AwanTunai Announces Funding of More than 811 Billion Rupiah, in the form of Equity and "Loans"

AwanTunai is building a credit scoring system so that MSMEs can get access to loans from banks

Startups CloudCash confirmed series A2 pendanaan funding which the company has acquired in the amount of $56,2 million (over 811 billion Rupiah) in equity and loan facilities. Equity funding of $11,2 million was provided by new investors BRI Ventures and OCBC NISP Ventura, as well as participation from previous investors, including Insignia Ventures and Global Brains.

Meanwhile, a loan facility of $45 million was provided from Accial Capital and Bank OCBC NISP. This is top up a loan granted by Bank OCBC NISP which has disbursed more than $45 million in facilities.

In an official statement delivered today (27/8), CEO of AwanTunai Dino Setiawan said this fresh funding will be used to finance the company's domestic expansion, so that more and more micro MSMEs are empowered with fast and affordable access to financing.

He continued, the company is currently building a data infrastructure for digitizing inventory purchase transactions online. The data is effective for credit risk management and opens up opportunities for micro MSMEs that previously had minimal access to working capital from banking institutions that have partnered with Awan Tunai.

"We hope that CloudTunai will become a platform that allows the banking industry to reach millions of traditional MSMEs that previously had difficulty obtaining services," he said.

As a new investor who entered this round, BRI Ventures also gave a statement. BRI Ventures CEO Nicko Widjaja said, AwanTunai has a customer profile similar to Bank BRI. By empowering micro merchants, they have helped small businesses maintain and grow their businesses in these difficult times.

"We hope to collaborate further with AwanTunai to reach MSMEs that have been underserved so far," said Nicko.

In addition to providing digitalized services for ordering inventory payments and consumer management for traditional wholesalers and retailers, the AwanTunai platform also provides financing for purchasing supplies to suppliers. fast-moving consumer goods (FMCG) and micro traders of everyday foodstuffs.

Micro MSMEs can purchase their inventory online online via app mobile devices AwanToko that can access affordable financing through a simple process of registering with a National Identity Card (KTP).

As of June 2021, the company has collaborated with more than 160 supplier partners to help traditional wholesalers digitize and finance their businesses. As well as, providing financing for purchasing supplies and integrated online ordering for consumers of micro UMKM stalls through the AwanToko mobile application.

AwanTunai has served more than 8.000 micro merchants as users, with an increasing number of users coming from tier 2 and 3 cities in Indonesia.

CloudCash's position in the industry quite unique, they focus on providing access to funding to small retail entrepreneurs such as warungs. The main products are CloudWholesale for supplier financing, helping shop owners to be able to make payments to distributors on time. In this system, AwanTunai also provides facilities point of sale to help business owners manage transactions.

There is also AwanToko product, the focus is on helping shop owners who are constrained by capital in increasing their stock of goods. The loan facility is facilitated through AwanTempo — all of the financing is in kind. Shopping can be done through the Wholesale Agent Store, which contains a fairly complete network of partner distributors.

Productive financing trends

According to the survey results summarized in the report “Evolving Landscape of Fintech Lending in Indonesia" by DSInnovate and AFPI, 75% of survey respondents (146 players ) working on the productive lending sector. While 53% play in the consumptive sector and 6,8% in sharia. However, one platform may have more than one business model.

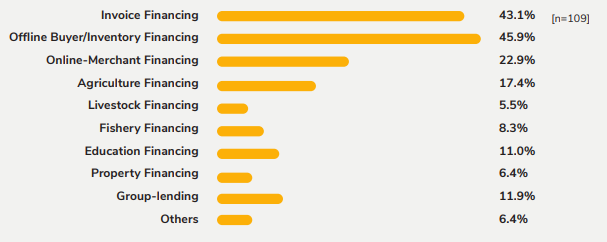

Of the total players who play in the productive sector, the majority peddle services through invoice and inventory financing — financing to suppliers is also included.

More Coverage:

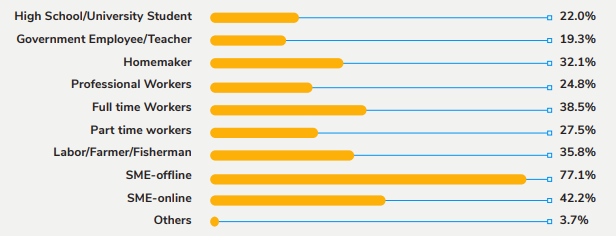

The productive sector is clearly more promising, especially now that there are around 59,2 million MSMEs spread across Indonesia, this is reflected in the profile of the majority of borrowers in these services (offline and online MSMEs). The issue of capital is still one of the most significant because bank credit facilities have not fully accommodated these needs.

The average loan application is 2,5 million Rupiah to 25 million Rupiah. Although some platforms offer fantastic loans of hundreds to billions of rupiah. The distribution is more than 90% still around Jabodetabek and Java, although new policy will encourage the players fintech to participate in prioritizing access to loans to other regions as well.

Sign up for our

newsletter