BRI Ventures Aims for the Final Round of "Sembrani Kiqani" Raising of 784 Billion Rupiah

Has closed the first funding round in June 2022

BRI Ventures (BVI) aims to raise the final round of managed funds Sembrani Kiqani with a target of $50 million or around 784 billion Rupiah. Reported from Deal Street Asia, BVI had previously closed the first round of Sembrani Kiqani in June 2022.

Through uploads on the page LinkedIn, BVI Founding CEO Nicko Widjaja tells the story of his journey managed funds Sembrani Nusantara was formed in June 2020 at the height of the uncertainty of the global situation, and started with low expectations. Sembrani Nusantara is the first venture-managed fund in Indonesia to be licensed and supervised by the OJK. Managed funds obtained exceeded the initial target of IDR 300 billion in early 2021.

Then, Kiqani was also formed the following year, similar to the current global situation. However, his party was able to secure the first round of funds from various LPs with higher achievement than the target.

"Managing two managed funds in Indonesia is not easy, especially when these managed funds are pioneers—and launched in a situation full of uncertainty. Despite the many obstacles, obstacles, (and negative things), Sembrani and Kiqani were able to withstand all odds ," wrote Nico.

BVI focus

BVI was formed in 2019 with a debut fund under management of $250 million or equivalent to Rp3,5 trillion. Nicko Widjaja was appointed CEO of BVI in July 2019, leaving his position as CEO MDI Ventures which has been going on for more than 4 years.

With initial funds supported by the parent company, BVI has channeled investment into companies that focus on the fintech industry such as Investree, Modalku, Payfazz, Tanihub, and also Nium.

Sembrani Nusantara was launched as a medium for companies to seek external funding. The structure itself is relatively new because it is in the form of a Joint Investment Contract (KIB), which adopts a concept similar to a Collective Investment Contract (KIK) in mutual funds. These managed funds channel investments in early-stage startups in sectors such as education, agro-maritime, retail, logistics, and health.

Not long ago, Sembrani Nusantara was also alleged to have injected a round of investment seed on e-playertrade B2B, Shoppingparts, with ticket sizes worth $2 million-$3 million. This has been confirmed by Nicko Widjaja as reported by Deal Street Asia.

Still with the same mission, Sembrani Kiqani targets early-stage startups, only focused on consumer brands targeting the sector direct-to-consumer (D2C) and initiatives in the field of web3. Through this medium, the company has disbursed funds for the company game blockchain-based Yield Guild Games SEA and eco-packaging startup Plepah.

In March 2022, the CVC involved in the Merah Putih Fund (MPF) has also signed an agreement to establish a new managed fund, namely the Fundnel Secondaries Fund, which targets an investment of $50 million or more than IDR780 billion in early 2023.

Funding for the first semester of 2022

DailySocial.id re-captured digital startup funding transactions during the first half of 2022. There are several interesting trends that can be observed, amid the skewed issues that are currently in the spotlight in the ecosystem—one of which is the market correction due to the global economic crisis—which has a direct impact on how investors value a startup.

Entering the second quarter of 2022 a number of upheavals, also has a direct impact on the startup investment climate. On the surface, news like startups do layoffs, pivot business, until the closing of the business was widely heard. However, the shock conditions did not dampen the disbursement of funding to Indonesian startups.

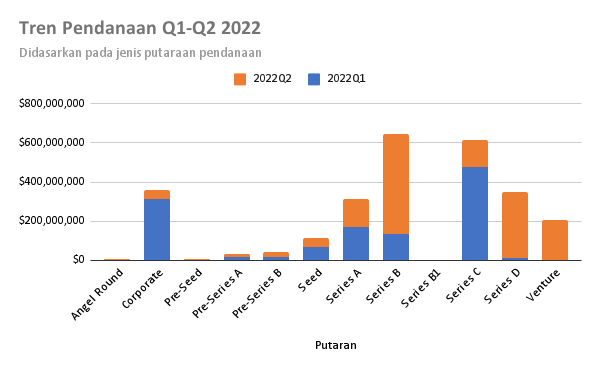

Funding trends throughout H1 2022

Funding trends throughout H1 2022From the graph above, there is value growth in continued funding throughout the second quarter of 2022, especially series B and above. The number of initial and pre-initial funding transactions still dominates. This shows the presence of several new business models that are stealing the attention of investors.

More Coverage:

One sector that is also quite ogled is D2C. This sector is seen as an opportunity to lower costs and maximize profits by eliminating supply chain paths.

According to McKinsey, D2C refers to the practice of selling products directly to consumers through a company's own website, without going through a third-party retailer or wholesaler. This concept would remove the barrier between producers and consumers, giving producers more control over their brand, reputation, marketing, and sales tactics.

The D2C concept is also said to be able to help brands build their relationship with their customers, by providing them with a unique experience and value proposition as a differentiator.

Sign up for our

newsletter