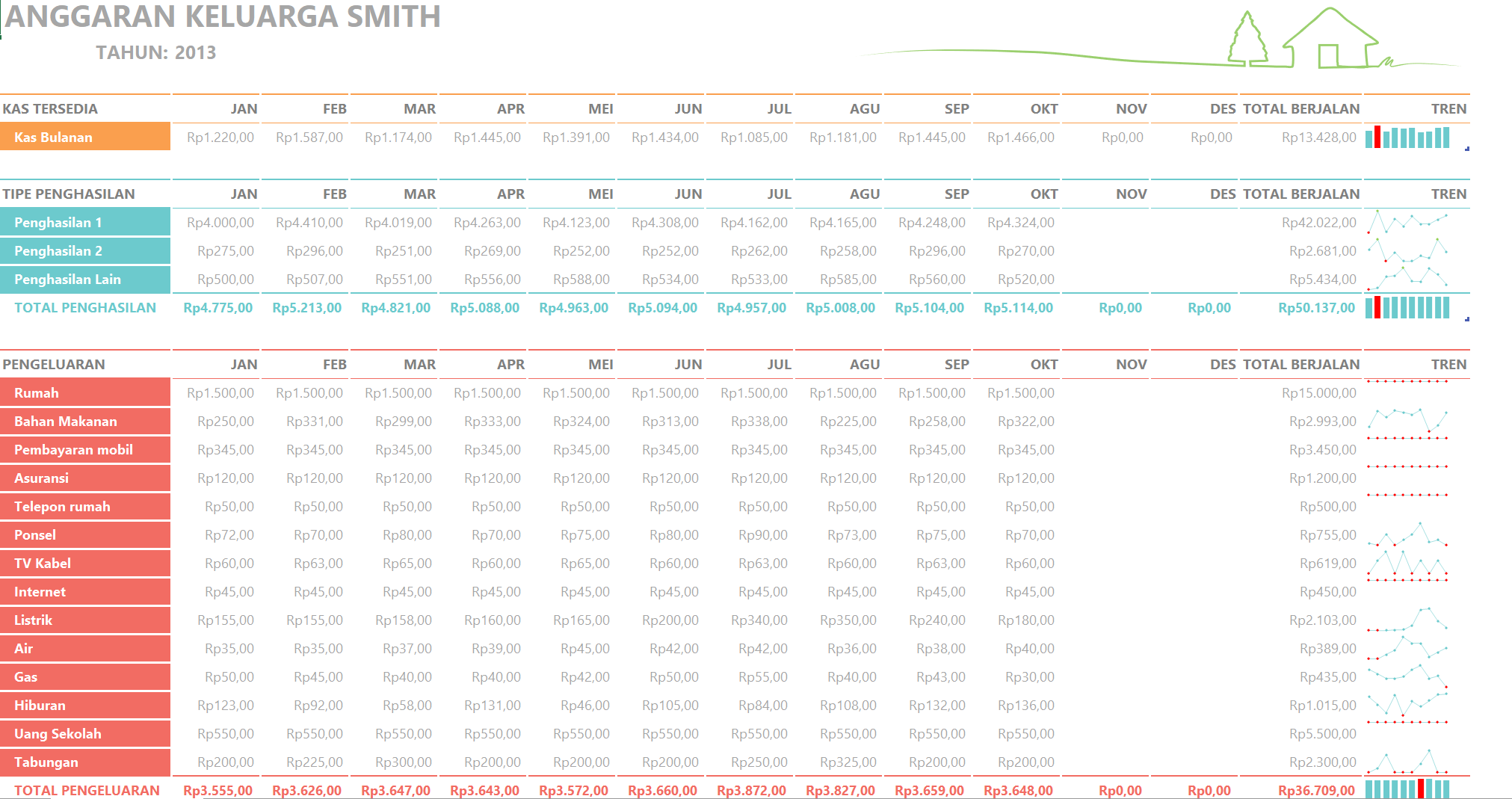

In addition to the simple format, you can also use the format cash flow monthly like following.

For those of you who live with other family members who are already working and earning, you can also use the format cash flow family. So that family income and expenses can be reported neatly. Format cash flow family you can find HERE.

Tips for organizing cash flow personal

After setting cash flow digitally in spreadsheet, you have to take care cash flow to run positively. Following tips which you can follow while making cash flow.

1. Distinguish between needs and wants

Surely you have felt that your salary ran out first before the mandatory payments were completed. Be careful if you use the money for impersonal desires urgent, because the real desire can be achieved gradually. You must determine the priority scale of needs so that cash flow also not minus.

2. Prepare an emergency fund

It is very important to prepare an emergency fund when you have income, because this emergency fund is useful when there is an unexpected situation so that funds for daily life will not be disturbed.

3. Consistent in managing cash flow

The key to managing finances is to be consistent in reporting every expense and income, because if you forget to record it, it will be fatal when the summary is at the end.

Now you can go straight to making cash flow personal so that monthly finances are well managed. You can immediately use the example cash flow which is already available in this article.

Sign up for our

newsletter