AMVESINDO's Notes Regarding the Digital Startup Ecosystem During the Pandemic

There is a change in consumer behavior, momentum to work on SME solutions, and the amount of funding is still large

Indonesia's startup landscape is marked by a number of investments from local and foreign venture capital companies. The Indonesian Venture Capital Association (AMVESINDO) noted that the pandemic had various impacts on startups and SMEs. A number of business actors experienced negative impacts, such as decreased transactions and service closures; but others experienced positive impacts, such as soaring demand/transactions and expanding consumer reach.

In a webinar session initiated by AMVESINDO revealed, several trends to quite interesting potential in several sectors that can be used as a reference for investment activities of local and foreign venture capital companies.

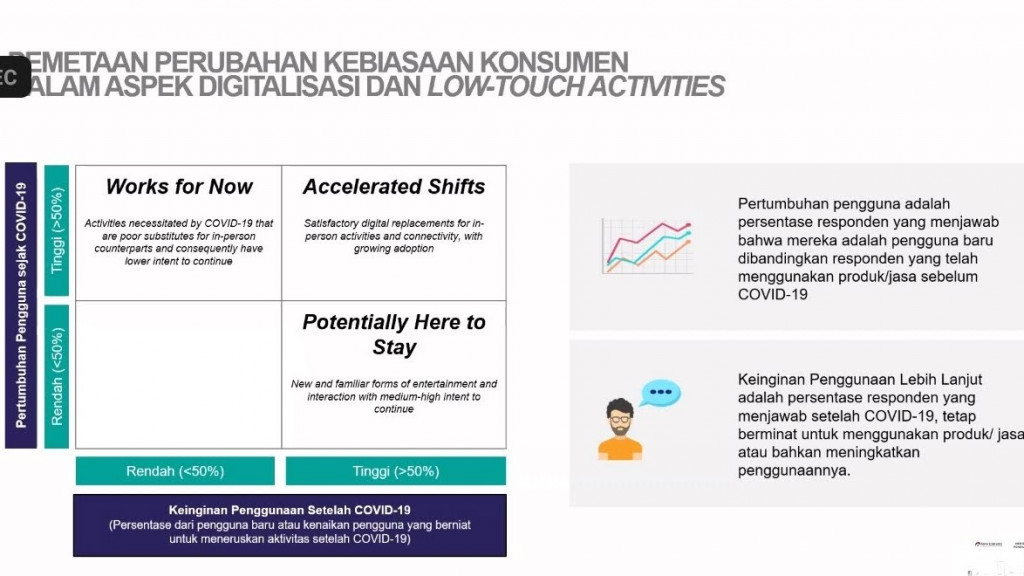

Mapping changes in consumer habits

The pandemic that came since the beginning of the year, in particular, has changed the habits of most consumers. They were previously still doing activities online and also offline, when the PSBB rules are enforced, activities begin shifting to online. According to AMVESINDO Chairman I William Gozali, this encourages startups to be able to adapt to situations as people's behavior changes.

"If we look at startups or technology companies that are able to survive during the pandemic, they are ride hailing. When demand for ride hailing decreased, they then started shifting to other products or services such as food and logistics," said William.

Another sector that also experienced a drastic increase was the financial sector edutech, e-commerce, and healthtech. Although the products they present are not optimal, digital adoption has become more accelerated during the pandemic. Amvesindo also noted that the role of service fintech and logistics is very important to introduce and familiarize the Indonesian people to make transactions in a non-cash manner. According to William, this habit has increased in the number of adoptions during the pandemic.

"What needs to be considered is what is needed and of course it can run well at this time and start making changes. Because in the future or what is known as the new normal, has the potential to go on and on," said William

Potency social commerce, supply chains, and SMEs

During the pandemic, there are also more startup companies that specifically target SMEs as the target market. Although in the last 3 years there have been many startups targeting this sector, this year there are more and more startups that provide services, especially digital kiosk services that want to make it easier for SMEs to run their business.

