MPA Report: New Customer of OTT Platform in Ambles Region, Switches to TikTok

Netflix is the platform with the largest market share in Indonesia in the first half of 2023, competing strictly with Disney+ Hotstar

Southeast Asia just added 7.000 new SVOD subscribers (video-on-demand subscriptions) in the first half of 2023. This figure decreased compared to the same period in the previous year of 3,7 million subscribers, while compared to the second half of 2022, the decline was much sharper with 7 million new subscribers.

Quoting from the Media Partners Asia (MPA) report, in the first semester of 2022, the decline came from three popular applications: Netflix, Prime Video and Viu, which were only able to add 1,2 million aggregate subscribers, contributing 63% of total new subscribers. among all SVOD platforms.

Interestingly, MPA captures the TikTok phenomenon as a major driver of user growth for the platform mobile devices and web. MPA recorded more than 70% minute growth streaming for the last two years.

In the first half of 2023, TikTok recorded an increase streaming up 42% minutes, up 20 percentage points over the first half of 2021, and up 7 percentage points during the first half of 2022. "The short video app's rise reduced share for YouTube, which fell 4% year-on-year, and premium VOD, down 2% year-on-year," write the report.

In total, Southeast Asia had 47,6 million SVOD subscriptions at the end of the first half of 2023. Subscriber growth in Thailand, Malaysia and the Philippines was offset by a contraction in Indonesia, where total subscribers fell by 1,2 million.

MPA concluded that the slowdown was due to three factors, namely:

- Level drop churn in Indonesia due to the end of the FIFA World Cup soccer tournament in December 2022 and the end of the 2022-23 Premier League season in May 2023;

- Impact from significantly reduced local marketing and content investment beyond Netflix, Prime Video and Viu, all of which contributed to regional growth in the first half of 2023;

- The result of the price increases applied by the main platforms.

Asian content investment

Three emerging platforms – Netflix, Prime Video and Viu – have all capitalized on the popularity of Korean dramas, the single largest category of premium VOD content in Southeast Asia, accounting for 40% of premium VOD views across all regions in the first half of this year. Top shows during the period included The Glory (Netflix) and Taxi Driver Season 2 (Viu).

Not only Korean content, all services streaming Leading OTTs are also investing in Southeast Asian content, which accounts for 13% of premium VOD viewers, while US content accounts for 21%, Japanese anime 10% and Chinese content 9%. Thai content has the strongest regional impact, with films thriller Netflix Hunger is the most visited show.

“The region's leading premium VOD platform is in the midst of a shift towards quality customer growth, retention and monetization,” said MPA Executive Director Vivek Couto.

He continued, “Netflix has lowered prices and introduced member sharing measures, while Disney has increased prices in Indonesia and Thailand in an effort to lower churn rates and increase its ARPU subscriber base.”

Meanwhile, Vidio is the only local OTT that has a significant impact in Indonesia, it is hoped that it will be able to gain new customers again as League 1 and Premier League return. "While local listings are having an impact from Netflix and Amazon, particularly in Thailand and Indonesia, attracting new subscribers, while Viu will continue to benefit from its Korean output."

Note that the data on VOD premiums does not include figures for YouTube, TikTok, and streaming game. MPA's 'Southeast Asia Online Video Consumer Analytics & Insights' report tracks key metrics across online video categories with passive panels and establishments in five Southeast Asian markets: Indonesia, Malaysia, Philippines, Singapore and Thailand.

