Akulaku Become a Controlling Shareholder of Neo Commerce Bank

Increase ownership to 24,98%; plan a number of intensive integrations and synergies in the development of digital banking products

Akulaku (PT Akulaku Silvrr Indonesia) officially took over Neo Commerce Bank (PT Bank Neo Commerce Tbk - BBYB). This strategic action allows BBYB to take advantage of its technology Akulaku in digital transformation.

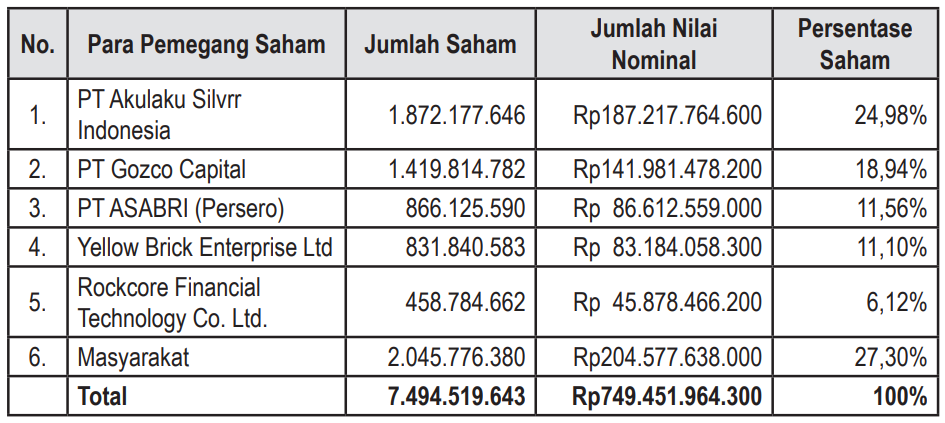

In accordance with the provisions of POJK 41/2019, the takeover of bank shares is considered to result in a transfer of bank control if the ownership becomes the largest. Currently portion of ownership Akulaku to BBYB is 24,98% and is the largest shareholder.

Previously in an interview with President Director of Bank Neo Commerce Tjandra Gunawan, since the end of 2020 the company has begun to boost the development of new products and features as well as strategic partnerships with the digital ecosystem. The goal is none other than to provide a new digital banking experience to its customers.

In particular, it was also conveyed, with the neo+ application, it specifically targets the segment mass market, especially young people who dominate the total population of Indonesia.

Role Akulaku in transformation

As known, Akulaku currently serving the service fintech loan-based, either in cash or in installments for the purchase of goods. According to the statistics submitted, the application is currently actively used by more than 5 million users with more than 150 million transactions being facilitated.

On the other hand, Akulaku also provides B2B services, one of which is related to digital banking solutions. The platform is capable of performing a range of capabilities, including e-KYC, credit scoring, account management, and transaction management.

According to Tjandra, this broad digital ecosystem can significantly contribute to Neo Commerce Bank. A number of integrations have also begun, such as opening an account through the application Akulaku. Then, the company will also take advantage of the ecosystem Akulaku to distribute loans to users.

Both of them are also developing loan origination system and online financing which is targeted for commercial in the second semester of 2021. Loan origination system is a system for processing credit approvals, particularly for direct loans/online financing.

By adopting a synergy model with an open ecosystem, his party does not rule out the possibility of adding strategic partnerships outside of the ecosystem Akulaku, It is good fintech, e-commerce, and other digital business lines.

Banks and digital platforms

Gojek through GoPay (PT Dompet Karya Anak Bangsa) in March 2021 also increased its ownership in PT Bank Jago Tbk (ARTO) bringing the total percentage of shares owned to 21,40%. The synergy of the two companies has also begun to be realized, one of which is related Bank Jago integration in the application Gojek as a payment option.

Not stopping there, Bank Jago has also started exploring synergies with other digital services, one of which is Bibit to bring mutual fund investment features into the application.

Other Digital Banks also carry out similar consolidations, for example blu with a different ecosystem owned by Blibli. It is known that the two are connected as one family in the Djarum group. It also includes the Cermati Fintech Group, which may be consolidating because it is also focusing on developing a BaaS-based platform -- the role of banking partners is very much needed for the expansion of platform capabilities.

More Coverage:

So far, there are several banks that are quite closely related to popular digital platforms, including:

| Banks | Digital Platforms |

| Neo Commerce | Akulaku |

| Jago | Gojek |

| Digital BCA | Blibli |

| BKE Bank (Sea Bank) | Shopee |

| KEB Hana (Bank Line) | LINE |

| Motion | Vision+ and MNC's digital ecosystem |

Other banking like AGRO (prospective digital bank owned by BRI) also getting ready. The possible consolidation is through the portfolio of CVC units owned. Several collaborations have also been initiated, for example with People's Capital, Investree, Payfazz, Modalku, and Tanihub.

In addition to features, the digital services mentioned above also have a large user base to allow conversions to new customers at each bank. As a banking service, it will also be more flexible in financial management; for example to deal with limitations floating money which are owned e-money.

Sign up for our

newsletter