Boiling Data, Building "Credit Scoring"

How a financial technology startup builds a customer "credit scoring" database

Have a bank account, but when you apply for a credit card it is always rejected? Here you are in the group underbanked. Under underbanked, there is unbanked which means you don't have a bank account.

The two groups above have been "isolated" by banks and other conventional financial services, even though they have great business potential. The utilization of this segment is low and the 111 banks operating in Indonesia cannot take advantage of it because it is too risky.

According to the latest report e-Conomy SEA 2019 compiled by Google, Temasek, and Bain & Company, there are 51% of the Indonesian population who fall into the group unbanked; underbanked 26%; and banked 23%.

In general, in Southeast Asia, 75% of the population in Southeast Asia falls into the category of underbanked and unbanked. They are underserved (under-served) for various reasons.

From the financial institution's point of view, there is a high cost of servicing them which is not worth the low income potential in the medium term. Other reasons include a limited credit history, low savings rates, and "limited awareness" when it comes to insurance or investments.

The common thread here is inclusion. How to improve the literacy of people who choose not to join the formal banking system to enter the ecosystem.

The classic reason for banks not to work on these two customer segments is the unavailability of data in BI Checking (now SLIK). With a banking system that is designed so exclusively, this forces banks to play it safe. If the financial reports are a little bad, they are immediately reprimanded by the regulator.

Banks in Indonesia have a cost of funds (cost of funds) tall one. This results in high interest charged to customers. Net interest margin (net interest margin/NIM) in this country is the highest in Southeast Asia, at 4,69% in August 2019 according to the OJK. Compare this with Singapore's NIM which is "only" at the level of 3,62%.

The business potential that has been left unattended for so long has finally been exploited by fintech players, ok? lending nor payment, which is starting to make the bank break out in a cold sweat.

See how it progresses Akulaku and Kredivo, two of the biggest fintech players on the side lending which offers the convenience of a "digital credit card". The process is completely done online and in a matter of minutes customers can immediately get approval.

Then GoPay, Ovo, and Dana which so quickly entered various regions with various product variations.

What needs to be emphasized here is that all of the companies mentioned above are new subsidiaries with less than five years of operation. They are more daring to work on the segment unbanked and unbankable than those who have been in the industry for a longer time.

How banks do credit scoring

The way banks analyze customers can be said to be quite conservative. The guidelines use 5C analysis with 5P principles. 5C covers character, capacity, capital, conditions, and collateral. While 5P is personality, purpose, prospect, paymentand party.

Every time you apply for credit to a bank, regardless of the type of product, the process requires a SLIK/Financial Information Service System (formerly called BI Checking or SID (Debtor Information System) as a determinant of the eligibility of prospective debtors.

SLIK can be accessed 24/7 online and offline by financial institutions, both banks and non-banks, as long as they are registered as members of the Credit Information Bureau (called the Credit Information Management Agency/LPIP). The SLIK contains information on debtors and credit facilities that are exchanged between financial institutions.

The customer has a credit score from his collectability record, calculated from 1 to 5. The smaller the score, the greater the potential for receiving applications. If he gets a score of 3, 4, and 5 he will automatically be rejected because he is blacklisted. People who have no credit history at all are included in the line that is automatically rejected.

