Business strategy PasarPolis Via Tap Insure and Agency Services

In-depth discussion with the President PasarPolis Peter van Zyl about business strategy to the process of raising investment funds

The Financial Services Authority (OJK) recently explained that the level of insurance penetration in Indonesia is currently only recorded at 2,75% of the total population of Indonesia, lower than neighboring countries in Southeast Asia. Meanwhile, the level of insurance density is also still at a low level, recorded at the end of last year at IDR 1,92 million per resident.

Responding to the data above, this does not mean that this is a bad problem. From a business perspective, this is a good problem because the room for improvement is still wide open. This is the perspective taken by Tap Insure (PT Asuransi For All), a general insurance company which is part of the Pasar Polis Group to take advantage of opportunities in Indonesia.

PasarPolis The Group now oversees three entities: PT PasarPolis Insurance Broker, PT PasarPolis Indonesia, and PT Asuransi For All (Tap Insure). Tap Insures became a new part of the group as digital general insurance after obtaining business license approval from the OJK on November 17 2022.

It was stated that Tap Insure was the only new insurance company in the last three years that received permission from the OJK during that year. Apart from that, in the same year, in the realm of technology companies, there was the Sea Group which fully acquired PT Asuransi Mega Pratama, now becoming PT Asuransi General SeaInsure.

“Have [your own] insurance, so game changer for us because we can underwriting yourself, determines the premium, and claims are handled directly by yourself. "We can also continue to innovate products and create a lot of differentiation in the market," explained the President PasarPolis Peter van Zyl to DailySocial.id.

Zyl just joined di PasarPolis since July 2023. He is known as a professional veteran in the insurance industry with a track record of more than 20 years. He served as President Director & CEO of Allianz Indonesia for 7 years and held senior management positions at AIG for more than 15 years.

Before there was Tap Insure, process underwriting and claims processing is handed over directly by the insurance partner. As insurtech, PasarPolis only acts as a liaison between insurance companies and target consumers. For example, when compiling accident insurance for drivers Gojek, party PasarPolis negotiate with various insurance companies looking for the best premium, before being presented at Gojek.

“We have very rich data, allowing us to understand customers are able to build products with predictive models. For distribution efficiently, quickly and frictionless. So consumers don't just take out insurance, but the experience is enjoyable because now we are an insurance company full stack. "

Tap Insure allows for significant improvements. The level of consumer satisfaction reached 90% because 74% of claims could be processed within 24 hours, showing the company's commitment to innovation and efficiency in this industry.

Tap Insure's latest collaboration is with Shinhan EZ General Insurance, developing protection for Tap Auto motor vehicle insurance, namely Extended Warranty for used and new cars. This step also marks Shinhan EZ's entry into Indonesia, which has expertise in the field of micro insurance.

Tap Auto provides protection against unexpected repair costs, covering vital components, such as the engine (including ECU & radiator), transmission (including ECU & radiator), steering system, brake system, and air conditioning and heating equipment (including AC Compressor ).

Apart from that, Tap Insure has other insurance products, such as: Movable Property All Risks Insurance, Property All Risks Insurance, Fire Insurance, Personal Accident Insurance, Goods Transport Insurance, and Earthquake Insurance.

Start strengthening your agency business

At the same time, the group of companies also began to strengthen business contributions from agency channels. According to Zyl, business PasarPolis relies heavily on B2B2C channels, which account for more than 65% of its total revenue. The channel shows consistent growth year after year, despite a saturated market.

Cumulatively since it was first established in 2015 until last year, more than 1,5 billion policies have been issued to 40 million consumers. The ecosystem partners are also diverse, such as Gojek, Xiaomi, IKEA, Shopee, DANA, and Home Credit.

Agency and D2C channels, on the other hand, saw substantial growth, exceeding 15% on an annual basis month to month. The prospects on this channel are very promising, especially as Indonesian people still need a face-to-face presence from an agent to get an explanation regarding the insurance product they want to buy.

"You also don't need to meet face to face, agents don't need to be stuck in traffic jams on the highway. With the application, they can focus on providing services to their customers."