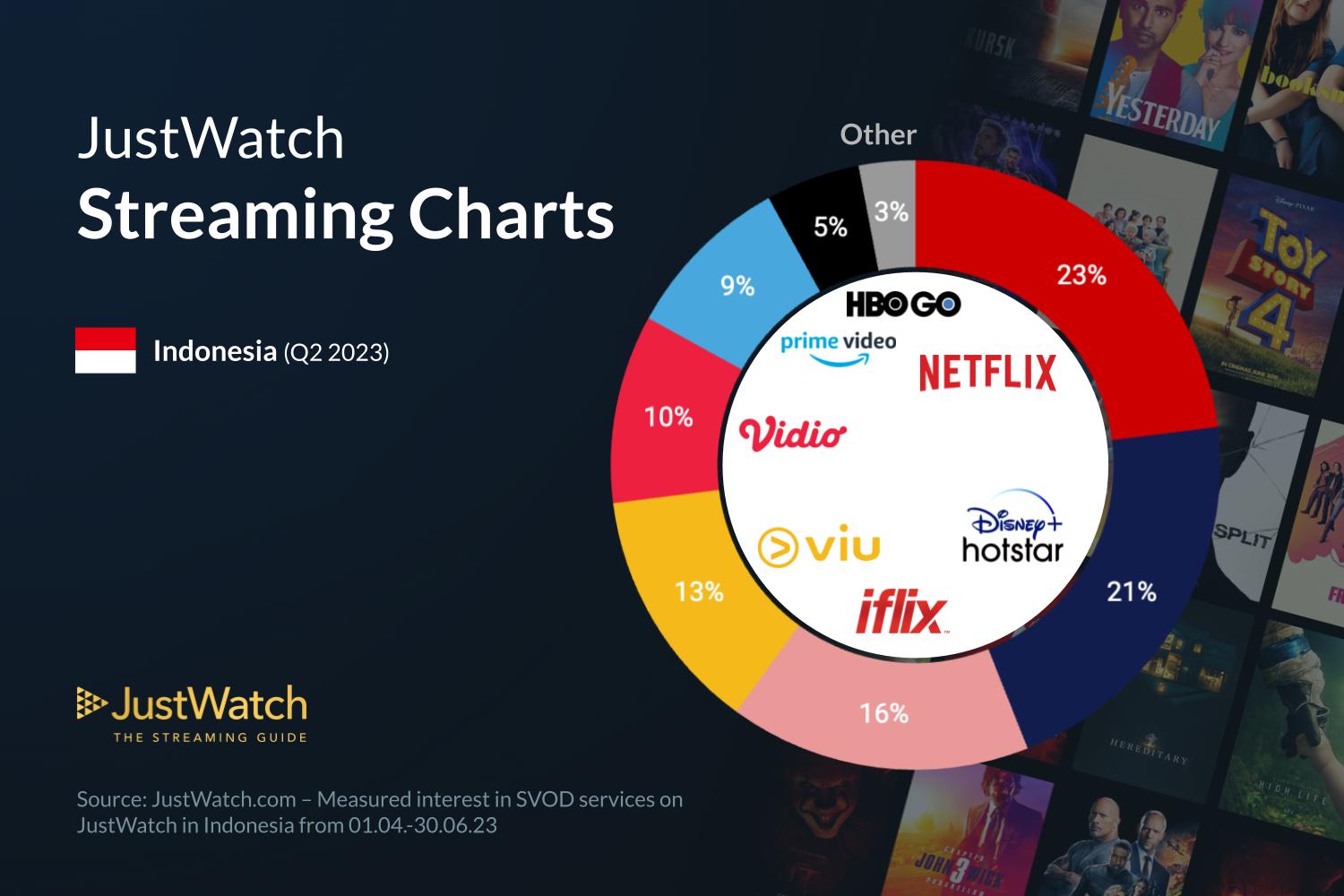

OTT market share in Indonesia

Separately, citing separate data summarized by JustWatch, Netflix has named (23%) the largest market share application in Indonesia. Netflix is in tight competition with Disney+ Hotstar (21%) with a difference of only 2%. Meanwhile Iflix (+WeTV) (16%) is in third place, trailing 5%.

More Coverage:

In the previous quarter, both Netflix and Disney+ Hotstar occupy the highest position as applications with the largest market share, each with 22%.

In Indonesia alone, there are seven OTT services that are most accessed by users, in the fourth position is filled by Viu (13%), followed by Vidio (10%), Prime Video (9%), HBO Go (5%), and others (3). %).