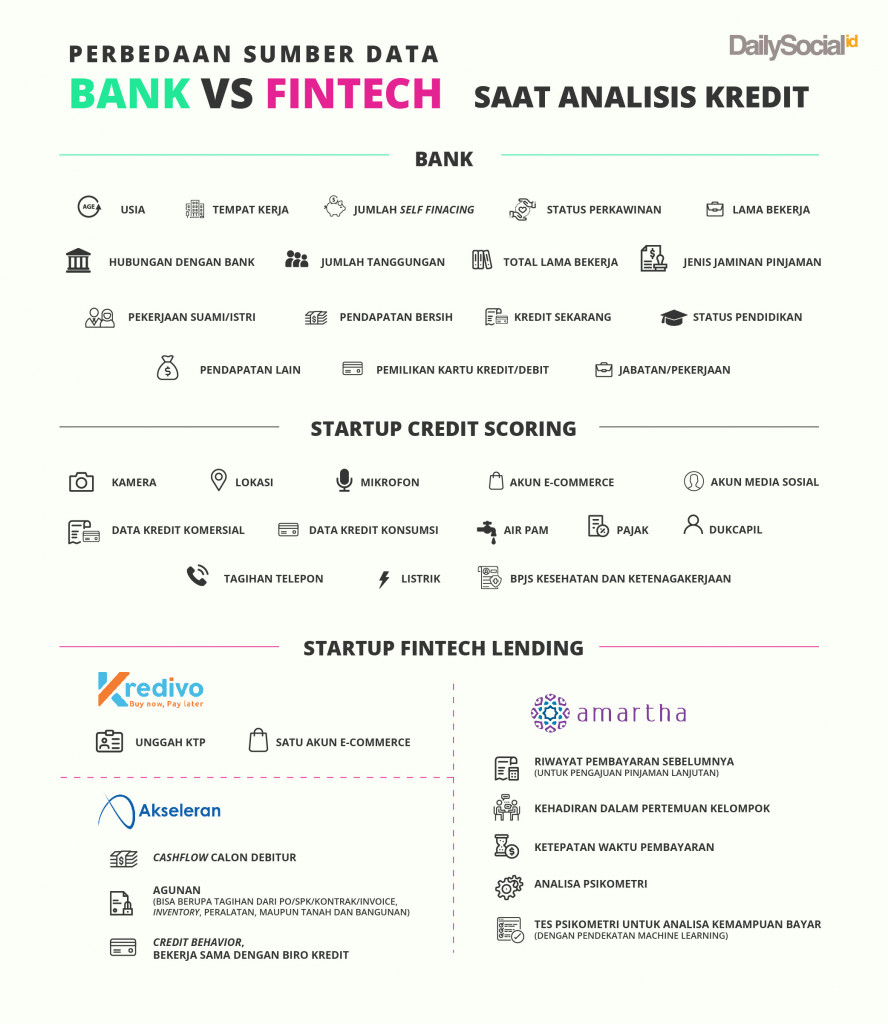

Considering that banks only take segments bankable For those who have a credit history, the data sources used are mostly credit data plus other data to strengthen their credit score.

The case is different with fintech startups. Because customers do not necessarily have sufficient credit data, fintech startups will rely on other data or so-called alternative data to generate credit scores.

"So risk appetite in using credit scoring could be different, is it more risk tolerance or not, and this depends on their individual needs," said Director of Pefindo Credit Bureau Yohanes Arts Abimanyu (7/11).