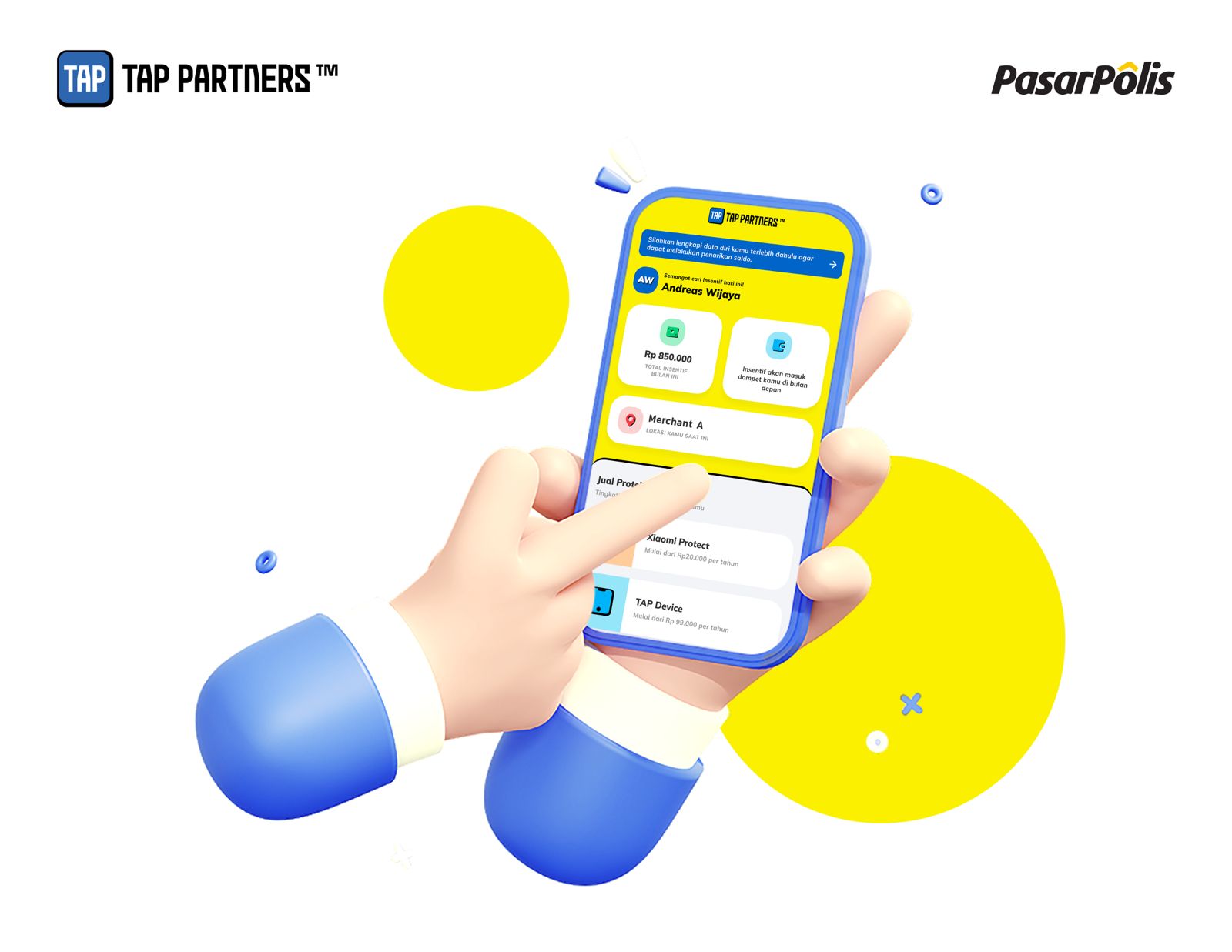

PasarPolis Partners (PT PasarPolis Indonesia) has been present since 2020, it is claimed that more than 11 thousand agents have joined spread across five big cities, namely Jakarta, Surabaya, Solo, Semarang and Bandung. The PP Mitra application is equipped with a number of features, such as automation of the data reconciliation system, from the policy data input process to premium payments, instant incentive disbursement process, instant policy issuance. real-time, and efficient claims processing.