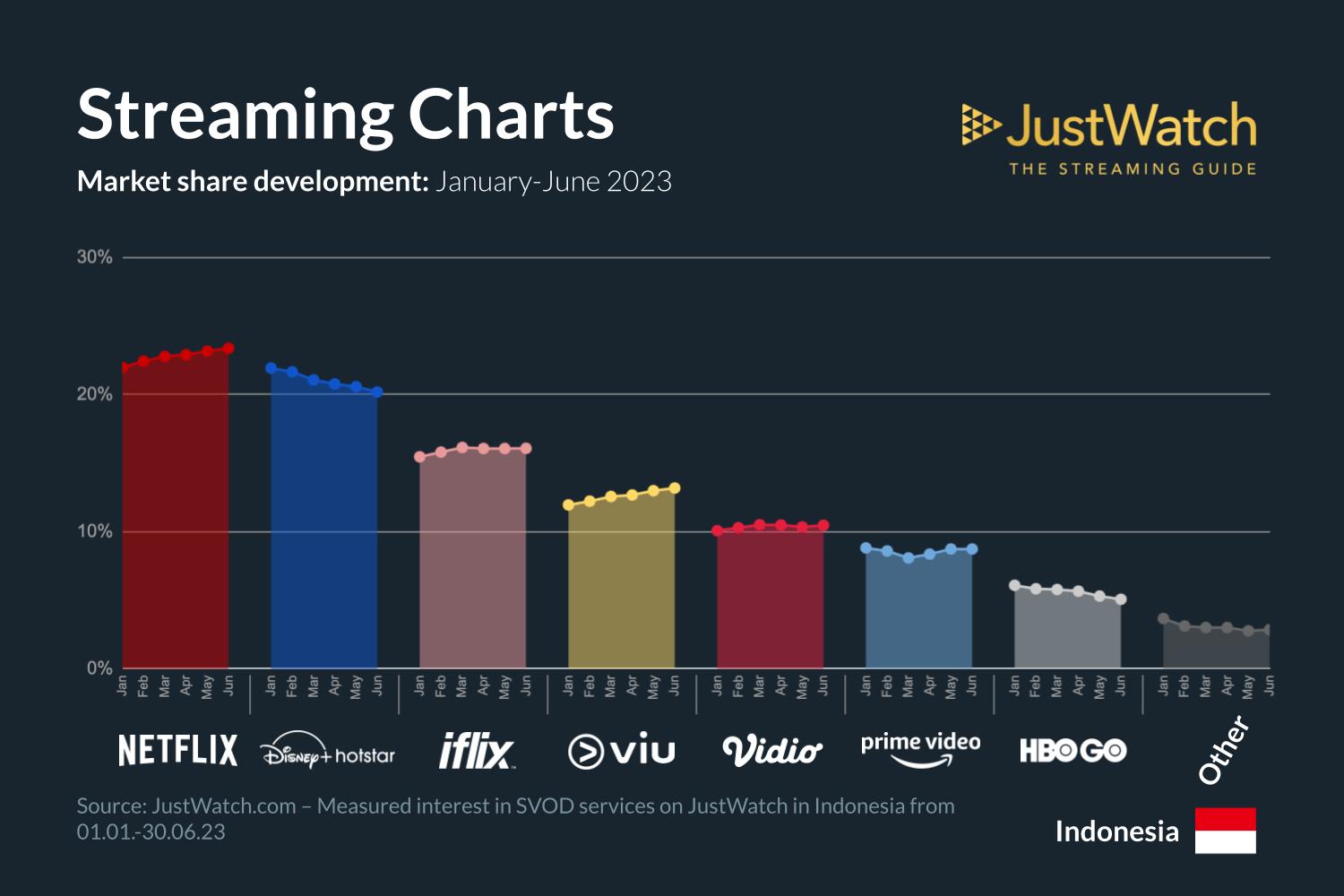

JustWatch also notes the development of the market share of SVOD players in the first half of 2023 in Indonesia. The results are exactly reflected in the achievements in the second quarter of 2023, that Netflix and Viu lead in terms of growth. These two platforms added 1% in the last three months. On opposite sides of the spectrum, Disney+ Hotstar and HBO Go suffered 1% losses in the second quarter.

Sign up for our

newsletter