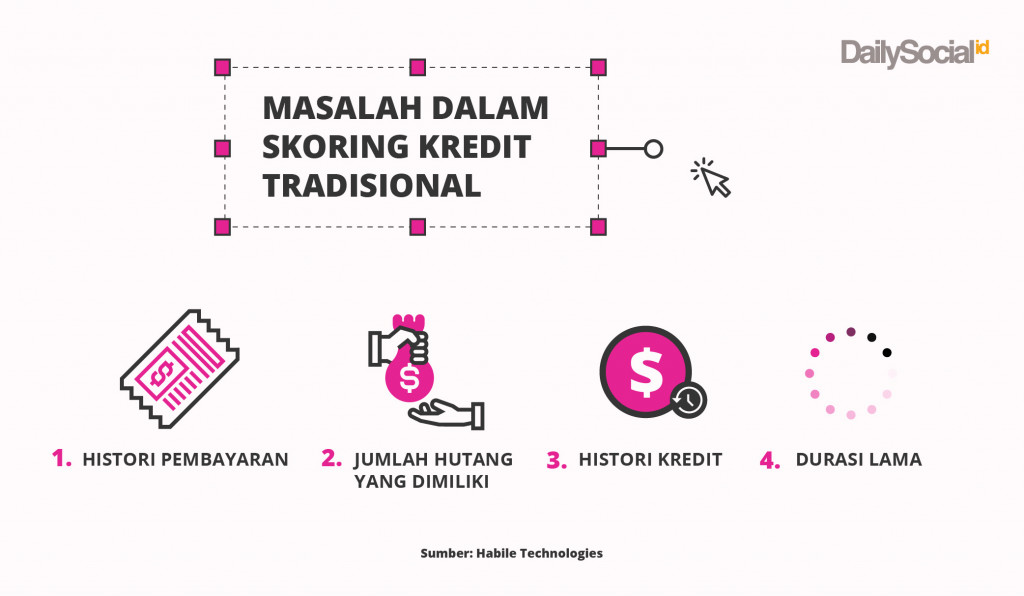

The question that then arises is whether the credit analysis that has been used by banks is fully qualified? The answer varies, depending on the point of view used.

According to Fineoz Co-Founder and CEO Anis Radianis, an AI-based credit risk solution service, there are three primary quality criteria for credit scores. First, the level of credit score accuracy in selecting good and bad prospective customers. Second, a dynamic model following the latest developments, and a credit score that not only reduces risk but is able to maximize profit.

This primary quality is very important because it can determine the survival of financial institutions in running their business.

In Indonesia, unfortunately, credit scores still rely on internal sources which fundamentally have many weaknesses. For example, in selecting customers who are able to pay their debts, they still use the traditional statistical approach which is very inaccurate, not dynamic, and less profitable.

In general, the use of credit data in making credit scores will have better quality when compared to using alternative data.

"Why still use the traditional approach? Because it's easy to explain, and simple. So there are some financial institutions who consider the quality of their credit scores to be good," explained Anis to DailySocial (20 / 11).

The end result with this approach can really reduce the level of default risk. However, this has to be paid for by the many rejections of prospective customers because banks prefer to play it safe.

Not to mention secondary qualities such as speed levels. Many financial institutions take days to process underwriting. Indeed, there are already players who make credit scores in minutes, but the primary quality in sorting good or bad is still the old approach.

"Banks can use models" scoring loans that are calibrated once or twice a year, because in a year there are many new things that can happen to maximize their profits by working on actual potential customers qualified," he added.

Banks cannot be as dynamic as fintech startups, but they do not rule out the possibility to collaborate while still adhering to the principles careful. This can be seen in various collaborations in distributing productive loans to micro-enterprises and being registered as fintech borrowers.

This strategy shows that banks rely on the method and quality of credit scores in fintech startups. They want to increase the distribution of credit funds, by minimizing the risk of default because this distribution is recorded outside their accounting books.

In the end, the bank must continue to carry out its function as a intermediate, collect funds from the surplus community and distribute it again to the deficit community (requires financing from the bank).

One of the banks that DailySocial contact is BCA. EVP Secretariat & Corporate Communication of BCA Hera F Haryn explained that the credit score used by BCA still uses data contained within BCA, such as debtor demographic data and transactions.

"As for the manufacturing technique scoring using two ways, namely statistical logistic regression and start using machine learning," he said (14/11).

Logistic regression is one of the popular statistical models used for binary classification, prediction of this or that type, yes or no, A or B, etc. He can also be used for classification multiclass.

BCA realized the LC Automize solution, together with Singapore-based AI startup 6Estates, to automate manual documents and compliance checks based on international rules and international standards when analyzing LC documents (letters of credit), by combining AI and robotic process automation for business trade finance.

This method is expected to reduce the turnaround time for processing each incoming application. BCA can also grow its business exponentially without facing scalability issues.

It's still in the early stages of implementation machine learning within the BCA business structure. Most likely LC Automize will be passed on to other lines.

How fintech builds a credit score

Basically, all companies, whether engaged in fintech or not, can collect customer data, whether online or offline, to be reused for various purposes. One of them, build a credit analysis system.

This understanding can be a provision that all companies have the capability to have an independent credit score system, as long as they have the technology and skills expertise.

Early way Gojek or Traveloka releasing financial products, such as PayLater, also starting from collecting data on consumer habits which are cultivated slowly until finally they can be utilized for further development in the financial sector.

Meanwhile, fintech lending startups mostly build their credit scores with other data that is not yet available in the credit bureaus. Before tripping over a case, initially players could access various data on the smartphone of the prospective debtor.