Then, as many as 11 insurance companies worked together to market their products through this channel, assisted by PasarPolis Insurance Brokers. Tap Insure, Allianz, Zurich, SeaInsurance, Sinarmas, are some of the names that have joined.

“We're going to get exponential growth in 2024 as agents become a big focus. So, we plan to keep B2B2C, not reduce it. At the same time increasing agency."

Zyl said, to pursue an increase in contributions from agency channels, the company is currently signing a partnership with an insurance company that has the largest agent network in Indonesia. He could not go into further detail regarding this, but it is believed that it can completely change the dynamics of the insurance world in Indonesia.

Not only that, Tap Insure also utilizes agencies for its marketing strategy by presenting Tap Partners. Tap Insure targets partnerships with various stores offline. So far it has collaborated with Xiaomi Shop and almost 500 shop traders offline the other.

One of the conveniences offered by Tap Partners is purchasing a cellphone with the system bundling that makes it easier for consumers to immediately have protection insurance products gadgets, along with cellphone purchase transactions in stores offline.

Currently raising funding

Explained further, PasarPolis Currently starting to open fundraising. If there are no obstacles, it is targeted to be closed in the first quarter of 2024. What is certain is that the funds obtained will be used to develop its offerings in digital assets to reach a wider population. Therefore, companies will invest more in talent and technology. Moreover, the ambition to increase the contribution of the agency business next year continues.

“If we want to be 10 times better in service, speed, product offering, we need to continue to invest. We also want to be 10 times more effective and efficient than our peers or competitors.”

PasarPolis last announced $5 million in funding from the International Finance Corporation (IFC) in February 2021. This funding was raised four months after announcing a Series B round worth $54 million. Mentioned, PasarPolis join the ranks soonicorn aka the valuation reaches $59 billion.

“Fundraising can significantly accelerate our journey to becoming a profitable organization.”

At the same time, Zyl considers that the step towards profitability is now a priority, even though it takes time. Expanding digital assets certainly requires costs which are an influencing factor in determining company growth. His party will continue to overcome these costs so that the business scale can increase effectively.

However, on the one hand, one of the main aspects that contributes to the path to profitability is how the business interaction approach is taken PasarPolis. According to Zyl, every transaction that produces a profit is called contribution margin. This figure will continue to be increased for all business operations, therefore every business deal is carried out after ensuring the profits that will be obtained.

More Coverage:

“Indonesia allows us to develop our business profitably, compared to other countries in Southeast Asia because we have a good combination. Our clear goal is to be profitable by 2025, it could be sooner or later.”

Approach insurtech blockchain is also a concern PasarPolis in the future. Internal discussions regarding this topic are still early but it is certain to implement it immediately because the benefits offered are very large. Blockchain provides the ability to manage, predict, fraud detection, and most importantly ensure the protection of customer data.

He continued, although currently not everyone in Indonesia uses blockchain technology, the application of blockchain technology to business is increasingly necessary. The wealth of data on offer underscores its importance in the insurance landscape.

“Even though it is still in the discussion stage, the potential benefits blockchain already visible not only to us in PasarPolis, but also for the industry as a whole.”

In the regional arena, it is delivered now PasarPolis has spread its wings to Thailand, Vietnam, and recently Singapore. Indonesia remains the company's main market. Malaysia and the Philippines are not yet in his next plans.

Zyl assesses that Malaysia is a country with generally mature insurance market penetration. Meanwhile, his party often evaluates potential opportunities based on partnerships and market readiness. “For us, expansion depends on market readiness and continuity. We prioritize a pragmatic approach, ensuring that our expansion into new territories is feasible and successful.”

Currently, the company's total employees regionally have almost reached 200 people, the majority of whom are a team from Indonesia, reaching 160 people.

“The success of a company is not solely determined by the number of individuals it employs, but also by their abilities. As a company insurtech", our focus lies on technology, not just gathering a large workforce," he concluded.

Sign up for our

newsletter

Premium

Premium