AwanTunai Pockets Advanced Funding of 161 Billion Rupiah

A number of investors were also involved, including Atlas Pacific, BRI Ventures, OCBC NISP Ventura, and Insignia Venture Partners.

AwanTunai posted a pre-series B funding of $11,2 million or around 161,2 billion Rupiah. The investors involved include Atlas Pacific, BRI Ventures, OCBC NISP Ventura, Insignia Venture Partners, and several others. The investment data of this round has been entered into the regulatory system. A number of parties involved also confirmed to DailySocial.id.

Bank OCBC NISP itself is also one of the institutional lenders forCashCloud. Their collaboration has been inaugurated since last September 2020, focusing on the distribution of forwarding financing facilities (channeling).

The last time AwanTunai announced equity funding was in 2018 for round series A $4,3 million led by Insignia Venture Partners and AMTD Group. In 2020 they also get funding debt from Accial Capital for $20 million.

CloudCash's position in the industry quite unique, they focus on providing access to funding to small retail entrepreneurs such as warungs. The main products are CloudWholesale for supplier financing, helping shop owners to be able to make payments to distributors on time. In this system, AwanTunai also provides facilities point of sale to help business owners manage transactions.

There is also AwanToko product, the focus is on helping shop owners who are constrained by capital in increasing their stock of goods. The loan facility is facilitated through AwanTempo -- all of the financing is in kind. Shopping can be done through the Wholesale Agent Store, which contains a fairly complete network of partner distributors.

Immediately expand to other financing

CloudTunai was founded in 2017 by three people founder, including Dino Setiawan, Rama Notowidigdo, and Windy Natriavi. Its mission is to improve the welfare of MSMEs through access to affordable financing. Although until now the main focus is still on financing supply chain leaders in the retail business, but the company is also planning further expansion.

This matter delivered directly by Dino as CEO in an interview in 2020. The company is preparing a new product for crop financing for small farmers. Already partnered with foreign NGOs and partners agricultural products to channel financing from AwanTunai to farmers. The concept of financing is similar to CloudTempo. Para must know the farmers to minimize the risk of default.

One of the realizations is through collaboration with Vegetablebox which was inaugurated last August 2020 for financing to farmers. CloudCash and Vegetablebox is "sister company", pioneered by co-founder the same, namely Rama Notowidigdo

Productive financing is the prima donna

According to the survey results summarized in the report "Evolving Landscape of Fintech Lending in Indonesia" by DSInnovate and AFPI, 75% of survey respondents (146 players ) working on the productive lending sector. While 53% play in the consumptive sector and 6,8% in sharia. However, one platform may have more than one business model.

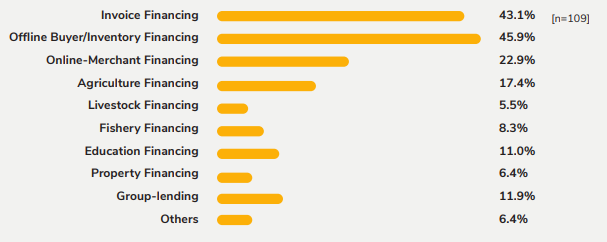

Of the total players who play in the productive sector, the majority peddle services through invoice and inventory financing -- financing to suppliers is also included.

More Coverage:

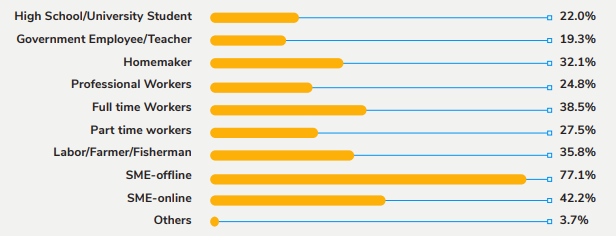

The productive sector is clearly more promising, especially now that there are around 59,2 million MSMEs spread across Indonesia, this is reflected in the profile of the majority of borrowers in these services (MSMEs). offline and online). The issue of capital is still one of the most significant because bank credit facilities have not fully accommodated these needs.

The average loan application is 2,5 million Rupiah to 25 million Rupiah. Although some platforms offer fantastic loans of hundreds to billions of rupiah. The distribution is more than 90% still around Jabodetabek and Java, although new policy will encourage the players fintech to participate in prioritizing access to loans to other regions as well.

Sign up for our

newsletter