Now OJK limits the digital data that can be accessed from smartphones, namely the camera, microphone, and location. These three are considered the most relevant and needed by the company in identifying potential customers.

For Tongdun, China's digital financial innovation platform for credit scores that have been registered with the OJK, these three types of data are actually still considered insufficient to obtain data on customer habits. For startups like them, the main point is to look holistically, from various sides, through as much data as possible to produce an accurate credit analysis.

Therefore, the company is in discussions with PLN, BPJS, Dukcapil, the Directorate General of Taxes, and telecommunications companies to utilize their data in depth for analysis needs. So far, banks have not fully utilized these basic data.

Director of Consulting and Solution Tongdun Suhardiman Agung explained that the digital footprint in Indonesia is not evenly spread, it is still concentrated in big cities. He gave an example, PLN electricity bills are classified as basic data that can provide an overview of a person's finances.

From there, it can also be seen how to verify addresses by looking at their PLN customer IDs, to make sure they are not fraudsters. Seeing what the economic background looks like is enough to pay attention to electricity consumption. For example, a customer sells with such a turnover, then the electricity consumption must match the prediction.

"Indonesia is interesting because there are many SMEs, the informal economy is large. But the challenge is how can we know if the street food stalls are financially good or not. The trick is to use offline data for analysis by machine learning"explained Suhardiman to DailySocial (6 / 11).

Meanwhile, Tongdun still uses digital data to assist partners in risk analysis, but everything must go through customer licensing. Customers should also be aware that they are providing data access, whether it's from a Facebook account or an e-commerce account to get credit.

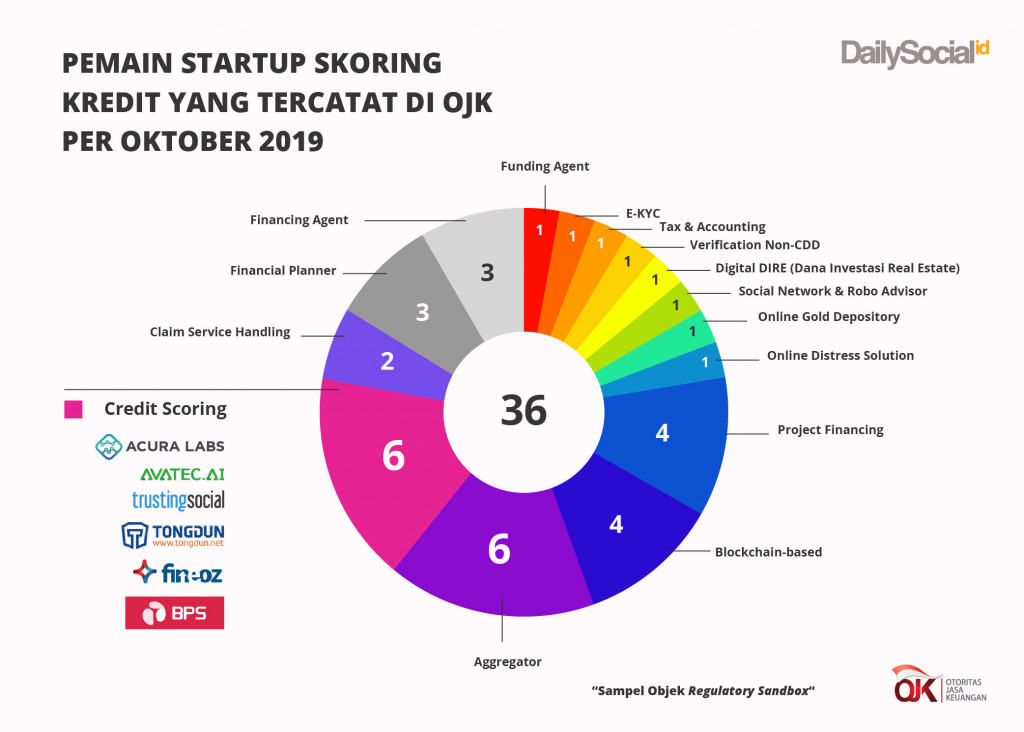

The fintech startup niches, such as Fineoz and Tongdun, competing to provide speedy risk analysis with AI technology, machine learning, computing platformsand core technologies combined with API and cloud computing.