The beauty sector is also a potential for startups to investors who want to provide funding. The more local and foreign players who present beauty products to the Indonesian people, it seems that there are more players and of course it is an opportunity in itself.

"As a country full of social media users, the concept of social commerce to be relevant, to map out what kind of logistics needs and costs that players need to incur when offering products to customers," said William.

On the other hand slowly but surely, food tech or technology-based culinary platforms are also starting to show a lot of positive growth at this time. Initiated by platform ride hailing, now more and more platforms food tech experiencing positive growth. One of their strengths is, with support big data previously implemented by the platform ride hailing in Indonesia.

"Since the beginning there have been 3 sectors that have played an important role in the startup ecosystem, namely finance, e-commerce, and logistics. The three sectors need each other and each has a related role. Now derivative sector E-commerce began to emerge and has interesting potential to be explored," said William.

The amount of funding is still large

The venture capital industry in general also experienced an increase in performance in 2019. Starting from an increase in assets, funding sources, and capital, which is a sign that the venture capital industry can still grow. The challenge that remains as homework is the large portion of Profit Sharing Financing instruments from the existing portfolio of venture capital companies.

AMVESINDO noted that as of December 31, 2019, the growth of PMV assets including PMVD (Regional Venture Capital Companies) reached Rp 19.65 Trillion, an increase of 58.72% compared to the 2018 period.

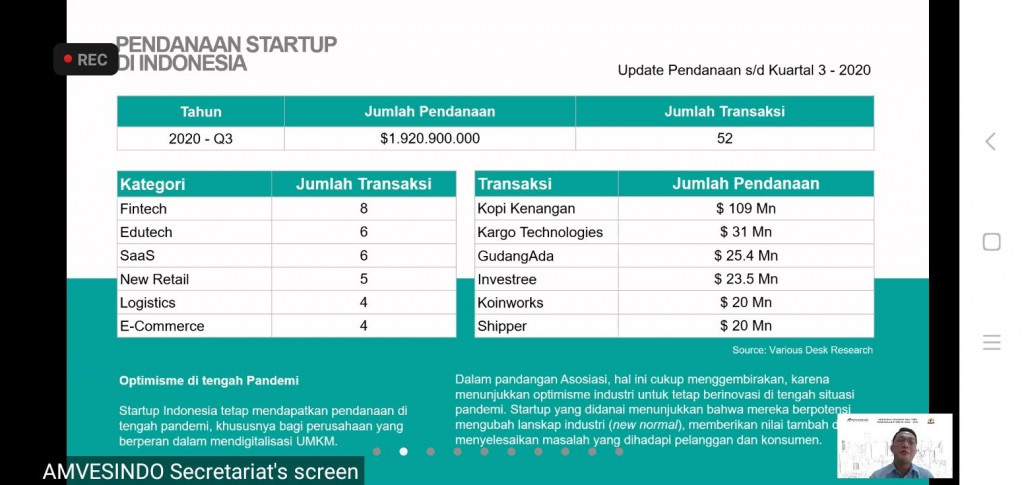

Even though the condition is experiencing a global crisis, the amount of funding from the beginning of the year until this November still big enough the amount. In Q3 2020, there were 52 funding transactions conducted by venture capital companies for startups, with a total funding of $1.920.900.000 million.

This funding is channeled to startups from various sectors, with the three largest sectors, namely fintech (6 funding transactions), edutech (6 funding transactions), and SaaS (6 Funding transactions).

More Coverage:

In providing funding to startups, there are at least four points that PMV considers, namely: market growth potential, adaptability, quality founders, as well as a clear business model, and efficient use of funds.

"In the future, it is predicted that the sectors that accelerate well are: e-health, e-groceries, edutech and e-logistics which has great potential to develop and is currently unanswered in Indonesia. Diversification is also very good for startup companies to implement, so they can survive during the pandemic and when conditions enter the new normal," William said.

Sign up for our

newsletter