Anis explained that it is not always good to have a lot of data, because according to him, quantity is very much different from quality. The greater the quantity of data does not guarantee the better the quality of analysis and credit decisions produced.

"Fineoz focuses on improving the quality of credit decisions. We do not deny the importance of multiple data sources. However, with AI technology, all data limitations can be overcome more easily."

Fineoz itself has processed nearly 3,5 million customer data through several strategic partnerships. There are various types of credit data, including commercial credit data (invoice financing, seller financing, merchant financing, etc.) and consumer loans (motorcycle, car, KTA, and loans) payday loans).

Not to be outdone, Pefindo Credit Bureau (PBK) collects credit data from various sources. Starting from SID BI, SLIK OJK, financial institutions that are members of PBK, including cooperatives, fintech p2p lending, and non-financial institutions such as retailer.

They also cooperate with other institutions to access non-credit data, such as BPJS Employment, Taspen, tax identity, bankruptcy data, defaults from Supreme Court decisions, issuer data from the IDX, and company rating data from the Indonesian Securities Rating Agency.

Yohanes said that PBK has recorded credit data of 91 million individual data and 500 thousand company data. So that all this data can be used as well as possible, the company continues to develop the accuracy of the data and methodology of PBK credit scoring.

"In addition, we plan to develop alternative credit scoring to meet people who are still struggling unbanked or underserved. In addition, it is possible to develop AI."

The future of credit scores in Indonesia

Financial institutions and fintech cannot always run alone. CautiousThe ability of banks to disburse loans and the dynamics of fintech in processing data for risk analysis are the right combination to work with customers unbanked and unbankable.

It's no wonder that more and more financial institutions, including services p2plending, working with similar companies Tongdun and Fineoz to help them analyze potential customers from various angle.

Most recently, Bank Permata became Actioncalendar institution biggest in Kredivo. The bank disburses up to Rp1 trillion to be redistributed by the company.

The bank's decision to put such large funds is definitely not an easy decision. Startups like Kredivo must have a standardized risk management system that is equivalent to a bank.

On Monday (2/12), Pefindo Credit Bureau collaborated with Fineoz to develop credit information in the form of alternative scoring through the use of alternative data.

"We collaborate on the use of alternative data, so that community coverage unbanked for scoring credit and access to finance could be greater," said Anis.

The Indonesian Joint Funding Fintech Association (AFPI) also released a data center Fintech Data Center (FDC) to make it easier for p2p players to do credit assessments. Its function is the same as BI Checking and SLIK with the spirit of avoiding potential defaults, fraud, and excessive credit distribution.

FDC has been connected with BI Checking and SLIK. Later this partnership will increase with other parties, including BPJS Health and Employment, insurance, multi-finance, banking, and the capital market.

Suhardiman said, the ability of fintech players who focus on credit analysis certainly has more value. Technology investment and expertise that must be disbursed is not a cheap price.

"We're more like data aggregator, connected to various data sources. Moreover, we have expertise specialized in this field. Fintech players or banks don't necessarily have one exposure like us," he said.

Currently layer The first thing that is most helped by the presence of credit score players is banking. Layer The next one will be cross-industry. Suhardiman gave an example, in China, the utilization of credit analysis is very important advance. There, this kind of data is used by logistics companies to analyze delivery status and Profiling driver.

Insurance companies in China also take advantage of credit scores for claim payments as a measure to prevent potential fraud.

"The technology that we brought to Indonesia from China is still a small part. We can't necessarily bring everything because it adapts to the habits of the people here and requires personalization."

This can be a big picture that demand the need for credit analysis will be higher in Indonesia.

One of the new players who are ready to step on the gas is CekAja. Initially CekAja was a financial product aggregator platform, then they soon entered a credit score business called CheckScore.

The product, which will be released early next year, is the realization of the acquisition by CekAja for id/x to assist in the scoring process with Experian, which has experience in the same field. Experian is one of three companies credit scoring largest in the world, along with Equifax and Transunion.

Sign up for our

newsletter